The crypto market is not only rebounding, but it is also booming into 2026 with a new wave that is drawing the worldwide focus of investors. Bitcoin has just broken past $97,000, indicating a resurgence of power within the entire digital asset sector, and most of the larger altcoins are tracking its trajectory or even surpassing it. It is not a mute blip, but it is developing into an epoch in the greater cycle of crypto. (Forbes)

This article dissects the drivers of the rally, the drivers of market trends in the current investor behaviour and the signals that scholars are monitoring to see what lies ahead.

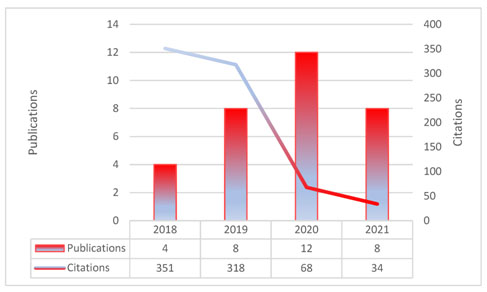

Crypto is surging into 2026, with Bitcoin topping $97K and major altcoins gaining momentum, signalling a powerful market rebound. (Image Source: Investing Haven)

The Current Momentum: What is Going On

The price trend of Bitcoin in January 2026 has brought attention to the financial world. Following a period of trading in the mid-90,000, and a short-lived rise to a high of 97,000, BTC is not only what sentiment indicates, but also a rising market price with a wide market involvement.

In the meantime, other cryptocurrencies such as Ethereum and XRP have risen, and the altcoins have been recording good gains as investors seek other markets beyond the hegemony of Bitcoin. This interrelated movement brings out a market that is re-engaging in the board.

Macro Drivers: What Makes This Rally Have Strength

Several high-impact forces are simultaneously impacting the market dynamics:

- Lighter Inflation And Interest Rate Expectation: World investors are responding to the diminishing inflation concerns, particularly in the United States. Reduced expectations of inflation tend to reflect a more accommodating climate of risk assets, encompassing Bitcoin and crypto more extensively.

- Safe-Haven Demand Under Uncertain Times: The geopolitical forces, economic crosswinds and market volatility have pushed a few classic investors towards crypto, as it may be called, a kind of digital safe-haven asset. The recent actions of Bitcoin testify to a revival in the interest surrounding this story.

- Regulatory Credibility Creating Confidence: There is an increment in hope that there will be better crypto regulations, especially in the area of the structure of the digital asset markets. The deliberations on legislative frameworks are an indication that investors are likely to retreat with confidence that policy frameworks will be fully developed by 2026.

Altcoins: Not Only in the Footsteps of Bitcoin

BlackBerry loves to dominate the market, but Bitcoin is not the only coin to consider:

- XRP, Solana And Selected Tokens: These have recorded significant returns compared to the BTC action and provide traders with options that can capture industry-specific stories.

- Privacy-Centric Assets: Cryptocurrencies emphasising privacy are also beginning to receive interest, and both usage and demand are beginning to rise as regulatory attention turns to privacy-centric products and institutional demand moves toward anonymity-centric products.

This attribute of altcoins tends to represent the movement of capital around in a rotation mode, with traders transferring assets out of Bitcoin into more risky, higher-reward investments as soon as a recovery occurs.

Institutional Capital: Stark Market Force

Institutional involvement is one of the characteristic aspects of this stage of the rally. Massive capital inflows, like those invested in Bitcoin exchange-traded funds and other institutional investments, have the potential to speed up price fluctuations and expand the range of investors in crypto.

The flows in exact inflows vary daily, but record ETF flows and fresh institutional demand have been witnessed throughout the market, which heralds the end of retail-driven cycles in previous years. (coincentral)

Technical Signals: What Graphs Are Saying

Technically, the critical milestones in the Bitcoin market are the marks of psychological and structural milestones of $95,000 and $100,000:

- Breakout Momentum: Breaking these levels may result in additional breakout momentum as traders get reassurances of strength.

- Trend Structures: According to short-term momentum indicators, there is an increase in risk sentiment, whereas the long-term trend structures indicate healthy accumulation periods after corrections in late 2025.

These technical strata introduce a new aspect to the story – a strata where price movement and sentiment are supporting each other.

: ? .

BTC has pushed back above ~$95k, but this move is only meaningful if price can reclaim and hold the next resistance band.

