In the ever-evolving world of cryptocurrency, XRP continues to draw the attention of seasoned investors, curious analysts, and enthusiastic traders. Recent volatility in the market has once again brought this digital asset into the limelight—this time, with whales making big waves. So, what’s behind all this activity? And more importantly, what does it mean for the future of XRP?

Let’s dive into the depths of XRP market trends, explore the silent stirrings of whale movements, and decode what these patterns could spell for traders, investors, and observers alike.

XRP Whales and Market Moves Uncovered(Image Source: Investing Heaven)

When the Big Fish Swim: Whale Activity in Focus

Whales—those mysterious, deep-pocketed crypto players—are on the move. And when whales stir, the entire ecosystem tends to ripple (pun intended).

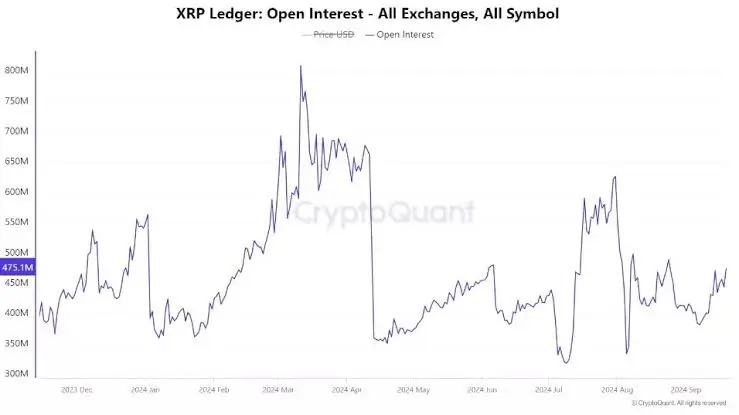

Recently, large-scale XRP transfers were detected, many of which occurred on major exchanges. These weren’t just your average retail transactions. These were serious transfers—hundreds of millions of tokens being shuffled like poker chips at a high-stakes table. Such activity usually signals that something’s brewing beneath the surface. Often, these moves happen before price swings, suggesting strategic shifts by major holders.

But what are they preparing for? That’s the million-dollar (or billion-token) question.

The increase in exchange reserves—tokens held on exchanges—could imply that whales are getting ready to offload some of their holdings. And when whales sell, it often brings a drop in price, at least in the short term.

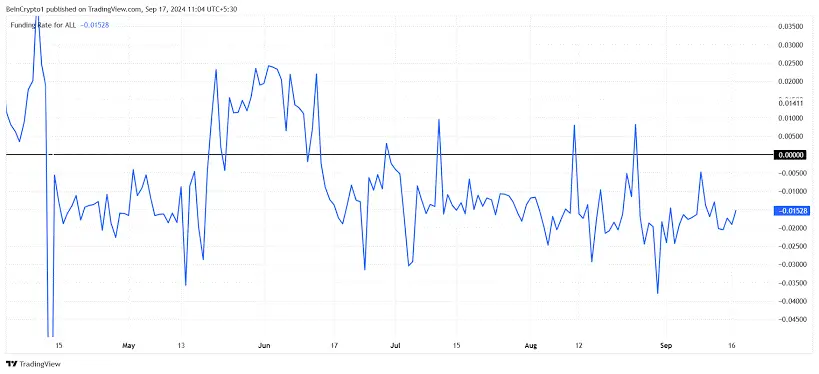

Reading the Room: XRP Funding Rates and Sentiment

Let’s talk about funding rates. If you’re new to the concept, think of it as a measure of who’s betting which way the wind is blowing. When funding rates are positive, traders are generally optimistic (bullish). When negative, they’re preparing for a storm (bearish).

XRP’s funding rate has shown signs of volatility, fluctuating in recent sessions. This tells us that while some traders are hopeful, others are bracing for correction. It’s like a tug-of-war, and the rope is XRP itself.

XRP Sentiment and Funding Rates Decoded (Image Source: BelnCrypto)

For serious traders and analysts, keeping an eye on these rates isn’t optional—it’s essential. It reveals the emotional pulse of the market, even when the charts are still.

