The crypto market plunge was exacerbated by the upcoming massive Deribit $28.5B expiry, which investors dispelled, thus culminating in the short-term uncertainty. The traders indulged in defensive strategies, and concerns about the price drop of Bitcoin intensified ahead of the options event, which was record-sized.

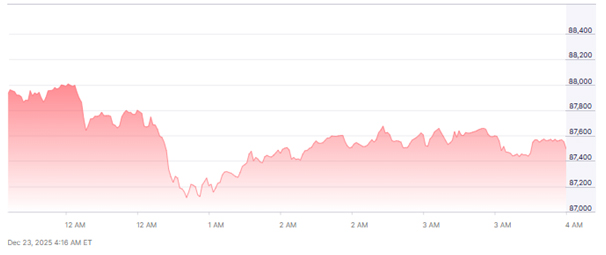

Due to the activity of the derivatives market and its largest expiry, the price action mirrored rising caution. The prices of the two leading digital currencies headed downwards, with Bitcoin hitting below $88,000 during the U.S. trading and, subsequently, reversing the earlier gains exceeding $90,000. Ethereum was not spared either, with its value dropping and reverting to under $3,000 as the overall risk appetite dried up.

Deribit $28.5B expiry intensified Bitcoin price drop fears.

Why Is The Deribit $28.5B Expiry Pressuring Crypto Markets?

The Deribit $28.5B expiry comprises Bitcoin and Ethereum options that are set to mature this Friday. The amount exceeds half of the market’s total open interest of $52.2 billion at Deribit.

Such concentration not only raises the hedging activity but also, at times, causes short-term volatility to be heightened more than usual. During the last few trading sessions, Bitcoin has performed rather erratically, oscillating between $85,000 and $90,000.

The selling pressure that has been affecting the market is due to traders adjusting their positions as the expiry of the options looms large. The price swings are actually what the market participants are becoming more and more sensitive to; these are the options settlement dynamics driving forces.

How Is Bitcoin Price Drop Reflecting Trader Positioning?

The decline in the Bitcoin price is indicative of the market participants’ inclination towards defensive positioning as opposed to aggressive risk-taking. The traders seem to be just rolling their protective positions forward rather than closing the exposure.

Such behaviour is suggestive of caution that is even beyond the immediate expiry window. At the $85,000 put strike, open interest amounting to $1.2 billion is a whopping concentration. If the downside momentum is building, the spot prices may be attracted lower by this concentration.

Meanwhile, the walk-in-the-park call spreads targeting higher levels are staying fresh, yet the short-dated protection has increased in price.

Bitcoin’s decline shows traders favour defensive positions, not risk.

What Does Options Data Signal About Market Sentiment?

Options pricing suggests that caution is still the main attitude, although some stabilisation in skew levels has taken place. Call and put prices have come closer together, with the gap between them narrowing from recent extremes.

Despite this, the market still reflects a worried attitude regarding the possibility of downside risks. Traders moved from selling December puts at $85,000-70,000 to buying January puts at $80,000-75,000.

This transition indicates that there will be hedging in place through early 2026. The method used indicates that traders are getting ready for prolonged volatility instead of a rapid bounce back.

Crypto Market Slump Persists Despite Stock Resilience

The crypto market decline is still rolling on, with some stocks connected to the cryptocurrencies, though, displaying relative strength. The stock of Hut 8 shot up sharply after the signing of a long-term AI data centre lease.

Coinbase and Robinhood, among others, were able to maintain their gains, but they were lower than their session highs. The strategy alternated between gains and losses at a very modest level as crypto prices went down.

The split is an indication of confidence in the infrastructure sector at the retail level as opposed to the digital tokens priced. The prices of digital assets are still very susceptible to the volatilities that derivatives cause.

Crypto market slump continues, while Hut 8 stock rises sharply.

Liquidity And Macro Factors Add To Downside Pressure

A thin liquidity level during the holidays has contributed to market instability. During uncertain times, lower trade volumes can result in larger price fluctuations. Bitcoin has thus, in this scenario, been dramatically affected by the market, considering its price movement.

In addition, macroeconomic caution has also factored into investors’ decisions to take risks and the timing of entering 2026. The defensive stance that the market has taken indicates that traders are still sceptical about sudden changes in policy, the overall financial condition, and the situation in the $28.5B Deribit expiry has been the centre of these worries.

Outlook Remains Uncertain After Deribit $28.5B Expiry

The immediate outlook is influenced by the way the markets take the expiry aftermath. A clean settlement might eliminate the short-term pressure and lead to price stabilisation. On the other hand, the hedges that are still in place indicate that the risks of volatility are still high.

Bitcoin’s reclaiming of higher levels will be dependent on the demand getting through and the liquidity getting better. Until then, traders might continue to be cautious as the crypto market downturn is a test of investor confidence.

Also Read: Tom Lee Responds To Fundstrat Bitcoin Debate As Market Outlooks Diverge

FAQs

Q1: What is the Deribit $28.5B expiry?

It means that the options of Bitcoin and Ethereum amounting to $28.5 billion expiring on Deribit, the biggest in history.

Q2: Why did the price of Bitcoin go down by less than $88,000?

The fall was a result of selling pressure and defensive positioning ahead of the major options expiry.

Q3: Is it the crypto market slump that is a long-term downturn signal?

Not really, but traders are still cautious because of the volatility and the unclear liquidity situation.

Q4: Will there be a chance for prices to recover once the expiry is done?

A recovery is contingent upon the reduction of volatility and the installment of buying interest after the settlement.