The International Energy Agency (IEA) has sounded the alarm on a cooling trend in global spending on critical minerals, despite continued demand growth for key commodities like lithium and copper in 2024.

Released this week, the IEA critical minerals 2024 report reveals that after two years of robust capital flows into exploration and development, investment across major mineral markets is beginning to plateau—raising concerns about the long-term security of supply chains essential to energy transition technologies.

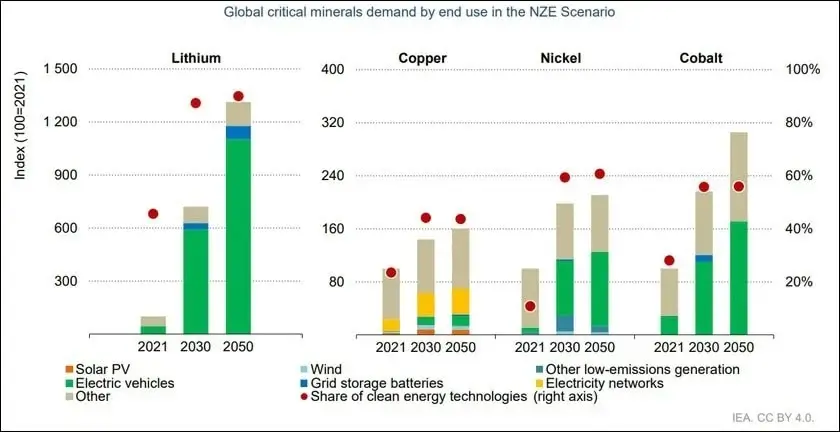

Image 1: Global mining infographic showing demand and investment trends for lithium, copper, and rare earths

Source: IEA Critical Minerals Report

Critical Minerals Investment Slowdown Sparks Supply Chain Fears

The critical minerals investment slowdown in 2024 comes as a surprise to many analysts, given surging global targets for electric vehicles (EVs), solar infrastructure, and grid storage. However, high interest rates, permitting delays, and geopolitical headwinds have weighed on investor sentiment—especially in jurisdictions outside of China.

According to the IEA, global investment in critical mineral development grew just 10% this year, down from 30% in 2023. Lithium projects fared better than others, but even here, the rate of new funding tapered amid volatile spot prices and rising supply from Australia and South America.

Lithium Demand Growth 2024 Remains Strong but Volatile

Despite the investment dip, lithium demand growth in 2024 remains solid. Battery manufacturers and EV producers continue to secure long-term offtake deals, particularly in Asia-Pacific and North America.

Australia continues to play a pivotal role in global lithium supply, contributing significantly to the world’s output through both established and emerging projects. However, new lithium developments are encountering environmental and financing challenges, with smaller players struggling to move beyond feasibility.

Image 2: Litthium brine operations in South America

Source: [Energy Storage Publishing]

The IEA notes that while short-term lithium supply is keeping pace, long-term security will require diversified sourcing, refining, and recycling infrastructure.

Copper Project Pipeline Faces Major Shortfall

The report also highlights a growing concern around the copper project pipeline shortfall, which may pose a greater risk to global decarbonisation than lithium.

Demand for copper—essential for grid transmission, EV wiring, and renewable generation—is expected to double by 2035. Yet current pipeline projects are insufficient to meet even half that need, according to the IEA.

“We are entering a copper crunch,” one analyst remarked. “The mismatch between required demand and committed investment is becoming too large to ignore.”

Image 3: Open-pit copper mine in Chile

(Image courtesy of Glencore: https://www.gbreports.com/ )

Global Mineral Supply Concentration Remains High

The IEA critical minerals 2024 report also underscores the risk posed by continued global mineral supply concentration, with China remaining dominant in cobalt refining, graphite processing, and rare earths separation.

China accounts for:

- 70% of global rare earths processing

- 60% of cobalt refining

- 90% of natural graphite anode supply

This concentration not only leaves supply chains vulnerable to disruption but has triggered policy responses in the EU, US, and Australia, which are now offering incentives for domestic and allied mineral production.

China Export Controls and Market Uncertainty

Beijing’s recent export controls on minerals like gallium and germanium have compounded investor anxiety, signalling a willingness to weaponise supply chains amid trade tensions.

These restrictions, combined with inflationary pressures and volatile commodity prices, have added a layer of caution to the global IEA investment trends 2024, which had previously been buoyed by net-zero targets.

Rare Earths and Processing Bottlenecks

The rare earths market share controlled by China also creates complications for western nations trying to build wind turbines and electric vehicles. Without diversified processing capacity, even large-scale mining projects may be bottlenecked.

This is particularly true for cobalt and graphite processing, where non-Chinese capacity remains limited despite growing deposits in Africa, Australia, and Canada.

Australia’s Position: Strategic Yet Pressured

Australia remains a key player in the global critical minerals market, but its projects face familiar barriers: approvals, workforce shortages, and funding uncertainty.

Government initiatives such as the Critical Minerals Strategy and partnerships with the US and Japan are helping unlock new developments—but the pace may not be fast enough to meet demand projections.

Conclusion: Investment Urgency Meets Policy Caution

The IEA critical minerals 2024 report delivers a clear message: the global energy transition cannot be realised without secure, scalable supply chains for critical minerals.

Yet the current critical minerals investment slowdown signals a dangerous disconnect between policy ambition and market execution.

Unless governments and industry recalibrate incentives, streamline permitting, and expand refining capacity beyond China, the world risks falling short on its clean energy goals—not for lack of demand, but because of insufficient investment.