On the chart, the… pic.twitter.com/RT3ZIoQzzz

— Martin Leinweber (@mleinweber2) January 14, 2026

Human Side: Fear and Greed Traders

Most importantly, over the charts and macro numbers is an emotional rhythm. Markets are not only data-driven, but human psychology fear, greed and hope-driven.

The current rally is an expression of optimism, trepidation, and fresh risk-taking. The traders that were scalded by the 2025 drawdowns are returning to the field, and new entrants are pursuing the newest frontier of returns. This mixture of feelings tends to enhance market trends and maintain price dynamics in their dynamic nature.

What Follows Next: Signals to Watch

To determine the possibilities of the development of the current rally, monitor:

- Regulatory changes that might be a boost to confidence or bring a new strain.

- Institutional capital flows and ETF flows are accelerators.

- Macro data releases – inflation reports, rate decisions or geopolitical events can suddenly alter risk sentiment.

- Market notices such as Bitcoin at $100,000 or any 20 percent or more increases in major altcoins, meaning new breakout behaviour.

The Implications of This to Crypto Enthusiasts

You may be an experienced trader, a long-term hodder or a curious investor, but this one in the market seems important. The rally illustrates that macro trends, investor psychology and cross-market intersect to provide opportunities – and risks – worth appreciating.

A Structure Change: Altcoins Are Gaining Traction

By the beginning of 2026, capital rotation is not merely a buzzword anymore; it is a theme. Traders and investors are now actively pursuing returns in the altcoins, particularly tokens related to privacy, decentralised finance (DeFi), and smart contract-based platforms, after Bitcoin has monopolised market attention for a long period.

Recent statistics indicate that privacy coins like Monero (XMR) and Zcash (ZEC) are making higher gains in comparison with Bitcoin due to a resurgence of interest in on-chain anonymity and utility-driven stories.

The altcoin trading volume on centralised exchanges is still hearty and is indicative of a true market entry and not just the movements by mere speculation. Such systemic change is an interesting narrative: 2026 represents a shift to more of a crypto rally than a Bitcoin-only narrative, in which altcoins no longer follow BTC, but run alongside it.

In early 2026, altcoins like Monero and Zcash are surging alongside Bitcoin, as investors seek returns in privacy, DeFi, and smart contract tokens. (Image Source: LinkedIn)

The Privacy Story: Niche to Frontline

Privacy coins have always occupied a peripheral place in the mainstream crypto curiosity, getting marginalized to Bitcoin and Ethereum. But this rally is different. Data from January 2026 shows:

- Monero rose to new all-time highs, increasing market cap by a wide margin as traders switch to privacy plays.

- The issue of surveillance, regulatory investigation and tracking of online traces is increasingly driving the demands of anonymity-enhancing assets.

This tendency is not just the price action, but it also indicates evolving investor psychology. Crypto is not a speculative investment anymore; to a certain group of people, it is turning into an instrument of financial privacy in an ever-surveilled digital space.

The words and practicality of this situation are resounding: In an age where online histories are examined with a vulture, property that considers privacy more highly is no longer an imaginative gambit, but it becomes a practical instrument.

Breadth in the Market: Institutional-Level Signals

Other than the retail excitement and the social buzz, institutional involvement is a pillar that supports the 2026 rally.

Professional Capital and ETF Flows: Bitcoin and altcoin ETFs are reentering crypto markets with institutional capital. Inflows of exchange-traded products have been reported in records, which indicates that professional money managers have renewed confidence in digital assets. This can be used to understand why the price action of Bitcoin has been stable around significant psychological levels, and why Ethereum, XRP and other institutional-backed tokens are recording high returns.

Buy Signal Dilemma By VanEck: It is worth noting that an indicator used by asset manager VanEck, a global firm, has just given Bitcoin a buy signal, the first time in over two years, indicating that additional market stabilisation is coming to the top 100 crypto assets. Such data exchange is important in the sense that it demonstrates that market breadth is getting better, that is, it does not accumulate profits in a small pool of tokens but disperses throughout the different areas.

Crypto Moves Are Still Directly Influenced By Macro Forces

The crypto boom is not occurring in a vacuum, but it is closely linked to macroeconomic settings that affect risk assets all over the world.

Interest Rate Outlook: As the position of the Federal Reserve changes with the inflation rate and the economic performance, the anticipation of a drop in monetary strain is usually converted into a higher risk appetite, which is favourable to crypto markets. Although Bitcoin retains an advocate base around strategic price floors, anticipation of price adjustment and inflation levels are still contributing to the flow of speculation.

