TL;DR

- 2025 is a hinge year: the International Seabed Authority (ISA) just wrapped its 30th session with “historic decisions” and second reading of the draft Mining Code, but no final green light yet. (isa.org.jm, IISD)

- 37–38 countries now back a moratorium/precautionary pause or ban—political headwinds are real.(Mongabay, Deep Sea Conservation Coalition, Environmental Justice Foundation)

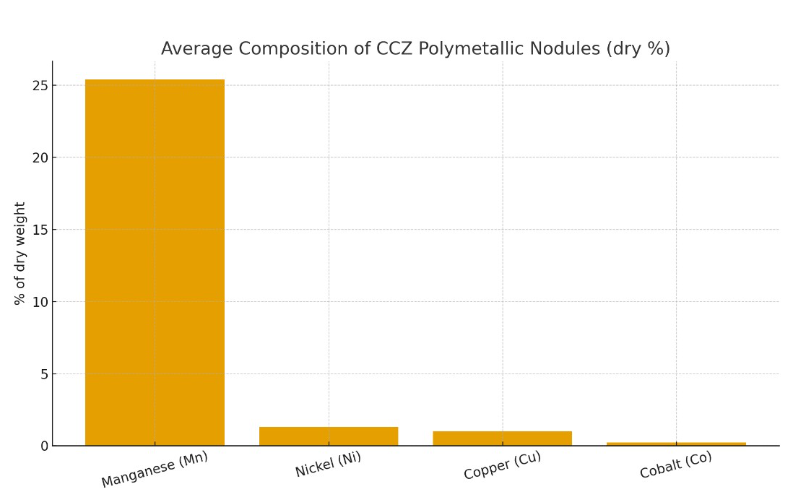

- Polymetallic nodules in the Clarion-Clipperton Zone (CCZ) remain the flagship resource, with average grades around ~25% Mn, ~1.3% Ni, ~1.0% Cu, ~0.2–0.24% Co (dry). (See composition chart below.) ( ScienceDirect, Omlus, U.S. Geological Survey)

- On the corporate side, pure-play deep-sea miners are mostly off ASX/TSXV today; however, TSXV plays like Kraken Robotics (PNG) (enabling tech) and Chatham Rock Phosphate (NZP) (legacy seabed mining proposal) sit closest to the action. For sector benchmarks, The Metals Company (NASDAQ: TMC) targets Q4 2027 first production from its NORI-D area—subject to permits and the final code.(The Metals Company, The Motley Food)

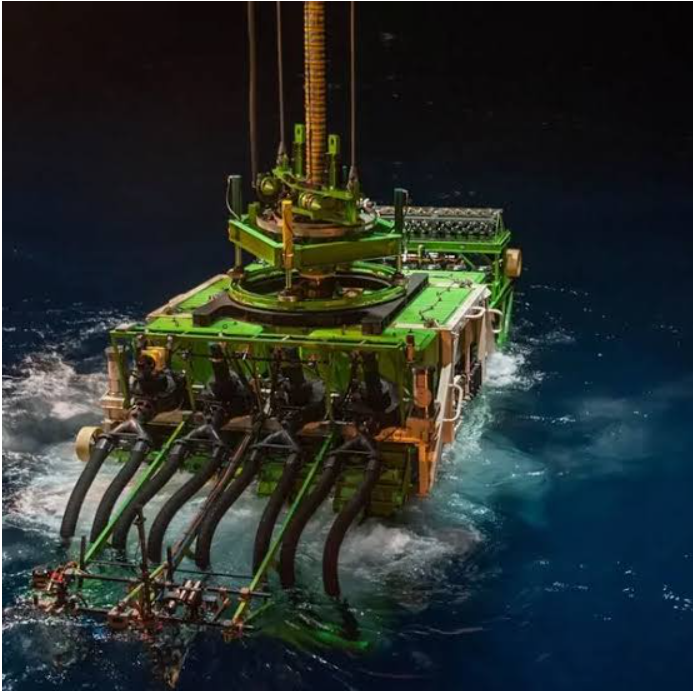

Why “Deep-sea Mining 2025” Matters

Source: Royal IHC

Electrification has gone from trend to baseline, with EVs, grid-storage and renewable build-outs demanding orders of magnitude more nickel, cobalt, copper and manganese than legacy supply chains were designed for. Ocean nodules and cobalt-rich crusts promise a new geography of supply—metals that sit on or near the seabed floor, loosely attached and potentially harvestable by remotely operated collectors feeding risers to a surface production vessel.

