The short of it

Canadian (CSE/TSX) and Australian (ASX)-listed companies are building the pipes institutions need: advanced custody, regulated markets, and blockchain-as-a-service (BaaS). Enhanced regulation in both countries and the listing of spot Bitcoin ETFs on the ASX in 2024 are pulling crypto closer into institutional finance. (Treasury, Data Center Dynamics, CCN.com)

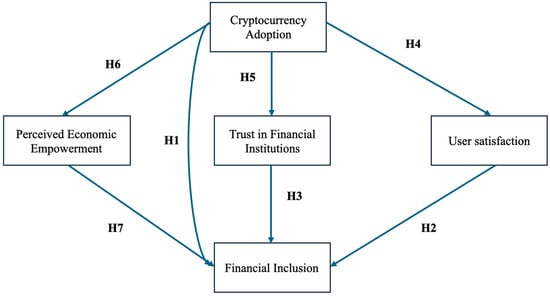

Institutional Crypto Infrastructure: How Firms on the CSE and ASX Are Paving the Way for Widespread Adoption (Image Source: MDPI )

Why Canada and Australia matter now

Canada paced North America’s approval of a spot Bitcoin ETF in 2021, institutionalizing access and setting compliance expectations for custody and asset segregation. The Canadian Securities Administrators (CSA) then tightened oversight through pre-registration undertakings (PRUs) and definitive guidance on client assets handling by platforms. (Bloomberg, securities-administrators.ca)

Australia has accelerated in 2024–2025: the ASX-listed VanEck’s spot Bitcoin ETFs (VBTC) in June 2024 and DigitalX’s (BTXX) in July 2024, with Treasury putting out proposals for licensing and custody requirements tailored to digital-asset platforms. These two threads, listed access and fit-for-purpose regulation, are the overpass institutions want. (Data Center Dynamics)

The core stack: custody, trading, and BaaS

Non-negotiable is custody. In Canada, exchanges and dealers must hire qualified custodians, keep client assets segregated, and deny re-hypothecation. That pushed infrastructure toward bank-standard controls and third-party auditing. The same applies to Australia’s mooted regime, requiring transparent custody and asset-holding conditions for platform licences.

Trading infrastructure is increasingly regulated. Canada’s CIRO and CSA require platforms to register as investment dealers or trade on strict interim undertakings. In reality, it means stricter risk controls, improved disclosures, and narrower product shelves for retail and institutional clients. (ciro.ca, Gowling WLG)

Custody comes first: Canada and Australia are shaping crypto rules with bank-grade safeguards and strict asset protection (Image caption: Fireblocks)

Blockchain-as-a-service (BaaS) & compute add a new institutional layer: secure data centers, high-performance compute (HPC) for validation & analytics, NFT/asset issuance rails, and compliance tooling. Mined lists that are now HPC and cloud providers now lease compute, host corporate workloads, and host regulated tokenisation projects. CSE/TSX highlight: build-out in Canada

Hut 8 (TSX/Nasdaq): shift from mining to multi-tenant infrastructure

After acquisition, Hut 8 hosts data centers, colocation, and cloud computing as well as digital assets business–as an enterprise-class on-ramp to computation and compliance-aware workloads. For institutions, this means capacity, redundancy, and SLAs closer to traditional IT. (Global Practice Guides)

HIVE Digital (TSX/Nasdaq): AI/HPC infrastructure with telecom-grade partners

HIVE remade and relocated into an AI/HPC cloud, joining the NVIDIA partner program and securing Canada-wide co-location with Bell. Institutional plumbing: dark-fibre reach, robust power, and reliable latency over compliant digital-asset operations.

BIGG Digital Assets (CSE/TSXV): compliance-first trading and analytics

By integrating orderly access with forensics and compliance tooling through Blockchain Intelligence Group (Chain Analytics) and Netcoins (registered crypto platform), BIGG integrates. Netcoins registers growth in assets held on custody and OTC desk and API, where professional flows are met directly. (OSC, Bigg Digital Assets)

Why it matters: Canadian listings put these companies under public-market regulation and disclosure, the rulebook (PRUs, custody, leverage limits), keeping infrastructure anchored to investor-protection standards. Institutions are able to access without creating risk frameworks.

BIGG Digital Assets: compliance-led trading meets analytics and custody growth (Image caption: (Image Source: GlobeNewswire)

ASX highlight: listed access and licensed rails

DigitalX (ASX: DCC): ETF gateway with institutional partners

DigitalX’s spot Bitcoin ETF BTXX was the second ASX Bitcoin ETF in July 2024, with K2 Asset Management and 3iQ in contention and Coinbase as custodian—nice names for compliance teams. That model reduces operational drag for super funds, wealth platforms, and treasury desks.