Geopolitical Dynamics: As the world grows more uncertain, with Covid-19 policy or market idiosyncracies or geopolitical tensions, a handful of investors may switch to crypto as an alternative store of value. This dynamic enhances the Bitcoin digital safe-haven story, which was especially potent at the beginning of 2026. The interaction between the macro forces and the performance of digital assets is factual, visible, and extremely relevant to professional and amateur investors.

The 2026 crypto boom is shaped by global economic shifts and geopolitical uncertainty, with Bitcoin emerging as a digital safe‑haven for investors. (Image Source: Crypto Council for Innovation)

An Altcoin Spring – Not a Sightseeing Tour

Even though there are headlines about an altcoin season, seasoned traders are hesitant. There are metrics which show that the dominance of Bitcoin has not been weakened despite the advancement of altcoins.

This is a subtle narrative, though, as altcoins are gaining momentum ever-along with Bitcoin, this is not an altcoin season with a speculative fever. Rather, it is a much more considered shift of capital into projects of apparent utility, solid fundamentals or an increasing user base.

More capital is getting locked into tokens which are pegged to real-life applications, including the DeFi and smart contracts and even payment methods between two different countries. That is why Ethereum, the XRP of Ripple and some privacy coins demonstrate superiority in some windows.

Risk and Opportunity Intersection

To learn more about the actual meaning of this rally, which can be relevant to the readers, it is better to think of crypto markets as any other changing asset class:

- Risk Awareness: Cryptocurrencies are still unstable. Blistering profits can be trailed by drastic withdrawals. The price movements of smaller tokens, particularly meme-linked plays, can become exaggerated.

- Opportunity Recognition: The assets with the active developer communities, the use cases, and the adoption paths have much better chances of outperforming the noise-related assets. Sustainable growth phases can all be encouraged by institutional capital, liquidity improvements and clarity of regulation.

Simply put, it is not about pursuing every green chart candle, but rather it is about knowing the reason why capital moves where it does.

Understanding the 2026 crypto rally means balancing risk and opportunity; focusing on projects with strong adoption, active communities, and real use cases rather than chasing every price spike. (Image Source: MDPI)

What Comes Next: Monitoring Signals

With the changing market, these are the key indicators being observed by the forward-looking market players:

- Regulatory Clarity: The introduction of new laws or guidelines by major jurisdictions can radically affect the feeling and the institutional involvement.

- ETF Flows/Institutional Capital: It is important to monitor exchange-traded products that persist in net inflows, as these are significant changes that can affect Bitcoin and the rest of the markets.

- Macro Economic Data: Risk assets, including crypto, are affected by inflation, employment and commentaries by the central banks.

- Adoption Metrics: The usage of networks, the development and activity of the DeFi industry tend to become long-term value creation.

Also Read: Rising Global Conflict Risks: Could World War 3 Reshape Bitcoin’s Role?

Successive Reflections: A Rally With Meaning and Storytelling

The crypto boom of 2026 will be beyond just price action – it will be a narrative at the interplay between macro forces, investor psychology, institutional involvement and changing crypto applications. Whether you are a seasoned trader, a keen investor or a toer in the digital asset pool, this step is rich in context and a deep understanding of risk and strategy.

Since the new direction of Bitcoin under new leadership, to the altcoins that are changing the market expectations and the privacy coins rewriting the history of utility and anonymity, this resurgence of the crypto industry sounds not like a flash but as a chapter of the current history of crypto maturation.

Frequently Asked Questions (FAQs)

- Q1: Is it the beginning of a crypto bull market?

Ans: The rally phases are clear, but long-term trends require macroeconomic stability, regulatory progress, and sustained capital inflows. - Q2: Will altcoins outperform Bitcoin in 2026?

Ans: Certain altcoins may perform better, especially those with clear utility and adoption. However, Bitcoin will remain the centre of gravity in the market. - Q3: Are privacy coins safe to invest in?

Ans: Privacy coins are volatile and often subject to regulatory scrutiny. They can perform well in niche market conditions but carry specific risks. - Q4: Should beginners trade during a market rally?

Ans: Beginners should prioritise risk discipline. Start with education, consider dollar-cost averaging, and avoid high leverage exposure. - Q5: Which economic indicators should I observe?

Ans: Key indicators include inflation data, interest rates, geopolitical events, and ETF flows; all essential macro factors influencing crypto markets.