Executive summary

There is a quiet but far-reaching revolution underway in mining. From the Pilbara to the Cadia belt to remote goldfields around Australia, operators, technology companies and research institutions are piloting how to use old tailings as feedstock, not landfill. The motivations are realistic: declining ore grades, surging demand for key minerals, better social licence and more acute regulation. New process technologies (from enhanced flotation and hydrometallurgy to biological leaching and patented chemical-free processes) are able to recover metals previously not considered economic. Meanwhile, information, digital twins and high-tech monitoring systems are making reprocessing and tailings management more reliable and safe.

This report describes the technical choices, outlines the economics and business models, and delves into four Australia-focused case studies: Wiluna Mining’s retreatment project, EnviroGold’s NVRO demonstrations, Cadia’s automation initiatives and Fortescue’s electric/autonomous haulage plans. It concludes with actionable policy and industry recommendations to accelerate a commercially resilient, socially acceptable path to circular-thinking mining in Australia. ( Reuters, CSIRO)

1. The scale: why Tailings Now Matter to Australia (and the world)

Tailings are the powdered rock remaining after minerals have been released during processing of the ore. Traditionally, tailings were piped into engineered (and sometimes unengineered) storage facilities and left there. But two factors have altered the way the industry perceives them.

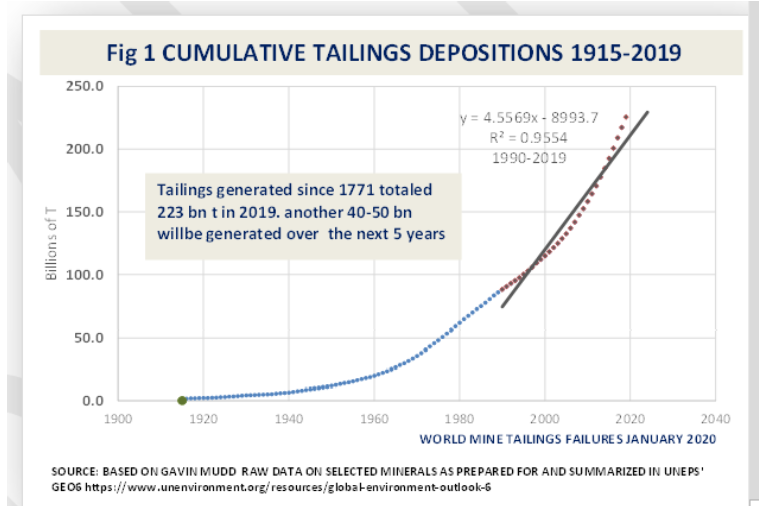

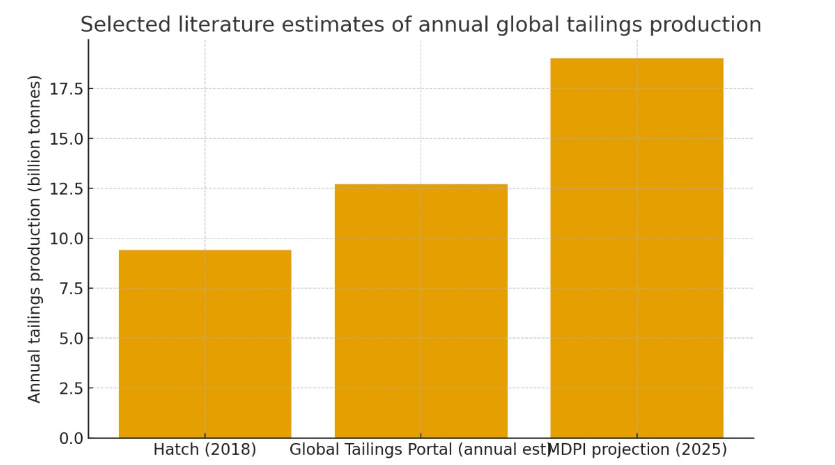

First, volume: recent scholarship and international overviews estimate yearly worldwide tailings production at single-digit to double-digit billions of tonnes (various studies apply differing methodologies — in this case, Hatch approximated ~9.4 billion tonnes in 2018 while the Global Tailings Portal and other assessments demonstrate higher, range-based estimates). That volume includes residual amounts of gold, copper, nickel, rare earths and strategic commodities more generally. The TSFs (tailings storage facilities) of the world hold hundreds of billions of tonnes of solid material: a hidden resource base. (Hatch, MDPI)

Second, regulation and risk: events like Brumadinho 2019 revealed the disastrous human and environmental toll of collapsed tailings facilities and set off the Global Industry Standard on Tailings Management (GISTM). That benchmark — combined with investor insistence and citizen activism — compels re-thinking how older tailings are handled, offering both challenge and opportunity. In Australia, TSF surveys reveal several hundred active and inactive facilities that are now candidates for remediation, re-use or resource recovery.

