Bitcoin breaks US$120,000 as spot ETF inflows reach the ceiling and airdrop mania sends testnets and wallets into a tizzy. Desk traders roll back stops; enthusiasts make dozens of wallets and spam smart contracts to become “eligible.” This is not just price action — it’s two markets crashing together: institutional capital pouring in through ETFs and retail speculators hoping for free tokens. (CoinDesk)

Bitcoin tops US$120K as ETF inflows and airdrop mania collide. (Image Source: USFunds)

Why Is This Important Now?

If ETFs are pumping consistent allocative capital, they change the crypto’s behavior during bear and bull markets. If airdrop hunting is causing violent short-term wallet churn, that creates noise and liquidity that amplifies action. Together, they can build a solid foundation — or a wobbly ladder that collapses when liquidity vanishes. ETF flows in the past several days and a clean on-chain accumulation sign make the question urgent. (Yahoo Finance)

Snapshot: Facts You Can’t Ignore

A brief list of challenging facts to work from:

- Bitcoin shatters US$120k on decent volume and volatility — a fresh inflection that grabs headlines and desk tops. (CoinDesk)

- Big spot Bitcoin ETFs experience multi-day inflows, institutional channels are open, and capital is pouring in magnitude. (Yahoo Finance)

- Glassnode’s accumulation metrics show mid-size wallets transitioning to net buying, with exchange supply tightening, and on-chain demand is legitimate. (CoinDesk)

- Airdrop schedules and guides list dozens of projects with potential token allocations; testnets and “airdrop farming” communities scale activity to qualify wallets. That action drives the on-chain mania. (CoinGecko)

- While that’s happening, sell-side analysts and big banks issue favorable targets and flow commentary that validate institutional demand. That makes a difference for how long the money sticks around. (CoinDesk)

It’s these five points that everything else in this feature rests upon. They’re the template: price + capital + on-chain demand + airdrop behavior + institutional validation.

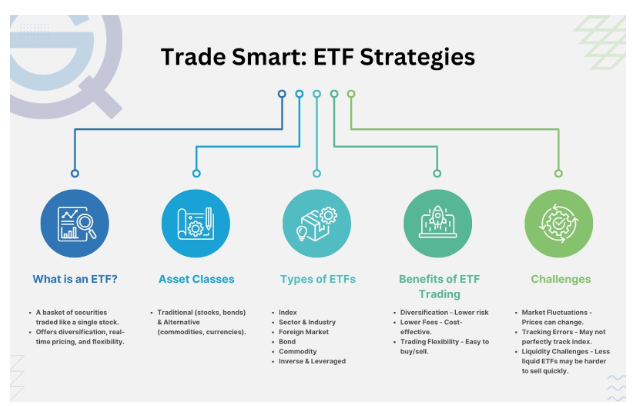

Two Worlds, One Market: How ETFs And Airdrops Play Different Roles

Look at ETFs and airdrops as two types of gravity. ETFs are similar to a slow, heavy tug: steady, measurable capital that can hang around in the background and wring out volatility over the long term. Airdrops are similar to high-speed, localized gusts: flash attacks of activity, pilot trades, and volume-of-trade surges that can pad order books — and dissipate.

ETFs change supply dynamics. When buying by spot ETF managers, they withdraw coins from exchanges and into custody. That reduces out there liquid supply and forces marginal buyers to pay more. If flows persist to flow, price support can persist. Recent multi-day ETF inflows illustrate exactly that mechanism in action. (Yahoo Finance)

Airdrops change behavior. Token drop promises to customers of a project to get people to experiment with software, bridge tokens, and create transaction history. These activities pump on-chain activity, create transitory demand for gas and L2 capacity, and — most significantly — can inflate the appearance of grassroots activity. Teams farm eligibility with dozens of wallets. The result is more addresses, more volume — and more noise. (CoinGecko)

ETFs tighten supply; airdrops spark bursts of noisy activity.(Image Source: (Image Source: Quantified Strategies)

