The Green Turn in Crypto Mining

Crypto mining has been most conventionally criticized on the points of high power requirements and environmental consequences. But the conversation has shifted recently. In Australia, the United States, the United Kingdom, and Canada, miners are embracing renewable-powered solutions as a means to reduce costs, increase sustainability, and respond to heightened investor and regulator pressures.

Crypto Mining Goes Green: Renewables Power Growth in Australia, UK, US, and Canada ( Image Source: Coinfomania )

These companies, including Iris Energy (ASX), Hut 8 (TSX), Argo Blockchain (LSE), and Riot Platforms (NASDAQ), are at the forefront of this revolution, showing that mining can be done without reducing its carbon footprint. Hydroelectric, solar, wind, and geothermal-powered, these companies are not only changing the face of the industry but also making it sustainable in the long term for a cleaner world.

Why Sustainability is Important in Mining

The blockchain industry has long been accused of consuming fossil fuels, coal-based grids in nations like China and Kazakhstan. Reports on energy tracking cite that the energy usage of Bitcoin in the past was comparable to the usage of small countries, which has drawn criticism from governments, ecologists, and the corporate press.

But that pressure has brought innovation, too. Sustainability is no longer business as a PR practice; it is a business necessity now. ESG-mandated investors are redirecting billions of dollars into projects that prove blockchain is possible without poisoning the world. Miners that fail to innovate will not only lose reputation but operationally more costly expenses as fossil fuels become economically less attractive.

Australia: Iris Energy and the New Renewables in Mining

Australia has led the way in mining with renewables, and Iris Energy is a prime example. ASX-listed, the firm is a renewable energy expert to fuel its mining operations with 100% renewable energy, mostly hydroelectricity.

By positioning its data centres in regions where there is an abundance of clean power, Iris Energy has a low carbon footprint and cheaper power costs than fossil fuel-powered miners. The strategy has drawn mainstream investors and green-themed funds and placed the company at the forefront of carbon-free Bitcoin mining.

Australia’s broader renewable energy push also highlights this trend. With abundant solar and wind resources, Australian miners are well-positioned to exploit government incentives and falling renewable prices.

Iris Energy shows how Australia is driving crypto mining with 100% renewable power, led by hydroelectricity ( Image Source: Discovery Alert )

Canada: Hut 8 and Hydroelectric Powerhouses

Canada’s massive hydropower resources make it one of the most attractive places to mine cryptocurrency in a clean and green way. Hut 8 Mining Corp (TSX) has exploited this and is now the world’s leading green blockchain powerhouse.

The company situates its mining farms strategically near hydroelectric power plants, taking advantage of loads of inexpensive and renewable green energy. In addition to reducing carbon footprints, this renders Hut 8 cost-advantageously competitive.

Canada’s administration also favors clean mining ventures increasingly as a way of attracting foreign investment while making the sector greener in line with the nation’s climate goals. Because Canada derives the majority of its electricity from hydroelectric energy, miners like Hut 8 enjoy tremendous opportunities to expand responsibly.

Hut 8 Mining taps Canada’s vast hydropower, cementing its place as a global leader in green blockchain operations ( Image Source: AP News )

United Kingdom: Argo Blockchain’s ESG Commitment

Argo Blockchain (LSE) in the UK has been a leader in the quest for sustainability as the central business model. Argo invests in hydro-powered mining centers in North America while mapping its corporate strategy on ESG directives.

Argo has also joined up to such initiatives as the Crypto Climate Accord, which commits to net-zero emissions by 2030. The measures are aimed at winning regulators over, securing green financing, and convincing institutional investors, who increasingly demand more disclosure in the environmental aspect.

Collectively, regulation in the UK is becoming increasingly friendly towards green finance. With London achieving a position as a hub for sustainable investment, Argo’s approach becomes easily implementable within the country’s finance industry.

Argo Blockchain leads the UK’s green crypto push, investing in hydro-powered mining and following strict ESG guidelines ( Image Source: The Block )

United States: Riot Platforms and Solar Growth

In America, Riot Platforms (NASDAQ) has embraced green strategies in long-term growth. Although the energy of the company at the moment is mainly sourced from natural gas and blended sources, Riot has also continued to invest in solar-powered mining hubs, with much focus in Texas.

Texas has become a global hotspot for crypto mining because of its deregulated power grid and increasing supply of affordable renewables. Solar farms and wind farms are sprouting up quickly throughout the state, giving miners plenty of low-cost green power to tap.

Riot’s move to renewables is part of a bigger trend in the U.S. market, as public pressure as well as incentives at the state level are encouraging miners to switch to cleaner methods.

Riot Platforms drives sustainable crypto in the US, investing in solar-powered mining hubs while blending current energy sources (Image Source: Reuters )

Renewable Energy Sources Driving the Change

In all four countries, miners are using alternative renewable sources to power their operations:

- Hydropower: Canada and select regions in the U.S. are leaders in this, with cheap, reliable, clean energy.

- Solar: Australia and Texas are leading the charge with huge solar farms, perfect to power mining rigs during the day.

