The Pacific archipelago known as the Marshall Islands is making big news in the world arena – not because of its beautiful atolls or geographical significance but due to its innovative take on public finances. Towards the end of 2025, the government initiated an innovative take on social security in the form of the world’s first blockchain-based Universal Basic Income scheme, providing its people with financial assistance in cash form, including, as an additional choice, digital money. (theguardian)

It’s not a hype project or a pilot project. Rather, it’s an operational safety net program in the country known as the ENRA system, which makes use of sovereign funds via the digital wallet on the Stellar blockchain platform. The payment of this service also involves USDM1, the dollar-pegged sovereign digital bonds, which are accessible via the Lomalo wallet app offered by the government itself.

While several countries remain on the fence about central bank digital currencies or digital welfare infrastructure, the Marshall Islands is already providing cash on a blockchain. In fact, for the residents, this is both a novelty and an inevitability.

Marshall Islands launches the world’s first blockchain-based UBI with digital payments. (Image Source: The Guardian)

A Fresh Start for Public Cash Transfers

While universal basic income is a theoretical concept and a topic of debate among economists and politicians, and while countries are only starting to consider it, the Marshall Islands are already using such a system.

Under this initiative, all eligible citizens start to get around US$200 every quarter, or approximately US$800 annually, with the aim of compensating for the rising cost of living and bolstering the safety net. Assistees have the option to collect the money either traditionally, for example, by bank transfer and cheque, or access the same amount of cash via an electronic wallet facilitated by blockchain technology.

Also important is the optional crypto-enabled payout. This is evidence of the desire to straddle financial hurdles in a country which stretches across almost 30 coral atolls, some of which have no banking infrastructure. Blockchain enables quick one-off transactions even in rural areas where digital banking is scanty.

This is the first time in history that the welfare model is being upended like this, and it raises an overriding question about the implications of programmable money being combined with public welfare.

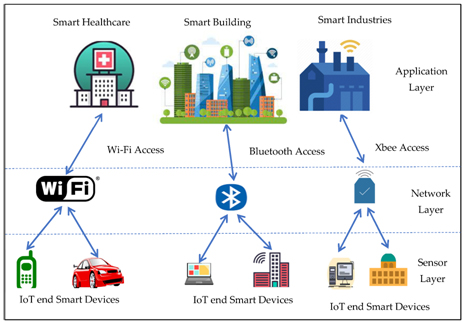

Marrying Money and Blockchain: How It Works

However, the essence of the Marshall Islands’ project is USDM1, the sovereign digital bond that is fully collateralized by US Treasury Bills with maturities of no more than six months. This is not some hot new cryptocurrency that may fluctuate from day to day. This is an enforceable public asset, secured in trust and backed by the US dollar under the jurisdiction of the law of the State of New York.

The government uses Stellar’s blockchain infrastructure to distribute USDM1 funds, taking advantage of its low costs and fast settlement times. Citizens who choose to participate have funds deposited directly into their Lomalo wallet, which has been developed by blockchain collaborators.

This system combines the traditional method of sovereign finance with technology:

- The effectiveness of USDM1 having Treasury support, thus non-speculative.

- Security and Transparency from Stellar’s Open Network.

- Accessibility through smartphones and simple digital interfaces.

The Marshall Islands, essentially, has used blockchain as a tool for the distribution of welfare, as opposed to a tool for speculation.

USDM1 is a US Treasury-backed digital bond, using blockchain to deliver welfare, not speculation. (Image Source: Cointribune)

Why It Matters: Beyond a Novelty

To begin with, a payment of US $800 per year might seem quite small. However, there are a number of levels at which this particular programme is important:

- Addressing Financial Exclusion

There are also Marshallese who reside far from banking facilities. Conventional banking transactions may be slow or even not possible in certain atolls. The use of blockchain wallets provides money access via another platform that banks cannot reach.

- A Blueprint for Small States

Small island nations are plagued by economic challenges such as isolation, lack of banks, and reliance on foreign aid. The Marshall islands example is one where technology is used to bring public programs closer at a considerably reduced cost without compromising stability.

- A Practical Application of Blockchain

Cryptocurrencies face difficulties in terms of stories associated with volatility and speculation. In this case, blockchain is applied in real social policy implementation, including payment delivery, transparency, and predictability.

The Human Story: Inclusion & Opportunity

The interviewed citizens see this initiative as a great relief, especially during a challenging economy. In a country where the distance is large and the services are also far, receiving payments instantly through digital means is a revolutionary aspect, especially for citizens who cannot reach bank services.

Finance Minister David Paul reiterated that the digital solution is to improve the financial systems and that no one will be left behind. The digital solution is an option not an obligation – a balance between inclusion and individual choice. (coinglass)

For young adults operating small enterprises in Majuro or Ebeye, getting money immediately in electronic money form may mean being able to pay money owed to a supplier rather than waiting days for the check to clear. It may mean, for seniors in atolls, fewer trips to access cash support.

