In a bold stride toward the future of decentralised finance, blockchain solutions provider Keeta has partnered with fintech innovator SOLO to launch a blockchain-native credit bureau—a groundbreaking development aimed at redefining digital credit in the Web3 era.

This collaboration introduces a trustless, decentralised system for evaluating creditworthiness, allowing users to build and manage a portable financial identity that’s verifiable across blockchain and traditional finance ecosystems.

Keeta and SOLO launch blockchain credit bureau for Web3 finance ( Image Source: PYMNTS.com )

A New Vision for Credit in a Decentralised World

Traditional credit bureaus have long operated under centralised frameworks, often failing to reflect the financial realities of today’s increasingly digital and globalised economy. Millions of individuals—freelancers, crypto earners, and decentralised organisations—operate outside the boundaries of conventional banking systems.

Keeta and SOLO’s new credit bureau aims to change that. By enabling on-chain financial identities, the platform empowers users with transparent, secure credit profiles that aren’t tied to geography or central authorities. In doing so, it’s not just transplanting credit scores onto the blockchain—it’s reimagining what credit means in a decentralised landscape.

The Role of PASS: Verified Identity on the Blockchain

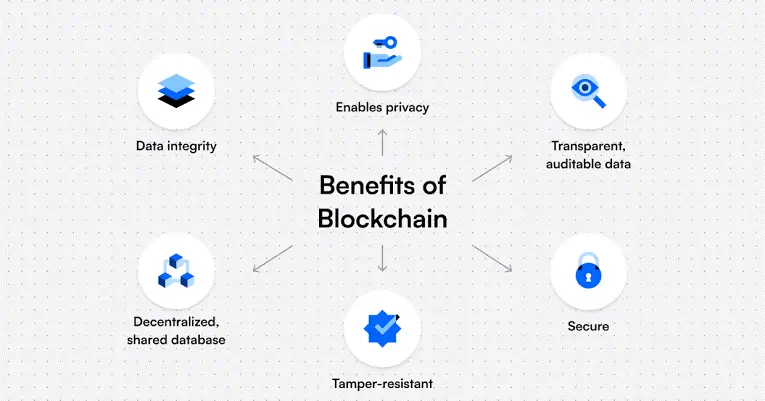

At the core of this initiative lies PASS, a decentralised identity protocol engineered by SOLO. PASS acts as an encrypted, tamper-proof digital credential that compiles a user’s financial data, lending history, and behavioural patterns into a unified on-chain profile.

PASS: Enabling Verified Digital Identity on the Blockchain ( Image Source: Dock Labs )

Unlike static credit reports managed by third parties, PASS offers full data ownership to the user. This profile can be used across DeFi protocols, lending apps, fintech platforms, or even peer-to-peer lending systems—creating a dynamic and transparent record of financial activity.

By combining PASS with Keeta’s high-speed, scalable blockchain infrastructure, the credit bureau delivers real-time credit assessments without compromising security or user privacy.

Built for Web3, Designed for Everyone

Though tailored to the decentralised finance space, this new credit framework is inclusive by design. It caters to a wide spectrum of users and use cases, including:

- Freelancers earning in stablecoins without access to local credit history

- Remote gig workers who operate outside traditional employment systems

- DAOs and crypto startups seeking alternative credit solutions

- Fintechs and neobanks requiring decentralised credit checks

- Traditional banks exploring integration with blockchain-based lending

The system’s adaptability allows seamless integration across sectors, paving the way for decentralised credit models to reach mainstream adoption.

Also Read: Blockchain in Academia: Morocco’s New Weapon Against Diploma Fraud

More Than a Credit Score: A Holistic Lending Ecosystem

What makes this credit bureau stand out is its ambition to go beyond scores and profiles. Keeta and SOLO plan to roll out an integrated lending infrastructure in the months ahead, which will include:

- A decentralised, borderless lending marketplace

- Stablecoin-powered loan origination tools

- Blockchain-based repayment tracking

- Privacy-focused data-sharing for lenders

- Cross-compatible integration with Web2 and Web3 platforms

Together, these features form a full-service ecosystem for decentralised lending—an infrastructure designed not just to digitise credit, but to transform it entirely.

Empowering the Underbanked with On-Chain Identity

Consider a Nigerian freelancer paid in USDT who has no traditional bank account or formal credit score. Under today’s system, this individual remains invisible to lenders.

With PASS, that same freelancer could verify income, demonstrate a history of on-time repayments, and prove financial reliability—entirely on-chain. This opens up access to loans from DeFi protocols, crypto lenders, or fintech apps without the need for a traditional credit history.

It’s a powerful use case that exemplifies how decentralised identity can drive real-world financial inclusion.

SOLO, the new @KeetaNetwork‘s partner, opens the door for institutional adoption into 100+ banks.

Banking sector is one of the target segments for Keeta network.$KTA is your stake in the future of banking, payment and RWA landscapes. https://t.co/2oAnb0zabI— Julinthanhnga (@julinthanhnga1) June 6, 2025

A Trust Layer for the Blockchain Economy

Georgina Merhom, founder of SOLO, describes the project as a “trust layer” for the decentralised financial world—one that eliminates institutional bias and opaque systems. It enables trust through code, not centralised authority.

Keeta CEO Ty Schenk highlights the platform’s regulatory readiness and scalability, which allow it to securely support millions of users across diverse use cases without compromising performance.

As global interest in decentralised tools accelerates, this innovation arrives at a critical juncture—where traditional systems no longer serve the increasingly digital and borderless financial landscape.

The Future of Credit is On-Chain

Keeta and SOLO’s blockchain-native credit bureau is more than a technological innovation—it represents a new philosophy for credit: one that is decentralised, user-owned, and globally accessible.

As Web3 tools become more embedded in everyday life, having a verified financial identity on-chain could be as essential as having a government ID. From stablecoin loans and business credit to mortgage applications backed by digital assets, decentralised credit could soon underpin a wide range of financial services.

And with this launch, Keeta and SOLO are laying the foundation for that future.

Conclusion

This is more than a new fintech launch. It’s a radical rethinking of how credit is earned, assessed, and shared in the digital age. It signals a shift toward systems where financial identity is portable, transparent, and in the hands of the individual.

Whether you’re a DeFi user, fintech builder, or simply someone looking to understand the next evolution of finance, one thing is clear:

Decentralised credit has arrived—and it’s here to stay.