Source: Discovery Alert

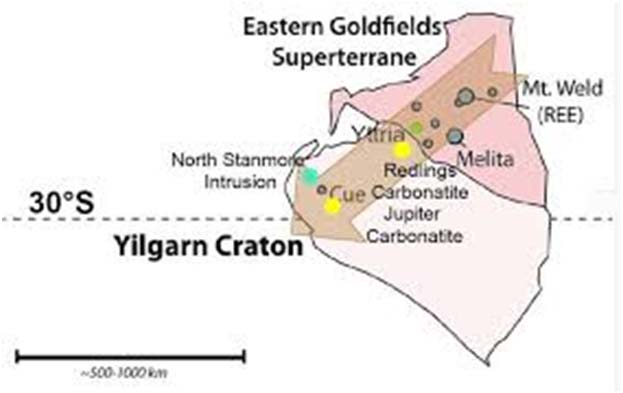

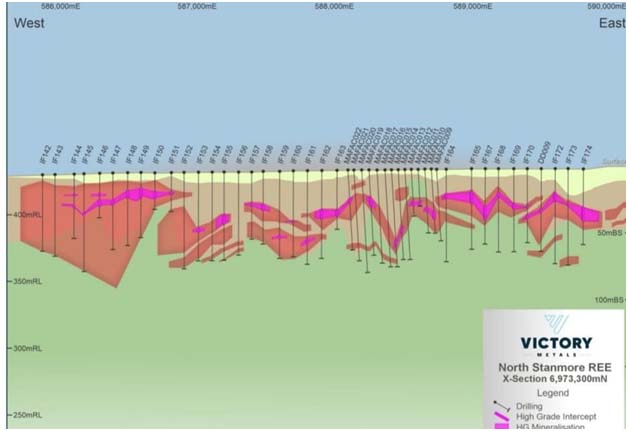

Victory Metals has just announced the sort of resource update that brings suppliers, OEMs and national security planners to a grinding halt. The company’s North Stanmore heavy rare earth project in Western Australia has grown its mineral resource base significantly — something that moves the talk from ‘potential’ to ‘practical supply’.

On the face of things the numbers count: the North Stanmore package now looks like one of the bigger clay-hosted heavy rare earth (HREE) systems in existence, with good ratios of dysprosium and terbium — the two elements that are becoming more highly valued for magnet resistance in electric motors and wind-turbine generators. That mix puts real commercial muscle behind North Stanmore, because rare-earth concentration — rather than tonnage — is what underlies profitable magnet-grade output.

What the upgrade translates to in practice is simple. A larger, more valuable resource provides the impetus for increased engineering spending: Victory is preparing the pre-feasibility work that translates geological conviction into mine plan, processing options and cost estimates. That study will be the link between ‘success in exploration’ and project funding, and it’s precisely the step investors and prospective offtake partners hold their breath for.

A Supply Story that Holds Significance Beyond Mining Headlines

Source: Mining Data Online

Source: https://clients3.weblink.com.au/pdf/VTM/02903539.pdf

Why should a Munich-based carmaker or South Australian wind-farm developer care about an upgrade in Cue, WA? Because dysprosium and terbium effectively add years to the life and efficiency of permanent magnets. Those are the magnets at the centre of EV motors, precision actuators and most renewable-energy technologies. As a deposit has greater heavy-rare-earth concentrations, downstream plants are able to sacrifice less on alloy mixes, and that translates to stronger magnets and less supply-chain headaches driven by dependency. That’s more strategic as jurisdictions seek to diversify from single-source processing markets abroad.

Victory’s recent metallurgical comments provide further colour: the project has yielded high total rare earth oxide content mixed rare earth oxide (MREO) in initial testwork — evidence the deposit is not large on paper only but also metallurgically prospective. That type of product turns a mine into something more than an extractive project: it turns the mine into a feedstock node for magnet-producers and refiners.

Money, Markets And Momentum

Funding indications are already tracking the geology. Victory has made early-stage financing steps and has drawn interest from foreign backers — including a high-profile letter-of-interest for substantial debt financing — that indicate viable avenues to development if technical and permitting issues are resolved. That third-party interest does two things: it confirms the resource in capital markets and it increases the likelihood of local processing or at least secure export contracts.

On the economics side, its scoping activity and general market modelling indicate strong returns with sensible assumptions around price. Those economics will inform the pre-feasibility planning and decide if North Stanmore goes ahead as a low-footprint, modular clay-hosted operation — the kind of configuration that can be extended in stages to fit demand.

What sets North Stanmore Apart — A Pragmatic Perspective

Many rare-earth anecdotes sound like geology summaries; what’s interesting to note here is the deposit type and location. Clay-hosted HREEs, if suitable for simple low-energy processing, have the ability to shift project economics significantly towards localised value capture. The scale, HREE ratios, and suitable metallurgy in North Stanmore means the project might bypass some of the convoluted crushing‑and‑leach circuits that drive costs up in other deposits. If Victory is able to certify low-cost processing pathways at scale, the project may serve as a model for lower-carbon, lower-cost HREE production beyond established processing centers.

That applied distinction also counts when it comes to rare earth mining services. If the project goes ahead, WA’s contractors and service providers — from clay extraction experts to hydrometallurgical engineers — then suddenly have new, near-term demand on their hands. That’s a local economic multiplier: employment, on-the-ground skills formation and possibility of WA-based downstream activity.

Also Read: Speakman Wants AI in Schools. Here’s What That Means for NSW

Risks, Timing And The Long View

A dose of realism: resource upgrades are essential but they do not eradicate technical, environmental or regulatory risk. Pre-feasibility and bankable feasibility phases will challenge assumptions regarding recovery rates, reagent consumptions, tailings handling and rehabilitation. The EXIM letter-of-interest and early capital raisings are positive but conditional — due diligence is still tough and financing is seldom uncomplicated in critical minerals projects.

Nevertheless, the path is set. North Stanmore is transitioning from ‘exploration asset’ to ‘developable project’, and for producers pursuing secure, diversified HREE sources the result is comforting: Australia is yielding deposits with material heavy-rare-earth content and definite avenues to production. That transforms North Stanmore into more than another resources headline, but a prospective linchpin in the quest to reset rare-earth supply chains beyond concentrated processing jurisdictions.

Final take: why this matters now

The international energy transition and electrification of transport place a premium on magnet quality and security of supply. North Stanmore’s upgrade of resources does more than fatten the balance sheet of Victory Metals — it re-shapes a corner of the critical minerals map, providing a pragmatic path to long-life magnet feedstock and local industrial growth. If the early promise is upheld by the pre-feasibility work, North Stanmore may stand as testament to the way geology, technology and policy converge to deliver new, resilient supply chains for the technologies that power contemporary life.