The strategic logic is simple: diversify supply chains, reduce over-reliance on a handful of onshore jurisdictions, and—if life-cycle analysis pans out—target lower waste footprints than some terrestrial routes. The policy reality is not as simple: the ICS/ISA system must write a Mining Code that can credibly protect fragile abyssal ecosystems, satisfy member states, and stand up to litigation and public scrutiny. In 2025, that tension is at its peak.(isa.org.jm)

The 2025 regulatory landscape: progress, but no green light yet

ISA’s 30th Session (July 2025)

- The ISA Assembly described its 30th session as “landmark,” noting historic decisions and progress on the Mining Code; meanwhile, the Council completed the second reading of the draft code, revealing significant divergences remaining.(Twin Politics, isa.org.jm )

- The “two-year rule”—triggered by Nauru in June 2021—pushed the Council to work toward exploitation regulations by July 2023, a deadline that passed without adoption; negotiations have continued through 2024–2025.( IISD Earth Negotiation Bulletin, ScienceDirect)

Moratorium momentum

- Between 2024 and mid-2025, governments calling for a pause/moratorium/ban rose to ~37–38 countries; EU institutions and many scientists pushed for precaution. (Counts vary by source and date; the direction of travel is unmistakable.)

- Portugal in April 2025 approved a national-waters moratorium—a European first at the national level. (Enhesa)

Investor takeaway: The ISA process is grinding forward, but policy risk remains material. Even if a code is adopted, many consumers (automakers, tech) have stated preferences for “pause” positions, which will influence offtakes and financing.

What’s Actually In The Rocks? A Quick Look At Nodule Grades

Polymetallic nodules in the CCZ typically show (dry weight) around 25% manganese, 1.3% nickel, 1.0% copper, and ~0.2–0.24% cobalt—with significant local variability across license blocks. The Cook Islands’ nodules often skew toward higher cobalt (~0.5% Co).

Sources include USGS/ISA factsheets and metallurgical conference proceedings; values reflect dry % and rounded figures for clarity.

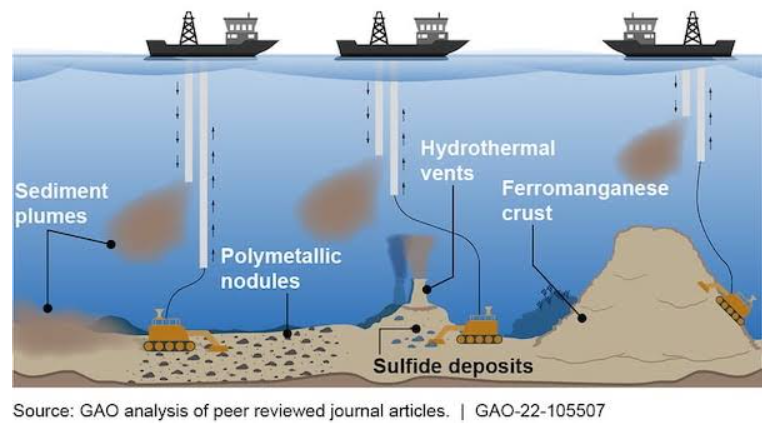

Tech Stack: How Ocean Mining Would Work (and what still needs to work)

- Seabed collectors (tracked ROVs) vacuum or sweep nodules into a buffer.

- Riser system brings nodules up 4–5 km to the production vessel.

- Offloading to bulk carriers for shipment to onshore processing—e.g., pyrometallurgy (RKEF) followed by hydromet steps to nickel/cobalt sulfates, copper cathode, manganese products.

Field trials to date:

- TMC (NORI) & Allseas have completed integrated pilot trials in the CCZ, lifting ~3,000+ tonnes of nodules in late 2022; a 60-minute run transported ~14 tonnes to the vessel Hidden Gem.

- GSR (DEME Group) tested its Patania II collector in 2021; the robot temporarily got stuck and was later reconnected—a useful reminder that engineering risk remains. Academic partners measured the sediment plume to inform impact models.(Reuters)

Where tech risk lives in 2025:

- Collector reliability and throughput at depth and over months, not days.

