Ethereum (ETH) is currently trading around $2,611.16 USD, reflecting a notable 4.64% increase. But beneath the price action lies a complex matrix of innovation, behaviour, and shifting market conditions. What exactly is driving Ethereum’s valuation? What factors are shaping ETH’s trajectory in 2025?

In today’s crypto landscape, Ethereum sits at the heart of digital finance and blockchain innovation. From powering decentralised apps to underpinning an entire financial ecosystem, Ethereum isn’t just a cryptocurrency—it’s infrastructure. But its valuation isn’t static or random. It’s determined by real-time shifts in technology, demand, economics, and behaviour.

Let’s unpack what’s driving Ethereum’s value right now, and why these Ethereum valuation factors matter more than ever.

Key Forces Driving Ethereum’s Value in 2025 ( Image Source: Forbes )

A New Era: Ethereum’s Technical Evolution

Ethereum’s switch from Proof of Work (PoW) to Proof of Stake (PoS) fundamentally transformed how the network operates. It now runs more efficiently, consumes far less energy, and processes transactions with greater speed.

This change wasn’t just cosmetic. It improved scalability and addressed a long-standing issue—gas fees. Developers and users now enjoy a more seamless and predictable experience. Ethereum 2.0 isn’t just an upgrade; it’s a whole new engine for innovation.

Add to that the growth of Layer 2 solutions and Ethereum’s implementation of sharding, and the platform becomes a scalable powerhouse. These enhancements allow it to handle a far greater number of users and transactions without choking up or slowing down.

And as blockchain developers continue to adopt and build on Ethereum, the technical progress directly feeds into valuation dynamics.

Also Read: Nigeria’s Blockchain Regulation Ignites Global Crypto Expansion

The DeFi Boom Is Back

Ethereum remains the home of Decentralised Finance (DeFi). From decentralised lending to permissionless trading, the ecosystem has exploded in size and importance.

As more users lock assets into DeFi protocols—be it for yield farming, staking, or decentralised insurance—the demand for ETH rises. Why? Because ETH is often the collateral or base currency for these transactions.

In 2025, the Total Value Locked (TVL) in DeFi protocols built on Ethereum has surged again. That means capital is flowing into the ecosystem, usage is rising, and trust is growing. Every transaction, every smart contract, and every new DeFi product reinforces Ethereum’s position at the centre of the decentralised economy.

And where there’s growth, there’s value. As the DeFi sector expands, so too does Ethereum’s relevance—and its price.

Institutional Capital Floods In

Not long ago, Ethereum was seen as a risky, niche digital asset. That view has shifted dramatically. Today, institutional players—banks, hedge funds, fintech firms—are embracing Ethereum as part of their long-term strategy.

Ethereum-based ETFs are now live in several markets, offering exposure to ETH without needing to own the actual token. Meanwhile, global financial firms are experimenting with Ethereum’s blockchain to tokenise traditional assets like bonds, property, and commodities.

All of this is boosting Ethereum’s perceived legitimacy. For the average investor, if large institutions are on board, it signals confidence. For the market as a whole, it means deeper liquidity and reduced volatility in the long run.

Ethereum is no longer the rebel outsider. It’s becoming an integral part of modern finance.

Smart Contracts Fuel Real-World Use

Smart contracts—self-executing agreements coded into the blockchain—are what set Ethereum apart. These little bits of logic power everything from NFT marketplaces and DAOs to DeFi apps and supply chain platforms.

The demand for smart contracts is growing exponentially. As more businesses and developers build decentralised apps (dApps), they turn to Ethereum for its established infrastructure and developer community.

The more smart contracts in use, the more ETH is used to pay for computation on the network. It’s a simple equation: More smart contracts = higher ETH demand = price pressure upwards.

Whether it’s artists minting NFTs or corporations issuing bonds on-chain, the application layer built on Ethereum strengthens the value of the base layer—ETH itself.

Smart Contracts Power Real-World Applications ( Image Source: Calibraint )

ETH as a Store of Value

Ethereum has begun to attract attention as a potential store of value—much like Bitcoin. Thanks to its burn mechanism introduced in the EIP-1559 upgrade, a portion of ETH is now permanently removed from circulation with every transaction.

That means Ethereum’s supply is no longer strictly inflationary. In fact, under heavy usage, it can become deflationary.

This fundamental shift adds a new layer to Ethereum’s valuation dynamics. Not only is demand increasing, but supply is decreasing—especially when the network is most active.

Crypto investors who once only saw Bitcoin as a hedge now consider Ethereum a dual-threat: a utility token with real-world application and a potentially deflationary asset with value-preserving characteristics.

Regulatory Winds and Whispers

Regulation continues to cast a long shadow over crypto markets. In 2025, many governments are finally offering clearer guidance on digital assets. For Ethereum, this clarity can be a blessing—or a curse.

The good news? Ethereum is generally viewed more favourably than some other tokens. Its decentralised structure, large development community, and use in real applications give it credibility.

The challenge? Governments want transparency and control. Ethereum projects that embrace regulatory compliance—like identity verification or audited smart contracts—may flourish. Others might struggle.