VanEck (VBTC) on ASX: the door-opener

VBTC’s listing in June 2024 opened the door to ASX-traded exposure to Bitcoin, which signals that crypto is investable through conventional brokers and custody chains. The pairing of VBTC and BTXX gives the market brand distinction and fee rivalry. (Data Center Dynamics)

The rulebook in motion

Australia’s Treasury plans involve licences for digital asset platform licences and prescribed custody requirements, the back-end pieces that issuers of ETFs, brokers, and advisers need before ramping up allocations. The result is a market building the rails first and then calling for flow. (Yahoo Finance)

From “crypto curious” to live: what institutions actually implement

- Traded on the exchange for convenience and straight-through processing (STP). ASX-listed spot ETFs integrate into existing brokers, custodians, and reporting stacks. (Data Center Dynamics)

- Nominated sub-custodians with qualified custody and audited controls, something Canada already has in place for platforms. (Gowling WLG)

- OTC and API connectivity by treasury desks and market makers, Netcoins’ OTC and API model is one public example in Canada. (Bigg Digital Assets)

- BaaS and HPC for tokenization pilots, analytics, and proofs-of-reserve, where listed operators like HIVE and Hut 8 provide reliable power, cooling, and SLA-driven capacity. (com.au)

Capital flows: the ETF effect

Canada’s initial ETFs (such as Purpose BTCC) institutionalized exposure. Australia’s 2024 ASX listings (VBTC and BTXX) carried that playbook to local super and wealth platforms, with early performance making headlines and underpinning demand signals. The bigger picture: wrapped regulation is the path of preference for mass portfolios increasingly.

Regulation as a feature, not a bug

Canada:

- PRUs and registration compel CTPs to segregate client funds, restrict leverage, and filter listings.

- CSA guidelines set a framework for how platforms determine if a token is a security or derivative, and what to do if a regulator says it is.

Australia:

- Proposals from Treasury map a platform licence, custody rules, and disclosure rules, bringing crypto onto more traditional market infrastructure.

- For institutions, that predictability lowers legal risk and opens up mandate approvals.

Partnerships that de-risk adoption

- DigitalX × K2 Asset Management × 3iQ × Coinbase Custody: an ETF stack institutions appreciate.

- HIVE × NVIDIA Partner Network × Bell: compute, fibre, and data-centre standards synchronized to enterprise requirements.

- BIGG (Netcoins) × compliance tooling (Blockchain Intelligence Group): trading combined with on-chain forensics in one listed envelope.

These partnerships transfer crypto’s benefit to audit-ready propositions.

What this implies for investors and builders

For allocators: ETFs and registered platforms provide portfolio-ready exposure without new piles of custody.

- For fintechs: BaaS and HPC suppliers provide enterprise-class infrastructure for tokenisation, staking-as-a-service, and on-chain analytics.

- For regulators: Canada and Australia show that rules and access are capable of channeling demand into safer havens.

The common thread is: build the rails, then scale the flow.

Quick case notes

- Hut 8: enterprise-focused data centres and colocation offer institutions an easy way to access compute and digital-asset services under one listed umbrella. (Global Practice Guides)

- HIVE Digital: cloud and AI alliances expand revenue beyond mining, with facilities still crypto-enabled. (com.au)

- DigitalX: ASX-listed asset manager with a spot Bitcoin ETF (BTXX) and tier-one partners; an obvious path for brokers and platforms. (Cointelegraph)

VanEck: ASX first to market in VBTC, setting benchmark for domestically listed spot exposure.

BIGG Digital Assets: CSE/TSXV exposure to a compliance-driven exchange (Netcoins) with chain-analytics (BIG). Convenient barometer for retail and OTC activity in a regulated environment.

FAQs (fast answers)

Is Hut 8 listed on the CSE?

No. Hut 8 is listed on the TSX and Nasdaq after the merger; it’s a Canadian-headquartered, listed business, but not on the CSE.

So what is BaaS in this context?

Secure, hosted blockchain services, issuance, validation, analytics, and HPC capacity offered from regulated, audited infrastructure. (vaneck.com.au)

Why are ASX Bitcoin ETFs significant?

They let Australian investors leverage familiar brokers, custodians, and reporting, no wallets required, and fit easily within mandates. (Data Center Dynamics)

How does Canada’s PRU regime benefit institutions?

It requires platforms to isolate client assets and meet dealer-grade obligations, raising the bar on operational risk.

Who are DigitalX’s BTXX coins held by?

BTXX is in the custody of Coinbase, aligned with global institutional practice. (Cointelegraph)

Is Australia moving toward a full licensing regime?

Yes. Treasury’s proposals set out platforms’ licences and standards of custody to be enforced, outlining how providers will operate.

Policy, Economics, and the Way Forward

Policy Landscapes: National Agendas Defining Mining

International momentum towards mining fueled by renewables cannot be dissociated from government energy and climate policy.

Australia has been slow to pair its mining sector with renewables, and federal and state governments have supported large-scale solar and hydro integration. Iris Energy, for example, leverages these policies to tap green power as much as to gain investor confidence as ESG-savvy capital floods the sector.

