A Social Media Storm with Market Consequences

Elon Musk is once again at the centre of a political and financial whirlwind. This latest controversy stems from Elon Musk’s escalating online spat with former U.S. President Donald Trump—one that’s quickly made waves both politically and on Wall Street.

The drama unfolded on X.com (formerly Twitter), where Musk posted a veiled criticism of Trump’s newly proposed “Second Term Tech Policy”, which includes closer federal scrutiny of electric vehicle manufacturers and AI companies. Musk, never shy about sharing his views, responded with a now-viral post that read:

“Politicians shouldn’t pick tech winners and losers. Let innovation breathe.”

In what appeared to be a direct reply, Trump’s Truth Social account accused Musk of being “overrated” and suggested that Tesla had “benefited too much from taxpayer dollars.” The resulting tension has since ignited a flood of reactions from investors, political commentators, and business analysts alike.

Tesla Share Price Reacts Swiftly

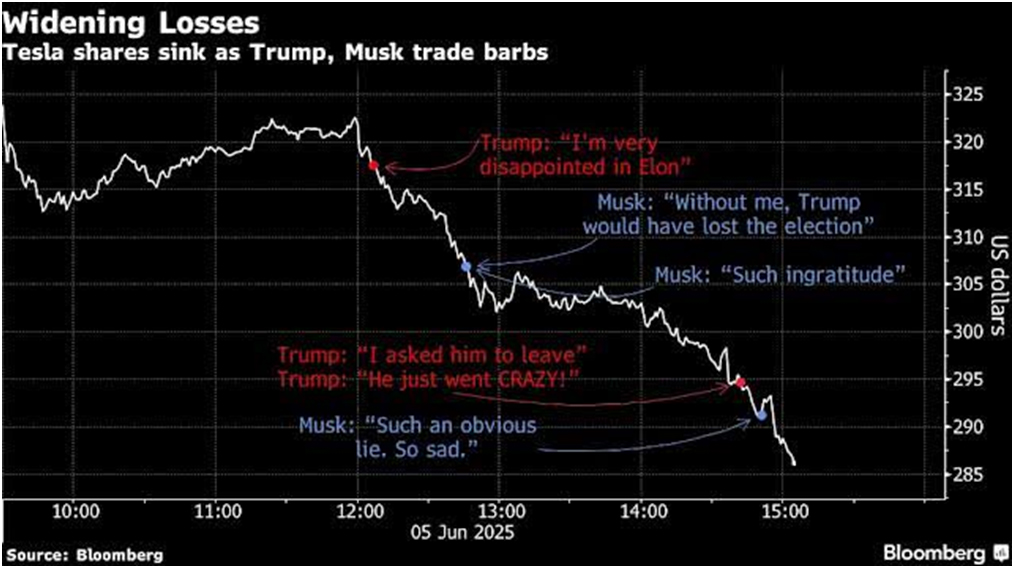

As the verbal barbs escalated, Tesla’s share price slid more than 4% in intraday trading, wiping billions off its market cap within hours. The dip comes amid broader concerns that Musk’s increasingly politicised presence may be impacting TSLA stock stability.

“Investors are jittery not because of Musk’s politics per se—but because of the unpredictability it introduces,” said Ayesha Duncan, a senior equity analyst at Harbor Funds Australia.

The sharp drop triggered renewed debate about Tesla’s governance and the role of its CEO’s personal brand in shaping share movement.

Tesla shares dipped sharply following Elon Musk’s online clash with Donald Trump. Source- Bloomberg/Yahoo Finance

Trump and Musk: From Bromance to Blowout?

The relationship between Trump and Elon Musk has always been complicated. Once appearing at odds during Trump’s presidency (especially over climate policies and the Paris Agreement), their ties seemed to warm in the post-White House era—until now.

Recent Epstein files revelations and controversial tweets from both men have further fuelled tensions. While no direct connection between Musk and Epstein was confirmed, Trump’s Truth Social posts implied that Musk’s critics should “look deeper into the billionaire class.”

Musk fired back hours later with a cryptic but pointed tweet:

“Projection is a powerful psychological defense mechanism.”

The back-and-forth has since gone viral, pushing #TrumpVsMusk into global trending status.

Tesla Stock Price Outlook: Storm or Correction?

Market analysts remain split on what’s next for Tesla stock price. Some argue this is a short-term overreaction driven by social media volatility. Others warn that the increasing overlap between Musk’s political commentary and Tesla’s brand identity could be detrimental in an election year.

“We’re in uncharted territory,” said financial strategist Marcus Tan from Perth-based Falcon Investments. “When one of the world’s most influential CEOs becomes a political lightning rod, market logic gets blurred.”

Elon Musk at a recent Tesla AI Day event, where questions about political distraction were [Source: gettyimages Credit: Saul Martinez]

Truth Social and the Election Echo Chamber

This episode is also emblematic of how Truth Social, Trump’s social platform, continues to shape political narratives outside mainstream media. While Musk remains dominant on X, Trump’s posts often go viral through right-leaning aggregators and fringe networks, driving further division.

The Musk Trump fallout highlights how modern elections are no longer shaped by rallies and debates alone—but by tech moguls with massive reach and zero filters.

Investor Sentiment: Risk or Resilience?

Despite the short-term hit to Tesla shares, long-term investors appear cautious but not panicked. Hedge funds and major ETFs including ARK Invest and BlackRock have yet to issue major revisions to their Tesla holdings.

Some bullish investors even view the controversy as “just another Musk moment,” citing his long history of bouncing back from public blowups.

“If history’s any guide, the stock could rebound just as quickly—provided the fundamentals stay strong,” said Duncan.

Photo: Getty Images

Conclusion: Personal Brands Collide, Markets React

The Elon Musk–Trump clash is more than a personality feud—it’s a reflection of how modern tech, politics, and public markets have become dangerously entangled. As the U.S. election cycle heats up, every tweet or Truth post from these high-profile figures could move markets, shift public sentiment, or even disrupt product pipelines.

For now, all eyes remain on Elon Musk, Tesla stock, and what could come next in this unpredictable saga between Silicon Valley’s biggest voice and America’s most polarising political figure.