Homeowners Watch Closely as Rates Flatten in Early June

The mortgage rates June 4 2025 snapshot brings a breath of stability to the U.S. housing market. After months of volatility, today’s data reveals fixed mortgage rates holding relatively flat, with a slight drop in shorter-term loans. Experts say this may present a narrow opportunity for homeowners looking to refinance—if they move quickly.

According to Zillow’s national mortgage index, the 30-year fixed mortgage rate currently averages 6.89%, remaining just under the psychologically significant 7% mark. Meanwhile, the 15-year fixed mortgage rate has slipped to 5.95%, making it the most attractive it’s been since early March.

“It’s a holding pattern for now, but any signs of economic softening or Treasury yield declines could send rates downward,” said Casey Grant, a senior mortgage analyst at Beacon Lending Research.

Today’s Mortgage Interest Rates Snapshot

Here’s where national mortgage averages stand as of June 4, 2025:

- 30-year fixed-rate mortgage:89% (no major change from previous week)

- 15-year fixed-rate mortgage:95% (down 8 basis points)

- 5/1 ARM (Adjustable Rate):52% (marginal uptick)

- VA Loan Rates (30-year): averaging 6.49% depending on lender and eligibility

This modest movement contrasts with the rapid rate swings of earlier in the year, when speculation around Fed policy and bond yields sent mortgage pricing on a rollercoaster ride.

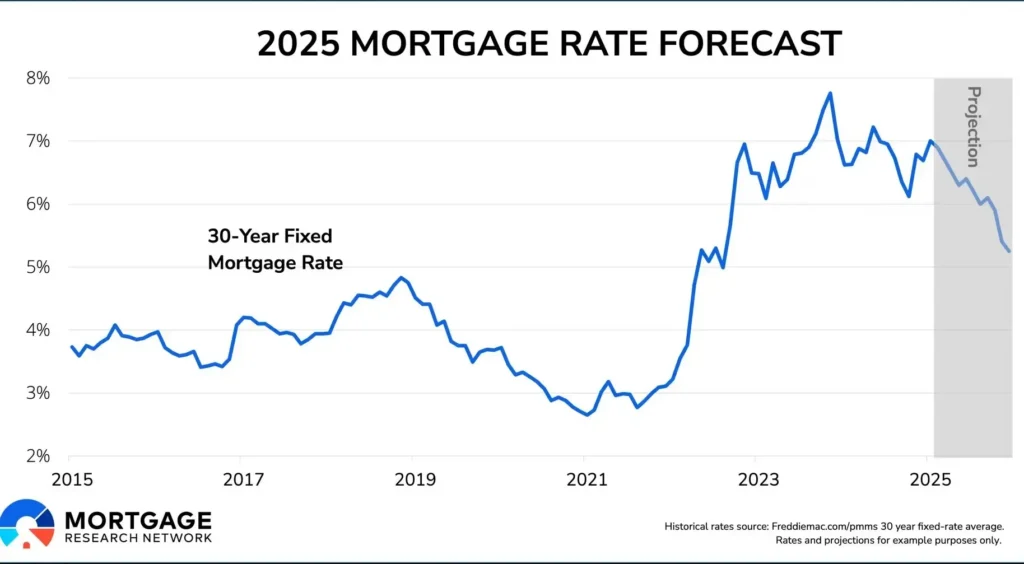

Weekly average mortgage rates in the US, with June 2025 data showing mild easing.

Source: Mortgage Research

What’s Driving the Mortgage Market Right Now?

Rates continue to mirror activity in the 10-year U.S. Treasury bond yield, which has remained stable around 4.1% as investors digest mixed economic signals. While inflation has cooled closer to the Fed’s 2% target, job market softness and signs of cooling consumer spending are beginning to weigh on economic optimism.

This makes lenders cautious. As a result, ARM vs fixed mortgage 2025 comparisons remain nuanced: adjustable-rate mortgages offer marginal short-term savings, but most buyers are sticking with fixed options for stability.

“With bond yields steady and inflation not flaring up, mortgage rates are staying grounded—but we’re one weak jobs report away from a slide,” said Grant.

Mortgage applicants meet with loan officers amid June 2025’s steady rate trend. Credit: PeopleImages / Getty Images

Refinancing: A Second Chance Window?

Refinance mortgage rates June 2025 are drawing renewed attention as some borrowers see a slim margin of savings compared to their original rates from late 2023 or early 2024.

For homeowners who locked in mortgages at rates between 7.25%–8%, refinancing into today’s mid-6% range could offer moderate relief—especially when paired with term reduction to 15 years. However, many are still hesitant due to closing costs and market uncertainty.

“Refinance volume is picking up, but it’s mostly selective,” noted Maria Lopez, a mortgage consultant with Pacific Trust Loans. “It’s homeowners who are doing math, not reacting emotionally.”

VA Loan Interest Rates Today

VA loan rates—available to U.S. veterans and active-duty military—remain more favourable than conventional loan offers. Many VA-approved lenders are quoting sub-6.5% on 30-year terms. These government-backed products continue to be a lifeline for eligible borrowers priced out of conventional lending.

https://finance.yahoo.com/video/mortgage-rates-move-higher-home-162008749.html

Housing Affordability Remains a Challenge

Despite the mild pullback in rates, housing affordability remains an issue across key metro areas. In cities like Los Angeles, Seattle, and Miami, rising home prices and limited inventory continue to keep first-time buyers on the sidelines. Even with a 6.9% mortgage rate, the average monthly payment on a $500,000 home tops $3,300 (excluding taxes and insurance).

Even so, the recent drop in 15-year mortgage rates—alongside lender-driven incentives—could offer some relief to cost-conscious borrowers willing to navigate tighter budgets.

Also Read: Australia’s Economy Faces $2.2B Hit from Natural Disasters in Early 2025

Homebuyers touring new listings in Phoenix as mortgage rates ease slightly in June.

Source: Yahoo Finance

What to Watch Ahead

Looking forward, the Federal Reserve’s upcoming statement and June inflation data will likely shape whether mortgage rates shift again this month. If bond yields begin to slide due to economic concerns—or if rate cut forecasts gain traction—mortgage rates could trend even lower.

For now, lenders and buyers are in a holding pattern, watching the data and waiting for a decisive shift.

Conclusion: Quiet Before the Policy Storm?

The mortgage rates June 4 2025 update doesn’t scream headlines—but that’s exactly why experts are paying attention. Stability after chaos often signals a turning point, especially in housing finance. With economic clouds still forming and Fed moves looming, now may be a smart time for borrowers to lock