According to data from CryptoQuant, we see a stark slowdown in Bitcoin treasury purchases, indicating a change in institutional behaviour. Treasury firms, while still accumulating Bitcoin, appear to be preferring smaller purchases, whose size, however, is exceedingly minuscule compared to what it was in early 2025. Analysts caution that such changes will influence price dynamics and market sentiment in the coming months. The pattern is indicative of caution and not an indication of a complete withdrawal from Bitcoin as a reserve asset.

Market observers note that institutional strategies have become more conservative with a watchful eye on accumulation and risk management. While overall holdings remain at high levels, a drop in purchase sizes signals a growing awareness of liquidity and market stability. Institutions, on their part, seem to be crunching numbers with one eye on market conditions before any large-scale purchases are made.

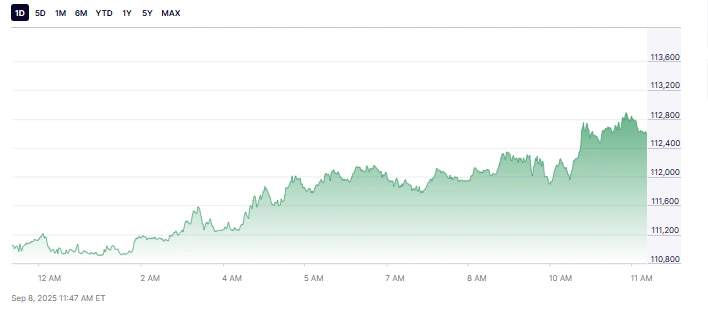

CryptoQuant shows Bitcoin treasury buys slowing with much smaller institutional purchases.

What Is Driving Reduced Bitcoin Institutional Demand?

Several factors are supporting a decline in institutional buying for Bitcoin. One major concern has been market volatility, where sudden price swings or drops in a short time expose firms to losses if they acquire in huge quantities or make ill-timed purchases. The other considerable constraint is liquidity. Companies, meanwhile, might be avoiding large acquisitions in a single transaction over time.

According to CryptoQuant data, major treasury firms have averaged barely 343 BTC per purchase in August 2025. That is incompatible with those earlier in the year when transactions were far more gigantic in size. An even more prudent mannerism is illustrated by another strategy-focused entity that chose to reduce the month of August purchases to a bare 1,200 BTC. This further epitomises the decline in average purchase units in institutional purchaser risk inclination.

Aggregate Treasury Holdings Still Substantial

While maintaining relatively minor transactions, Bitcoin holdings of treasury firms shall remain substantial. Meanwhile, CryptoQuant reports total holdings reaching about 840,000 BTC in 2025. Hence, it indicates that institutions consider Bitcoin a reserve asset of strategic value and are being more careful in individual purchases.

Topping the charts, Strategy holds about 637,000 BTC as an expression of strong confidence in the long-term prospects of Bitcoin. According to analysts, even with a slower rate of Bitcoin acquisition, institutional investors holding large amounts continue to be an important factor supporting the market. Large holdings with big institutions serve as evidence to indicate that institutions still value having digital assets on their balance sheets.

Transaction Frequency Remains Active

Along with a decrease in the size of individual purchases, the transactions continue to stay fairly active. CryptoQuant reported 46 deals in August 2025, just shy of June’s 53. It indicates that firms have chosen more frequent, smaller purchases rather than sporadic, large-scale acquisitions.

The pattern talks to a middle-of-the-road accumulation approach, which allows firms to manage risk and maintain an exposure toward Bitcoin at the same time. Market participants now interpret this activity as the institutional interest having never disappeared but rather having transformed into careful allocation and timing.

How Could Weakened Demand Affect Bitcoin Prices?

The reduction in institutional purchases might have some implications for Bitcoin pricing. In the early months of 2025, institutions were absorbing over 3,100 BTC daily, thus exerting strong upward price pressure. A smaller buying size will affect the capacity of this support source and may, therefore, increase the weight on the Bitcoin price volatility.

The decline in megascale purchases by treasury firms was said by experts to kill price momentum. Continuous accumulation, however, with the entry of new treasury firms, can help offset some of it. Due to the changes in strategy preceding mainstream movements, investors are hereby advised to keep an eye on institutional activities.

Are New Entrants Still Accumulating Bitcoin?

Despite the cautious buying stance of established players, new treasury entities are still being born into the market. Reports say that some 28 new companies were formed through July and August, with confirmed additions exceeding 140,000 BTC. Such new entrants, therefore, opt to indicate that institutional capital outside the umbrella of broad caution still finds Bitcoin attractive.

The influx of new foreign businesses underscores the fact that there is still confidence placed upon Bitcoin as a long-term asset. Though there is a deliberate effort on the part of seasoned players to temper purchases, the new firms seem ready to step in to take measured positions, thereby ensuring that capital keeps flowing into the market. Analysts see this as a positive signal for sustaining institutional interest.

Why Are Institutions Scaling Back Purchases?

A decline in institutional demand for Bitcoin can be explained by multiple factors. Market volatility, liquidity security issues, and regulatory uncertainty have caused firms to adopt conservative approaches. Diversification of portfolios is taking place, such that less emphasis is placed on one digital asset.

This stance is cautious, rather than withdrawing in any way from Bitcoin in favour of strategic realignment. Companies thus retain exposure, but not excessive amounts relative to financial risk exposure. Observers have stated that this trend indicates a Renaissance of an institutional market that is more mature and more concerned with risk.

Conclusion

Bitcoin institutional demand has weakened, but total treasury holdings remain strong. Smaller purchase sizes speak of strategic caution, not an outright exit. New entrants and continued frequent transactions reveal sustained interest in Bitcoin accumulation.

Market participants must keep an eye on institutional behaviour, as these will be the trends they expect will govern the behaviour of Bitcoin prices and investor sentiment in the months ahead. While there is still caution, continued accumulation speaks to the continued appeal of Bitcoin as a reserve asset.

Also Read: Bitcoin Price Holds $110K as Market Tests Key On-Chain Support at $109,400

FAQs

- What is a bitcoin treasury?

A bitcoin treasury refers to a company or institution that holds bitcoin on its balance sheet as a reserve asset.

- Why has institutional demand declined?

Less demand is due to volatility in the market, liquidity constraints, and cautious investment strategies.

- How does less institutional buying affect Bitcoin price?

Reduced buying by institutions would potentially lessen any price support and lead to an increase in market volatility.

- Are new companies entering the bitcoin treasury space?

Yes, there are new treasury firms being formed, and they are adding to the significant Bitcoin holdings in the markets.