Executive summary

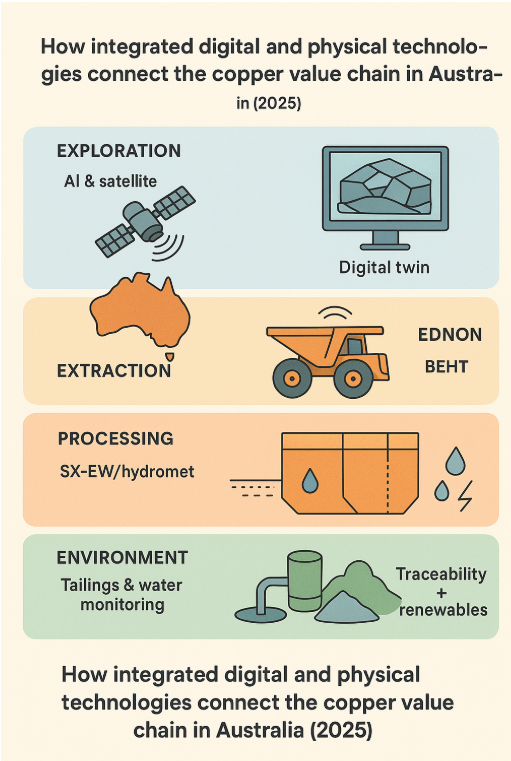

Australia is at the forefront of a technology-driven transformation in copper mining. As global demand for copper — driven by electrification, renewable energy, and electric vehicles — surges, Australian miners, service companies, and research organisations are rapidly adopting digital technologies, automation, advanced processing methods and sustainability-focused systems to boost recovery, reduce costs, and lower environmental footprints. This article surveys the leading innovations in 2025, situates them in an Australia-centric context, presents case studies, and recommends pathways for miners, investors and policymakers.

Why Has Attention Shifted to Copper?

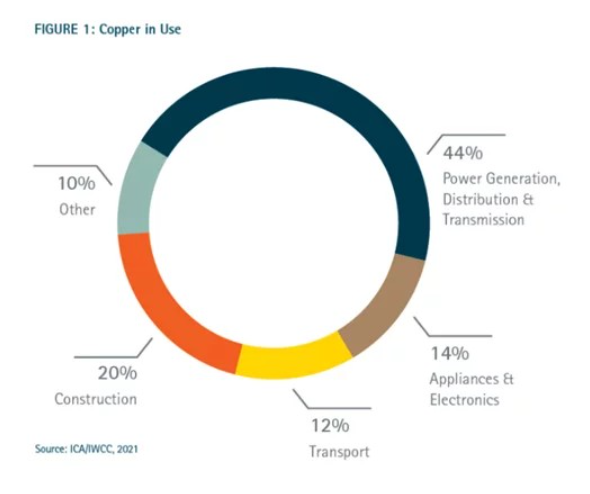

Copper is foundational to the energy transition: it is used extensively in power grids, wind turbines, EV motors and charging infrastructure. Australia, with sizable copper resources and an advanced mining services sector, faces an opportunity to convert resource potential into resilient, low-carbon, high-value supply chains. Key pressures pushing innovation in 2025 include: rising global demand, deeper/lower-grade orebodies, workforce availability challenges in remote regions, and tighter environmental/social licence requirements.

Source: Copper Alliance

Technology Categories Reshaping Copper Mining In Australia

Below, we group innovations into seven technology themes and explain practical Australian applications, benefits and adoption maturity.

1. Digitalisation & data platforms (“digital mine”)

What: Converged data platforms, cloud analytics, digital twins and mine-wide dashboards that integrate geology, fleet, process plant, environmental and market data.

Why it matters: Operators can run virtual experiments (digital twins), optimise throughput in real time, and run advanced scheduling that accounts for energy costs, water constraints and equipment health.

Australia examples: Major operators, service companies and local tech vendors are building integrated platforms for remote monitoring and optimisation of copper plants and sites. Digital twins are used to run ore blend scenarios for mills and SX‑EW circuits. ( ResearchGate, Farmonaut)

Maturity: High for monitoring and reporting; accelerating for prescriptive optimisation and full-plant digital twins.

2. Automation, autonomy and electrification of fleets

What: Autonomous haulage systems (AHS), driverless drills, automated shovels, battery-electric haul trucks (BEHTs) and remote fleet operations.

Australia examples & milestones: Australian mining has long been a testbed for AHS and BEHT trials. Industry leaders have trialled and rolled out driverless fleets in iron ore operations and are adapting learnings to copper operations. Collaborative BEHT trials by major miners are underway in Australia, aiming to lower diesel use, reduce emissions and lower maintenance costs. Autonomous integration reduces exposure of workers to hazardous zones while improving utilisation.(mine.nridigital.com)

Benefits: Lower operating costs per tonne, reduced GHG emissions (especially with renewables), fewer onsite staff, and better uptime through fleet optimisation.

