The crypto market is ablaze—literally. Crypto prices are soaring, meme coins are back in the spotlight, and influencers are loudly touting the “next big winner” across social media. Some view it as the cue for the next breakout. Others view it as everything getting a little too familiar.

Is this the next boom—or merely another bubble waiting to burst?

While some investors cheer on the green charts, market veterans and analysts are getting more and more anxious. The recent upsurge is not innovation or adoption by itself—it’s increasingly driven by emotion, speculation, and social media hype. And that’s triggering some big red flags.

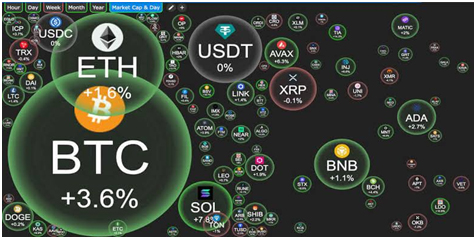

Is Crypto Heading Toward Another Price Surge Collapse? ( Image source: iMi Blockchain )

Red Flags Are Flashing

These are the things analysts are paying attention to right now:

- Token prices are exploding, frequently with no visible utility or path defined.

- Retail investors are coming in, driven more by TikTok memes than by due diligence.

- New tokens are debuting by the day and some for but a few hours before they disappear.

- Social media mania is catching up with research, with many buying off of memes and influencers.

These fads are not new. They are the same as previous bubble phases—where price and popularity sweep upwards until the bubble bursts.

What Exactly Is a Bubble?

An asset price bubble exists when prices rise so much beyond their true value. Crypto has seen its share of speculative frenzies. We’ve seen it in 2017, in 2021, and now, for some, again in 2025.

The driver isn’t always innovation. It’s more frequently FOMO—fear of missing out—instigated by news, celebrity promotion, and dreams of sudden riches.

What starts as excitement can quickly turn to irrational exuberance. And when the euphoria passes, history shows prices crash down as steeply as they rose.

#BITCOIN – In my opinion (https://t.co/SQPY1vECUA), the Bitcoin 2025 conference in Las Vegas did not bring anything new, apart from reaffirming that the Bitcoin “sect” continues to thrive as long as prices are rising.

The old market adage says, “Sell when the optimism becomes… pic.twitter.com/VJz7Mkakve

— Witold Mergist (@MergistWitold) May 31, 2025

What’s Different This Time?

Compared with past cycles, the crypto universe now is louder, faster, and far more mainstream. Digital assets are no longer an outlier. They’re showing up in super funds, political campaigns, and evening TV news.

Some of the key differences this cycle are:

- Crypto ETFs and tokenised securities gaining approval and attention

- Politicians mentioning blockchain as a policy topic

- Finance influencers creating viral investment content aimed at first-time traders

Throw in a mix of speculative NFTs, high-risk DeFi platforms, and tokenised games, and you’ve got a wild ride—filled with both opportunity and risk.

Also Read: U.S. Dollar Gains Pressure In The Last Operating Day Of H1

Why Experts Are Cautious

While innovation flourishes in blockchain, all price surges are not necessarily reflecting real progress. Most tokens are gaining attention purely through hype, lacking any real utility or long-term value.

Economists and market researchers are especially wary of:

Sudden, vertical price graphs with little consolidation

- Leverage and risky derivatives going mainstream among retail investors

- A flood of new entrants drawn by influencer hype

- Fewer people doing research, instead taking cues from viral videos or Telegram channels

That is, it’s more about speculation than smart investing.

What Normal Aussies Should Do

If you’re thinking of investing—or already invested some crypto—it’s time to slow down.

These are some rational suggestions for surviving the present market:

- Don’t get swept up in the crowd—excitement isn’t a strategy. Make decisions based on research, not just noise.

- Deal with tokens as shares—study the fundamentals

- Understand where we are in the cycle—booms don’t last forever

- Don’t put all your eggs in one basket—diversify

- Understand your exit strategy—not just when to get in, but when to sell out

- It’s not fear—it’s being realistic.

Bubble Slang vs. Long-Term Conviction

Let’s be clear: there is no one yelling “crash.” Some still believe in the long-term that crypto is worth something—especially in areas like decentralised finance, payments, or blockchain gaming.

Belief and blind hope, however, are not the same thing.

If you’re in crypto for the tech, great—don’t bother with chasing green candles or whatever else. But if you’re there to chase green candles, you may be inviting disappointment.

So, Are We in a Bubble?

We may not have a crystal ball, but the warning signs of an overheated market are becoming harder to dismiss. Quickly advancing prices, bets founded on speculation, and retail mania don’t have a history of ending quietly.

The reality? We may be seeing the earliest signs of another correction. Or perhaps this is just the natural growing pains of a volatile but growing market. Whatever it is, savvy money moves with caution, not emotion.

Closing Thoughts: Be Curious, Not Reckless

Crypto is not going away. But the landscape is changing—and fast. For those willing to listen, stay alert, and invest responsibly, there is still much opportunity.

But remember: markets don’t pay back panic—or foolish optimism. Markets pay back preparation, patience, and vision.

And so whether you’re an old pro or simply dipping your toes in the water, the question isn’t “Will it boom?” but “Are you ready if it doesn’t?”