- Wind: The U.S. and the UK are investing big in wind, often with mining operations that require flexible, scalable power.

- Geothermal: Less prevalent, but geothermal mining is also being eyed for development in North America as a source of clean power throughout the year.

The diversification reduces the dependence on fossil fuels and allows mining operations to be less subject to the fluctuations of the energy market.

The Criticism of Crypto Mining

Despite all these green revolutions, the industry is criticized. As per environmentalists, even mining based on renewable energy is electricity-hungry to a point where it can be used by industries or homes elsewhere.

But the miners counter that all but a few of these projects are taking advantage of stranded or excess renewable power—power otherwise lost because it can’t be put to use with existing grid limitations. By tapping the excess, crypto activity can actually make adoption of renewables viable by generating new demand and compensating for more buildout infrastructure.

The debate continues, but one thing is clear: renewables provide a much cleaner future than coal alternatives.

The Role of ESG in Mining’s Future Investment

Leading the way in this green charge is the expansion of ESG-investing funds. These funds now manage trillions of dollars globally and are setting standards for best practice among companies across industries.

For cryptocurrency miners, adhering to ESG principles is no longer optional. Argo Blockchain and Iris Energy are some companies that openly appeal to ESG investors through the release of sustainability reports, issuing carbon-neutral goals, and showing facilities powered by renewable energy.

In exchange, they receive access to more capital, gaining traction on less transparent peers. This union of green mining and green finance can determine the shape of the industry in the decade ahead.

Looking Ahead: Sustainability as Survival

The push for renewables-driven mining is not a fleeting trend. With a growing cost of energy, tougher regulations, and investors in despair, sustainability becomes the survival measure of crypto today.

Firms that transform quickly—engage hydro, solar, wind, and geothermal—can consider acquiring the future of mining. The firms that cling to traditional, fossil-based models can look forward to being priced or regulated out of business.

In a sense, the future of the industry mirrors the broader energy transformation taking place globally: not only a fight for profit, but to remain alive in a world where sustainability is becoming ever more critical.

Carbon-Neutral Mining: Jargon to Reality

Carbon-neutral is now at the forefront of the way miners describe their activities. It was first pooh-poohed as a marketing concept, but today is a real attempt at reducing emissions. Some balance out their emissions by buying carbon credits or paying for reforestation projects. But real change is on the supply side—where miners directly link to renewable-fuelled power grids.

This is not merely a function of guilt reduction. Through using power from renewables, crypto miners achieve quantifiable emissions savings without exposing themselves to fossil-fuel market risk volatility. It’s a model that combines environmental responsibility and business resilience.

The Cost Advantage of Renewables

The biggest cost of crypto mining is electricity, 50–70% of expenditures. Depending on fossil fuels is always guaranteed, but profits were a gamble with volatile energy prices. Renewable energy provides stability and, in the majority of cases, reduced long-term costs.

Canadian and US hydroelectric power supplies cheap, stable electricity, and Australian sunshine allows miners to reduce the cost of energy during the daytime with huge solar farms. Combining wind power in the UK ends dependence on expensive imports, and cleaner, competitively priced energy is supplied to miners.

The advantage is obvious: renewable-equipment miners gain even if Bitcoin falls, but fossil-fuel-hobbled miners realize razor-thin margins.

Policy Support: Governments Join In

Government policy is now an added value for sustainable crypto mining activities.

- United States: Texas and Wyoming actively court miners with tax credits and renewable partnerships incentives.

- Canada: Quebec, with a fortune of hydro at its disposal, promotes crypto mining as a way to monetize unused energy.

- United Kingdom: Regulation is tighter, yet the Net Zero Strategy from the government includes blockchain in the list of industries that will need to transform to deliver on green aspirations with investment for innovation.

- Australia: State governments, particularly Queensland and New South Wales, are turning to renewable corridors, whereby industrial operators—i.e., miners—have access to megawatt-scale solar and wind projects.

Government incentives are not merely cost savings but also attract institutional investors on a sustainability-driven agenda.

The ESG Investor Connection

Investing in cryptocurrency is no longer speculative. Institutional investors now consider ESG performance in their decision-making before deploying capital.

Mining companies that can show integration of renewables lend instant credibility to previously sidelined funds from Bitcoin. Australia’s Iris Energy and Canada’s Hut 8 have already tapped green finance streams tied directly to their sustainability reports.

It’s a self-reinforcing virtuous circle: capital chases green practices, driving growth, driving subsequent adoption of renewables to speed up.

Community Impact: It’s More Than Mining

Green crypto mining is not just about emissions reduction—it’s also about neighborhood revitalization. Renewable-energy-powered data centers tend to introduce new infrastructure and new jobs into communities ravaged by industrial decline.

In Australia, coal-free regions are being rejuvenated through solar-powered initiatives, creating a fresh economic backbone for citizens.

These and other social gains grant miners a “licence to operate” and win the respect in host communities that would otherwise oppose similar energy-thirsty ventures.

