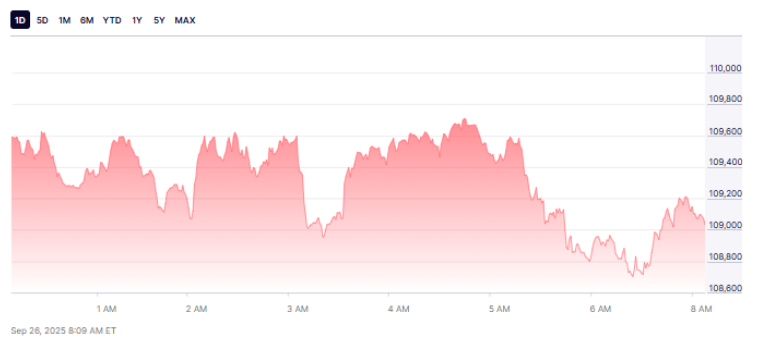

September 2025 has marked another downturn for cryptocurrencies. Bitcoin has fallen below $112,000, unnerving investors globally.

Market analysts speak of rising worries for an impending US government shutdown. Traders fear disruptions to public spending may hinder economic stability.

Such uncertainty comes alongside large-scale liquidations. The week saw a sell-off of over $1.65 billion worth of crypto assets, thus compounding the pressure on the markets.

September 2025 crypto slump: Bitcoin drops below $112K amid US shutdown fears

What Is Causing the Crypto Market Downturn in September 2025?

The recent crypto market slump occurred due to two prevalent reasons. US Government Shutdown Fears

Shutdown-ready investors feel uncertain. In contrast to previous shutdowns during which government officials were merely furloughed, this time, bigger disruptions could take place in federal agencies. Market Liquidations and Interest Rate Concerns

Significant sell-offs have taken place in Bitcoin, Ethereum, and the rest of the leading cryptocurrencies. Meanwhile, the traders are wary regarding interest rate uncertainty due to the Federal Reserve.

This joined assault of factors has generated a broad-market fall. Investor sentiment is weakening, especially in the face of high-risk, leveraged positions.

How Have Major Cryptocurrencies Responded?

Bitcoin slipped from $112,000 in September 2025 and busted a major support level. Ethereum has fallen below $4,000 for the time being, while Solana and XRP have also seen price drops. A decline on a wide front shows the increasing risk aversion.

Traders want to take their money to safe-haven instruments, including stablecoins and fiat holdings.

Leverage-driven instruments saw a liquidation of $1.65 billion. If the volatility stays at this level, analysts warn that this might continue.

Will Regulatory Changes Affect the Market?

New ETFs would set long-term market sentiment. BlackRock filed for a Bitcoin Premium Income ETF, with income from covered call options.

Hashdex allowed its US Crypto Index ETF to trade XRP, Solana, and Stellar, creating modest participation in the market.

On the regulatory front, while developments could inject confidence in investors, they do nothing to alleviate short-term pressures emanating from the shutdown in the US and large-scale liquidation.

What Should Investors Do in This Volatile Period?

During the current downturn, investors should remain cautious. A proper and sufficient diversification among crypto and traditional assets is a good way to mitigate risk.

With the prevalent volatility, short-term traders may be in for easy money, but long-term holders should prepare to take hits on volatility. Risk management techniques such as stop-loss orders should be in place.

One should keep an eye on worldwide political-economic news. Investors must also keep abreast of shutdown developments, Federal Reserve policy, in addition to crypto market trends.

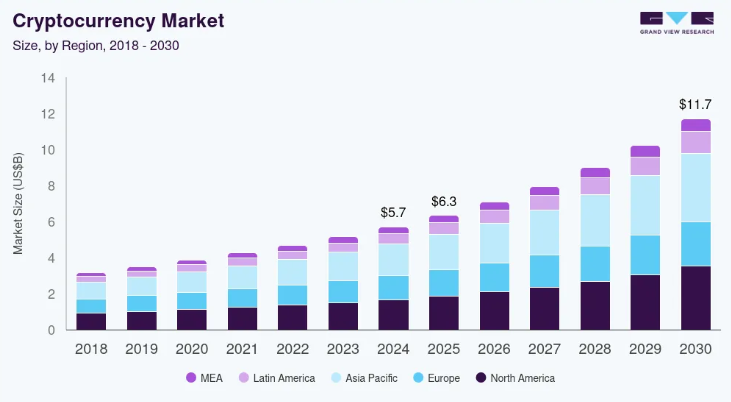

Cryptocurrency Market Forecast

What Are the Broader Implications for Finance?

The crypto price crash under the US government shutdown spectre shows just how fractured markets are under geopolitical upheavals.

Lingering uncertainties could weigh on investor confidence, going into digital and traditional markets. Institutional investors are watching these trends with magnified focus.

European banks are exploring euro-based stablecoins under MiCA regulations. These aim to be stable alternatives for investors working their way through turbulence.

The present downtrend spells out the interconnection and influence of political events and economic uncertainty on crypto-market behaviours.

Could Global Economic Trends Magnify the Existential Crisis?

The world economic conditions can further influence the price of a cryptocurrency. Inflationary expectations and energy costs appear to be running high, and coupled with international politicking, things are getting uncertain by the day.

These somewhat formal and on-the-rise international markets would certainly be watched by investors, especially if any downturn in equity or commodity sectors can induce a fresh bout of selling pressure on an already weak crypto.

The interplay between US fiscal policy and the world economic conditions will probably dictate how cryptocurrencies perform in the months to come.

Also Read: Crypto Market Reacts After FOMC Rate Cut — Bitcoin, Ethereum and Altcoin Outlook

FAQs

- What caused the cryptocurrency price drop?

Based on fears of a US government shutdown, the crypto prices went down, with crypto liquidations of $1.65 billion.

- What was Bitcoin’s recent low?

Bitcoin fell below $112,000 in a major market correction.

- Were other cryptocurrencies also affected?

Yes. Ethereum, XRP, and Solana have also dipped in the shadow of market-wide caution.

- Would this downturn open up any investment opportunities?

Some analysts indeed bring out such long-term potential, but the short-term risk remains quite high.

- How should investors respond to this downturn?

Diversification, risk management, and staying informed about political and economic developments are key strategies.