Maturity: Rapid adoption of autonomy for surface equipment; BEHTs commercially trialled and scaling through the late 2020s.

3. IoT sensors, AI-driven predictive maintenance and process control

What: Wide deployment of edge sensors (vibration, thermal, acoustic), continuous water and tailings monitoring, combined with AI/ML models for anomaly detection and predictive maintenance. ( WEG, Farmonaut)

Application in Australia: Remote sites in Australia deploy sensor suites on SAG/ball mill motors, conveyors, crushers and pumps to detect early signs of failure. Predictive maintenance reduces unplanned downtime and extends equipment life — crucial for operations where spares and technicians are costly to mobilise.

Maturity: Growing quickly; many brownfield sites retrofit sensors and integrate with remote operation centres.

4. Advanced mineral processing: hydrometallurgy, SX‑EW and low‑carbon processing

What: Greater use of hydrometallurgical routes (heap leach, in‑situ leaching, pressure oxidation, solvent extraction–electrowinning (SX‑EW)), and improved reagent/circuit design to process lower‑grade and complex ores more efficiently.

Why Australia cares: Processing complex or lower‑grade copper ores economically is vital for unlocking new deposits across South Australia, Queensland and Western Australia. SX‑EW and hybrid circuits are attractive where water and energy footprints can be optimised.

Maturity: SX‑EW is a mature route but is being modernised with digital control and improved chemistries; POX and other advanced flowsheets are in increasing pilot/demo use.

5. Exploration and resource targeting: AI, satellite and sensor fusion

What: Machine‑learning models that combine historical drilling, geophysics, geochemistry and hyperspectral/satellite data to prioritise targets; drones and low‑cost space data for rapid area screening.

Australia examples: Startups and service providers work with juniors and majors to digitise historical datasets and run AI models to find blind copper targets. Australian governments and research bodies fund critical minerals exploration tech to accelerate discovery pipelines.

Maturity: Rapidly maturing; early successes have shortened exploration cycles and re-ranked prospects.

6. Water, tailings and environmental monitoring tech

What: Smart tailings monitoring, dry stacking pilots, paste tailings, continuous water quality sensing, and tailings facility digital twins.

Application: Given Australia’s variable climate and increasing social scrutiny, operators are deploying continuous monitoring networks and using predictive models to forecast tailings facility behaviour during floods or droughts.

Maturity: Pilots to early deployments; regulatory scrutiny accelerating rollouts.

7. Supply‑chain traceability, circularity and low‑carbon logistics

What: Blockchain and provenance platforms to verify low‑carbon copper, coupled with on‑site renewables and battery storage to reduce emissions intensity.

Why: Buyers (manufacturers, governments) increasingly seek provenance and emissions metrics for copper used in energy transition projects.

Maturity: Proof‑of‑concept and limited commercial pilots; expected growth as demand for certified low‑carbon metals rises.

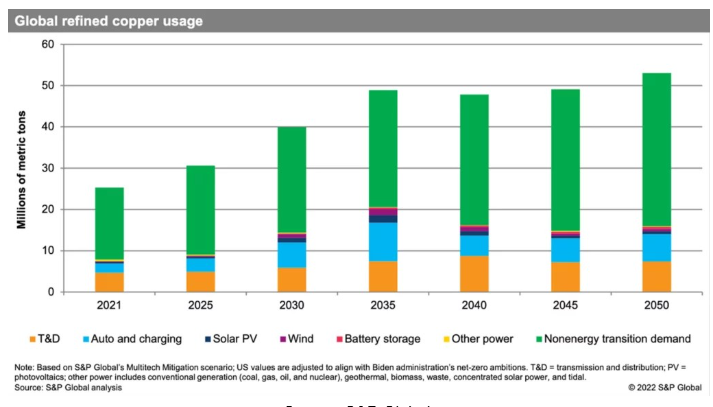

Source: S&P Global

Case studies (2024–25)

BHP & Rio Tinto — battery-electric haul truck trials and shared learnings

In 2024–25, major Australian miners initiated collaborative BEHT trials, switching diesel haul trucks to battery-electric models in large surface operations. Trials assess performance, charging strategies, energy draw and integration with renewables and microgrids. Early findings indicate substantial reductions in onsite diesel use and potential lifecycle emissions improvements when charged with low‑carbon electricity.( bhp.com , riotinto.com )

Sensor retrofit at a copper concentrator (industrial example)

Several Australian operations have retrofitted IoT sensor packages to critical mills and SAG motors. Continuous vibration and thermal analytics spotted bearing degradation weeks earlier than routine inspections, allowing planned downtime and avoiding cascading failures. These interventions typically halve unplanned downtime events for critical equipment.