On-chain: Who’s Taking, Who’s Transferring

It pays to be on-chain narrative because it separates noise from intent. Glassnode’s recent accumulation metrics show mid-cap wallets (10–1,000 BTC) accumulating balances as exchange reserves decline — a classic sign of demand outstripping on-hand supply. That’s not retail gossip; it’s a behavioural pattern that you can measure in snapshots of addresses and net flows. (CoinDesk)

Why it matters: ETF buying usually shows up as systematic exchange-to-custody flows — low-and-slow batched buying. Retail airdrop activity shows up as tiny, frequent transactions, contract calls, and growing transitory wallets. They both exist today. The former tightens supply; the latter raises near-term fees and congestion on-chain.

Two Scenarios: A Trading Desk And An Airdrop Hunter

Picture a London trading desk at 09:15 AEST: an institutional trader watching over ETF fill rates and order books. When the ETF is at a premium, the desk arbitrages, hedges, and allocates. A new report from a sell-side desk can trigger multi-million-dollar allocation realignments within minutes. The flows are sticky when the underlying buyers are treasuries or long-term funds.

And suppose an airdrop Discord at the same time: a thread drops a “claim checklist” for a coming Layer-2 airdrop. Members get together to run bridge flows, call contract functions, and spin up temporary wallets to “prove activity.” It’s a cheap search for a jackpot for them. The net effect is thousands of micro-transactions simulating use — and they get recorded in on-chain analytics. (CoinGecko)

There are so many things this guy doesn’t get.

First of TVL doesn’t get inflated by leveraging / looping stables as mentioned in OP tweet.

You put 1 USD in, you borrow 90 cents which you redeposit and borrow again, the TVL stays fixed at 1 USD.

Second regarding “there… https://t.co/fyIs5k19uU pic.twitter.com/aT6wklBUQs

— letsgetonchain (@letsgetonchain) October 2, 2025

Both scenes create price pressure — one predictable, one chaotic.

The Central Tension: Durable Adoption Or Amplified Speculation?

Three scenarios explain what we’re watching:

- Durable Adoption: ETF flows persist, major custodians increase capacity, and buying is matched by rising institutional allocations (treasuries, funds). On-chain adoption becomes steadier as real users and protocols capture attention. Volatility falls; markets begin to look more like traditional asset classes.

- Speculative Amplification: ETF-driven momentum pulls in hot money, and airdrop hunting creates insane on-chain activity that spikes short-term volumes. Prices increase, liquidity evaporates at major levels, and the market is at risk. A shock — regulatory announcement or sudden liquidity withdrawal — can induce sharp corrections.

- Hybrid Cycle: ETFs provide a base, but airdrop-induced retail activity leads to sharp localised whipsaws. The market grows, but with recurring mini-bubbles coincident with token events.

Now the data is in favor of a hybrid launch: measurable ETF flows and real accumulation exist together with furious on-chain turnover driven by airdrops. That makes the rally real — and rough. (Yahoo Finance)

ETF flows steady the market, while airdrops fuel volatile speculation. (Image Source: AInvest)

Why Free Tokens Matter Beyond Airdrops

Airdrops are not just giveaways; they impact long-term token distribution, governance participation, and network effects. Rewarding early adopters allows projects to bootstrap communities quickly. But it also has perverse consequences: participation just to get tokens, instead of building lasting product loyalties. The surface metric — active addresses — is less reliable unless you read the data carefully. (CoinGecko)

That is why on-chain quality matters. Analysts don’t care anymore about addresses and raw tx volumes but “meaningful activity” — repeated use of contracts, value transferred, and extended wallet behavior. Those signals distinguish between real utility and airdrop farms.

