Source: Global Lithium

Global Lithium Resources has just taken a major step forward in Western Australia’s Eastern Goldfields. The company and the Kakarra Part B Native Title claim group have solidified a “Working Together Protocol,” setting the stage to finalise a Native Title Mining Agreement (NTMA) for the Manna lithium project before year’s end. This milestone clears a key hurdle toward actual mining operations on Country.

GM Ron Mitchell described the progress as highly encouraging. He highlighted that both sides are working in good faith to protect cultural heritage and ensure mutual benefit throughout the project’s life. With the NTMA and mining lease pending, this agreement brings Manna significantly closer to production.

The Significance of the Agreement

At its core, this isn’t just a box-ticking exercise—it’s a genuine demonstration of respectful collaboration. Manna rests on land with deep cultural significance for the Kakarra Part B people. Formalising protocols around cultural heritage and transparent engagement means mining can proceed—but safely, ethically and with local custodians at the table.

The accord ushers in clarity for both sides: Global Lithium gains the social licence it needs to explore and develop, while the Kakarra Group secures a say in how their land is managed, and a stake in the benefits.

Source: Global Lithium

Manna’s Path Ahead: Finance, Feasibility and First Output

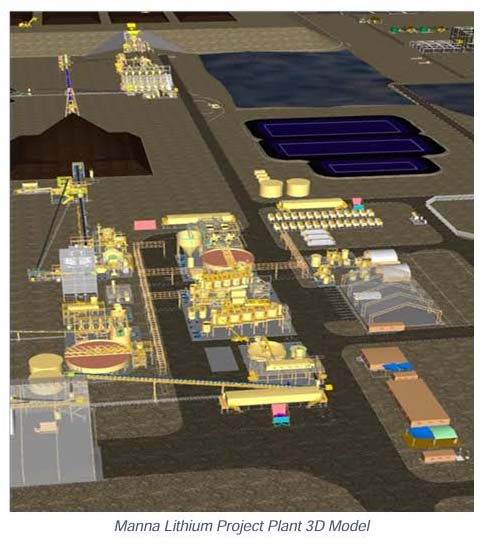

Beyond native title, Manna is shaping up into a strong commercial proposition. A scoping study released earlier this year foresees a ten-year operation yielding 2.2 million tonnes of spodumene concentrate. With envisaged capital costs near A$300 million and a payback in as little as 15 months, the project carries a standout economic profile.

Global Lithium’s roadmap is clear: first, formalise native title and secure a mining lease, then push ahead with a full feasibility study. If the numbers hold, mining could mobilise as early as 2026.

A Fresh Lens: Manna as Sovereign Supply-Chain Anchor

Source: Global Lithium

Everyone else writes lithium stories in terms of EV demand and gigafactories. Here’s a different view: securing Manna is really about Australia stamping control over its “critical minerals destiny.”

With rising scrutiny around foreign influence—especially given past board-change tussles and FIRB investigations—getting this deal right marks Global Lithium’s pivot to rebuilding trust. The NTMA and transparent governance could become an example of how sovereign resources development can respect culture, comply with national law, and still attract investment.

Community Value Beyond the Pound Signs

On the ground, these negotiations go beyond dotted lines. The “Working Together Protocol” includes joint planning of a cultural heritage management plan. That protects sacred sites and ensures any exploration or operations tread lightly.

This agreement lays the foundation for training, jobs and economic benefits for the Kakarra Part B community. It means a long-term partnership, not just a transaction—ensuring the Manna project builds cultural as well as economic capital.

Timing Is Everything in Lithium

The lithium market has cooled from its red-hot highs, pressuring developers to move swiftly from concept to cashflow. Manna’s combination of resource size, attractive economics and now hard-won social licence puts it in a rare position.

As battery metals demand rebounds, projects that are development-ready—and backed by local agreement—will be winners.

What Comes Next for Manna?

- Native Title Agreement: Targeted before year’s end, it unlocks mining lease applications.

- Full Feasibility Study: As soon as land and title issues are settled, this will define cost structure and production pathway.

- Financing: With clarity on tenements and tenure, Global Lithium can pursue offtake partners or project financing with more confidence.

- Drilling Expansion: Meanwhile, further exploration could boost Manna’s resource base, adding optional upside.

In Summary: Manna as a Model, Not Just a Mine

The Manna project stands out—not just for its lithium potential, but for how it’s being executed. This blend of cultural respect, economic feasibility, and strategic clarity could set a new standard for resource development in WA’s critical-minerals push.

Global Lithium is sending a message: development can be fast, profitable—and done the right way.