Simply put: there is a vast legacy of material, shifting regulatory expectations, and market demand for critical metals — all of which make the conditions for tailings to be valuable feedstock rather than immovable waste.

2. The technical toolbox: how tailings can be reworked

There isn’t a one-size-fits-all approach to tailings deposits. Rather, the industry is putting together a toolkit of methods, selected for mineralogy, grain size, chemistry and local restrictions (water, remoteness, community priorities). The methods lie in practical families:

2.1 Physical separation and refurbishment (flotation, gravity, magnetic)

Fine-grained tailings can still contain coarse and heavy mineral phases suitable for flotation, gravity separation and magnetic techniques. Operators upgrade old concentrators or construct modular circuits to recover residual gold, copper or iron minerals. Where practical, this technique is established and comparatively low-risk. (AusIMM)

2.2 Hydrometallurgy (leaching, closed-loop chemical processing)

Reprocessing is usually done with customized leach chemistries that can dissolve target metals from the tailings matrix and enable precipitation, solvent extraction or electrowinning. Hydrometallurgy is selective and scalable depending on reagents and circuit design, but reagents and process effluent need to be carefully managed. Modern flowsheets for copper or rare earths recovery from tailings reveal realistic opex in the low tens of USD per tonne (site dependent). (ScienceDirect, T&E)

2.3 Biological strategies (bio-leaching, enzyme-mediated solubilisation)

Firms like Allonnia (a Sydney-based bio-ingenuity company) are developing microbial or enzyme-meditated approaches to solubilise target metals or pre-treat tailings in a manner that minimises reagent consumption or upgrades feed for downstream processes. Such approaches can be more environmentally friendly (less chemical usage) but tend to be in pilot or early commercial scale and rely on favourable mineral chemistry. (Allonia)

2.4 Thermal / high-energy processes (innovative pyrometallurgical / plasma methods)

Experimental plasma-assisted digestion or intense thermal oxidation (some companies market it as “chemical-free” high-energy processing) is being tested on highly specific recalcitrant tailings, particularly where encapsulated or nanometal clusters are resistant to normal leaching. IPRI.Tech and other researchers are marketing such techniques; these have good potential where energy input and emissions can be controlled or compensated. (Ipri)

2.5 Dewatering, dry-stacking and secondary utilization (construction materials, geopolymers)

Dewatering of tailings to form paste, dry stacks or agglomerated material minimizes water requirements and allows reuse as road base, bricks or engineered construction materials. This minimizes dam footprint and risk while generating sellable co-products. CSIRO research on dewatering and FO–RO water recovery also falls under this. (AusIMM, CSIRO)

2.6 Pre-concentration & “ore-sand” concepts

Pre-sorting (ore sorting based on sensors) may eliminate some inert gangue ahead of fine processing, significantly cutting throughputs and cost. University of Queensland’s OreSand research and associated projects demonstrate how pre-separation can yield a high-value sand product and minimize tailings volumes downstream.

(For a concise overview of techniques and working tradeoffs, refer to the table I created earlier: “Tailings techniques — summary table (illustrative)”. (Sustainable Mineral Institute)

3. Why reprocessing is cheaper — and why, sometimes, it is not

There is a recurring assertion among investors: reprocessing tailings costs much less than developing new mines. That is so, sometimes, but the truth needs to be teased out.

3.1 The “cheap drill”—why reprocessing is low cost

No blasting, restricted haulage: tailings are onsite; there is no strip ratio or drilling. This removes much of the major portion of capital and operating expense of virgin mining.

Use of existing infrastructure: old plants, pipelines and power connections can be reused.

Less capital intensity for small modular plants: new modular circuits and pilots reduce the initial commitment required to test viability.