Hydrometallurgical pilots and SX‑EW improvements

Australian processing companies and pilot plants are trialling modern SX‑EW chemistries and plant control upgrades to increase copper recovery on low‑grade oxide/supergene ores. Digital process control has tightened reagent dosing and reduced organic entrainment—raising cathode quality and reducing operating costs.

Innovation showcases and ecosystem development

Events such as Copper to the World 2025 and industry innovation hours with Austmine bring startups, miners and investors together in Australia to accelerate pilot‑to‑commercial pathways for disruptive technologies, from remote sensing to mine decarbonisation solutions.

Visuals, infographics, charts and tables

- Infographic — Technology Stack for a Modern Australian Copper Mine

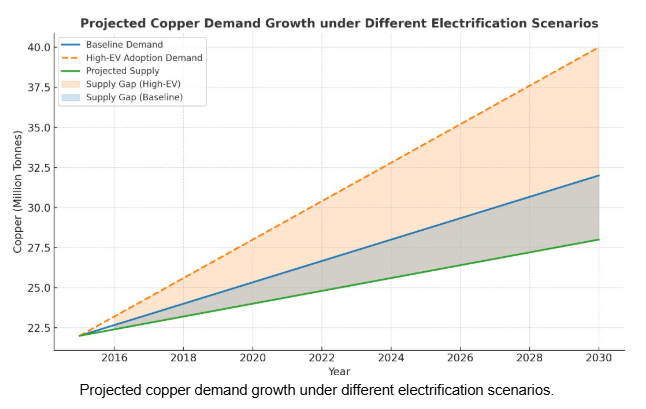

- Copper demand vs. supply gap (2015–2030) — scenario lines

Projected copper demand growth under different electrification scenarios.

- Timeline — Key Australian milestones in automation & hydrometallurgy (2015–2025)

| Year | Milestone | Details / Notes |

| 2015–2017 | AHS ramp-up in Pilbara | Rio Tinto expanded autonomous haulage trucks across Pilbara; Hope Downs 4 among first retrofits (Komatsu AHS). |

| 2018 | First autonomous heavy-haul train delivery (AutoHaul) | July 2018: Rio Tinto ran world’s first autonomous heavy-haul train delivery in Pilbara. |

| 2019 | AutoHaul fully operational | World’s first fully autonomous, long-distance heavy-haul rail network. |

| 2019 | Hydromet pilot plant work (Clean TeQ Sunrise) | Integrated pilot work on nickel-cobalt hydromet flowsheets conducted in WA facilities. |

| 2020 | Modern Manufacturing Initiative (MMI) launched | $1.3B federal program supporting advanced manufacturing & processing, relevant to hydromet pilots. |

| 2021 | Autonomous site vehicle innovation | Rio Tinto announced deployment of world’s first fully autonomous water trucks at Gudai-Darri. |

| 2021–2022 | Funding streams open | Federal government issued MMI funding guidance, supporting pilots & demonstration projects. |

| 2023 | Critical Minerals Strategy 2023–2030 | National framework prioritising onshore processing, hydromet pilot scale-up, and investment. |

| 2023–2024 | Critical Minerals Facility & budgets | Multi-billion financing facility to back pilot plants & critical mineral processing. |

| 2024 | BEHT trials begin | Rio Tinto & BHP started collaborative Pilbara trials of battery-electric haul trucks (Caterpillar early-learner units at Jimblebar). |

| 2024–2025 | Hydromet R&D & pilots continue | CSIRO, ANSTO and universities advancing hydromet & bioleach pilot studies (reported at ALTA conferences). |

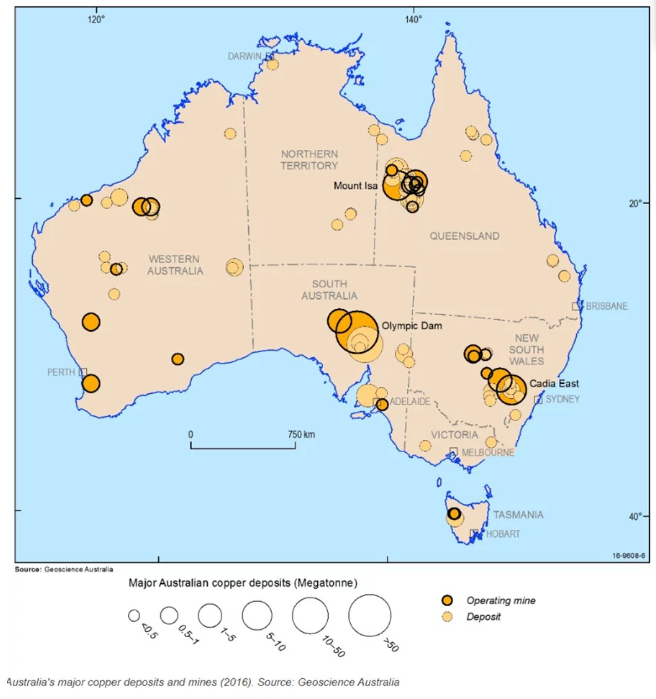

- Map — Australia: copper project hotspots & tech pilots

Source: Geoscience Australia

Source: Geoscience Australia

- Recommended KPIs for digital transition projects

Her

| KPI | Definition / What It Measures | Why It Matters |

| Uptime % | Percentage of operational time that equipment or systems are running | Higher uptime reflects reliability, reduced downtime, and better ROI on technology. |

