There’s a substantial amount of money sitting in short-term vehicles around the world. Latest industry estimates put global money-market fund assets at close to $10 trillion, and American money-market funds alone at more than $7 trillion. And if only a fraction of that liquidity redeploys to crypto markets when interest rates drift lower, it could dish up disproportionate price action and fuel a rapid, bouncy rally. (Fitch Ratings)

Nearly $10 trillion sits parked in money-market funds worldwide. If just a slice flows into crypto as rates ease, it could spark a sharp rally (Image Section: Bloomberg.com)

Why $9.5 trillion matters (and why investors are taking notice)

Numbers this big change market dynamics. Money-market funds (MMFs) are ultra-short-term havens for cash; they generate attractive returns when short-term rates are high and offer on-call liquidity. Institutional treasuries, corporations, wealth managers, and individual investors store cash in them when they want safety and yield. Global MMF holdings have ballooned in recent years; some official estimates and industry figures place global MMF holdings in the high-single-digit trillions, and U.S. MMFs recently hit new records of well over $7 trillion. That mountain is potential fuel, not guaranteed fire, for risk assets if investors switch out of cash vehicles. (Fitch Ratings)

The trigger: falling rates and the safety-to-risk rotation

Markets generally go on liquidity and future returns. When the central banks cut rates, money-market yields fall; that dilutes the return advantage of MMFs over risk assets. Behaviourally, investors are therefore faced with a choice: keep accumulating safe but falling yields, or switch into riskier but more rewarding products, equities, real-estate investment trusts, private markets, or crypto. Bears note that a $9.5 trillion “wall of cash” will be seeking yield when policy is relaxed, something that traders pay close attention to for a liquidity deficit into markets like Bitcoin and altcoins. (Forbes)

How a relatively modest flow can create a parabolic movement in crypto

Crypto markets are quite shallow for very big trades. When even 0.5–2% of a multi-trillion dollar universe moves into digital assets quickly, prices respond vigorously:

- Spot liquidity on leading exchanges rushes together; aggressive buying inundates order books.

- Futures and derivatives markets amplify moves through basis, margin, and funding tensions.

- Retail FOMO and algo play can chase momentum, creating a feedback loop.

That’s the structure of a parabolic rally: explosive price acceleration, levered long, and a spike in volatility that leads later entrants to try to chase prices upward. Analysts argue that a rotation in the tens or hundreds of billions, instead of trillions, would still be material for crypto markets. CoinDesk and other crypto publications have laid out how recent MMF records put this risk/reward arithmetic in front of Bitcoin and altcoins. (CoinDesk)

Even a small slice of trillions in money-market funds could trigger a parabolic crypto rally, with shallow liquidity, leverage, and FOMO driving explosive price moves (Image Source: SGT Markets)

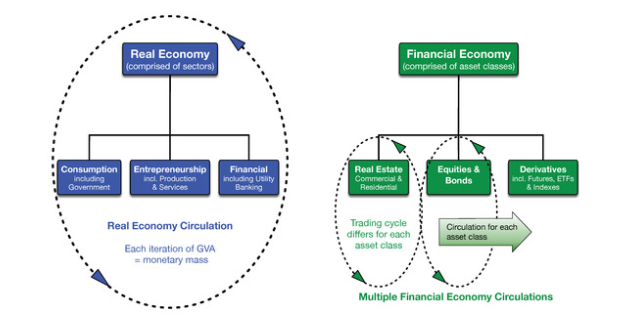

Where the funds would circulate first, a rotation of pipes

Money does not teleport; money circulates through pipes that control how fast and how far it flows:

- Treasury bills & short-term debt reverse, institutions redeem MMF units to free cash. That can put short-term pressure on short-end yields and push money into risk assets.

- Stablecoins & crypto on-ramps, large consumers often exchange their USD to stablecoins (USDT, USDC, etc.) before buying crypto; prime brokers and OTC desks facilitate large blocks without showing up on public order books in real-time.

- Spot exchanges & ETFs, retail and institutional appetite strike spot order books; where spot ETFs are present, institutional flows can then flow into regulated products offering smoother custody.

- Derivatives markets, futures, perpetual swaps, and options amplify directional trades by leverage and funding rates.