Several industry commentaries report tailings reprocessing opex at near the bottom of the mining cost curve in successful projects (figures mentioned in industry roundups vary from sub-USD 2/t to tens of USD/t depending on deposit and process). (Crux investor , T&E)

3.2 The “reality check”—why most tailings projects fail commercial test

Variability of grade and distribution: tailings are heterogenous. Economically recoverable concentrations in some areas of a TSF; none elsewhere. Characterisation is costly.

- Complexity of processing: fine particles are problematic — fine grained slimes, refractory phases, or sulfide/oxide matrices may demand energy-hungry or chemically aggressive flowsheets.

- Logistics and permitting: hydrometallurgical circuits generate wastewater streams; approvals, community consultation and remediation requirements can extend timelines.

- Market sensitivity: recovered volumes and prices (particularly for gold, copper or strategic elements) have a strong impact on project NPV.

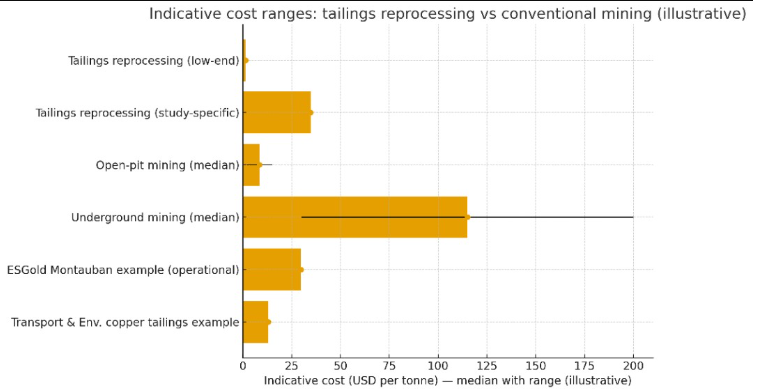

- Example numbers: one recent investment opportunity (CruxInvestor synthesis) compares an indicative tailings re-treatment cost of USD 1–2 per tonne to open pit’s USD 2–15/t and underground’s USD 30–200/t — but other cited detailed techno-economic analyses have higher individual opex rates (e.g., a TEA used by academics and referenced herein at ~USD 34.7/t for a specific tailings re-treatment case). That range emphasizes site-specificity of economics. (Crux investor, digitalcommons)

Figure 1 (above) illustrates these indicative ranges — use it as a reality check and not as a hard industry average.

4. Digital and data tools: the quiet enabler

If process chemistry and mechanical engineering represent the first wave of change, data and digital systems represent the second. Contemporary digital tools do three interrelated jobs:

4.1 Real-time safety and monitoring

Remote monitoring, drones, satellite interferometry and integrated dashboards increasingly offer real-time tailings-facility health indicators (seepage, deformation, water saturation). They mitigate surprise failure threat and input to early-warning systems and contingency planning — a regulatory and reputational necessity since Brumadinho. (Global Tailings Review, worldminetailingsfailure.org)

4.2 Process optimisation (digital twins and advanced analytics)

Digital twins and generative modelling allow operators to experiment with alterations to the plant, try reagent schedules, and adjust conveyors and mills in the digital world. BHP and other tier-one miners have reported substantial boosts from digital twins and advanced analytics — allowing for more precise control of mills, blending and reagent decisions. All this optimisation boosts recoveries and reduces energy and reagent intensity — important when margins on tailings reprocessing can be tight. (bhp.com)

4.3 Predictive maintenance and fleet optimization

Fleet telematics, component monitoring at component level and predictive software minimize downtime and maintenance expenses on reused existing plants for reprocessing. Cumulatively, this results in increased uptime and a reduced path to profitable cashflow on pilot and small commercial plants.

In summary, the data layer converts marginal metallurgy into manageable metallurgy: improved inputs (characterisation), improved processing (digital twins), improved outputs (predictive maintenance and quality control). (Mining Technology)

5. In-depth case studies

The following four case studies were selected to show actual technical and commercial results at Australian operations or headed by Australian companies/teams.

Case study A — Wiluna Mining: tailings retreatment in practice

Wiluna Mining (Western Australia) has also aggressively adopted a tailings retreatment program, commissioning circuits to treat tailings and dump-leach stockpile material as part of plant feed and yielded thousands of ounces of gold from reprocessed tailings in 2023–24. Company reports and quarterly reports record tailings feed into CIL tanks during the ramp-up and commissioning stage, with volumes of material recorded and gold recovered. Wiluna’s experience illustrates the operating dynamics: incorporate tailings feed into a conventional CIL circuit, ramp throughput with assurance of recovery, deal with water and variable feed grade — and utilize the cashflow to underpin wider restart activity or exploration. (Wiluna Mining, minedocs.com)

Lessons: conservative ramp-up and prudent sampling; be prepared to accept that tailings reprocessing does not substitute the central mine plan but can deliver mid-life cashflow and clean up liabilities.

