Gold price remained around a one-week high on Thursday, underpinned by the weaker US Dollar. Traders were subdued in front of Friday’s Nonfarm Payrolls (NFP) report, which will be a crucial test for the Fed. Anticipation of Federal Reserve rate cuts still underpins demand for the gold market. But relief over relaxing global trade tensions may cause a short-term fall in the price of gold.

Gold slips with markets eyeing Fed cuts and key US payroll report.

Will Fed Rate Cut Hopes Keep Boosting Gold Despite Firm Risk Tone?

Markets are factoring in a 25% possibility of a Fed cut on July 29–30. A September reduction of 25 basis points is already broadly anticipated by market participants. Weaker labour data and lower inflation enhance the argument for earlier Fed policy loosening. This backdrop is driving down the value of the US dollar and increasing gold’s attraction as a non-yielding asset. Nevertheless, gold’s rally could be capped without more robust economic or geopolitical drivers.

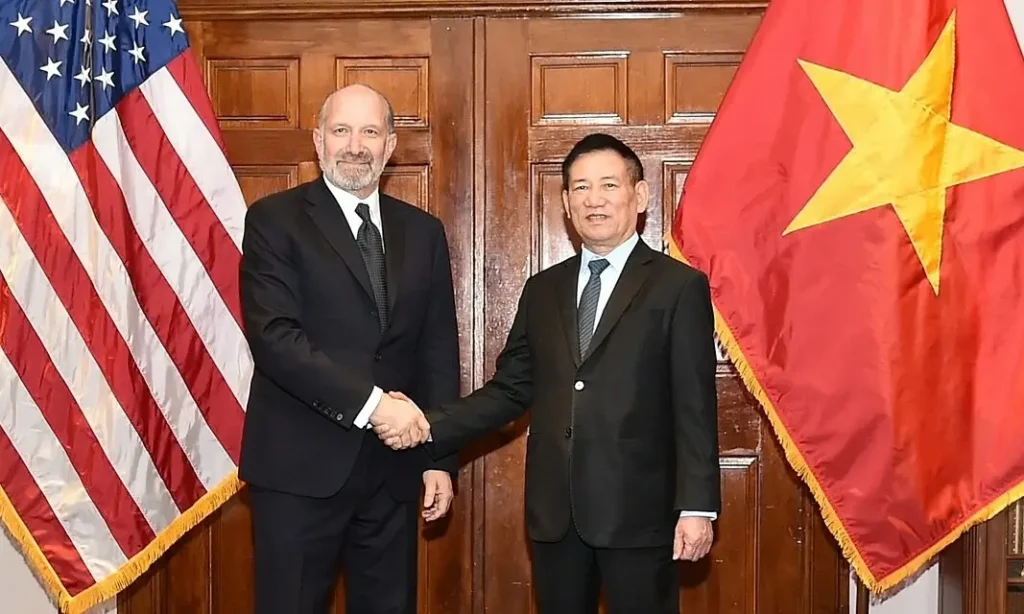

US-Vietnam Trade Agreement Caps Gold’s Upside Potential

President Trump announced a new US-Vietnam trade agreement on Wednesday. The 20% tariff is imposed on Vietnamese imports while the US enjoys tariff-free access. The agreement cut investor anxiety over sustained trade tensions and improved market confidence.

Better sentiment prompted some profit-selling in gold after a three-day advance. While the negotiations with India are progressing, those with Japan, however, remain stalled. Trump has not rolled over any deadlines, leaving more general trade threats hanging in the balance.

US-Vietnam trade deal limits gold’s upside momentum

US Labour Market Weakened by Job Losses

The US labour market weakened this week with poor ADP numbers. Private payrolls fell 33K in June — the first reduction in more than two years. May’s employment gain was also lowered to 29K, supporting a weakening trend. The earlier released JOLTS report also indicated softening labour demand in the US. This drift may prompt the Fed to reduce rates earlier for the sake of economic stability.

Traders await NFP confirmation of Economic Slowdown

Investors await the US NFP report scheduled for release on Friday to direct short-term gold direction. The report should indicate additional evidence of a cooling job market. Weak NFP figures would reinforce expectations for a Fed rate cut later this month. A strong number, on the other hand, will drive the US Dollar up and precipitate a gold prices. Risk-off ahead of this very important economic release is keeping traders away from aggressive positions.

Traders eye NFP for signs of US economic slowdown

Is Gold Still on a Bullish Path Amid Fed Cut Bets?

The recent gold rally that broke above the 200-hour SMA is bullish. Current support is at $3,330–$3,329, close to the 200-hour SMA. A fall to this level will precipitate technical selling towards $3,300. Short-term resistance is between $3,363 and $3,365 — last week’s peak. Allowed must be the move to $3,400 if $3,365 is broken. Momentum indicators on daily charts are still positive but need to be backed by fundamentals.

Greater Uncertainty Could Cap Any Fall in Gold Price

The US-Vietnam trade agreement could cut short-term safe-haven demand for gold. Yet, open Japan-India trade disputes leave risk sentiment volatile. Labour market weakness and inflation fears could still be backing gold in the short term. Markets are extremely vulnerable to Fed statements and economic data. Despite a bit of profit-taking, loss depth in gold might still be limited. Gold could bounce sharply if the NFP report is a disappointment or if trade tensions flare up again.

Key Takeaways:

- Gold trades near one-week high as Fed cut bets weigh on US Dollar.

- US-Vietnam trade deal boosts risk appetite and limits upside for gold.

- Private US payrolls drop by 33K, first decline in two years.

- NFP report on Friday is key to gold’s near-term direction.

- Technical support is set at $3,330; meanwhile, $3,365 and $3,400 could resist.

- Broader risks could continue to provide support despite short-term pullbacks.

Read Also :/prodigy-old-pirate-hyperion-nt-grant