Image: Steve Lovegrove/shutterstock.com

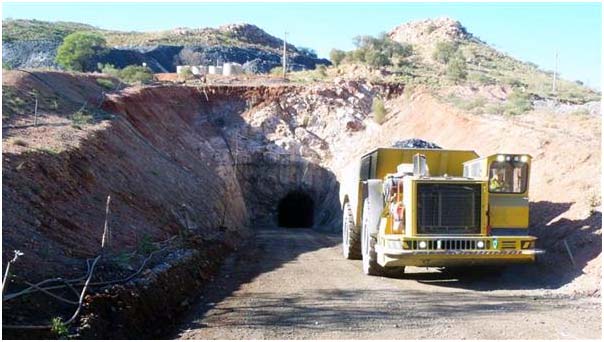

In a move that represents its evolution from explorer to developer, Black Cat Syndicate has contracted Mineral Mining Services (MMS) to expose the Fingals Deposit, north of Kalgoorlie, to open-pit mining. The deal not only brings digging crews and equipment to site, but brings existing processing within reach through the Lakewood facility—a company milestone for its Kal East gold expansion.

With this arrangement, ore production will commence from mid‑2026, propelling the company into inaugural gold production phases with minimal initial infrastructure cost.

Strong Foundations: What’s Currently Happening

Source: Northern Star Resources

Contract signed: Open-pit mining operations at Fingals by MMS will be based on off site plans drawn up earlier this year.

Ore access secured: Tipping rights at Lakewood processing plant over Lakeside give Black Cat scope to toll-treat ore instead of building its own mill.

Timeline: Pre-stripping and pit preparation late 2025, production rolling into 2026—underpinned by faith in resources and weather windows.

The transaction is a radical change of direction from past strategy: away from extended analysis and high capex and directly into monetising the asset via established third-party avenues.

Fingals: Hidden Promise Near the Surface

Source: Listcorp

Fingals is one of the more under-estimated early-stage finds in the Kal East corridor. Grades have surface proximity in transition zones and saprolite offering accessible ounces with no deep shafts needed. Paired with Norwood and Whistler, Fingals brings an expanding portfolio providing Lakewood with feed and fits into a low-capital, high-flexibility strategy.

Existing material previously drilled to economic cut-off can be hauled to the mill on haul road—no construction permits, no major works interfering with operations, no crushing plants.

Local stakeholders—landholders, councils and native title groups—reacted well immediately to the clarity and timing following the announcement. Black Cat and MMS emphasized in early community meetings their focus on ensuring local staff, local suppliers and regional logistics take priority, reducing dependency on FIFO (fly-in fly-out) models.

The ripple impact flows through Bendigo Road maintenance timetables, Kalgoorlie fuel depot procurement contracts, and even first-year training courses for locals eyeing haulage, geology or environmental monitoring positions.

Why This Contract Brings New Perspective

Flexibility rather than size: Black Cat is preferring flexible implementation suited for resource size, rather than huge mill construction.

Payback of capital minimized: Through commissioning mining and toll treating, upfront costs are focused on developing ore zones—not building.

Room to expand: On the back of deeper cap drilling results, the project can expand quickly—no up-front plant investment to limit decision-making.

Local sustainability: Job retention emphasis in Kalgoorlie and shires surrounding it buck the trend of the typical boom-bust cycle.

That is unlike conventional Kalgoorlie projects which require initial high costs of investment before production—Fingals overturned that paradigm.

The Financial Equation

Black Cat has A$35–38 per tonne mine cost and Lakewood toll-treatment under A$45 per tonne. A production estimate of 35,000–40,000 ounces per annum from Fingals becomes very realistic at grades of 2–3 g/t gold. Toll treatment avoids initial mill construction, and investment is in the range of A$15–20 million—recovered in the first year of operation.

A small-cap gold chart watcher had this to say, “This strategy materially shortens payback periods,” while creating optionality in case of declining gold prices or a steep recovery.

Also Read: Speakman Wants AI in Schools. Here’s What That Means for NSW

Industry-Wide Implications

Black Cat’s approach can change the project development mindset of juniors in WA. The Fingals strategy of “mine small fast, grow later” shatters the norm of exploration being followed by lengthy processing capacity. Instead, the Fingals approach takes a hybrid: early production via common mills, with potential for expansion when targets revert.

If successful, the plan would trigger infrastructure sharing models in Kalgoorlie, encouraging other companies to haul ore to Lakewood rather than build competing mills.

What’s on the Horizon

Early mining activities: MMS crews will begin site establishment and haul road construction from the northern pit at some point during 2026’s dry season.

Growth in resources: Ongoing extension drilling, especially in the upper-grade zones, could accelerate ramp-up beyond debt-neutral production.

Toll treatment risks: Lakewood capacity limitations or disruptions may impact Fingals cash flow in the absence of alternative expressions.

Regulatory and environmental requirements: Black Cat and MMS must achieve on-going conformity with water, heritage and dust controls along RMS operating roads.

Last Word: A Blueprint for Responsive Mining

Leasing mining at Fingals and using Lakewood’s already built mill is a smart turn that combines geological assurance with operating practicality. It is a gold-mining story for the next millenium: fast, flexible, community-oriented and low in initial cost—just the story appropriate to markets that like unlockable early-stage value.

In an industry once dominated by titans of yore, Fingals shows that a quick-footed operator can choose speed, neighborhood connectivity and quickness—and still deliver ounces. For Kal East and its crew, the future came on time.