September 2025 was a historic week in the US spot Ethereum ETF space. Investors withdrew a whopping US$795.8 million from the funds in five consecutive trading days. The greatest single-day outflow happened last Thursday, with an amount standing at US$251.2 million. Analysts have blamed this sell-off on last week’s sharp plunge in cryptocurrency prices. However, confidence remained rather fractured even with a slight recovery during the last 24 hours.

An Ethereum ETF investor sell-off mirrors a cautious market sentiment: Many institutional investors reportedly allowed portfolio adjustments to limit exposure to volatile digital assets. Withdrawal amplification could have been catalysed even more by regulatory uncertainties in the US.

Investors pulled US$795.8M from US Ethereum ETFs in five days, hitting US$251.2M in a single session

How Did Bitcoin ETFs Compare?

Bitcoin ETFs, conversely, saw even larger absolute outflows while the ETH ETFs were suffering heavy losses. The same week witnessed huge net outflows in Bitcoin ETFs amounting to US$897.6 million, with net outflows recorded for four out of five trading days. Wednesday was the only net inflow day, recording US$241 million.

While in absolute outflow terms, Bitcoin ETFs experience larger outflows, more funds were lost in percentage terms for Ethereum ETFs due to them having much less in asset under management (AUM). This means that market fluctuations probably affected Ethereum ETF holders quite strongly compared to Bitcoin ETF holders.

Crypto Prices Decline Amid Massive Outflows

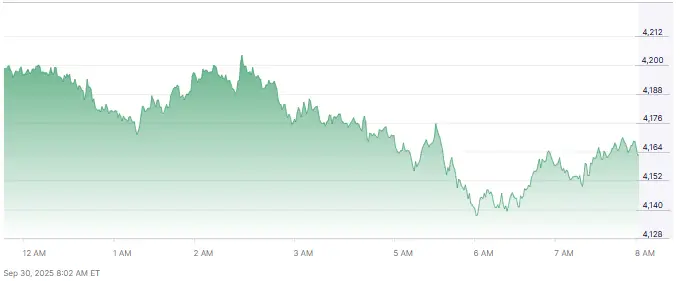

The largest withdrawals in the Ethereum ETF coincided with falling cryptocurrency prices. Ethereum decreased by a few percentage points before rebounding slightly. Over the past 24 hours, Ethereum rose by 2.6% to US$4,113 (AU$6,258). Bitcoin also recovered slightly, rising 2.2% to US$111,745 (AU$170,052).

This temporary recovery accentuates the fact that the market is making an attempt to stabilise in the midst of investor sell-offs. Analysts have asserted that short-term volatility is a significant driver in ETF outflows, most especially by institutional investors who try to manage risk.

Ethereum climbs 2.6% to US$4,113, while Bitcoin edges up 2.2% to US$111,745 in the past 24 hours

Are Institutional Investors Driving the Ethereum ETF Investor Sell-Off?

The year 2025 would definitely have seen investors at large playing a broader role in the outflows from the Ethereum ETF. Because of their large positions, their trading activities always tend to add oomph to a market trend.

Reports in the media have recently suggested that several institutions went in for portfolio rebalancing to lower their exposure to Ethereum. Some investors reportedly anticipated a market correction and liquidated accordingly. Others followed internal risk guidelines, avoiding the risk, which contributed to the largest Ethereum ETF withdrawals.

What Are the Implications of Ethereum ETF Outflows 2025?

Giving room for continuous outflows from the Ethereum ETF could give rise to multiple consequences on the market. With less institutional demand, there may be downward pressure on the price of Ethereum. Such ETFs bring about liquidity and establish asset prices.

But the market creeps along. Good investor sentiment or regulatory breakthroughs would see heavy inflows again. Analysts remark somewhat contra: that outflows remain temporary does not generally stand for a long-term trend.

Ethereum ETF outflows may push ETH prices down and reduce market liquidity

Outlook: Can Ethereum ETF Inflows Rebound?

To this day, Ethereum ETFs may have a strong inflow in the coming months. New investments may occur as confidence is reinvigorated in Ethereum, institutions return to the scene, and prices stabilise.

Market analysts say that, after the outflow, the asset always becomes cheaper, so it is a good time for investors to buy. If the broader cryptocurrency market recovers, the inflows into Ethereum ETFs may very well offset outflows currently being witnessed.

Also Read: Crypto Market Reacts After FOMC Rate Cut — Bitcoin, Ethereum and Altcoin Outlook

FAQs

- What caused the largest withdrawals for Ethereum ETFs in 2025?

These were caused by falling prices in the crypto markets, investors exercising caution, and regulatory uncertainties.

- How did Ethereum ETFs compare in performance to Bitcoin ETFs?

Ethereum ETFs fared worse in percentage terms, but Bitcoin ETFs suffered bigger absolute outflows.

- Do institutional investors affect Ethereum ETF outflows?

They do, as institutions’ rebalancing and risk management strategies often intensify sell-offs in ETFs.

- Can the inflows into Ethereum ETFs be restored post these outflows?

Positive market events coupled with renewed confidence could help cause inflows soon.

- What is the wider effect of Ethereum ETF outflows?

Reduced interest at the institutional level may temporarily impact Ethereum’s price and liquidity, but markets can recover.