Because stablecoins and institutional OTC desks create an instant bridge from dollars to crypto, comparatively modest reallocation out of MMFs can imply concentrated buying in minutes to days. Crypto market structure increases speed and volatility compared to traditional equities. (ici.org)

Why institutional action trumps headline numbers

Not all of the MMF money is redeemable or poised to be reallocated rapidly into crypto. Some simply languish in corporate cash reserves, pension funds, and working capital liquidity; those monies have regulation and mandate constraints. Institutional decision-makers reallocate slowly. But there are a couple of things that can compel action:

Tactical re-optimisation after a surprise Fed cut, when portfolio managers are seeking yield.

Macro hedging adjustments, where asset managers shift allocations across entire books, including alternatives.

Speculative impulses from hedge funds or macro desks that are happy to take risks with freshly available liquidity.

The point: a relatively small fraction of the headline $9.5T moving quickly can still have an outsized market impact. Analysts and fund strategists framing these scenarios cite the same MMF metrics and macro signals we’ve seen in industry reports. (Fitch Ratings)

Only a fraction of the $9.5T in money-market funds can shift fast, but even small reallocations by institutions after Fed cuts or macro shifts could jolt crypto markets (Image Source: Los Angeles Times)

What recent numbers indicate, data, and trends

Industry commentators indicate MMF holdings at all-time highs in recent quarters as a result of higher short rates and risk aversion. In the US, weekly ICI numbers consistently set new highs as retail and institutional flows surged. Central bank short-term liquidity operations and quarter-end also push cash into short-term assets; repo usage and central bank standing facilities have seen periodic surges that mirror the same tightness and reallocation requirements. They shape the plumbing signals: rotations faster or filthier, depending on timing and settlement conditions. (ici.org)

This is classic weak end-user sponsorship: foreigners have stepped back, LDI isn’t chasing real duration at these levels, and dealers had to warehouse more risk into thin liquidity. In real terms, that nudges term premium higher and compresses breakevens intraday unless nominals… https://t.co/B34Yp07178

— Monetary Commentary (@monetarycomm) September 18, 2025

Historical insight: liquidity rotates, timing matters

History shows that overlooked cash does not always precipitate spontaneous rallies. Behavioural inertia, issues related to valuation, and substitute yield alternatives (term deposits, longer-maturity bonds, real assets) change outcomes. History also shows how liquidity shocks and sentiment reversals, typically caused by policy surprises, geopolitical changes, or technical breakout levels, cause swift repricings. Crypto’s retail-fueled and skewed liquidity make it structurally more vulnerable to such rotations than deep, liquid markets like US Treasuries or the S&P 500. Analysts point out both the potential and the risk. (ThinkAdvisor)

History shows cash piles don’t always trigger rallies, but policy shocks or sentiment shifts can spark sharp moves, and crypto’s thin liquidity makes it especially vulnerable (Image Source: Investopedia)

The anatomy of a crypto parabolic: a rapid scenario

Imagine this realistic, abbreviated timeline:

- The Fed teases a string of rate cuts. MMF yields fall; weekly MMF flows slow. (Reuters)

- $150–350 billion flows out of MMFs in six weeks as fund managers seek yield. A minority trades into stablecoins via prime brokers. (ici.org)

- Hedge funds and institutional investors provide spot Bitcoin and leading altcoins on OTC desks and exchanges, increasing the visible order books.

- Futures funding rates turn positive; leverage rises, and momentum traders flood in. Price charts explode, creating gamma squeezes in option markets. Retail interest surges on social sentiment and FOMO.

That’s how a parabolic rally finds its footing, not through one giant huge trade, but through choreographed micro-flows magnified by market structure. CoinDesk and other market observers have referred to similar mechanics when explaining big pools of cash and crypto’s sensitivity to rotation. (CoinDesk)

Risks, dampeners, and real-world frictions

Don’t believe money flows instantaneously or symmetrically. A variety of influences cool the “wall of cash → instant moon” story:

- Mandates & governance: corporate treasuries and pension funds are subject to strict regulation.

- Regulatory friction: institutional crypto entry is confronted with KYC, custody, and compliance obstacles in nearly every jurisdiction.

- Exit mechanics: fast upside can reverse just as fast, margin calls, derivatives losses, and liquidity suck can amplify falls.

- Alternative destinations: cash instead buys equities, bonds, or private placements if managers see better risk/return.