Case study B — EnviroGold Global: demonstration and licensing of NVRO

EnviroGold has purchased and is running demonstration NVRO (neutralising, volume reduction, oxidation-type) pilot plants capable of chemically or electro-chemically treating tailings and extracting metal while neutralising environmental danger. Their technology strategy focuses on modular demonstration plants (treatment up to several tonnes per day in demo environments) and commercial licensing to third-party processors. EnviroGold has finished virtual simulation work and is positioning NVRO as a licenceable, site-f可iable solution. That business model — technology development and subsequent licensing to locally expert operators — is one commercially appealing route because it keeps the developer’s capital at risk to a minimum while facilitating quick deployment to several TSFs. (Yahoo Finance, Envirogoldglobal.com)

Lessons: modular pilot plants make low-risk commercial routes if matched with local operators; digital simulation expedites project de-risking.

Case study C — Cadia (Newmont / Ridgeway): automation and complex site integration

Cadia (Central West NSW) is not a reprocessing tailings story in itself, yet its experience with automation and integration demonstrates how sophisticated mining operations can tie together various OEMs, digital twins and automation stacks — competency that can be applied to reprocessing plants. Newmont’s drive toward automation (through partnerships with OEMs like Epiroc) and the implementation of integrated control systems offer a template for the way digital control can minimize variation in operations and maximize plant throughput in reprocessing situations. In brief: automation decreases operational risk and lifts the ceiling on recovery from recalcitrant feed. (pure gold films)

Case study D — Fortescue: fleet electrification, autonomy and system efficiency

Fortescue’s aggressive acquisition and certification program for battery-electric, autonomous haul trucks (with Liebherr and other partners) is another route to cost and emissions reduction in surface operations. Autonomously electrified fleets alter hauling economics, which is applicable if reprocessing facilities entail major on-site haulage or mobile filtration/dewatering infrastructure. Fortescue’s investments (large truck orders and charging systems) illustrate the scaling up of fleet electrification and autonomy in Australian conditions.

Lessons throughout case studies: success is the product of metallurgy, modular pilot plants, electronic control and a pragmatic commercial route to cash flow. (The Australian)

6. Environmental, social, regulatory and technical challenges

Before we break out the champagne, it is crucial to bring to light the challenges — practical and political — that often derailed tailings projects.

- Chemical and water management: most hydrometallurgical processes produce concentrate effluents that must be treated. FO–RO and other modern water recovery techniques minimize net discharge but increase operating and capital complexity. CSIRO’s research on FO–RO is promising for on-site water recovery but serves as a reminder for operators of fouling and energy compromises.

- Residual risk and responsibility: redone tailings can minimize one risk but generate new forms of chemicals; regulators insist on transparency about long-term stability. National regulators and Global standards (GISTM) call for transparency and adequate closure planning.

- Scale and logistics: low-tonnages of valuable material are economically workable; massive, low-grade quantities need economies of scale available that not all sites provide. Transport economics from remote TSFs or absence of local facilities can make a project dead.

- Community expectations: local communities desire remediation, employment and guarantees that reprocessing won’t recreate risk. Wider, open consultation is still non-negotiable.

- Technical uncertainty: certain tailings are refractory phases, clays, or organically-bound metals that defy traditional extraction — R&D work continues and is frequently site-specific.

7. Policy and industry suggestions for Australia (practical, realizable)

If Australia desires to turn its tailings legacy into a national asset (material security, employment, remediation), a number of calculated steps would bring results sooner.

Focused R&D and demonstration funding

State and federal government grants can de-risk pilot plants and co-finance demonstration facilities for encouraging methods (bio-extraction, FO–RO, NVRO-type systems). Natural vehicles are CSIRO and university collaborations (e.g., UQ OreSand).

Incentivise Modular, Licenceable Technology Models

Technologies that scale via licensing (process provided by developer, local capex carried by operator) are lower in risk and are able to scale impact more quickly than one or more large corporate investments. EnviroGold’s licensing model is one such example.