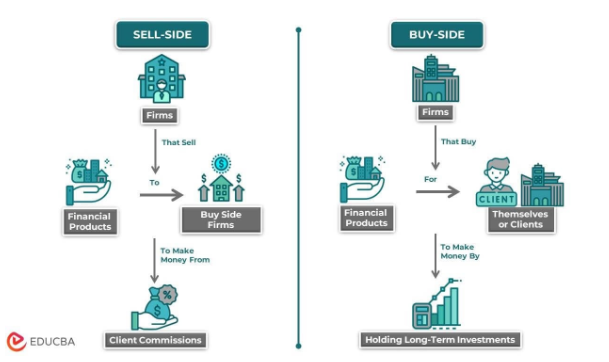

The Institutional View: Why Sell-side And Buy-side Conversation Matters

When sell-side banks publish bullish targets and ETF managers show consistent inflows, they do more than predict price — they shift perceptions. Institutions that read those signals start building allocation frameworks, which can be self-fulfilling. Citi’s recent note and other bank commentary push allocators from curiosity to commitment, which matters for durability.

But institution flows are also technical. ETF arbitrage desks, market-making, and derivatives create levered exposures that reshape short-term dynamics. The ability to distinguish between “real capital” (long holdings) and “flow capital” (arbitrage + leverage) is necessary in order to measure risk.

Bank calls and ETF inflows drive institutions; leverage adds complexity. (Image Source: EDUCBA)

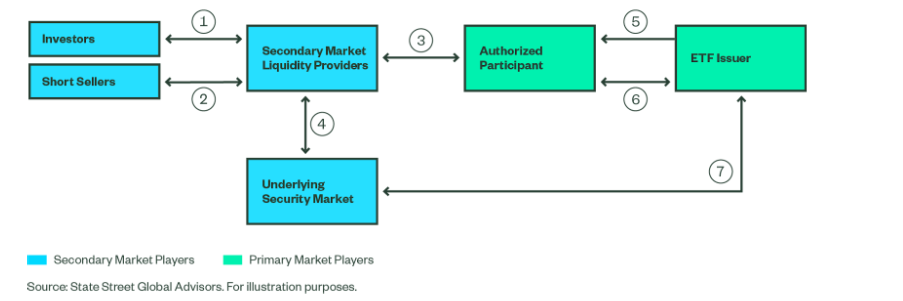

Etf Anatomy — How Institutional Flows Change The Plumbing

Spot ETFs buy physical coins and hold them in custody. That removes supply from exchanges and reduces the float available for intraday trade.

When flows move smoothly, desks see one-way suction: liquidity dries out at critical levels, and even tiny buys propel the price higher. Over the last few days, the ETF flow charts show sustained multi-day inflows — proof that capital is in fact coming through, not simply talked about. That supports the price mechanically. (Farside)

ETF demand also creates secondary dynamics. Arbitrage desks and market-makers sell the product of the ETF against spot and futures. That action adds complexity: at times, it is “real buying” in the market that turns out to be hedged, synthetic, or short-term. Distinguish true allocation (long treasury or fund buying) from flow capital (arbitrage). The differentiation is crucial to durability. (The Block)

Editor and trader action: look at daily spot-ETF flow tables and compare them against net exchange outflows. When ETFs’ net constant buying and exchange reserves are falling, that is more evidence of long-term allocation. The Block and Farside both have current ETF flow trackers you can review daily. (The Block)

Spot ETFs drain exchange supply, tighten markets, and push prices up. (Image Source: State Street Investment Management)

On-chain Forensic — Separating Accumulation From Small Talk

On-chain information gives you two clear views: who is moving coins and where they go from there.

A good guideline: extended buildup takes the form of multi-day inflows into long-term and mid-cap wallets, as well as diminishing exchange reserves. CoinDesk and Glassnode have shown accumulating trends forming along with declining exchange balances as the price advanced beyond US$120k. That trend indicates more than a short-term retail spike — it indicates true holders stacking.