Policy drives mining’s green shift: renewables and ESG capital shape Australia’s future (Image Source: Discovery Alert)

Canada has long promoted hydroelectric power, especially in larger provinces like Quebec and British Columbia. It is that policy stance that has made it one of the lowest-cost and cleanest power markets globally—a natural magnet for Hut 8 and other miners.

United Kingdom policymakers are stricter on emissions, which pushes such companies as Argo Blockchain towards an ESG-first model. Its decision to place mining operations in part within North America is a prime example of the way in which British energy realities are compelling miners to seek greener grids abroad while still complying at home.

United States policy is fractured. While some states, including New York, prohibit fossil-fuel-powered mining with moratoriums, others, notably Texas, court miners aggressively with inexpensive land, tax breaks, and increasingly solar and wind power. Riot Platforms has been too quick to ride that Texan wave, investing heavily in solar-backed nodes.

These models show how renewable mining isn’t just a corporate choice but also a response to policy carrots and sticks.

Economic Waves: Job Creation and Investment

When most people hear “crypto mining,” they envision banks of servers quietly burning power. But economic effects have ripple effects.

- Investment in Infrastructure: Mining operations typically need new substations, transmission lines, and cooling systems. That translates into contracts for engineering firms, construction crews, and equipment makers.

- Job Creation: From electricians to data engineers, renewable-powered mines generate jobs for towns that otherwise could have seen the loss of old-fashioned businesses. A prime example is found in Canadian and Texas towns, where previously closed industrial parks are now speckled with state-of-the-art mine centers.

- Capital Flows: ESG-conscious investors now invest in miners that can prove to have sustainability credentials. That is a far cry from a couple of years back when mining was considered uninvestable by institutions that were concerned about environmental reputations.

In essence, renewable-fueled mining creates a feedback loop: cleaner power lowers costs, attracts capital, and earns community acceptance, leading to more expansion.

Challenges and Skepticism: The Other Side of the Coin

Not everyone is convinced crypto mining can, or should, be done greenly.

- Grid Stress: Even with renewably generated power, massive mines could stress local grids, leading to concerns over stability and competition with household consumers.

- Greenwashing Risks: Others argue that “100% renewable” is too frequently a matter of purchasing renewable energy credits (RECs) and not actually using clean electricity in real-time.

- Regulatory Uncertainty: Since policies shift, like the EU’s MiCA regime or US state prohibitions, miners do not know if future legislation will allow big operations.

- Volatility of Crypto Markets: As Bitcoin prices slide, even the most sustainable mining setup can become unprofitable, putting long-term sustainability into question.

This cynicism forces miners not just to adopt green strategies but also to actively showcase them. Otherwise, they risk being dismissed as the latest form of corporate “green speak.”

Crypto mining’s green doubts: grid strain, greenwashing, policy risks, and market volatility (Image Source: NBC News )

Future Scenarios: Beyond Mining Towards Energy-Blockchain Convergence ????

Mining may be today’s star, but the bigger story is about how energy and blockchain are converging towards one another.

- Neighbourhood Energy Trading: Imagine a suburban street with solar panels on each dwelling. Instead of selling to the grid, households trade excess power with neighbours using blockchain smart contracts. This turns energy into a peer-to-peer good, decentralised like crypto.

- Tokenised Carbon Credits: Mines can balance their operations by creating blockchain-validated carbon credits. These tokens can flow through financial markets, with the transparency lacking in conventional offsets.

- Grid Balancing Services: Already, there are some miners acting as “demand response” partners, closing down during times of peak stress on grids and increasing capacity when renewables provide more electricity than is needed. In this way, mining ceases to be a drain but a stabiliser of power systems.

- Integration with AI and Data: Renewable-powered mining centers can be utilized as high-performance computing centers for AI training, redeploying their infrastructure to multiple digital industries.

Also Read: AI and Business Trends 2025: How the US, UK, and Australia Are Leading Innovation

The path forward is to suggest that the starting point could be mining, but eventually, blockchain-energy merging can rebuild entire economies.

Conclusion: Mining as a Reflection of Transition

If you’re talking about renewable energy-powered crypto mining, you’re really talking about a whole larger story, the battle between digital dreams and the limits of the planet.

Australia, Canada, the UK, and the US each offer different models: hydropower, ESG guidelines, solar expansion, and hybrid models. Together, they amount to a patchwork experiment to see if high-tech industries can grow without heightening environmental scars.

The verdict is uncertain. Transparency, regulation, and volatility challenges remain. But one thing is clear: the debate over sustainability has shifted from the periphery to the mainstream of crypto mining.

If the intersection of blockchain and renewables comes to pass, then the future will not so much be one of lines of humming rigs as one of teeming communities trading solar energy backed by open, decentralised technology. In that sense, crypto mining isn’t getting on the sustainability bandwagon but might be driving it.