- Riser uptime and de-gassing / dewatering management.

- Environmental monitoring at industrial scale (plumes, noise, benthic recovery).

- Onshore flowsheets that convert nodules into battery-grade inputs with compelling LCA and cost profiles.

Supply-chain relevance: EV and clean-tech metals

Multiple agencies flag that nodules/crusts hold very large in situ metal endowments, particularly for nickel and cobalt—one GEOMAR factsheet estimates CCZ nodules hold roughly three to five times more Ni and Co than currently economically mineable land deposits (not the same as reserves). That scale—if responsibly accessed—could diversify supply for EV cathodes and grid-storage.

The USGS notes >120 Mt Cobalt resources in nodules/crusts globally (conceptual, not permitted or economically extractable today). Context matters: those are resources—not reserves—and conversion depends on technology, regulation, and markets.

The rulebook: ISA, the “two-year rule,” and What Comes Next

- Law of the Sea framework delegates “Area” governance to the ISA. Private/mining-state contractors hold exploration contracts; exploitation requires an adopted Mining Code (rules, regulations & procedures). The two-year rule (UNCLOS Annex/1994 Agreement) allows a sponsoring state to force consideration of an application even if regulations aren’t finished—hence Nauru’s 2021 move backing TMC’s NORI.

- In 2025, the Council’s second reading is done; the Assembly adopted several decisions, but no exploitation yet. The next sessions will likely tackle environmental thresholds, payments, and compliance. Expect regional environmental management plan (REMP) debates for the CCZ to resurface.

National waters vs. “the Area”:

- Several countries (e.g., Norway) are scoping seabed minerals in their EEZs/continental shelves; at the same time, the European Parliament has criticized rapid national openings and repeatedly endorsed a moratorium. Portugal has implemented a national-waters moratorium. This divergence complicates investor positioning across jurisdictions. (European Parliament)

Environmental science: what we know, what we don’t

- Sediment plumes: Field work during GSR’s 2021 trials and analyses by MIT and MiningImpact partners measured plume behavior; while near-field plumes were smaller than some models predicted under test conditions, scalability to full operations is uncertain. Monitoring and thresholds are central to the ISA talks.

- Biodiversity & recovery: Decades-old disturbance experiments (e.g., DISCOL) showed slow recovery of abyssal communities; more recent CCZ studies highlight endemic species and large knowledge gaps. 2024–2025 reviews by agencies and NGOs continue to recommend precaution pending baseline data and proven mitigation.

- Climate services: Opponents argue we risk perturbing carbon sequestration and ocean biogeochemistry; evidence remains mixed, but the burden of proof is on miners to demonstrate no serious harm. The policy trendline in 2025 reflects that precautionary bias.

Where the Money May Be Made (or lost): the 2025–2030 Investable Picture

Source: Deep Sea Mining

Capital cycle and the first movers

The first scaled project to reach commercial production—if permitted—would likely anchor offtake pricing and establish technical and ESG precedents for others. In 2025, The Metals Company (TMC) is the visible bellwether: updated presentations and filings reiterate a Q4 2027 production target from NORI-D with Allseas as offshore partner, subject to approvals. (Investors should treat these as forward-looking.)

Cost curve & offtakes

- Nodules may avoid some mine development capex (no drilling/blasting/stripping), but amortizing vessels + collectors + risers + environmental monitoring is non-trivial.

- Onshore flowsheets (e.g., RKEF + hydromet) must deliver competitive cash costs and LCAs versus laterites/sulfides—and must do so at scale without creating a new environmental backlash.

Execution risk checklist (investor edition)

- Regulatory: Will the ISA adopt a code that’s bankable? Will key buyer regions honor a moratorium?

- Engineering: Can a collector run thousands of hours/year at depth with planned throughput?

- ESG: Will automakers sign offtakes before (or only after) third-party verified impact monitoring?

- Commodity: If Ni/Co markets soften, project NPVs can compress—early projects are hypersensitive to metal baskets.

ASX & TSXV: Who’s truly “leading the charge”?