Contrast that with airdrop activity: farmers and hunters generate a high volume of small transactions, contract calls, and new ephemeral wallets. Those inflate active-address figures without generating holding behaviour. The signal looks like bursts of contract interactions, not prolonged transfers to cold custody. Look at the shape of the flows: frequent small txs + swift withdrawals = farming; steady inbound flows to custody = accumulation. (CryptoRank)

Practical things you can test this afternoon:

- Daily exchange netflow: Are exchanges withdrawing more BTC than they receive? Glassnode dashboards show this figure. (insights.glassnode.com)

- Accumulation trend score (15d): Is the 10–1,000 BTC wallet cohort in accumulation? CoinDesk outlined recent spikes in that score. (CoinDesk)

- New wallet creation + contract call spikes: check Dapp trackers (DappRadar / Cryptorank) for spikes in testnet activity that don’t make sense. (CryptoRank)

Airdrop Farming — Mechanics That Make On-chain Noise

Airdrops are incentivized for action: bridge assets, stake tokens, call governance functionality, perform testnets. That simple incentive system creates predictable behavior.

Communities coordinate. on Discord and X. Labor is divided, wallets spun up, and interactions replayed to build claimable history. Sites like Bankless and airdrops.io screen “hunt. lists” and guide users through the exact steps. That tooling lowers the cost of farming and adds on-chain mess. (Bankless)

Two things occur as a consequence. First, on-chain activity looks busier — more tx volume, more contract calls, low-value transfers. Publishers look at surface stats in a vacuum and get this confused with product adoption. Second, the supply effects are transitory: airdrop hunters don’t hold large token positions for long; they sell at the first chance, generating short-term volatility about distribution events. (Bankless)

Simple test for identifying farming: track repeat interactions per wallet over 7–30 days. Farming is many wallets with high interaction volumes bundled into a small time window and low balance in the long term. Genuine users have fewer interactions, heavier balances, and ongoing activity. Employ Nansen, Dune, or a custom Glassnode query to design this cohort analysis.

Two Wallet Sample Studies — A Whale, A Farm

I won’t define private wallets, but public treasury buys and regular farm cycles indicate the distinction.

A: Corporate Treasury (Public Company).

Metaplanet’s recent buy (5,288 BTC) swayed public coffers; Strategy (formerly MicroStrategy) continues to show huge treasury reserves and purchases this year. Those are tangible, lumpy deposits in custody and show up in legacy media and treasuries disclosures. That’s durable deployment — balance-sheet driven and not simple to roll back quickly without corporate governance problems. (CoinDesk)

Why it matters: if a corporate or treasury buyer is building up, they tend to hold. That takes supply away and alters the marginal buyer set of the market.

B: Airdrop Farm (Behavioural Archetype).

A farm handles hundreds of tiny contract interactions on various L2s and testnets over a two-week interval. Tools list likely targets; communities mobilize on Discord and X. After a snapshot or claim, farms will withdraw or sell, leading to the original volume to increase and then collapse. You spot an unusual spike in contract calls, many gas-cheap L2 txs, and many new wallets with extremely low balances. (Bankless)

Why it matters: farms are generating transient demand and on-chain activity, but not typically lasting liquidity or mass product adoption.

Interaction Effects — How ETF Flows And Airdrops Interact To Highlight Movements

When an ETF constricts supply and airdrop farming increases on-chain demand, the market can become one where small retail surges create price movement more than usual.

Here’s the micro: ETF buying removes resting liquidity from order books; short-term retail and airdrop farmers create taker demand spikes. When the book is thinner, even modest taker volume creates an exaggerated move. Add on derivatives flows and options expiries, and the short-term move snowballs.

This mixture explains the recent sharp leaps and greater realised volatility despite building institutional demand. CoinDesk’s accumulation reports point to both trends at once — institutional accumulation as well as bouts of retail buying. (CoinDesk)

Pay attention because this example is highly educational and completes this post.

