Lithium Rally Supports Australian Miners

Sudden price gains in lithium markets have given a respite, albeit merely temporary, for Australian miners that have faced a prolonged period of uncertainty. Dealing with an abrupt shutdown by CATL in China and a rampant spree of speculative trading, prices for lithium carbonate and spodumene swiftly corrected and took a strong upside move. Such an unexpected upward movement in markets has lifted the mining stocks, increased valuations of companies, and provided some stay of execution on asset sales for resisting companies. Analysts warn that the recovery is still fragile.

Lithium price surge offers brief relief for Australian miners.

What triggered the lithium price surge?

The rally hit the market earlier this month after a closure in operations by the largest Chinese battery manufacturer, Contemporary Amperex Technology Co. Ltd. (CATL). The shutdown came about after the mining license of CATL expired on 9th August 2025, thereby stoking overnight supply apprehensions. China is the largest lithium processor in the world, with CATL also being central on global EV battery supply chains.

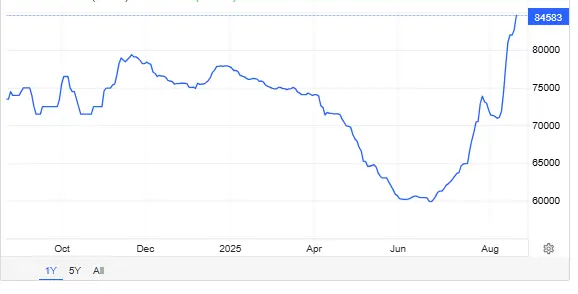

Speculators did not lose any time in pushing prices up while foreseeing a tighter supply. Prices for benchmark hard-rock spodumene have risen to USD 880 per tonne, after being as low as USD 610 in mid-June. This sharp price increase can be counted among the strongest short-term rallies of 2025.

Yet, this surge remains sharply beneath those record highs of 2022, which stood above USD 6,000 per tonne. This contrast underlines the volatility of the sector, where supply disruptions can shift markets rapidly.

Can this lithium rally support Australian miners?

The rally would have surely given breathing space for the Australian lithium makers. The shares of major miners had rallied by about a third in recent weeks. From companies sitting on asset sales, a change in strategy is being considered.

For instance, Mineral Resources (MinRes) was considering selling a part of its Mt Marion and Wodgina lithium assets, which are valued at more than USD 2 billion. Now, the better price outlook from above has eased the pressure to wait for better valuations.

Such has been the scenario across the market. Investor confidence has lifted for IGO, Allkem, and SQM’s Australian operations as well. Most producers, according to analysts, can optimally operate and turn a profit at current prices without embarking on large-scale restructuring.

Lithium Market Share

Is the price rebound sustainable?

The question investors are now faced with is whether this surge in lithium prices is here to stay. This time, the surge was triggered by the CATL disruption and speculative buying, rather than actual growth in demand.

Worldwide EV sales are still good, but not as good as the forecast by early 2020. Car manufacturers shall continue to hedge their investment into EVs with strategies for hybrids, thereby making lithium demand in the long term uncertain. If supply from China resumes

If supply from China picks up speed, the uplift in prices will simply vanish as quickly as the news came.

Market strategists feel prices are steadying at levels that are remunerative but not exorbitant. Such a middle ground may be good for Australian miners, who prefer steady demand rather than unsustainable peaks. However, oversupply risks may arise if South American and African projects suddenly speed up.

Miners may delay sales of key assets

The comeback has already altered strategic plans. Some miners, who saw forced asset sales during low prices, may now halt those plans.

MinRes had been approached by international funds and trading houses seeking to acquire its assets, but no offers matched their internal valuation. Having higher spodumene prices now gives it the luxury of waiting. Similarly, the firm IGO has been looking into its Greenbushes stake, with improved market sentiment likely to extend those talks.

This pattern paints price volatility as the main shaping force on corporate strategy. In slumps, distressed sales and restructurings follow. As prices rise, even modestly, miners regain bargaining power.

Speculative trading looms large

Speculative trading is one feature where the new rally differs from the old ones. That short-covering activity in the Australian Securities Exchange (ASX) has pushed share prices of lithium miners much higher than fundamentals could justify.

Lithium producers rank among the top five shorted stocks on the ASX. This means that any too-rapid upward move in the price forces short sellers to cover their positions, pushing the price higher in a feedback loop. Analysis says that most of the recent rally has been due to this technical activity and not due to long-term value changes.

Investors are, therefore, being advised to remain cautious. The moment speculative momentum goes away, these share prices would retreat as fast as they allied themselves. That said, the rally has shown how closely the financial aspect of lithium markets follows commodity dynamics.

Also Read: Lithium, Nickel, and Cobalt: The Battery Metals Race Across Stock Exchanges

A fragile but vital breather for miners

The lithium price surge has provided precious time for Australian miners. The price rally inflates valuations, creating some breathing room to slow down asset sales and bring their operations into a state of temporary balance.

Such a recovery is fragile since it depends, among other things, on speculative trading and a single supply disruption. Prices have dwindled well below the 2022 highs, while demand is unevenly growing. For longer-term stability, it requires sustained EV adoption and balanced supply growth as opposed to the so-called short-lived shocks.

The core message for Australian lithium producers is that welcome price rallies need to be taken cautiously. The lithium rally supports Australian miners, yet sustainability depends on more than temporary supply interruptions.