Source: Liontown Resources

Kathleen Valley will work harder. Liontown Resources has secured a big $316 million in fresh money, a move that was made to keep its prized Western Australian lithium project moving at full speed—bucking global market fears.

The deal is in two parts. One, an $266 million institutional placement—already underwritten, giving the company the confidence it needs to strategize big. Two, an additional $50 million from a conditional placement by strategic partners like lithium giant Canmax Technologies.

When all that debt, plus a staged $20 million share purchase plan, arrives in the company’s bank account, Liontown stands poised on the threshold of possessing half a billion dollars in cash. It’s not just about having healthy finances—it’s the kind of financial muscle that lets the miner branch out, take on new projects, and weather any storms the lithium market might throw its way.

Not A Mere Funding Win

Source: Liontown Resources

Whereas money-raising in mining is never unheard of, the size and timing of this deal say a lot about where Liontown stands. Spodumene—the raw lithium mineral Kathleen Valley mines—is trading off lows from last year’s highs. That type of market deflation can freeze projects out, but Liontown is going all-in instead of backing away.

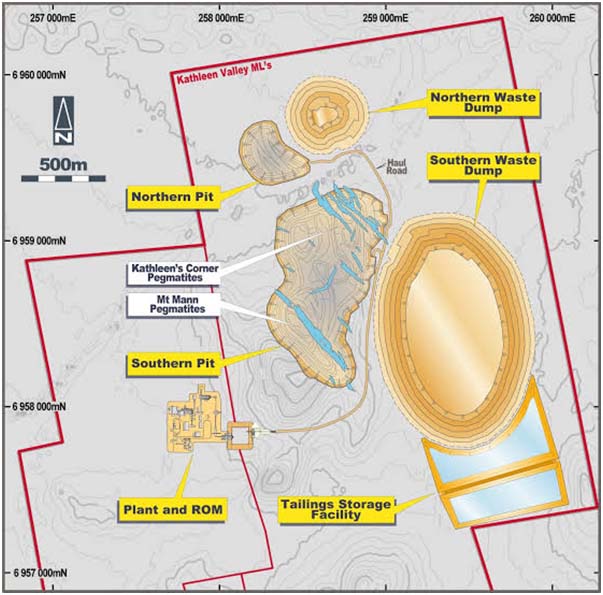

A good chunk of the confidence comes from the mine itself. Kathleen Valley is not a venture play; mid-2024 production has commenced, and the long-life opportunity is already ranked as one of the world’s largest, highest-grade hard-rock lithium deposits. This fresh shot of capital ensures the ramp-up to full underground mining stays on track, with a target to go completely underground by late 2026.

Why the National Reconstruction Fund Is Involved

One of the more sensational facets of this surge is the $50 million stake that the federal government’s National Reconstruction Fund Corporation (NRFC) has made. Government money isn’t charity—it’s policy.

By investing in Kathleen Valley, the NRFC is in effect placing a bet on Australia’s position in the world’s critical minerals supply chain. The signal is clear: lithium is not a commodity, it’s a building block of the nation’s industrial future. The investment is not about helping one company—it’s about keeping Australia in the game and competitive in the race to supply electric vehicles, grid-scale batteries, and other green technologies.

Federal Industry Minister Tim Ayres has long been convinced why moves like these matter. Public investment, he argues, brings in extra private capital, accelerates projects, and secures supply chains—all while securing regional work. In Kathleen Valley’s case, that means Western Australian work, procurement with local suppliers, and continued engagement with First Nations peoples.

The Canmax Factor

For all the government support, the conditional placement with Canmax Technologies is just as fascinating. Canmax is a giant in lithium chemical processing—a process that turns spodumene concentrate into battery-grade lithium.

Their investment has more than just monetary implications. It has the potential for longer-term offtake agreements, downstream integration being easier, and an existing buyer for the product of Kathleen Valley. That is a huge strategic benefit in a market where it is not always easier to sell the product than to produce it.

A Different Approach to this Raise

Most capital raising stories are stats-oriented. This one breaks away from the pack: it’s not only sustaining Kathleen Valley—it’s writing the next chapter of Australia’s story on critical minerals.

Lithium has had its boom-and-bust cycle. Prices soar, investment floods in, supply matches, prices crash, and marginal players fail. Liontown’s raise is a buffer against all that volatility. By getting their balance sheet ready now, they are allowing themselves to weather market troughs without sacrificing quality or putting growth on hold.

It’s also a sign of intent. With all that capital parked in the bank, Liontown is able to continue spending on efficiency gains, exploring downstream opportunities, and building skills in the workforce—all things that make it more robust in the long run.

Kathleen Valley’s Growing Footprint

Source: Liontown Resources on Twitter

At a local level, Kathleen Valley is already employing hundreds and has a significant local economic footprint. The project has been mindful of working with local communities and engaging with Traditional Owners, something the company frames as being part of its “social licence to operate.”.

That social licence is worth its weight in gold. The global battery industry cares more than ever about how and where its raw materials are mined. Best mining practice isn’t a nice extra—it’s now a competitive advantage.

Market Conditions: Test of Nerves

No discussion of lithium today can gloss over the market issue. Spodumene prices have cooled sharply, squeezed by slower-than-expected EV uptake in some markets and an increasing supply of new metal hitting the market.

For a lower-capitalised miner, that’s a dangerous bet. For Liontown—with this fresh funds and partnerships—it’s an opportunity. Low prices tend to eliminate the high-cost producers, paving the way for the best-quality projects to consolidate their position. If prices do rebound over the next two years, Kathleen Valley will be ready to reap the reward.

The Road Ahead

The institutional placement is to be finalised in mid-August. The placement involving Canmax still needs the nod from Liontown’s shareholders as well as clearance from Chinese regulatory bodies. Despite these formalities, the company’s leadership appears confident that both steps will be completed, paving the way for the deal to progress.

Along with securing the capital, the company has floated a share purchase plan to existing investors—giving retail investors the chance to get in on the development of the project. All board members have agreed to invest, a small but telling indication of insider belief.

When the dust settles, near-term milestones will be production ramp-up goals, ongoing progress towards ultimate underground mining, and any developments on downstream processing or offtake agreements.

A Mine With a Much Greater Significance

Kathleen Valley is poised to be something more than a mine. It’s part of Australia’s industrial future—saving jobs, technology, and sovereign capacity to supply in a fast-changing world marketplace.

Basing $316 million on these terms isn’t a badge of budgetary health—it’s an indication that Liontown is taking a long view. Amid the savagery of the lithium markets, that’s not simply prudent—because it’s a survival tactic.