But the overall trend is toward inclusion. Regulatory acceptance opens doors to institutional investors, retail users, and new markets. And every new entrant adds to ETH’s valuation potential.

Competition, Yes. But Ethereum Isn’t Slowing Down

Ethereum isn’t without challengers. From Solana and Avalanche to newer blockchains promising faster speeds or lower costs, the competition is real.

But Ethereum isn’t standing still.

The Ethereum Foundation and broader community are investing heavily in research, developer tools, and long-term scalability solutions. The goal isn’t just to maintain dominance—it’s to evolve continuously and adapt to changing demands.

Ethereum’s first-mover advantage, combined with its active and engaged developer base, makes it a tough competitor to dethrone. Even if other blockchains gain temporary attention, Ethereum’s deep liquidity, established ecosystem, and constant upgrades give it staying power.

Behavioural Trends in Crypto Investors

Let’s not forget one of the biggest drivers of crypto valuation: people.

Investor behaviour plays a massive role in Ethereum’s price movement. Fear, hype, news cycles, and social media chatter can all create short-term volatility.

However, in 2025, there’s a noticeable maturity in the market. Investors are looking beyond memes and moonshots. They’re paying attention to fundamentals: network activity, staking rewards, gas fee dynamics, and developer activity.

That behavioural shift is helping to stabilise ETH. It’s also raising its floor. More investors now treat Ethereum as a long-term asset, not just a speculative trade.

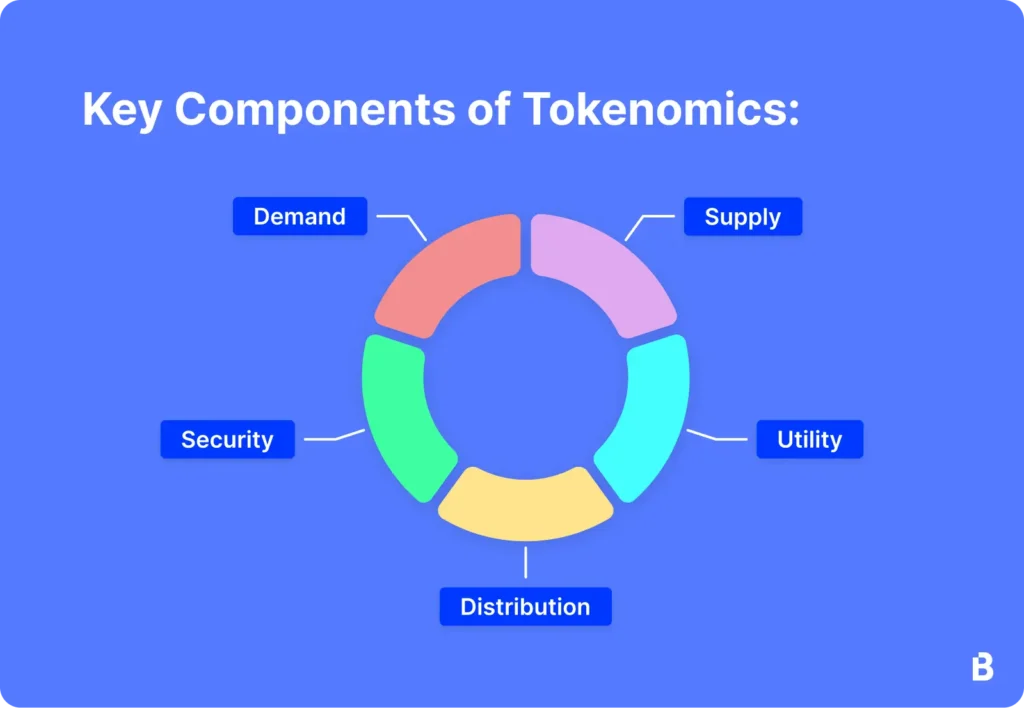

Tokenomics and Ecosystem Dynamics

ETH’s tokenomics—the economic rules governing its supply and distribution—are increasingly aligned with sustainable growth. The post-merge model of staking rewards, coupled with regular ETH burns, creates a feedback loop of scarcity and value.

Ethereum’s Token Model and Ecosystem Growth ( Image Source: Blockpit )

Meanwhile, the ecosystem surrounding Ethereum continues to flourish. From Layer 2s and sidechains to middleware and oracle services, the Ethereum universe is vast and interconnected.

Every new protocol built on Ethereum strengthens the entire network. Every bridge, every partnership, every API call—it all loops back to ETH being at the core.

The Bottom Line

Ethereum’s valuation isn’t driven by a single metric. It’s a symphony of technology, behaviour, economics, and innovation.

If you’re a crypto expert, you’ll see the intricate web of forces at play—staking yields, scalability trade-offs, regulatory positioning.

If you’re new to crypto, what matters is this: Ethereum is being used, adopted, upgraded, and backed by serious players. And all of that supports its current and future value.

2025 is shaping up to be a defining year for Ethereum. Whether you’re trading, investing, building, or just curious, understanding these valuation factors can give you clarity—and maybe even an edge.

The ETH ecosystem is alive, evolving, and more relevant than ever. And that alone speaks volumes about where it’s heading next.