This means that individuals can plan their finances with confidence in the presence of informal transfers, summer jobs, and price fluctuations in the economy.

Translating the Tech Without the Geek-Speak

Here are the basic mechanics in simpler words:

- The blockchain offers a secure digital record-keeping mechanism. The blockchain provides a way to make transparent and irreversible payments.

- Stellar is the particular blockchain that is used, and it is known for its fast and low-cost payment transfers.

- USDM1 is an electronic equivalent of the government asset that is fully backed at all times by US Treasury bills.

- Lomalo wallet is an application used by citizens to receive and process their payments.

This means there will be no wild fluctuation of prices, as with some virtual currencies; there will also be no hidden charges, and customers will not have to queue to make payments at the bank.

For someone who has never heard of cryptocurrency, the Lomalo wallet is akin to having a digital banking account developed by the government using safe and advanced technology.

But unlike the popular cryptocurrencies found on trading platforms, USDM1 is not intended for speculation – it’s actually a digital form of real money safely and transparently stored.

The Debate Surrounding Blockchain Welfare

Not all agree. Concerns raised by skeptics include:

- Internet and Device Access: Not all atolls currently have internet or even smartphones, which could be a barrier.

- Financial Literacy: Some beneficiaries may not understand concepts like money, keys, and electronic transfer. This is where education becomes a highly essential component.

- UK Regulatory Concern: In institutions such as the International Monetary Fund, warnings are seriously made concerning the integration of unproven digital assets within sovereign programs. (cointelegraph)

But the government’s decision to make the use of crypto optional, alongside bank transfers and checks, is evidence of pragmatism rather than ideological conviction.

Critics raise access and literacy concerns, but crypto remains optional. (Image Source: MDPI)

A Global First with Real-World Impact

This is not a simulation pilot. The Republic of the Marshall Islands (RMI) is currently undertaking the UBI payment process via on-chain disbursements with money being directed into the digital wallets of the RMI citizens created with Crossmint technology on the Stellar network.

For local residents, it means that:

- Faster Access to Funds: Online payment dispersal avoids expensive cash delivery between 1,200+ remote islands.

- Greater Control: Their digital balance can be held, transferred, or spent among peers.

- Friction Is Reduced: Instant settlements are achieved even in areas without banking services.

According to sources, this marks the initial use of blockchain with visible public utility value beyond just markets or token trading. For ordinary citizens, this is, I think, less about crypto hype and more about financial infrastructure, especially where traditional banking solutions have come up short.

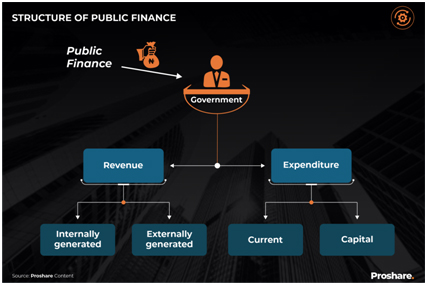

How This Could Impact Public Finance for Small Countries

1. Enhancing Financial Inclusion

A major difficulty in the Marshall Islands is getting its residents connected with mainstream financial systems. This is because most residents are either under-banked or receive cash deliveries on a sporadic basis.

This is because the blockchain technology-based solution reduces barriers:

- Traditional bank accounts are no longer required.

- Mobile wallets will operate in areas where banks cannot penetrate or where digital transitions counteract cash shortages and the unavailability of ATMs.

- And since USDM1 is totally supported by US Treasuries, there are no speculative risks because the asset has a fixed value in terms of dollars.

This has significance because, all too often, ‘crypto solutions’ have failed because of price volatility or because people have not been able to spend their crypto. This issue has been eliminated in this design.

Blockchain welfare could expand financial inclusion without volatility. (Image Source: Proshare)

2. Setting Precedents for Digital Public Services

The Marshall Islands’ integration of a digital sovereign instrument within its social service framework proves that public services offered via blockchain are not only possible but also operable in a manner which is fiscally responsible.

That is a radically different paradigm from past thinking, in which blockchain assets are fundamentally viewed as investment tools. This new program reframes the blockchain rail from a market to a utility.

For other smaller or developing nations, particularly if they have dispersed populations, weak banking infrastructure, or high remittance costs, it could set the template for the digital delivery of other social schemes.

Questions and Concerns: Risks Worth Watching

In this new approach, however, several issues have been noted by experts. These include:

1. Gaps in Access and Adoption

The technology is still dependent on smartphones and the availability of the internet. Not all Marshall Islanders have easy access, particularly in the outer islands. Yet few members of the public have adopted the digital wallet system compared to conventional payment methods and wire transfers.

This is merely an affirmation of the most basic fact about the interaction between technology and infrastructure: digital innovation must not outpace the tools people have to use it.