A candid note first: after Nautilus Minerals’ 2019 collapse, pure-play deep-sea miners largely left ASX/TSXV listings. Activity today splits into (i) TSXV enablers supplying subsea tech/services and (ii) legacy or niche seabed propositions, plus (iii) global benchmarks that investors track even if listed elsewhere.

Major Players & Stock Exchange Mapping

| Company | Exchange | Ticker | Focus Area |

| The Metals Company (TMC) | NASDAQ | TMC | CCZ nodules |

| GSR (subsidiary of DEME) | Private (Belgium) | — | CCZ pilot trials |

| Loke Marine Minerals | Oslo | Private | Norwegian shelf + CCZ JV |

| NORI (Nauru Ocean Resources Inc.) | TMC subsidiary | — | ISA contracts |

| DeepGreen (absorbed into TMC) | — | — | Early CCZ exploration |

| Blue Minerals Jamaica | Private | — | Caribbean EEZ focus |

Highlights

- TSXV — Kraken Robotics (PNG):

- What it does: High-resolution sonar, subsea imaging, robotics components, and data solutions used for seabed mapping/inspection. Not a miner, but an essential enabler for bathymetry, route surveys and monitoring.

- Why it matters: Any industrial seabed operation is a sensor platform first; persistent imaging and plume monitoring will be non-negotiable. Kraken has already been active on offshore energy and defense programs, giving it ruggedization credentials.

- TSXV — Chatham Rock Phosphate (NZP):

- What it does: Proposes to mine phosphate sands on the Chatham Rise (New Zealand EEZ). It’s not CCZ nodules, but it’s one of the few TSXV names with a seabed extraction thesis in public markets (noting New Zealand’s strict permitting history and earlier setbacks).

- Why it matters: Illustrates national-waters seabed mining dynamics—science-heavy EIA and social license hurdles.

- Benchmark (not ASX/TSXV) — The Metals Company (NASDAQ: TMC):

- What it does: CCZ nodules via NORI (Nauru-sponsored); pilot trials with Allseas; targeting Q4 2027 first production and publishing PFS/NPV updates.

- Why it matters: First-mover with transparent filings, making it a sentiment proxy for the entire theme.

- Benchmark (not ASX/TSXV) — GSR (DEME Group, Euronext Brussels):

- What it does: Builder of Patania collectors; ran CCZ trials with academia; incident history informs engineering risk narratives.

- Why it matters: Technology pathfinder and policy lightning rod; critical to plume science corpus.

Where are the ASX names? As of 2025, there’s no obvious ASX-listed pure-play in CCZ nodules/crusts post-Nautilus. Australia’s contribution is more likely to show up in offshore services (vessel ops, ROV support) and processing technology—often via private companies or global primes. (Nautilus’ 2019 bankruptcy remains a cautionary tale for speculative seabed ventures.)

Business opportunities by value chain segment

1) Exploration, survey, and environmental baseline

- Bathymetric mapping & AUV/ROV inspections (sensors, imaging platforms)

- Environmental DNA (eDNA) & acoustic monitoring solutions

- Data platforms integrating geology + plume + biodiversity

Who benefits: sensor makers (e.g., Kraken Robotics), AUV integrators, geospatial analytics vendors. Barrier: ISA protocols will likely mandate stringent baseline datasets—a service-revenue annuity for years.

2) Offshore extraction systems

- Collector vehicles (redundancy, traction, selective picking vs. bulldozing), riser towers/hoses, surface handling.

- Bottlenecks: reliability at depth, scheduled maintenance, and the ESG burden of plume/noise.

Who benefits: global engineering primes (Allseas, DEME/GSR). Early TMC/Allseas tests are promising, but scaling remains unproven commercially.

3) Logistics & marine operations

- Production Support Vessels (PSVs), bulkers, remotely operated tooling, and remote operations centers.

- ASX angle: Australia’s world-class offshore services capabilities, though many names are private or diversified.

4) Onshore processing and refining

- Nodules processed via RKEF + hydromet to produce Ni/Co sulfates, Cu cathode, Mn silicate; this returns the debate to emissions, waste, and residues compared with onshore ore routes.

Risks: from A (assembly politics) to Z (zincs and zeolites)

- Policy risk: The ISA could slow-roll adoption or embed tight environmental thresholds that crimp economics. National moratoria can deter offtakers who need brand safety.