| Cost per tonne (A$/tCu) | Total operating cost divided by tonnes of copper produced | Core measure of efficiency and competitiveness in the Australian copper industry. |

| Scope 1 Intensity (tCO₂e/tCu) | Direct GHG emissions per tonne of copper produced (Scope 1) | Tracks decarbonisation progress; critical for ESG and investor reporting. |

| Water Use per tonne (m³/tCu) | Freshwater consumption per tonne of copper produced | Key sustainability metric given Australia’s water-scarcity challenges. |

| Time-to-Value (months) | Time taken from project initiation to measurable business benefits | Captures agility of digital adoption; shorter cycles show stronger digital ROI. |

Economic, workforce and Regulatory Considerations

Capex vs Opex tradeoffs: Many digital and automation projects require upfront capital but produce sustained Opex savings (fuel, labour, downtime). Pilots should include robust Total Cost of Ownership (TCO) models.

- Workforce reskilling: Automation shifts roles toward remote operations, data science, maintenance engineering and environmental monitoring. Industry training and university partnerships are growing in Australia to supply talent.

- Regulatory interface: Tailings and water management technologies will be evaluated against tightening Australian federal and state regulations. Transparent reporting and third‑party verification of monitoring systems increase social licence to operate.

- Community & First Nations engagement: Deploying new tech must be coupled with genuine engagement and benefit sharing to maintain community trust in regional Australia.

Risks & challenges

- Technical integration & legacy assets: Brownfield sites require careful integration of sensors and automation into older plants.

- Cybersecurity: Greater digitalisation expands attack surface; miners must architect secure OT/IT separation and response plans.

- Operational safety: While autonomy reduces exposure, incidents (global examples) underline the need for conservative change management and fail‑safe systems.

- Capital availability for juniors: Small developers may face funding constraints to deploy pilots; government funded incentives and collaborative trials can bridge this.

Roadmap & recommendations for Australian stakeholders (short, medium, long term)

Short (0–18 months):

- Run non‑intrusive pilots (sensor retrofits, digital twins for single assets).

- Establish data governance and cybersecurity baselines.

- Initiate workforce reskilling programs.

Medium (18–48 months):

- Scale proven pilots (fleet autonomy corridors, BEHTs where feasible).

- Implement full‑plant digital twins and advanced SX‑EW control strategies.

- Integrate renewables + storage for charging BEHTs to lock in emissions reductions.

Long (48 months+):

- Move to end‑to‑end low‑carbon certified copper supply chains with traceability and reporting.

- Deploy in‑situ and low‑footprint extraction methods where geology and regulation permit.

Conclusion

By 2025, Australia’s copper sector is rapidly embracing a suite of digital and physical technologies that together promise productivity gains, lower carbon intensity and improved social and environmental performance. Realising these benefits requires thoughtful integration, investment in people and governance frameworks that ensure technology is safe, secure and equitable. For miners, investors and policymakers who act decisively, Australia can not only supply the copper the world needs — it can supply copper derived from smarter, cleaner, and more resilient operations.

Appendix

Technology snapshot

| Technology | Maturity (2025) | Typical benefit | Australian adopters / pilots |

| Autonomous haulage systems | High (surface) | +10–25% utilisation, safety gains | Rio Tinto, large Pilbara operations (transferable learnings) |

| Battery-electric haul trucks | Pilot → early commercial | -30–80% diesel use (site dependent) | Collaborative trials (major miners) |

| IoT sensors + predictive maintenance | Growing | -20–50% unplanned downtime | Multiple concentrator retrofits |

| SX‑EW modernisation | Mature + digital upgrades | Better recovery on oxides | Processing pilot plants |

| AI-driven exploration | Early commercial | Faster target ranking, lower exploration cost | Startups and service providers partnering with juniors |

Notes on visuals & data sources

- Suggested authoritative data sources for charts: IEA, USGS, Minerals Council of Australia, industry releases (BHP, Rio Tinto), Copper to the World / Austmine event materials, peer-reviewed hydrometallurgy literature, and internal piloting reports from technology vendors.

Disclaimer