What matters more are the technical signals. Enter the golden cross.

The golden cross occurs when a short-term moving average crosses above a long-term one. It’s often seen as a bullish indicator—like the market whispering, “Things are looking up.” But (and this is a big but), such indicators don’t guarantee smooth sailing. Short-term corrections can still sneak in and shake the boat.

The takeaway? It’s important to balance optimism with realism. Always assess technical patterns in context.

Institutional Interest: The Ripple Matures

Here’s something worth celebrating: institutional interest in XRP is on the rise.

With increased involvement in XRP CME futures, big players from the traditional finance world are dipping their toes into the Ripple pool. This is significant because institutional adoption typically brings with it stability, credibility, and longer-term investment behaviour.

It’s like XRP has graduated from college and is now being considered for that high-paying, stable job in the finance sector. And frankly, it’s about time.

More institutional backing means more liquidity, more analysis, and potentially less volatility in the long run. That said, it also means that retail investors need to stay sharper and more informed than ever.

The Legal Side: Ripple’s Tug-of-War with the SEC

No conversation about XRP is complete without mentioning the legal drama that’s been unfolding like a Netflix courtroom series: Ripple vs. the U.S. Securities and Exchange Commission (SEC).

This lawsuit has been hovering over XRP like a storm cloud. It affects everything from exchange listings to investor confidence. Legal uncertainty tends to create hesitation in the market—and hesitation leads to price instability.

However, there’s light at the end of this regulatory tunnel. Any positive outcome in the case could send a strong signal to the market, reigniting confidence and potentially driving prices upward. It’s a classic case of legal clarity equalling market optimism.

Exchange Reserves: Liquidity’s Quiet Messenger

Let’s circle back to exchange reserves. These figures may not make headlines, but they’re crucial for understanding what might come next.

An increase in exchange reserves means more XRP is being stored on trading platforms, making it available for transactions. That’s good news for liquidity. But it also means that some big holders might be preparing to sell.

Liquidity is a double-edged sword—it enables smooth trading, but it can also facilitate large sell-offs that impact prices quickly. Traders need to interpret these shifts carefully and not just react emotionally.

XRP/BTC Pair: A Story of Relative Strength

Sometimes, to truly understand XRP’s performance, you’ve got to look at it next to the heavyweight champ—Bitcoin.

The XRP/BTC pair acts like a comparative litmus test. If XRP is gaining strength against BTC, it means XRP is growing in relevance even in the broader crypto ecosystem. But if the pairing weakens, it may suggest that investors are favouring Bitcoin in uncertain times.

Right now, watching this pair is especially useful in gauging market confidence in XRP. It’s like checking your pace against the fastest runner in the race—it tells you whether you’re gaining ground or falling behind.

XRP/BTC: A Tale of Strength in Comparison (Image Source: Forex GDP)

What Does All This Mean for You?

If you’re holding XRP, thinking of buying in, or just enjoy following market drama, here’s the bottom line: the XRP market is pulsing with activity, insight, and possibility.

Whale movements hint at strategic plays by the biggest fish in the ocean. Funding rates reveal the mood of the market. Technical indicators like the golden cross offer glimpses of potential bullish behaviour. Institutional interest points to XRP’s maturity. Legal battles provide both risks and catalysts. Exchange reserves and trading pairs help fill in the rest of the picture.

It’s a complex puzzle—but one worth solving.

Final Thoughts: Stay Sharp, Stay Curious

The world of XRP is fast, fluid, and full of intrigue. From deep-pocketed whales to courtroom clashes, every element adds a twist to the story. But beneath all the noise lies something important: a digital asset with resilience, growing relevance, and a community that refuses to be ignored.

Whether you’re a long-time investor or a newcomer watching from the sidelines, staying informed is your best asset. Keep your eyes on the market trends, stay grounded in data, and always remember—just like in surfing, it’s not about avoiding the waves, but learning how to ride them.