Lead: A Melbourne man who admits trading on inside information related to Kidman Resources, the company that had a big Mt Holland lithium project, avoids immediate jail after pleading guilty. The County Court jailed him for 18 months, suspended on a recognisance order (a good-behaviour bond), and ordered him to forfeit the profits he made from the trades. (AFR)

Melbourne man admits Kidman lithium insider trading, avoids jail with suspended sentence and repayment order (Image Source: AFR)

What happened, in brief

In early April 2019, the defendant purchased approximately $130,600 of Kidman shares shortly after confidential discussions commenced for a possible takeover. In May 2019, when Wesfarmers announced a $1.90-per-share bid, the share price rocketed and the transactions returned a profit of approximately $65,000. The Australian Securities and Investments Commission (ASIC) later charged the man with insider trading offences. (asic.gov.au)

Why it matters

Lithium is the focal point of the electric vehicle and battery rush. Mergers, projects, and takeover speculation in the sector move markets and tempt individuals. If someone trades on confidential takeover plans, that activity erodes confidence in fair markets and can cost other investors. Courts and regulators say they prosecute to protect that trust. Judge Diana Manova described insider trading as “a form of fraud” that “goes to the heart of the integrity” of the market. (News.com.au)

The human factor

The accused’s relationship with Kidman was personal, the court was told: family members were high-ranking executives at the firm at the time. Character witnesses described him as a diligent, ordinary bloke now humiliated by publicity. Those references, combined with a plea of guilty and the indication of sentence provided by the judge, affected the outcome: a suspended sentence and an order for repayment rather than straight jail. (News.com.au)

Family ties to Kidman and strong character references helped the accused avoid jail, receiving a suspended sentence and repayment order (Image Source: Justice Info)

A brief timeline

- March–April 2019: Confidential talks and a “virtual certainty” offer for Kidman are ongoing in the company.

- 3–9 April 2019: The accused purchases Kidman shares while the information remains non-public.

- 2 May 2019: Wesfarmers announces the takeover bid, and Kidman’s shares skyrocket.

- August 2023: ASIC charges the Melbourne man with insider trading.

- July 2025: The defendant pleads guilty following an indication of sentence.

- September 2025: County Court imposes an 18-month suspended sentence and orders the return of profits. (asic.gov.au)

The law and the ledger

Insider trading is an offence against s1043A of the Corporations Act. Penalties on conviction can be harsh, but sentencing takes into account legal precedent, the defendant’s role, the degree of gain, and the wider public interest in deterrence. ASIC has a priority for insider trading as it compromises market integrity, and it pursues both civil and criminal actions where evidence supports this. (asic.gov.au)

Insider trading breaches s1043A of the Corporations Act, with penalties shaped by precedent, profit made, and public interest (Image Source: Federal Criminal Defense Attorney)

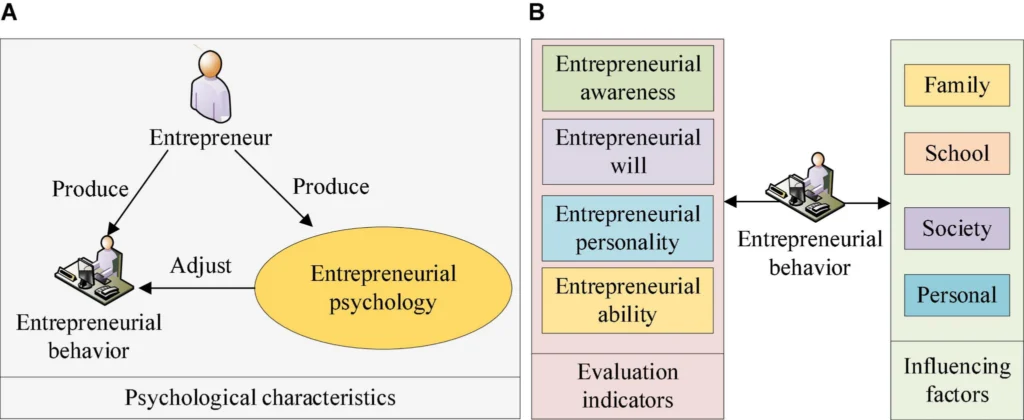

Further background: lithium’s appeal and the urge to trade

Lithium fuels electric-vehicle batteries and giant supply chains. That strategic value renders takeover speculation, joint-venture talks, and supply agreements market-moving news. For someone with a family connection to a company at the center of such talks, the line between chatter and forbidden tip can blur, and prosecutors argue that blurring offers an invitation to abuse. Officials say they pursue such cases to protect individual investors and market confidence.

