In a dramatic move that shook the world, the U.S. Department of Justice (DOJ) has seized more than $225 million in cryptocurrency assets linked to corrupt crypto scams. These assets were tied to international scam operations of copycat investment websites and fake online affiliations in an attempt to lure unsuspecting victims.

This isn’t just about crypto and dollars—it’s about turning lives around. Behind each stolen token is a betrayal of trust and economic devastation. And for the DOJ, this is a message that times are a-changin’: save the victims first, track down the culprits second.

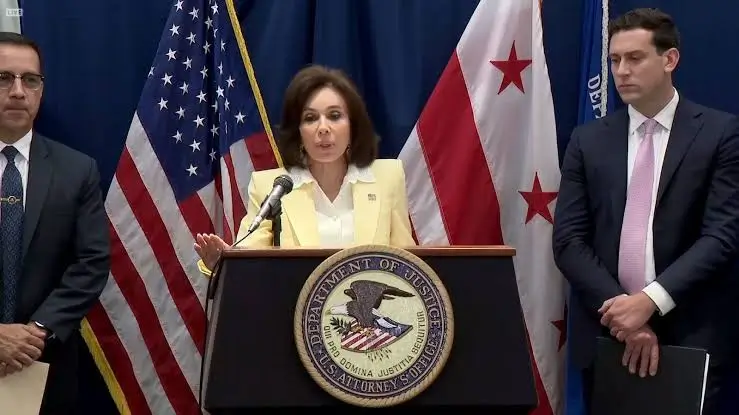

DOJ’s $225 Million Crypto Seizure Prioritises Scam Victims’ Recovery ( Image source: CNN )

Deception Disguised as Romance

In the middle of this scam is a dark scam known as “pig-butchering.” This is a technique where scammers form online friendships—often romantic or platonic in nature—with victims over extended periods of time. With trust established, the scammer then asks them to invest in what appears to be a lucrative crypto opportunity.

But it’s all just fantasy. The trading sites and software used are fake. The profits are acted out. And the funds? Funneled directly into crime syndicates. Victims, at times retirees or those who have never heard of crypto, lose their entire life savings without even realizing they’ve been cheated.

It’s not as much about clever hackers. It’s about mind games, isolation, and shattered self-esteem. The emotional harm is typically worse than the financial harm.

BREAKING: U.S. seizes $225M in crypto from a massive global scam network tied to over 400 victims. DOJ, FBI & USSS say it’s the largest crypto seizure in Secret Service history, aided by blockchain forensics & Tether $USDT. Recovery efforts underway.#CryptoScam #DOJ #FBI… pic.twitter.com/wmCVPHoJDq

— FinanceFeeds (@FXFinanceFeeds) June 19, 2025

A Small Bank, A Big Mistake

Perhaps the most stomach-wrenching tale associated with this case begins in rural Kansas. A small community bank—one of the reliable pillars upon which local farmers and small businesses relied—fell apart after its CEO, working independently, was taken in by a scam.

In attempting to recoup losses or maybe in pursuit of manipulation, he invested nearly $50 million of bank funds into phony crypto accounts. The damage was rapid and extensive. The bank shut down. Farmers were unable to get loans. Communities lost a valuable financial lifeline.

This was not just a business failure—this was a community crisis. The DOJ’s seizure now brings some glimmer of hope for rebuilding, but the scars remain.

A New Approach to Crypto Crime

Previously, the DOJ would allow a full-on criminal investigation to unfold before even attempting to seize assets. That sometimes left victims waiting years for restitution—if they received any at all.

This time, the department did not tarry. Following digital crumbs and in league with international partners, officials froze funds before the criminals could cause them to vanish. The goal is clear: refund money to victims quickly.

It’s a bold strategy, less concerned with courtroom wins and more with real results. Since cryptocurrency crime is a rapid pursuit, law enforcers are finally hot on its trail.

Real People, Real Losses

The majority of the victims never knew they’d be starring in a crypto crime story. Others were lonely, and others were under financial strain. The approach of the scam is exactly calculated—emotions, weakness, and trust are played on them.

People were promised fortunes and wound up in debt instead. Some sold their homes. Others took money from relatives and friends. That sense of shame and betrayal that follows usually prevents victims from opening their mouths, so that’s what makes this one case stand out.

It sends a message: you’re not dumb—you were targeted. And someone is now speaking out for you.

Ripple Effects Across the Industry

This historic seizure serves as a wake-up call, too, for the broader crypto community. While digital currencies grow in popularity, so do the risks. Exchanges, wallet operators, and crypto startups are now under more pressure to implement more secure protection.

It’s no longer a case of supplying tech innovation without accountability. Regulators in America, Australia, and around the globe are watching. Websites that turn a blind eye to scams risk legal penalties as well as reputational implosion.

For honest players in the industry, this is a chance to lead by example—prioritizing transparency, user education, and fraud prevention at every stage.

Also Read: Crypto Scam Sentencing: Dwayne Golden Jailed for $40M Fraud

What Everyday Investors Should Watch Out For

If you’re involved in crypto—or thinking about diving in—this case is a valuable reminder to tread carefully. Here are some key red flags:

- Strangers with investment tips: Be wary of unsolicited messages offering crypto advice, especially if they become overly friendly or personal.

- Promises of guaranteed profits: No legitimate investment offers certainty. High returns with no risk? That’s a lie.

- Unfamiliar exchanges or apps: Stick with licensed, highly rated sites. Check names and URLs.

- Secret requests: People who want to keep the transaction a secret are likely up to something shady.

Awareness is your defense. As scams evolve, awareness puts you ahead of them.

Looking Ahead

The DOJ is not finished. Although assets have been seized, investigations are ongoing. Authorities are rounding up suspects, some of whom are thought to be abroad. Extraditions and legal machinations may be next, but the short-term priority is on recovering stolen money and returning it to victims.

This model—quick seizure, quick restitution—can be the new standard in crypto enforcement. If successful, it could transform the way justice systems fight cybercrime worldwide.

Final Thoughts

The DOJ’s $225 million crypto seizure is more than just recovering stolen digital currency. It’s about recognizing that behind every scam is a human story—of trust violated, savings lost, and lives disrupted.

It shows what’s possible when law enforcement acts with urgency and empathy. It also challenges the crypto world to evolve—towards a future that protects people, not just profits.

Whether you’re a seasoned crypto trader or just curious about digital finance, this case is a turning point. It’s a reminder that while technology moves fast, justice can, too—when it chooses to put people first.