These tensions permit a rally, but neither necessarily nor equally so; they create opportunity and systemic danger. Industry specialists always caution against overly general “cash will flood into crypto” predictions while simultaneously suggesting potential upside scenarios. (ThinkAdvisor)

Money doesn’t flow into crypto instantly; rules, compliance hurdles, and alternative investments slow it down, while sharp reversals can turn rallies into risks (Image Source: MDPI)

How crypto infrastructure might soak up big inflows (or not)

The market’s capacity to absorb demand comes into play:

- OTC desks & prime brokerages make large block trades easier but require counterparties and liquidity providers.

- Exchange order books show the level of on-display liquidity at particular prices; thin books amplify movements.

- Room for stablecoin minting must scale to accommodate dollar conversions without wider frictions.

Big custodians, regulated spot ETFs when they were available, and institutional desks add to the ability to manage big inflows. But channels are not frictionless; maturity mismatches, settlement windows, and regulatory checks can slow the rotation and cause local dislocations. Those frictions sometimes make rallies nervous and ephemeral instead of smooth 12-month bull markets. (CoinDesk)

Crypto’s ability to absorb big inflows depends on OTC desks, exchanges, stablecoin capacity, and custodians, but frictions can turn rallies sharp and short-lived (Image Source: Debut Infotech)

What traders and funds need to be prepared for now

If you hedge or trade crypto exposure, take these working steps:

- Monitor MMF flows and weekly ICI data; redemptions are an early warning sign. (ici.org)

- Monitor central bank policy signals; rate-cutting tendencies come before rotation. (Reuters)

- Plot liquidity channels, follow stablecoin issuing, OTC desk spreads, and exchange order-book depth.

- Stress test for volatility, anticipate a sudden spike and an equally rapid unwind.

- Consider the execution approach, execution of large orders via OTC and algo VWAP reduces market impact.

Sound risk management considers both potential for upside and the speed of reversals characteristic of parabolic runs.

Also Read: Crypto Market Reacts After FOMC Rate Cut — Bitcoin, Ethereum and Altcoin Outlook

Frequently Asked Questions (FAQs)

Q: Is the $9.5 trillion amount true?

A: Dependent on what you mean. Global money-market fund assets are in the high single digits to near $10 trillion in more recent estimates; U.S. MMFs alone are over $7 trillion. Different agencies (industry groups, central banks, and think tanks) provide slightly varying numbers depending on scope and timing. (Fitch Ratings)

Q: If $9.5T exists, will it necessarily come into crypto?

A: No. Most MMF cash is operationally or mandatorily restricted. But only a limited percentage will be able to redeploy immediately into crypto, but even a limited percentage can move prices powerfully because crypto markets are relatively less deep than global equities or bond markets. (ThinkAdvisor)

Q: Which crypto assets would benefit the most?

A: Bitcoin usually takes the lead due to depth and liquidity, followed by large-cap altcoins. But inflows into a particular DeFi pool, stablecoins, or newly popular tokens can create concentrated gains in certain areas. Observe order-book depth and ETF or institutional product flows. (CoinDesk)

Q: Would regulators be able to halt this by shutting off institutional entry?

- Institutional behavior is influenced by regulation and compliance. Stricter rules delay adoption; clearer regulatory systems — such as approved custody arrangements and ETFs- facilitate it. Jurisdictional variation will be important. (CoinDesk)

Q: What would be the signals that would confirm the rotation is occurring?

A: Growing MMF redemptions, stablecoin mint surges, elevated OTC desk trading, abrupt positive futures funding levels, and visible buying on major exchanges are reliable early indicators. Also watch for central bank policy announcements for rate cuts or dovish turns. (ici.org)

Last perspective, potential and humility

The story of a $9.5 trillion “wall of cash” fueling crypto’s next parabolic upleg is the headline. The dynamics are present: large war chests of money, cheaper money, stablecoin plumbing, and derivatives are collectively capable of powering swift, steep advances. But there are qualifiers to the story: governance, mandates, regulatory nuance, and market-structure frictions all temper and direct outcomes.

For allocators and traders, the right approach is a blend of prudence and modesty. Track the numbers, MMF inflows, repo borrowing, stablecoin creation, and build execution strategies that respect crypto’s asymmetric liquidity landscape. For commentators, the lesson is this: liquidity wins over narrative. When policy compresses returns on good money, the search for yield accelerates, and where that yield is constrained, price discovery can be explosive.