Green crypto mining goes beyond emissions, bringing jobs and infrastructure to revitalise struggling communities ( Image Source: Openware )

The Renewable Mix: Hydro, Solar, Wind, and Geothermal

Different places use different green sources for their energy:

- Hydro: Economical and dependable in the US and Canada. A workhorse for large operators like Hut 8.

- Solar: Australia leads the charge with humongous solar farms that power miners like Iris Energy.

- Wind: Strong wind corridors in the UK and Canada light up mining farms.

- Geothermal: On the horizon yet, but promising in specific US states and parts of Canada, with clean and consistent energy.

By spreading their sources of renewables, miners prevent seasonal risk and level out operations around the clock.

Combating Environmental Smears

Its carbon bill has marred the image of the industry. But mining fueled by renewables reverses that. Instead of fighting with homes for fossil fuel energy, miners are able to offset grids with surplus renewable capacity that would otherwise go to waste.

This is a reversal—from being considered a sink to a source of green energy solutions.

Case Studies: Green Mining Leaders

- Iris Energy (Australia): Runs on hydro and solar power, building ESG investor confidence with transparent emissions disclosure.

- Hut 8 (Canada): Runs on hydro power and hosts data centers, diversifying income.

- Argo Blockchain (UK): Merges hydro and wind and is accessible as a London Stock Exchange-listed entity.

- Riot Platforms (US): Expands aggressively across Texas, where flexible grid arrangements and renewables provide cost benefits.

They show us that green mining is no trade-off—it’s a commercial benefit.

Challenges Down the Road

The road to renewables won’t be smooth sailing. Infrastructure remains expensive, renewable supply isn’t yet pervasive geographically, and regulatory ambiguity can torpedo the best of intentions.

But the global trend towards decarbonisation places fossil-fuel miners in a pickle, while renewable takers are gearing up to ride out the long game.

Also Read: Tokenisation and AI Adoption Drive Cryptos’ Maturity in 2025

Blockchain and Energy: The Coming Convergence

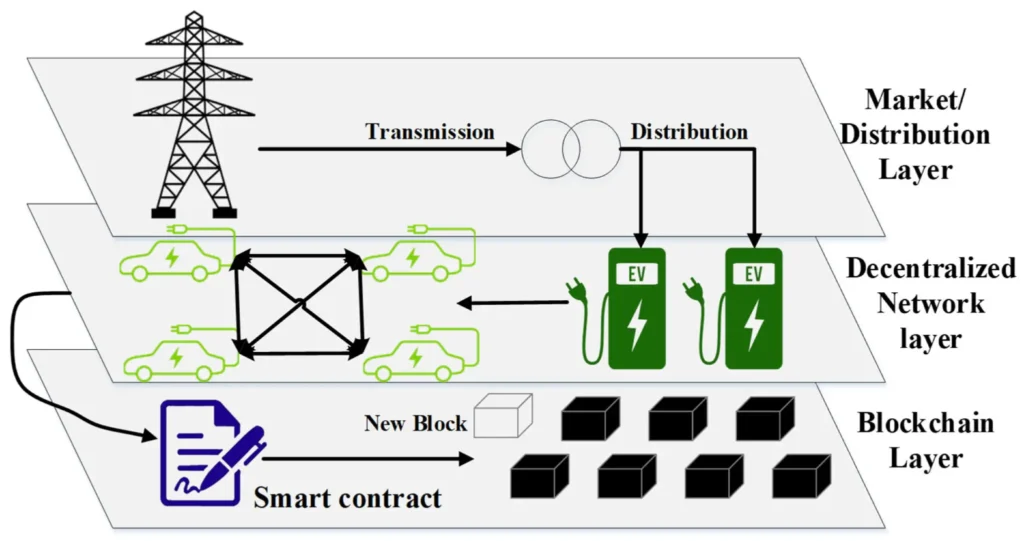

Mining is only the tip of the iceberg. The convergence of energy and blockchain has the potential to change the way houses trade power. One can imagine neighbourhoods using blockchain technology to trade excess solar energy between them, bypassing traditional utilities.

Being familiar with energy infrastructure, miners would be naturally positioned to take over these new markets, mixing up the distinction between virtual currency and the real energy economy.

Blockchain and energy converge as neighbourhoods could soon trade excess solar power directly using blockchain technology ( Image Source: MDPI )

Sustainability as Survival

El futuro de la industria de criptomonedas es claro: la sostenibilidad no es un lujo. Mineros que adopten la energía renovable no están mejorando su reputación; están asegurando su supervivencia. Quienes se resistan a los combustibles fósiles pueden quedarse fuera del negocio por parte de inversores, reguladores y comunidades.

As Bitcoin gets close to the financial core, pressure to decarbonize is mounting. The Australian, UK, US, and Canadian renewable-energy-fueled ventures prove that crypto’s energy-greedy reputation can be revised.

Conclusion: Profit Meets Planet

Crypto mining is no longer a story of machines churning out figures—it is among the power that pushes them. From Canadian hydroelectric facilities to Australian solar farms, crypto has a cleaner future waiting for it.

By linking profit to planet, miners are demonstrating that the existence of blockchain will be not only anchored in cryptography but also in clean and renewable energy.