The Federal Reserve reduced the benchmark interest rate by 25 basis points this week. A long-awaited decision in the market, the FOMC’s September meeting ended up confirming this rate cut.

Crypto-heads were anticipating disruption, yet they observed quite a restrained reaction across key assets. Bitcoin, Ethereum, XRP, Solana, and Binance Coin (BNB) responded very differently on account of their differing market sentiments.

This occasion highlighted the hazard underlying an FOMC rate cut crypto market impact as changes within monetary policy ripple through decentralised markets. Liquidity, investor confidence, and risk sentiment all contributed to the short-term trading outcomes.

Fed cuts rates by 25 bps at September meeting, meeting market expectations

Bitcoin Price Reaction: Fed Rate Cut Builds Optimism

Bitcoin kept on climbing after the announcement to trade at almost USD 117,000. A dip toward USD 115,500 was witnessed, but the asset quickly regained its footing.

Open interest for Bitcoin futures surged to about USD 85 billion, with long positions dominating. This implies that traders are looking for greater levels and might be testing the USD 120,000-mark in the next weeks.

According to analysts, Bitcoin’s resilience has been unusual, as almost all volatility comes with the announcement of a monetary policy. It used to get into sharper swings in past cycles. This time, however, investor maturity and institutional inflows probably curbed overreaction from the market.

The Bitcoin price reaction to the Fed rate cut underscores how institutional capital now provides stability, with liquidity cushioning short-term fluctuations.

Ethereum Price Stable After Fed Cut

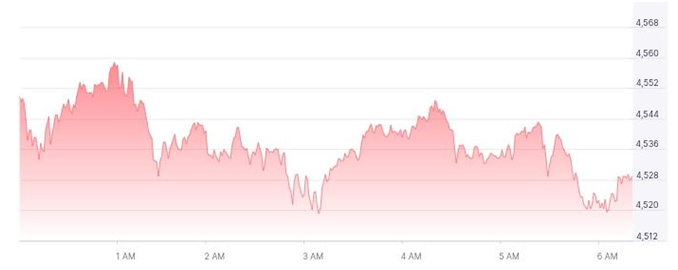

The ETH price demonstrated stability by holding above USD 4,500. The steady range for Ethereum probably spoke to investor confidence in the fundamentals, while BTC had the headlines.

Layer-2 networks now hold more than USD 40 billion in TVL. There were inflows into ETH product ETFs exceeding USD 1.2 billion every week, building a bullish sentiment in the longer term.

Such a combination of on-chain utility and institutional inflows translates to the slow and steady growth prospects of Ethereum. Market observers have said that the stability of ETH through high-volatility occurrences is reinforcing its status as a blue-chip digital asset.

Meanwhile, the narrative of Ethereum price staying stable after the Fed cut showed how ETH is much less reactive to policy shifts than smaller tokens.

Ethereum held above $4,500, showing steady investor confidence as BTC stole headlines

How Did Other Cryptos React?

Not every digital asset followed the exact path of Bitcoin and Ethereum. Hence, altcoins saw a mixed bag of results.

- XRP gained 1.63%, trading near USD 3.07. Confidence over ongoing institutional adoption remains today as the driver of interest.

- Solana (SOL) rose by nearly 3.2%, inching toward USD 244. Liquid DeFi activity seems to be the underpinning for its rise.

- Binance Coin (BNB) was back near 1,000, down a hair below 0.5%. The four-digit psychological figure means all the more for sentiment.

- Altcoins were more responsive to specific sector drivers than the cut itself. The rate decision created that backdrop; however, it was DeFi usage, exchange activity, and token upgrades that dictated actual movements.

What Does The FOMC Rate Cut Crypto Market Impact Mean?

The decision strengthened the expectation that a softer monetary environment will do the high-risk asset class good. Lowering the costs of borrowing translates into a higher appetite for equities and cryptocurrencies.

With the easing of previous cycles, the highly volatile markets have seen gains in the realm of 20-30%. Should there be a repetition of history, the forthcoming weeks could be bullish for crypto assets.

The Fed is also painting a picture of perhaps lowering interest rates a couple of times more by year-end. Such cues are keeping the bulls jogging in digital markets even farther.

But one must exercise caution. Macroeconomic uncertainty, lingering inflationary pressures, and geopolitical threats could finally keep a check on any gains. For now, the prevailing sentiment is positive, but risk management remains paramount.

Rate cut lifts outlook as cheaper borrowing fuels equities and crypto

Key Questions Ahead

Will Bitcoin Price Reaction to Fed Rate Cut Push BTC Higher?

With BTC hovering with the closest resistance at USD 117,000, further price uplift might be seen to break above the resistance of USD 120,000. This momentum depends on inflows from institutional buying and the derivatives side.

Can Ethereum Sustain Its Stable Position?

ETH stability suggests that investors believe in its long-term fundamental basis. Whether that takes the price beyond USD 4,800 soon, however, will depend upon continued demand for the ETF.

Will Altcoins Outperform Bitcoin?

Small-cap tokens, especially those in the DeFi space, may outperform BTC from a percentage gain perspective. Risk-on capital usually rotates into these assets after Bitcoin consolidates.

Risk Remains Despite Optimism

Despite bullish factors, risks remain. Under conditions of high profit-taking, Bitcoin might see a test of USD 115,000. Global inflationary pressures and regulatory crackdown could trigger disruptions in sentiment.

Cautious trading over recent months is slowly slipping as liquidity trickles back into crypto markets. Dominance of long positions is a signal of re-entering investors. Market-makers seem to acquiesce to volatility regarding the pricing of such measures.

XRP and SOL proved well-standing in their capabilities, whereas BNB clung to a significant threshold. Signs indicate that altcoins could be setting up for a broad market rally.

Also Read: Binance and Franklin Templeton Unite for Institutional Blockchain Push

FAQs

Q1: What triggered the latest price movement in the crypto markets?

A1: Renewed optimism in risk assets, including digital currencies, immediately followed the FOMC’s 25-basis-point rate cut.

Q2: Why is the price reaction of Bitcoin to the Fed rate cut important?

A2: It indicates institutional flows stabilising Bitcoin behaviour and thereby reducing extreme volatility around monetary announcements.

Q3: How did Ethereum respond to the Fed decision?

A3: Ethereum has remained steady above USD 4,500, backed by USD 40 billion TVL and strong ETF inflows.

Q4: Will altcoins rally harder than Bitcoin?

A4: Quite a few think DeFi and smaller tokens can offer higher percentage gains if liquidity expands.