Standardise monitoring and data transparency

Make real-time monitoring standards for TSFs (in line with GISTM) mandatory and make operators publish critical health metrics. This promotes local trust and allows third-party investment.

Incentives for cyclic use of reprocessed tailings

Provide tax incentives or procurement priority for construction projects utilizing certified tailings-derived products (geopolymers, aggregates). This drives demand pull for secondary products.

Accelerated permitting for small modular pilots

Streamline evaluation pathways for small, well-scoped pilots (with stringent environmental controls), which allow quick field verification without compromising stringent standards. Clarity of regulation lowers investor risk.

Public-private regional hubs

Create regional hubs where multiple nearby TSFs can share modular processing, water treatment and logistics — a cluster approach reduces per-project capex and develops local supply chains (engineering, labs, maintenance). Australia’s patchwork of deposits lends itself to such regional clustering.

8. Visuals and metrics

Figure 2 — Some literature estimates of annual global tailings production: varying methodologies yield varying numbers (Hatch 2018, Global Tailings Portal, MDPI projection).

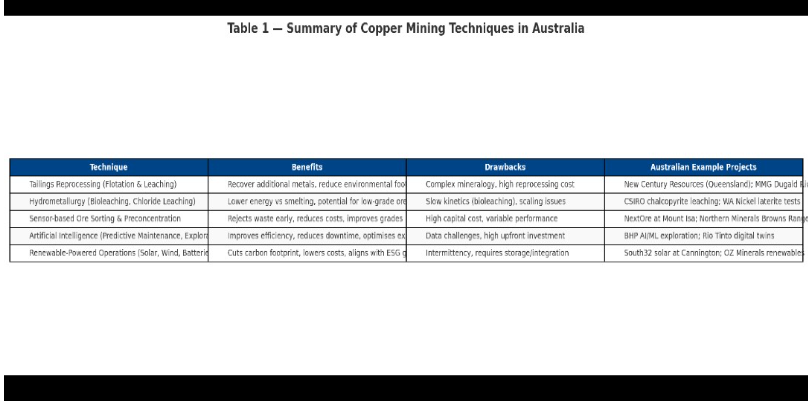

Table 1 — Summary of techniques: concise, pragmatic overview of most frequently encountered technique families, usual benefits and drawbacks, and Australian example projects. CSIRO, Envirogoldglobal.com

If your brief calls for it, I can also turn these charts into PNGs or SVGs for publication-quality, ready-to-use by a designer, and offer a wireframe suggestion for an extended infographic (map of Australia with Wiluna, Cadia, Pilbara, Kidston marked on it with icons representing technology type).

9. A further-reaching — a practical three-year plan for an operator or policy maker

Year 1 — Characterise & pilot

- Finish high-definition sampling and metallurgical testwork over a TSF’s bench-scale footprint.

- Operate at least one modular pilot (1–50 t/d) for a high-potential flowsheet (flotation + hydromet or bio-pre-treatment), with in-line FO–RO water recovery if the deposit is wet.

- Employ monitoring stack (sensors, satellite surveillance) and release an independent tailings-health dashboard.

Year 2 — Optimise & tie into circular markets

- Construct a demonstration plant and secure offtake for recovered metals and any construction co-products.

- Secure provincial/state money or tax credits for remediation activity and commercial pilot.

- Utilize digital twins to optimize recovery and reagent schedules, and iterate.

Year 3 — Scale responsibly

- Scale to commercial scale where techno-economic models are proven; contemplate licensing the process to regional hub partners.

- Combine fleet efficiency (electric haulage where applicable) and full closure planning for residual tailings.

This is a realistic route: pilot to demonstrator to licensed hub — rather than oversized single projects that struggle to close financing.

Conclusion — Pragmatic Optimism

The technological revolution which Andy Home and others characterize as quiet is quiet in that it is technical, iterative and engineer-led, lab scientist-led and locally innovated as opposed to high-visibility new mines. Australia has a number of comparative advantages for that revolution: robust research institutions (CSIRO, universities), an established mining services industry, and a structure of regulation and capital markets that increasingly values low-risk, high-transparency remediation and resource recovery.

There are no general answers: not all tailings deposits are a pot of gold in the mud. But the integration of focused metallurgy, modular demonstrations, high-definition digital monitoring, and reasonable public incentives provides several commercially viable avenues. That integration is precisely what’s making legacy waste an asset for Australia — economically beneficial, environmentally required, and politically reasonable.