The vote of confidence in the French government was necessitated by Prime Minister François Bayrou taking his mandate. His austerity plan, announced at the end of August, sought to cut down France’s fiscal deficits and restore investor confidence.

It called for saving €44 billion ($51 billion). Saving measures included scrapping two public holidays, freezing public spending, and pension reforms. Bayrou insisted on the need for this plan to avert further downgrades in credit rating.

He resorted to Article 49.1 of the constitution, forcing lawmakers to accept his government or bring it down. It was a high-risk gamble for Bayrou to tie his survival to this plan and to Parliament’s acceptance.

Bayrou’s mandate gamble triggers French government confidence vote

French government confidence vote ends in defeat

The gamble failed on 8 September 2025, with the Assembly voting down the plan by 364 votes against and 194 votes in favour. Within hours, Bayrou submitted his resignation.

The defeat revealed a deep mistrust regarding Macron’s centrist bloc that lacks a majority. Opposition lawmakers from left and right joined to denounce the austerity program as unjust and against the interests of the poor.

The event also saw the shortest premiership since Macron became president, with Bayrou remaining for just nine months. It thus highlighted the fragility of French politics into 2026.

Why did the austerity plan flop politically?

The François Bayrou austerity package collapsed under broad opposition. Left-wing groups branded the measures as punitive toward workers, pensioners, and middle-income households. The far-right castigated them as attacks on national sovereignty.

Public unions had already undertaken strike actions in anticipation of the reforms. Civil servants warned that the removal of holidays would lead to more labour fatigue. Pensioners feared a reduction in social protections.

Bayrou’s stance only strengthened those against him. He refused to consider adjustments or negotiate any amendments, thus precluding any potential allies. As the invasion went on, the austerity package became a rallying point for both extremes of the political spectrum.

Bayrou’s austerity plan collapses amid backlash from workers, pensioners, and middle-class groups

Macron must appoint another prime minister

Emmanuel Macron is to appoint his fifth prime minister in less than two years. The fast turnover reflects the worsening political instability in France in 2025, where weak coalitions dominate the legislature.

Macron has to juggle the urgent need for fiscal reform against the public rejection of harsh austerity. Whoever replaces Bayrou will face the very same structural challenge: getting a budget through a parliament where no block commands outright control.

Some have argued that Macron might look for a consensual person or a technocrat with credibility across and beyond party lines. Yet there remains, whatsoever, an unobstructed path, although early elections might come into sight as an option if there is no agreement.

How serious is France’s fiscal predicament?

The debt burden of France now stands at 114% of GDP, which is among the highest within the Eurozone. As for the deficit, it reached a level of 5.4% of GDP in 2024 and was expected to fall to 4.6% by 2026 under Bayrou’s plan.

The economists warn about soaring borrowing costs unless reforms occur. The yields on bonds, too, have risen, reflecting an element of investor concern. Among the infringements of fiscal rules, the European Commission has singled out France.

Bayrou’s defeat has left France with no credible road to deficit reduction, and credit rating agencies, including Fitch, would likely look into France’s sovereign outlook in the coming weeks.

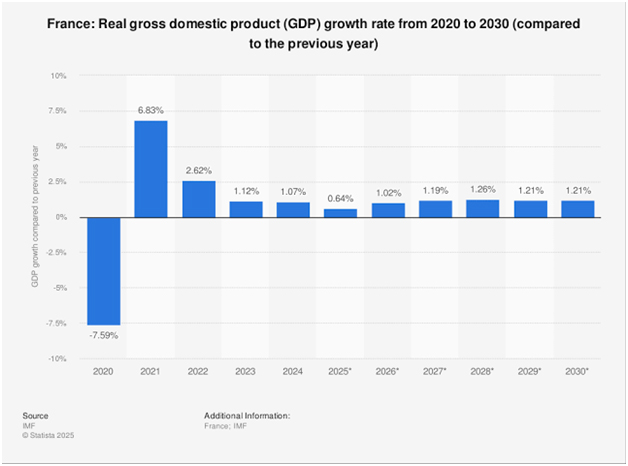

France’s GDP growth rate

Public unrest and market jitters rise

Political turmoil has spilled onto the streets. A so-called “Let`s Block Everything” nationwide strike is scheduled, reminiscent of the 2018 Yellow Vests movement. Protesters say austerity unfairly burdens ordinary citizens and lets elites get away free.

Inreach and markets are seeing something else as well. France’s sovereign 10-year record of uprisings is signalling investor unease. Bank analysts warn that instability might extend into the wider Eurozone.

The resignation plus the intimidation from protests forebode ill for France’s short-term stability. As Macron scurries to bring chaos into order, the world will be watching how the continent’s second-largest economy wants to make it through the crisis.

Also Read: Far-Right Surge Redefines the Path to France’s 2025 Election

FAQs

- What triggered the French government’s confidence vote?

Since François Bayrou saw fit to submit the plan for an austerity measure amounting to €44 billion for parliamentary vote under Article 49.1.

- What was the outcome of the vote?

The National Assembly rejected Bayrou’s plan by 364 votes against 194 votes for it.

- What is the debt status currently in France?

France’s public debt stands at 114% against GDP, one of the highest ratios in the Eurozone.

- What happens after Bayrou’s resignation?

President Macron must appoint a new Prime Minister who will manage to strive for consensus in a divided Parliament.