Lithium’s role in EV batteries makes takeover rumours highly market-moving, and regulators crack down to protect investors’ trust (Image Source: Discovery Alert)

How the court weighed up punishment

Sentencing is not only punishment, but also deters imitators and safeguards the community. The judge accepted that the offender had low sophistication, great family shame, and excellent character references. The court also made it clear that the conduct was serious and undermined market fairness. The balance led to a recognisance release order: an immediate, conditional release on the promise to keep the peace and be of good behaviour for a set period, and an order to refund the exact amount gained from the trades. (AFR)

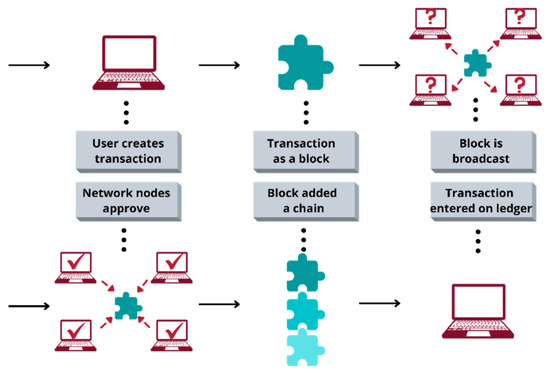

Global parallels and crypto warnings

Enforcement is across asset classes and borders. In the US and elsewhere, regulators have pursued insider-style cases in crypto trades and listings in securities, illustrating that regulators apply insider principles to non-traditional equities. That context is relevant because market participants are more active across borders and across asset classes; enforcement cooperation and information-sharing enhance the prospect of multi-jurisdictional investigation. (Department of Justice)

Regulators worldwide target insider trading across stocks and crypto, with cross-border cooperation boosting multi-jurisdictional probes (Image Source: MDPI)

The Kidman, Wesfarmers context

Kidman Resources owned 50% of the Mt Holland lithium project in a joint venture with Chile’s SQM. Mt. Holland is in WA and has been subject to global interest as the battery metals boom gained steam. Wesfarmers’ 2019 bid valued Kidman at about $776 million, or roughly $1.90 a share, and the announcement saw the stock leap higher. That is the immediate financial context of the trades at the heart of this case.

What investors can do

If you are a shareholder or follow an industry, deal carefully with rumours. Gossip from conference-room chatter, draft releases, and off-the-record tips can be illicit if they lead to trading. Investors should adhere to publicly released disclosures from exchanges and company announcements, and exercise caution when trading on non-public guidance. For company insiders, strong information walls and training reduce the risk of leaks becoming prosecutions. (asic.gov.au)

Investors should ignore rumours and rely only on public disclosures, while insiders need safeguards to prevent leaks turning into offences (Image Source: Forbes)

Governance steps companies must take

Boards and compliance teams must rehearse information controls regularly. That is, clearly established trading blackout periods for staff, firm guidelines for what constitutes inside information, audit trails for confidential discussions, and prompt public disclosure where markets demand. With stakes so high in lithium supply chains and national strategic interests involved, companies must be on their guard against unintentional or deliberate leakage that will cost shareholders and reputations. (Hall & Wilcox)

Sentencing indications and the public record

The sentence, suspended custody coupled with restitution of profits, balances personal mitigation against deterrence. A suspended sentence does not erase the criminal record or the economic sanction; it removes incarceration but not punishment, public censure, and a strict test of behaviour. ASIC highlights that forfeiture and prosecution maintain market integrity; commentators debate whether the courts should favour custody to increase deterrence. (AFR)

A brief legal primer

Inside information is defined as accurate, non-public information that a reasonable investor would consider material. Trading on those facts, or getting another to trade, triggers offences under s1043A of the Corporations Act. To succeed, prosecutors must prove the defendant knew the information was non-public when the trades were made; sanctions are fact and judicial discretion-based. (asic.gov.au)

Investor behaviour and market psychology

Headlines move money. The Wesfarmers bid prompted a revaluation of Kidman’s assets instantly. That price shock rearranges expectations of the Mt Holland project and can impact offtake negotiations, financing plans, and future consolidation. For retail investors, the lesson is simple: don’t trade on an unconfirmed rumor. For professionals, the rules around material non-public information are strict and enforced.