- Science risk: Plume dispersion, noise, and biodiversity impacts could prove costlier to mitigate than modeled, especially under cumulative impact frameworks.

- Engineering risk: Collector/riser downtime drives OPEX spikes and schedule slippage—field trials show non-zero failure rates.

- Commodity risk: A nickel glut or cobalt thrift/substitution (high-manganese or LFP chemistries) compresses project NPVs.

- Financing/ESG risk: Major OEMs may delay offtakes pending monitoring proof and third-party assurance, raising cost of capital.

Also Read: Deep-Sea Mining Environmental Impact: A New Frontier, A Growing Threat

Ocean-based mining vs. terrestrial: the “different, not automatically better” argument

Proponents argue that nodules avoid forest clearing, tailings ponds, and stripping ratios, and that a seafloor “vacuuming” approach could deliver lower solid waste per tonne of Ni/Co. Critics respond that abyssal ecosystems are ancient, slow-growing, and poorly studied—and that resuspension and noise could have system-level effects. Both can be true: nodules could be less bad than some terrestrial projects if engineered and governed well—but the evidentiary threshold is high. 2024–2025 agency/NGO briefs lean precautionary pending stronger data.

Company spotlights (briefs)

Kraken Robotics (TSXV: PNG) — Enabler

- Thesis: If deep-sea mining proceeds—even on a pilot basis—sensing & surveillance spend rises. Kraken’s synthetic aperture sonar (SAS), laser imaging and towed platforms offer the resolution operators need to map nodule fields, track collectors, and monitor plumes.

- Watch items 2025–2027: orders linked to environmental monitoring campaigns and ISR-style data contracts around ISA pilots.

Chatham Rock Phosphate (TSXV: NZP) — Legacy seabed mining proposal

- Thesis: A proxy for the national-waters variant of seabed extraction. Even if CCZ projects move slowly, country-specific opportunities could open (or shut) via domestic political cycles.

- Watch items: New Zealand regulatory posture; financing capabilities for low-capex pilots; offtake interest for ocean-sourced phosphate.

The Metals Company (NASDAQ: TMC) — Bellwether

- Thesis: If NORI-D secures approvals and hits Q4 2027 commercialization, it sets the tempo for financing others.

- Watch items 2025–2027: ISA code text (environmental thresholds & payments), U.S. regulatory strategy hinted in 2025 decks, and execution with Allseas and Korea Zinc partners.

GSR / DEME — Engineering pathfinder

- Thesis: Real-world collector trials + open science partnerships buttress the knowledge base; reliability and plume mitigation R&D from GSR will inform the code.

- Watch items: Patania lineage updates, scientific data releases, and any joint ventures with battery/steel partners.

Investor scenarios (2025–2030)

Base case (balanced progress):

- ISA adopts a conservative Mining Code in 2026–2027 with strict monitoring; one or two pilot-to-commercial transitions (NORI-D most likely) start ramping late 2027–2029. Enabler revenues (survey, sensors, analytics) grow first; miner cash flows arrive later.

Upside (accelerated):

- Stronger OEM support + clear LCA wins spark offtakes; financing costs fall; 2–3 projects line up by 2030. Adjacent equities (TSXV enablers) re-rate sooner.

Downside (policy stall):

- Moratorium coalition hardens; ISA code stalls or embeds deal-breaker constraints; national moratoria proliferate; capital flees to terrestrial expansions and recycling.

Practical Due Diligence Checklist (ASX/TSXV investor focus)

- Contract exposure: Does the company have contracts or pilots tied to CCZ operators or national EEZ projects?

- Technology proof: For enablers, look for TRL-9 equivalents—products already working in harsh offshore contexts.

- Regulatory literacy: Are management teams present at ISA sessions, engaging with REMPS and standards?

- ESG assurance: Independent impact monitoring and public data sharing will be valued by offtakers.

- Balance sheet: Multi-year cycles need non-dilutive funding or diversified revenue while regulations settle.

One Page Of Facts You Can Lift Into Your Deck

- ISA status (July 2025): Assembly adopted decisions; Council finished second reading of the Mining Code draft; negotiations continue.

- Moratorium count (mid-2025): ~37–38 governments support a pause/moratorium/ban in international waters.

