Trends in cryptocurrency distribution are being revealed as on-chain yield metrics come to the forefront of attention for their insights into market cycles and leverage behaviours. Analysts are trying to find out if the increase in DeFi yields indicates the distribution phase of risk assets, among which Bitcoin is the most important.

On-chain yields are a reflection of the liquidity demand for borrowing in the protocols, and the changes in these rates can demonstrate when the speculative positioning is about to peak or when it is already easing. Yield behaviour is considered by the observers as Blockchain yield signals offering an insight that is over and above the traditional one based on price movements.

This new perspective is gaining ground in the analysis of the Crypto market as the crypto markets get more institutional and data-driven. The largest DeFi lending marketplaces, which include the Aave protocol, offer stablecoin lending where the annual percentage yields (APY) are essentially controlled by the liquidity demand.

When leverage cycles are at their height, yields can sometimes go above the long-term averages, which is a sign of increased speculative activity. In the past, such yield spikes have coincided not only with the corrections or distribution of major assets but also with the periods of long-term upward trends, thus making it quite a tricky situation.

On-chain yields hint at the Bitcoin distribution phase cycle

On-chain yields hint at the Bitcoin distribution phase cycle

Can Stablecoin APY Spikes Predict Distribution?

The question that analysts are asking is whether the yield spikes in USDT and USDC are very reliable signals of distribution in the underlying markets. At Aave, when utilisation increases and lenders raise their demands for APY, the situation usually arises where there is a lot of leverage being used.

The spikes in stablecoin APY exceeding certain thresholds, especially above that 10% mark for USDT in previous cycles, have occurred during the times when later there was range-bound price action or even pullbacks in Bitcoin. The patterns of these yield spikes are pointing to distribution pressure preceding the larger market shifts. But still, not every yield surge indicates the same scenario.

The markets may not have reached their peaks yet, and stress-driven liquidity shifts are one of the exceptional events that may push APY to extreme levels. During times of stablecoin depegging or liquidity crisis, yields may spike not because of the speculative leverage but rather as a symptom of the liquidity stress that is rampant around the whole system.

What Do Yields Tell Us About Risk And Leverage?

High on-chain yields are a way of measuring the leverage that is being used in the Cryptocurrency distribution trend. The very high usage of the stablecoin lending markets means that the demand for borrowing is more than the supply, which is a good sign of a lot of traders being in the market.

This can lead to the concentration of risk, which has been the case that the end of such periods is the time when the average market returns start to deteriorate, and risk assets are transferred from the strong hands to the weak ones. In these circumstances, analysts will regard sustained high yields as a warning signal, especially when the prices of the broader market have already reached their local peaks.

Conversely, the moderate increase in yields during the long bull phase might just be a demand for liquidity and not an indication of the distribution. The data on yields, when combined with price and volatility metrics, can be a great help in the analysis of the crypto market and in distinguishing between the signals created by speculation and those caused by the anomalies of stress.

High on-chain yields signal heavy leverage demand

High on-chain yields signal heavy leverage demand

Stablecoin Yield Patterns And Bitcoin Behaviour

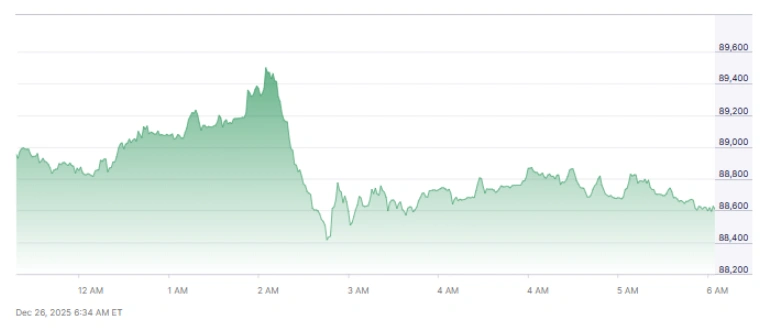

The previous cycles indicate that whenever the annual percentage yield (APY) on important stablecoins stays up, the price structure of major assets, most notably Bitcoin, may be setting its way for a correction.

The late 2024 and 2025 periods saw a higher yield, given that both USDT and USDC were the cause of increased volatility, and Bitcoin’s upside breakout performance was weaker. The above-mentioned very well support the notion that the rallies are not sustained, and over the spikes of yield, one can predict the distribution phases.

In addition to these, the borrowing of stablecoins in the market can be a sign of the local peaks getting congested. The reason being, speculative traders are taking their positions by using stablecoins, they are betting the prices will go up, hence the accumulation of traders. When the time of unwinding that leverage comes, it would be a case of amplifying distribution pressures.

Blockchain Yield Signals In Broader Market Context

The Blockchain yields now provide signals that are a complement to the technical indicators from the chart, thus ushering in a behavioural aspect in the risk assessments. Through the on-chain analysis of the yields from lending and borrowing, the investors and the analysts can ascertain the extent of overall leverage.

Besides, these indicators are part of the context in which the distribution trends in Cryptocurrency are interpreted, something that cannot be done with price charts alone, especially in the decentralised markets where the liquidity of lending is a vital factor.

In the Crypto market analysis, the yield data is taken together with some other metrics as volatility, trading volume and open interest, providing a comprehensive view of the market’s health.

Although no single indicator should dictate decisions, the patterns of blockchain yield can be regarded as an additional layer of signals that may indicate either the phases of distribution or the events of deleveraging in the near future.

Blockchain yields complementary charts, revealing leverage for risk assessments

Blockchain yields complementary charts, revealing leverage for risk assessments

Conclusion: Yields As A Distribution Signal Tool

Overall, tracking on-chain yields, particularly stablecoin APYs on leading DeFi platforms, appears to offer a promising proxy for distribution activity within crypto markets.

These Blockchain yield signals do not operate in isolation but can be interpreted alongside price and liquidity data to anticipate potential turning points. With proper context, such signals enrich global Crypto market analysis and illuminate broader shifts in Cryptocurrency distribution trends.

Also read: Why 2025 Became the Costliest Year in Crypto History Amid Hacks and Volatility

Frequently Asked Questions (FAQs)

Q1: What Are On-Chain Yields?

A1: On-chain yields are interest rates earned by lenders on decentralised lending protocols.

Q2: Why Do Stablecoin Yields Matter?

A2: Stablecoin yields reflect borrowing demand and can indicate leverage cycles.

Q3: Are Yield Spikes Always Bearish?

A3: No, yield spikes can stem from stress liquidity events, not just speculation.

Q4: How Do Analysts Use Blockchain Yield Signals?

A4: They compare yield data with price, volume and volatility to contextualise market conditions.