The Monero blockchain reorg in September 2025 shook the privacy coins community and gave rise to security fears. Despite reversing 117 transactions, Monero’s price leapt after the 18-block reorg, completely baffling analysts and traders. Thus, this incident is now set at the crossroads of technical risk and investor optimism.

The reorg started at block height 3,499,659, at around 05:12 UTC, stretched until block 3,499,676, and the whole series lasted 43 minutes.

Monero transactions stabilise after full confirmation of the 10th block. This reorganisation went very far beyond that margin. As a result, the usual safety net failed. Payments that were once considered safe were rolled back.

Security analysts claimed such an event could facilitate double-spending attacks. Double-spending is a situation where the same funds are spent twice. This undermines the acceptability and reliability of blockchain transactions.

Monero’s 18-block reorg reversed 117 transactions, but price jumped, baffling traders

Who Might Be Behind the Network Disturbance?

Qubic had spotlighted attention, spotlighting an AI-like blockchain and mining pool. Qubic had earlier proposed to go and stress-test Monero’s network. Therefore, it was implicated in this smaller six-block reorg earlier this year.

The Monero Research Lab pleaded caution. It was said to wait longer than the default ten confirmations for safety. It also advocated for the implementation of temporary DNS checkpoints to improve resilience on the Monero side. These checkpoints might add additional protection against longer reorgs.

Though without any real evidence, suspicions of Qubic remain quite strong. Their public statements and the reorgs occurred suspiciously close.

How Did Monero Price Surge After 18-Block Reorg?

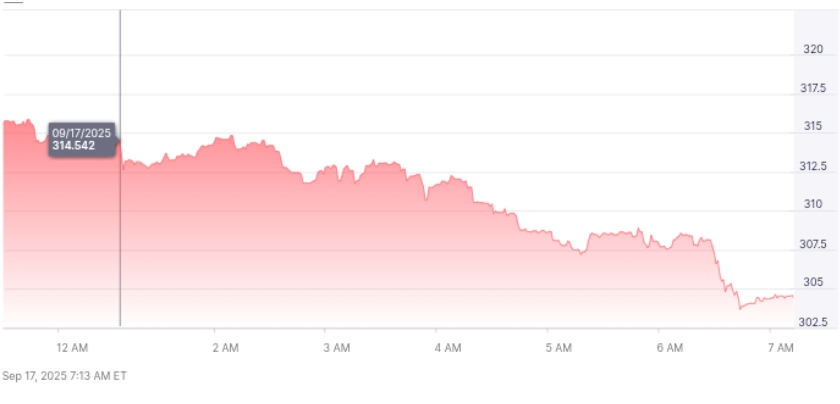

The market behaviour went against prediction. Monero traded not so much during the reorg. Then the rally commenced. XMR gained around 7.4% in a matter of hours.

Prices went from US $287.54 (≈AU$442.10) to US $306.55 (≈ AU$475). That upswing is significant compared to the decline of about 1% in the broader crypto markets.

For the whole month, Monero gained 20.5%, which somehow still cashed in investor spirits. Traders seem more willing to treat the event as a stress test rather than a failure.

Community figure “xenu” claimed it to be the largest reorg Monero has ever seen. Ironically, such dramatic attention may have drawn traders looking for volatility opportunities.

Monero defied predictions, rallying 7.4% post-reorg despite low initial trading

Why Did Investor Confidence Hold Firm?

Two main reasons uphold investor optimism. First, Monero’s privacy stands. While the reorg disturbed the system, it did not disclose user identities. Second, the event ended without permanent disruption: once the longer chain prevailed, life quickly returned to normal.

Moreover, the Monero community has a history of battling back from hard times. Monero’s developers respond fast, giving patches and safeguards against threats. That reputation of being very resilient probably prompted investors to come in, despite the risks.

In markets, perception is everything. Traders saw the reorg as one of those one-off technical events, not a death knell. The story is told by the increase in Monero price post-18-block reorg.

What Security Lessons Should the Community Learn?

The 18-block Monero reorganization of 2025 has called into question security assumptions surrounding confirmations. Ten confirmations may no longer be enough. Users may now have to demand longer periods of safety.

Additionally, a system of temporary DNS checkpoints might be employed to prevent extreme forks from occurring. It is a method of providing nodes with block data that has been verified, thereby minimising the acceptable depth of a reorg.

Experts warn that if lessons are ignored, greater attacks will be invited. The gap may even be exploited in a coordinated manner to achieve double-spending on a large scale. While no funds were proven stolen, the possibility is undeniable.

Temporary DNS checkpoints may curb deep reorgs by giving nodes verified block data

Is Monero’s Network Stability at Long-Term Risk?

The threat has perhaps passed quite soon, but questions remain. Can actors such as Qubic carry out reorgs at will? Uncertainties will follow. Long reorgs test the security and the public trust.

Yet, therein lies hope in terms of Monero’s recovery. The network was able to restart smoothly, prices were resilient, and developers expressed their commitment to strengthening the security of the network.

Presently, Monero remains a working privacy coin. But the Monero blockchain reorg in September 2025 will continue to be a reminder: Decentralised systems always have security battles before them.

Monero Shows Strength Despite Rare Reorg

The unprecedented reorg shook up investor confidence, but Monero escaped full-on disaster and instead went into a rally. The Monero blockchain reorg in September 2025 showcased both vulnerability and resilience.

The Monero price surge following the 18-block reorg demonstrates that market confidence remains intact. However, it is time that we remain vigilant. The lessons regarding security need to be put into practice before attackers can take advantage of them again.

For Monero, the future path is going to be decided by balancing privacy innovations against the stability of the network.

Also Read: Binance and Franklin Templeton Unite for Institutional Blockchain Push

FAQs

Q: What is a blockchain reorganisation?

A: A reorg happens when two chains compete. The longer chain replaces the shorter one, invalidating previous blocks.

Q: How many transactions were reversed in the Monero reorg?

A: Some 117 transactions were invalidated in the 18-block reorganisation of Monero in 2025.

Q: Should users trust the default ten confirmations anymore?

A: Not fully. The Monero Research Lab suggests waiting for more confirmations to be sure of transaction security.

Q: What happened to the price of Monero after the reorg?

A: Monero rose 7.4%, from US$287.54 to US$306.55, revealing some investor resilience.