Wesfarmers’ bid instantly reshaped Kidman’s value, showing how headlines move markets. Lesson: avoid rumours; rules on inside info are strict (Image Source: Frontiers)

The remarks of industry observers are that.

Market analysts remark that the Trojan horse here is less the size of the profit than the erosion of trust. A market that tolerates privileged trading encourages information asymmetry that harms liquidity and deters long-term investment. Industry groups repeatedly urge listed companies to tighten governance and regulators to keep enforcement high to protect smaller investors. That counsel is especially relevant to critical commodity sectors.

Governance measures and a practical checklist

Practical measures include written escalation procedures for takeover approaches, pre-clearance of trades by officers and directors, forensic audits of trades around sensitive announcements, and regular staff training. These measures reduce the risk of leaks finding their way into illicit trades and demonstrate to regulators that market integrity is being taken seriously by the company. (Hall & Wilcox)

Industry response and possible reforms

Investor groups and market participants often call for more transparent corporate rules and faster enforcement: mandatory registers for takeover approaches, stronger penalties for insiders who leak information, and improved cross-border coordination. Reform must balance efficient dealmaking with the need for fair markets. (Hall & Wilcox)

Practical checklist for individuals

- Don’t deal on whispers, wait for public announcements.

- Tell your broker if you’re unsure; most brokers offer trade holds for compliance screening.

- Keep private conversations off unmonitored channels.

- Take particular care if a family member holds a sensitive position; unwitting discussions can become evidence.

These sound habits protect you and make the markets more fair. (asic.gov.au)

Lithium Price Surge Eases Pressure on Australian Miners

Frequently Asked Questions (FAQs)

Q: Who was charged in this case?

- A Melbourne man who admits to trading Kidman Resources shares in April 2019 when the company was in secret takeover discussions. He pleaded guilty and was sentenced to 18 months ‘ imprisonment, released on recognisance; he must return the profits. (asic.gov.au)

Q: How much did he profit from the trades?

- News reports and court transcripts estimate the profit at around $64,975 to $68,114, depending on the accounting; the court ordered restitution of the precise profit. (News.com.au)

Q: What is the relevant legislation?

- Section 1043A of the Corporations Act prohibits trading with inside information; prosecutors can seek civil and criminal charges based on proof. (asic.gov.au)

Q: Why did the court not jail him?

- Sentencing involves a balancing of several considerations. The judge accepted a guilty plea, character references, personal circumstances, and an indication of sentence; these resulted in a conditional release and order for repayment instead of immediate jail. The judge also admonished that the behavior harms market integrity.

Q: Can family members also be charged?

Q: Is this pertinent to ASIC?

- Yes. ASIC’s initial media release suspected the likely source of information as a family member in a senior role and suggested others could be involved; prosecutions occur where evidence supports charges. (asic.gov.au)

Q: Does this impact crypto?

A: Yes. Regulators go after insider-type conduct across asset classes. Crypto insiders trading on non-public listings or listing details are subject to investigation and prosecution in multiple jurisdictions.

If you must drill down

For readers who want the sources, ASIC’s media release of the charges and contemporary reporting by the AFR and other publications include the facts and court reporting to explore further. (asic.gov.au)

Final thought

This case draws a clear line over moral hazard in a lucrative corner of the market. Lithium’s strategic value raises the stakes, but the law remains clear: confidential corporate information does not become a licence to profit. The court’s punishment balances penalty and mercy, but it holds a deterrent, forfeiture of ill-gotten gains, and a criminal record. For investors and executives, the message is simple: guard sensitive information and do not trade on whispers. The market depends on it.

Bottom line: the market rewards transparency and punishes shortcuts. In lithium’s fast-moving world, organisations that guard sensitive information protect not only investors but the industry’s future. Regulators will be keeping a close eye on lithium in the years to come.