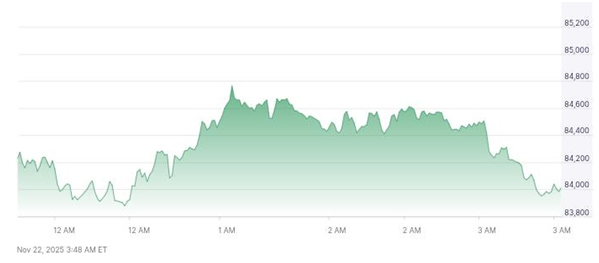

The global crypto scene is facing significant price fluctuations as the fall in Bitcoin prices has resulted in forced liquidations. The cryptocurrency market experienced about US$1.7 billion liquidations, which, in turn, added more stress to the wider market. The upheaval has demonstrated once again that the digital asset markets’ moods are not only easily changed but also that leveraging positions are determined to prevail.

Bitcoin price fall triggered US$1.7B liquidations, intensifying cryptocurrency market volatility.

What Factors Are Driving This Volatility?

The volatility in the cryptocurrency market is mainly due to several interconnected factors. To begin with, the Bitcoin price drop has set off liquidation cascades across both futures and margins. The article mentioned that around US$964 million in liquidations was caused by Bitcoin alone. At the same time, macroeconomic factors including a strong US dollar and increased interest rates are hampering risk assets globally. Investors’ outlook has turned cautious with traders exiting long positions to reduce losses. On-chain data reveals that within a single day over 404,000 accounts worldwide were liquidated.

Bitcoin Price Drop Signals Stress in Crypto Markets

The fall in Bitcoin prices is not a single event, but rather a manifestation of deeper pressures in the crypto market. Issuing the leitmotif of leveraging, the market’s ups and downs became more substantial. The slump in major cryptocurrencies’ values is challenging the patience of both retail and institutional investors. In particular, after Bitcoin fell, similar movements could be observed in other top coins like Ethereum, showing how deeply the market is interlinked.

Bitcoin’s fall reflects deeper market pressures, amplified by excessive leverage.

Liquidations of US$1.7 B Raise Alarm Bells

The liquidation figure of US$1.7 billion is a very sharp number in the story of cryptocurrency market volatility. This statistic captures forced exits to a great extent and, at the same time, indicates the high-leverage risk in such volatile markets. It can be inferred that the market change caught the weak hands and speculators as the number of liquidated accounts was so large. The whole incident has put in place re-examination of crypto trading risk-management practices.

Investor Sentiment Has Turned Cautious

Investors, who were initially very loud, now clear their positions and the market has become very timid and cautious. Many are holding off on new positions and reassessing portfolios rather than eagerly chasing upside. The nervous atmosphere is further complicated by global financial unease and regulatory uncertainty. The recent forced liquidations are perceived as risk-clearing moves, but they also pose the question of how deep the correction could go.

Investors once loud now cautious, clearing positions, avoiding new trades.

Is A Recovery On The Horizon Or Will The Slide Continue?

If we take a look at the future situation of the cryptocurrency market, we can see that while a rebound is possible, it is not guaranteed. The large pool of liquidations on one hand may get rid of the short-term risk and allow accumulation. However, on the other hand, there are still fundamental headwinds: regulatory uncertainty, macroeconomic pressure, and structural leverage that concern a lot of investors. For Bitcoin in particular, the price drop might put it at the edge of key support levels before a recovery that is sustained. If the market does not stabilize, further downside risks have to be acknowledged.

Outlook Remains Guarded Amid Global Context

To summarize, the fluctuations in the cryptocurrency market that we see today are the result of a combination of factors, namely: the fall in Bitcoin prices, the US$1.7B crypto liquidations, the loss of investor confidence, and the overall financial stress in the macro-environment. Unlike past instances when markets bounced back after such shake-outs, the current global scenario calls for caution to be the prevailing approach. The turning points in crypto cycles that often go unnoticed should be observed by both investors and watchers, namely, the liquidity flows, regulatory signals and on-chain liquidation data.

Also Read: Crypto Trading Singapore: Singapore Launches Regulated Bitcoin Futures

FAQs

Q1. What causes cryptocurrency market volatility?

For the most part, cryptocurrency market volatility is caused by a combination of factors including forced liquidations, large leveraged positions, sudden shifts in sentiment and macro-economic shocks affecting risk assets.

Q2. How does the Bitcoin price drop affect other cryptocurrencies?

The Bitcoin price drop usually has a cascading effect on other major altcoins, such as Ethereum, because sentiment and leveraged positions are often intertwined across the entire crypto ecosystem.

Q3. What does US$1.7 billion in crypto liquidations mean for investors?

A report of US$1.7 billion in crypto liquidations entails the taking of some positions that are forced and the releasing of those that are willing to go, which is a common practice that takes advantage of the dropping prices and therefore moves further downward the prices and also indicates high-risk market.

Q4. Should investors expect a recovery soon?

Even though the emergence of recovery is possible, the cryptocurrency market volatility coupled with macro pressure creates a guarded situation. Investors should keep an eye on liquidity, support levels, and regulatory developments before declaring a rebound.