- Two-year rule: Triggered by Nauru in June 2021; ISA missed July 2023 target for exploitation regulations and kept negotiating.

- Field trials:

- TMC/Allseas integrated pilot lifted ~3,000 t of nodules; 60-minute run showed ~14 t to deck.

- GSR Patania II trialed at ~4,500 m; a temporary disconnection incident and robust academic plume measurements underpin today’s impact debates.

- Typical CCZ nodule composition (dry): ~25% Mn, 1.3% Ni, 1.0% Cu, 0.2–0.24% Co.

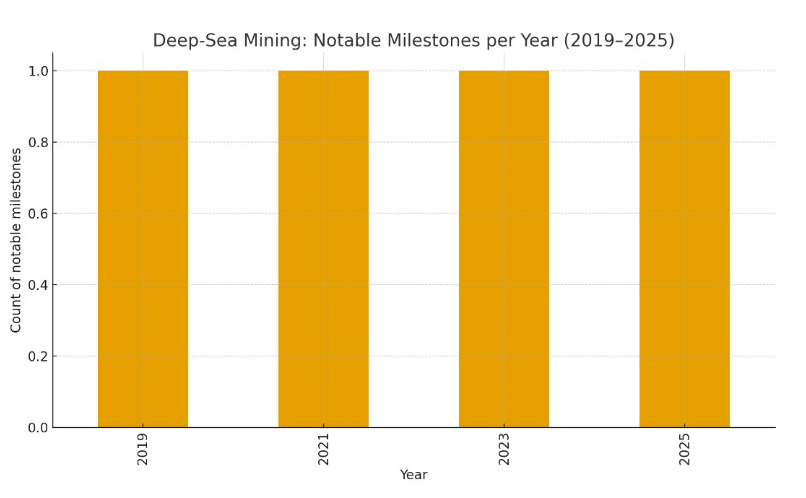

Appendix: timelines and visuals

- Key milestones (2019–2025) — Nautilus bankruptcy → Nauru two-year rule → 2023 deadline passes → ISA 30th session second reading in 2025.

Deep-Sea Mining (2019–2025)

| Year | Milestone | Impact |

| 2019 | Nautilus Minerals bankruptcy | Shattered early hype around seafloor mining. |

| 2021 | Nauru triggers “two-year rule” at ISA | Forces International Seabed Authority (ISA) to finalise mining code. |

| July 2023 | Two-year deadline expires | Mining code not ready, legal uncertainty grows. |

| 2024 | Industry lobbying + pilot trials | Heavy debate: economic potential vs environmental risk. |

| July 2025 | ISA 30th Session – 2nd reading of draft code | Critical moment; rules may finally be adopted or delayed again. |

- CCZ nodule composition (dry %) bar — shows Mn-heavy basket with battery-metal credits (Ni/Co/Cu).

Polymetallic Nodule Composition (Clarion–Clipperton Zone, Dry %)

| Metal | Typical Share (%) | Strategic Use |

| Manganese (Mn) | 28–34% | Steel alloys, EV batteries |

| Nickel (Ni) | 1.2–1.6% | EV batteries, stainless steel |

| Copper (Cu) | 1.0–1.3% | Wiring, electronics |

| Cobalt (Co) | 0.2–0.25% | Energy storage, EV cathodes |

| Others (Mo, REEs) | <0.1% | Catalysts, advanced alloys |

Final word: 2025 is the year to separate conviction from hype

If you’re screening ASX/TSXV for exposure to deep-sea mining 2025, the investable wedge today is enablers—sensors, survey, data, and offshore services—rather than miners. Kraken Robotics (TSXV: PNG) is a clear example on public markets; Chatham Rock Phosphate (TSXV: NZP) is a litmus test for national-waters seabed projects. For bellwether mining exposure, you’ll be watching TMC (NASDAQ), GSR/DEME (Euronext), and state-sponsored contractors—noting that regulatory outcomes will likely dictate who actually gets funded and when. (World Bank, ScienceDirect, The Metals Company)

The upside case is compelling—scale, grade mix, and geopolitical diversification—but the policy, science, and engineering hurdles are equally real. In 2025, the right posture is optionality: accumulate knowledge, back enablers with diversified end-markets, and keep dry powder for the moment the ISA’s guardrails are finally in black-and-white.