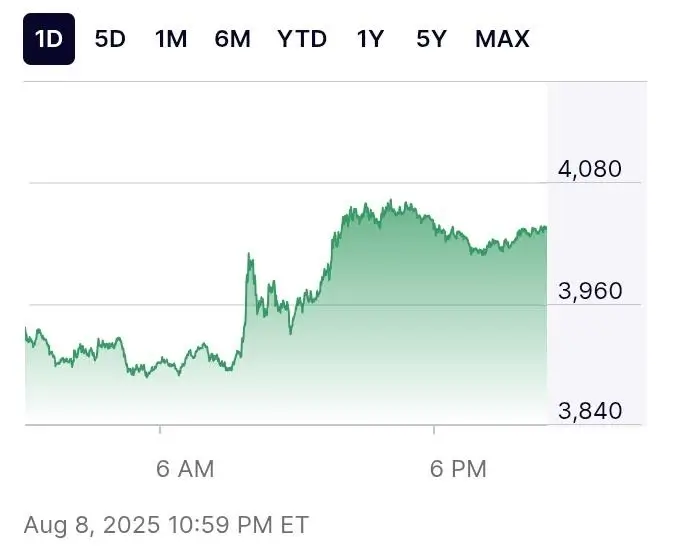

August 2025 saw a rally that pushed Ethereum past the $4,000 mark, creating a fresh cycle high. This bull move has brought optimism in the global cryptocurrency market. Investors, with the momentum behind them, are now looking up to new highs.

What is Driving Ethereum’s Latest Price Surge?

Strong institutional interest and rising acceptance of decentralised applications are driving the current price momentum for Ethereum. Analysts also cite Ethereum’s recent upgrades to the network which have improved scalability and lowered transaction costs.

Given that these flows from hedge funds and crypto-centric investment firms have soared in the last quarter, it is indicative of growing faith in Ethereum both as a technological platform and as a long-term asset.

Developers are also launching new decentralised finance (DeFi) platforms on Ethereum, adding demand for the network’s native token, Ether. With these factors combined, bullish sentiment has spread through trading desks worldwide.

Ethereum price surge

How Significant is the $4,000 Milestone?

It is psychologically and technically regarded as the $4,000 milestone in the cryptocurrency market. It is a sign of renewed strength after last year’s correction. Traders note that Ethereum had previously peaked last cycle at $4,891 in November 2021.

Reaching $4,000 in 2025 will mark the highest level in this market cycle. If a price sustains above this threshold, analysts say it is going to spur the rally into the next phase.

Hence this price mark further consolidates Ethereum’s stance as having become the second-largest cryptocurrency by market cap. It presently has a market cap of above $500 billion, ceding rank to only that of Bitcoin.

Can the Rally Sustain Amid Market Volatility?

Volatility still is a most defining feature of the crypto market, conversely amid the bullish momentum. Traders are observing macroeconomic data with much attention, from US inflation trends to global interest rate decisions.

Geopolitical developments and regulatory announcements may cause price swings in the short term. However, many investors consider that the technology that Ethereum is based on is sufficiently developed to outweigh those risks.

Short-term corrections can occur, but analysts foresee that an increase in network adoption will establish medium- to long-term growth. Ethereum upgrades will also reduce energy consumption, pointing out the concern of the environmental investor.

Ethereum’s Role in the Expanding Crypto Market

Industry reports suggest that the global cryptocurrency market size would reach the staggering figure of US$5.02 trillion by 2030. Ethereum might possibly continue to hold a dominant market share by virtue of its versatility.

The applications extend beyond currency transactions. Ethereum supports non-fungible tokens (NFTs), DeFi protocols, supply chain solutions, and enterprise blockchain integrations, thus giving it some value against sector-specific downturns.

Large corporates are increasingly experimenting with Ethereum tokenisation of real-world assets-a development that might thereby draw further institutional interest and growth in valuation for the long term.

Investor Outlook Turns Optimistic

Investor sentiment toward Ethereum has increasingly turned positive following the $4,000 breakout. Many portfolio managers regard Ethereum as a growth asset, with the added plus as a hedge against other conventional risks in the financial system.

The long-term holders, often called whales, have lessened their selling pressure, suggesting further rise expectation. The retail investors are also coming back into the market, stimulated by the recent rally.

Analysts believe Ethereum could retest its prior high within the next 12 to 18 months. Some places forecast that Ethereum may be in excess of $5,000 before the end of 2026, conditioned upon the overall market environment continuing to promote it.

ETH Share Chart

What Should Investors Watch Next?

An important technical level for Ethereum remains $4,200, that might set the pace for higher prices. Traders must then observe if volume continues to rise on strong on-chain activity to validate the rally.

Development of the Ethereum ecosystem will also remain in focus. Large protocol upgrades, partnerships, and real-world use cases will certainly drive demand for Ether.

Considerations of regulation of the cryptocurrency markets in the US, Europe, and Asia may dictate investor strategies in the coming months. Favorable policy signals will push institutional adoption further, while restrictive ones may curb the momentum temporarily.

Also Read: SolMining Launches XRP Contracts for Passive Income

Summary:

With a successful leap of Ethereum past the $4,000 mark, major momentum has been generated, cementing investor confidence in blockchain innovation. While the crypto currency market has been tipped to grow into the trillions, Ethereum is looking at prolonged leadership. The time is right for investors to remain bearish and alert to volatility and regulatory changes.