October started on a firm footing for Bitcoin, as it saw a surge beyond $120,000 before settling a little shy at $119,800. Institutional inflows have mainly contributed to this rally. A net inflow of 5,643 BTC was recorded into Bitcoin ETFs, valued at $675 million.

BlackRock alone entered 3,451 BTC worth $412.87 million, increasing its total holdings to 773,461 BTC or $92.5 billion. Ethereum ETFs also saw considerable activity. 14,864 ETH worth $65.6 million were added, with Fidelity taking the lead.

It is Fidelity, at least, that holds 772,054 ETH worth about $3.4 billion. These statistics paint a clear picture of growing institutional adoption in cryptocurrency.

Bitcoin kicks off October strong, surging past $121K before easing

What Do Analysts Say About Bitcoin’s Next Move?

Surpassing $120K happened in a three-day spell of $1.6 billion ETF inflows, with BlackRock’s IBIT spearheading the charge. Many analysts interpret these inflows as imposing a solid floor on prices.

Now, traders are looking at a retest of August’s $124K highs. But caution is still warranted; bears argue that much of the momentum is coming from perpetual futures rather than spot demand. Liquidity remains stacked below present levels; if momentum stalls, analysts see sharp retracements coming.

Important liquidation levels to note include $130K, potentially triggering $1.5 billion in liquidations, and $105K, risking $15 billion.

Is Altcoin Season Finally Arriving?

The Altcoin Season Index is now at 66, showing increasing strength. However, it has still not crossed the alt-season threshold. Market analysts are expecting Bitcoin to dominate market movement in October. Altcoins will then potentially follow once Bitcoin enters consolidation. Still, evidences for capital rotation keep surfacing.

Avalanche attracted attention after its entity AVAT declared a Nasdaq-bound merger-worth-675-million plans for 2026-a clue for strong institutional and corporate interests in blockchain ecosystems apart from Bitcoin and Ethereum.

Altcoin Index rises to 66, but Bitcoin remains dominant

Altcoins Attracting Institutional And Retail Attention

Ethereum remains rather central while smaller alts start picking up pace. Investors diversify as Bitcoin consolidation dominates. The plans for the Avalanche Nasdaq listing show institutional interest in blockchain scaling projects. This move endorses grounds for long-term adoption.

In the meantime, liquidity is pivoting towards selected altcoins. Such moves show that institutional players and retail traders alike are diversifying their portfolios. Strong flows towards Avalanche, Ethereum, and other chains tell of greater market growth. The Altcoin Season Index claims altcoins stand ready to gain momentum if Bitcoin dips into a period of stability.

Which Meme Coins Are Driving Retail Frenzy?

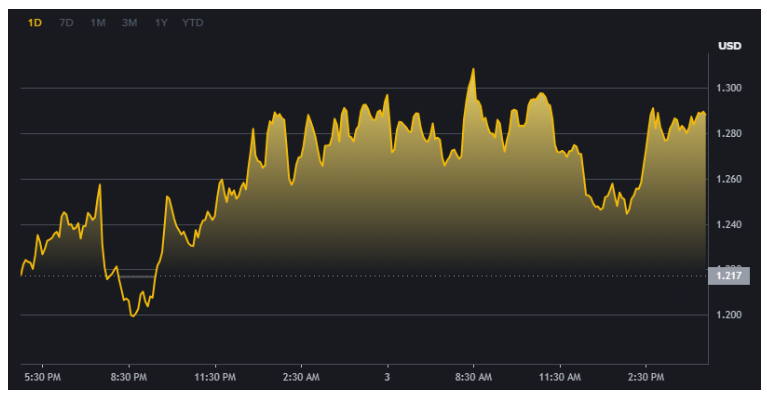

Meme coins have succeeded once again in attracting retail interest. Grand 31% in two days, SPX6900 now trades at $1.25. USELESS rose by 57% in a week, $76 million in volume. Most recently, “4” launched on Binance Smart Chain, reached $190 million in market capitalisation within two days.

That giant still sits at $141 million, with daily trading volume exploding at more than $271 million. Such moves showcase retail traders’ appetite for speculative gains. Liquidity is rotating into meme tokens with explosive-growth prospects in defiance of Bitcoin’s dominance.

Meme coins rally, SPX6900 jumps 31% in two days.

What Should Investors Watch Next?

October has inaugurated an array of themes within the crypto market in favour of institutional inflows. Sustained movement of Bitcoin past $120K should instil confidence. Any retest of $124K would only serve to galvanise further momentum.

Concurrently, retail flows into meme coins and altcoins signify speculative undertakings. Investors are encouraged to remain wary of liquidity-driven retracements. Sub-$110K levels could act as a strong downside magnet if sentiments deteriorate.

Altcoin Season Index has started rising, hinting at altcoins being set up for the breakout. Yet, the next move from Bitcoin remains a key driver for the broader market.

Also Read: ASX financial market news: strong rebound lifts market

FAQs

- What is the Altcoin Season Index?

The index measures altcoins’ under- or over-performance relative to Bitcoin. A reading above 75 signals a full-fledged altcoin season.

- Why is there a rising institutional demand for Bitcoin?

They are now using ETFs to gain exposure to it. These inflows stabilise the prices and drive increased adoption.

- Are meme coins safe to invest in?

Meme coins are quite volatile. They can enable one to earn quick gains but cause immensely threatening damage.

- What levels should a Bitcoin investor keep an eye on?

The resistance to the upside for most traders stands at 124,000. A downside risk would constitute a retracement to 110,000 or lower in case momentum starts to wane.