As I was mentioning, when you start looking beyond the surface of supply and demand zones, what truly separates a fleeting reaction from a sustainable move is the quality of absorption taking place… pic.twitter.com/yaOOVkEwYI

— ZERO IKA ️ (@IamZeroIka) October 3, 2025

What Can Arrest This Rally — Clearly Defined Trigger Events

A few specific events can turn the dynamic around quickly:

- ETF arbitrage or outflows unwind. As ETFs turn from inflows to outflows, the supply suction turns and order-book depth normalizes (or gets worse). The Block and Farside trackers publish daily flows — search for extended reversals. (The Block)

- Treasury holder mass sells. Corporate treasury dumping is rare, but regulation, governance, or tax factors may force selling. Large reported sales would affect liquidity rapidly. Metaplanet and Strategy moves are worth watching for signalling.

- Airdrop disappointments. When a big promised drop fails to materialize, farms will stop participating, and speculative liquidity dries up. That can remove a block of short-term demand overnight. Bankless and airdrop schedules allow you to keep up on likely events. (Bankless)

- Reg con shocks. New custody, tax, or trading rules can reallocate institutional demand in an instant. On-chain and ETF flows respond in rapid time to policy headlines.

An Actionable Watchlist — The 10 Data Points To Track Daily

- Spot BTC/ETH price + volume — price action tells you what traders have already bet. (CoinDesk) (CoinDesk)

- Daily spot-ETF flows — inflows vs outflows by issuer. (The Block / Farside) (The Block)

- Exchange reserves (BTC/ETH) — falling reserves = shrinking float. (Glassnode) (insights.glassnode.com)

- Accumulation trend score (cohorts) — mid-sized wallet activity. (Glassnode / CoinDesk) (CoinDesk)

- Netflow to custodians — large amount flows into known custodians. (on-chain trackers/treasury reports) (Strategy)

- Contract call spikes on L2s / testnets — indicator of farming. (CryptoRank / DappRadar)

- Options funding rates and open interest — measure leverage and vulnerability. (Derivatives desks/exchanges)

- Nansen cohort trading, buying, and selling — high wallet activity alerts.

- Airdrop schedules & old snapshot confirmations — anticipate churn. (airdrops.io / Bankless)

- Regulatory news headlines — custodial, tax, or ETF-structure announcements.

If five or more of the first six points line up (ETF flows + falling exchange reserves + accumulation + testnet spikes + options OI not haywire), you likely have a hybrid cycle: stable base + noisy retail overlay. If ETF flows reverse or options OI spikes wildly, it’s a fragility signal.

A Sober Short-to-medium Horizon Playbook

For readers in retail: grasp the difference between playing (short-term, event-driven/airdrop) and allocating (long-term, institutional thesis). Don’t mix confusing address metrics with long-term product adoption.

For traders: watch for ETF flow reversals and exchange reserves. Use canary positions and set liquidity-adaptive stops — thinner books need wider risk controls.

For editors/journalists: avoid headline-tautology. If on-chain activity surges, inform them what kind of activity it is — holding or farming — and show the cohorts. Provide readers with the watchlist below so they can make their own judgment.

Play smart: separate short-term trades from long-term bets and track key flows. (Image Source: Quantified Strategies)

Faqs (Shortcut Answers For Readers)

Q: Is This Rally All ETFS?

A: No. ETFs are a major force, but on-chain accumulation and retail airdrop action amplify the move. The dynamics trump any single factor.

Q: Are Airdrops Legal Or Risky?

A: Airdrops in themselves are not necessarily illegal, but what projects do when sending tokens out and the promises they make can be questionable. Users need to be careful of scams and always confirm through official means.

Q: Will It Change The Way Regulators Act?

A: Maybe. Greater flows and more visible institutional participation demand closer regulatory oversight surrounding custody, market manipulation, and investor protection.

Closing Thought — Two Markets In One Room

ETF flows and airdrop mania are not necessarily each other’s opposite — they exist side by side, often awkwardly. One does the heavy lifting: capital and custody. The other does the kinetic work: on-chain volume, narratives, and headline traction.

The sharp reader notices both. If you notice prices alone or addresses alone, you miss the shape of the market. If you notice both, you will see if this rally is a real bottom — or a glittering, jammed dash with a fragile finale.