The JPY-USD pair has remained volatile before the highly awaited US NFP report. The Yen just traded near a two-day low during the European session on Thursday. Following the US-Vietnam trade agreement, some optimism was generated and has taken away from a big part of the global demand for assets seen as safe.

Meanwhile, expectations of further rate hikes by the Bank of Japan are supporting the Japanese Yen outlook. Yet, the USD weakness is limited as traders await the US NFP report to provide clearer direction to the economy.

Will Trade Tensions Weaken the Yen Further?

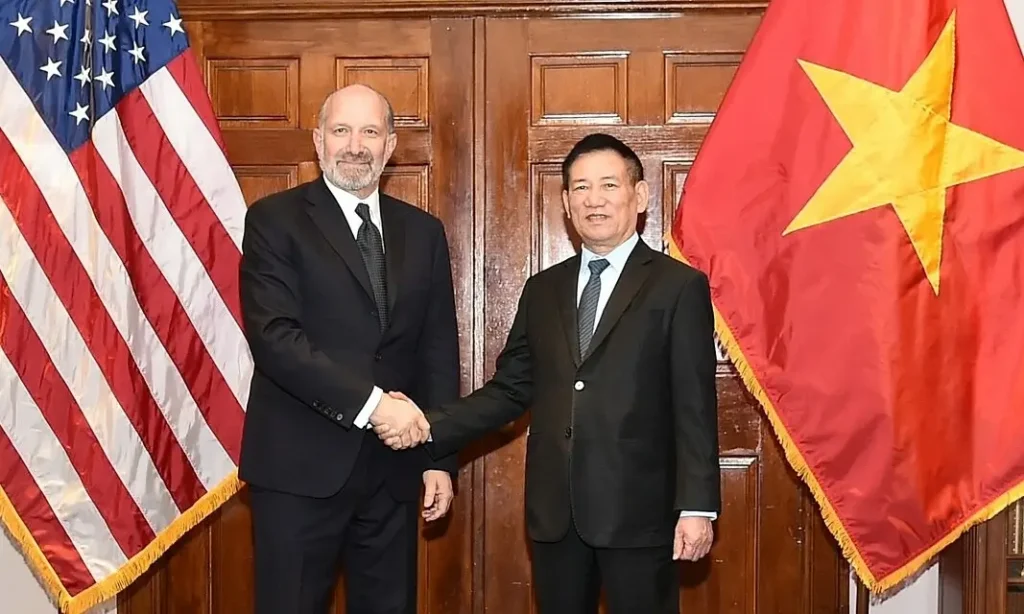

The new trade deal between America and Vietnam gave a bit of interest to global risk appetite. The dollar amount being put on the Yen—the so-called safe-haven currency—has diminished with this development.

Trump had another round of tariffs in mind for Japanese imports-harassing Japan in the process and adding more speculations. His comments reflected his ire at Japan’s refusal to buy more American-grown rice. He raised the tariff threat to up to 35% though he was rumoured to have said 24% before, shaking markets. Nonetheless, analysts believe the geopolitical noise will not undermine forex market fundamentals in the short term.

US-Vietnam trade deal

Can BoJ Rate Hike Bets Shield the Yen?

President of BoJ Kazuo Ueda has confirmed that policy rates will remain below neutral, suggesting future tightening. For more than a period of three years, Japanese consumer inflation has remained over the 2% target of the central bank. With companies passing raw material costs on to consumers, the pressure on monetary policy has increased. This has supported the speculation within the market that the BoJ might again raise the rates this year. Those expectations act as a counterweight to the yen’s weakness, particularly amid the general weakness of the USD.

How Will the Fed’s Dovish Bias Influence USD?

Fed Chief Jerome Powell indicated rate decisions will be data-dependent in the coming months. Markets are now pricing in a 25% chance of a cut in rates in the July meeting. There is also general agreement on at least two rate cuts by the end of 2025.

Trump’s recent verbal attacks on Powell and calls for him to resign have highlighted concerns over Fed independence. US data, led by the ADP private payroll report, further dented the greenback. That report indicated a decline of 33,000 jobs in June, compared to forecasts of growth.

Fed’s Chairman- Jerome Hayden

Traders Look to US NFP Report for Guidance

Later Thursday’s US NFP report will be instrumental in determining the future forex market trend. Markets anticipate the unemployment rate increasing from 4.2% to 4.3%, which will indicate a slowdown in the economy. A soft report would affirm weak hiring and increase the likelihood of a Fed rate cut.

Markets are waiting for significant positions in Japanese Yen vs USD until information gives definitive direction. A disappointing NFP print would support the Yen as safe-haven demand rises on poor US economic momentum.

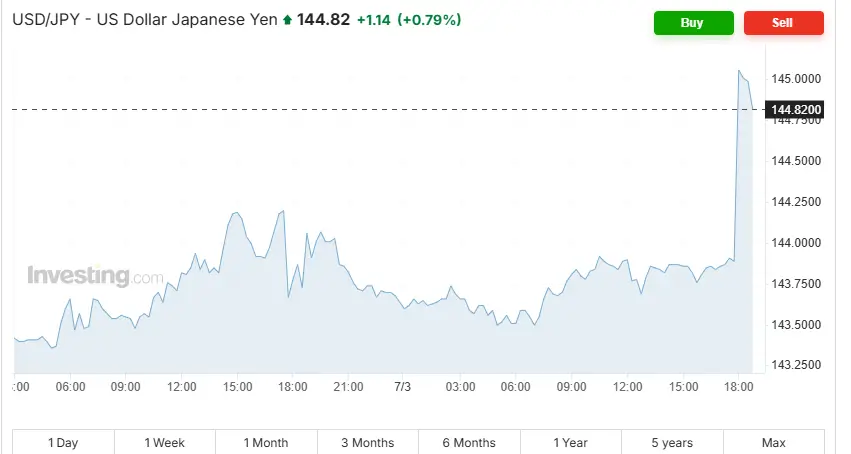

Technical Analysis: Resistance Around 144.00 Capping USD/JPY Upside

From a technical perspective, USD/JPY was rejected by the 200-period SMA on the four-hourly chart. Negative momentum indicators indicate that downtrend pressure is still intact short. In case of selling prolongation below the 143.35 support area, the pair might sink towards 143.00 or lower.

Further declines could target 142.65 or the May low around 142.10 if bearish momentum persists. Upside breaks above 144.00 will find resistance at 144.30, the present 200-SMA level. A break above 145.00 will change momentum to positive, with the next resistance target at 145.40.

USD/JPY Trend

Is Japanese Yen vs USD Outlook Still Data-Driven?

Japanese Yen vs USD short-term trend depends on forthcoming US labour market data. While expectations for BoJ rate hikes underpin the Yen, dovish Fed comments cap upside for the USD. The result of the NFP report might have a major impact on risk appetite and safe-haven flows.

More US-Japan trade tensions will be eyed by traders in the days ahead. Cautious sentiment and subdued volatility could otherwise rule the forex market space for now.