2. Cautionary Note Regarding Regulation

The global finance bodies, including the International Monetary Fund (IMF), have traditionally called for careful attention towards the incorporation of stablecoin systems into national programs. This is particularly due to the systemic risks associated with digital finance structures.

In this instance, the government claimed that USDM1 is not a new currency. This was done in order to maintain monetary stability under the U.S. dollar system, which is still considered the legal tender of the country. Such legal clarity, with U.S. Treasury collateral backing and protected by the laws of New York, is essential to alleviating any regulatory concern.

3. The Human Factor: Digital Literacy

For most people, handling digital wallets and making use of private keys is still foreign. It is imperative that public efforts are made in educating people on how this technology is not only for those already adept in technology. La inclusión financiera es tan necesaria a nivel de comprensión como de accesibilidad.

Access, regulation, and digital literacy remain key risks. (Image Source: BusinessDay)

Its Implications for the Future of the Welfare State

The general policy implications are big:

- Welfare Reinvention: Governments could leverage digital rails for faster and more transparent welfare payments.

- Lower Costs, Better Tracking: Blockchain-based systems would be able to reduce administration costs and offer excellent tracking.

- Customizable Public Programs: Money could be allocated with conditions that can be programmed, such as healthcare and educational credits.

Furthermore, since USDM1 is anchored by traditional instruments (U.S. Treasuries), a model of this sort honors financial stability, not dismantles it. Certain financial researchers have suggested that this could be just the beginning of a new era of sovereign tokenisation, whereby public assets and payments exist on secured networks.

Voices from the Ground and Beyond

Opinions both local and global offer a multi-tiered view:

- Marshellese Citizens: Most people appreciate the option of either doing it the old way or the new way using digital means. For those who live far, the option of receiving money directly to their phone is a game changer.

- Blockchain Supporters: This is seen by developers and other innovators in public finance as proof of concept, and it is by no means speculation. It is also an application of the technology that solves issues of transparency and speed using blockchain.

- Sceptics and Regulators: Concerns about reliance on digital infrastructure, exclusion from those unable to tap into technological capabilities, and even long-term sustainability issues in developing nations with little social support or compensatory wealth funds.

However, the Marshall Islands’ implementation, with a large trust fund and relying on external sources of stable assets, is not likely to be easily replicable without modifications.

Citizens welcome choice, innovators see promise, regulators urge caution. (Image Source: Rev)

Looking Ahead: Trends and Possibilities

The launch of UBI in the Marshall Islands could be a turning point when it comes to the way governments consider public payment. Some of the trends that are emerging from such projects include:

- Tokenised Public Assets: Aside from UBI, government bonds, as well as public resources, may also be tokenised for easier management.

- Interoperable Wallets: Standardized protocols could allow citizens to make digital payments for day-to-day activities rather than just receiving government assistance.

- Resilience in a Crisis: Blockchain is able to keep working during a natural disaster, for example, or a shortage of cash.

Policymakers in emerging markets are closely watching to see if this turns out to be the blueprint or just the cautionary tale.

Conclusion: Innovation Meets Inclusion

The Marshall Islands have done something remarkable. It has taken an idea that was hitherto relegated solely to academic circles and woven it into the national agenda. Through responsible use of blockchain technology, the Marshall Islands has proved that digital innovation and public welfare are not mutually exclusive. Whether or not this model is widely adopted or develops into something even more ambitious, the world is certainly paying attention.

Frequently Asked Questions (FAQs)

- Q: How is this UBI considered ‘crypto’?

A: It makes use of a blockchain platform (Stellar) and a digital asset (USDM1) to enable the disbursement of social benefits directly to digital wallets. - Q: Is USDM1 a cryptocurrency?

A: Not in the volatile sense. USDM1 is an independent digital bond pegged one-for-one to U.S. Treasuries. It is stable and redeemable in regular currency. - Q: Are the recipients required to use the digital wallet?

A: No, it is optional. Recipients can choose to receive payments via bank transfer or cheque if they prefer. - Q: Will this model be adopted in other countries?

A: Experts believe similar initiatives could be adopted by small or under-banked countries, though adoption depends on connectivity, infrastructure, and public trust. - Q: Can other countries use this model?

A: Yes; particularly smaller countries with challenging geography and limited banking networks. - Q: Is this a cryptocurrency or a sovereign currency?

A: USDM1 is an electronic sovereign bond, secured by U.S. Treasuries. It is not a cryptocurrency for investment purposes; it is designed to maintain stability while providing digital payment services. - Q: Can recipients transfer or trade their payments?

A: Within the Lomalo ecosystem, yes. Conversion to other digital assets may be restricted depending on regulations and usage terms. - Q: Does this replace the need for banks?

A: Not completely. Banks continue to provide loans, savings, and business financing. The digital wallet technology supplements financial services, particularly for communities underserved by traditional banks. - Q: Is this sustainable?

A: In the case of the Marshall Islands, yes. The UBI is supported by a trust fund and structured to last for many years. Continued success depends on adoption, connectivity, and governance.