China’s stablecoins may soon enter the global market after Beijing signaled a review of a roadmap supporting yuan-backed tokens. The State Council is expected to meet later this month to consider guidelines that could open the way for stablecoin development.

China considers allowing yuan-backed stablecoins to boost international use of its currency

A Shift in Policy Direction

If approved, the initiative would represent a departure from China’s earlier stance on digital assets. In 2021, authorities banned cryptocurrency trading and mining, citing concerns over financial risk. The rapid expansion of dollar-backed tokens and Washington’s stablecoin framework has now compelled Beijing to reassess its stance.

The roadmap will set responsibilities for regulators and outline risk measures. Officials familiar with the matter said safeguards will be central to preventing instability in financial markets. The plan would also establish limits for stablecoin use in commerce.

Senior Leadership to Review the Proposal

Senior leaders are expected to hold a study session by the end of August to define the framework for yuan-linked stablecoins. The agenda includes expanding global use of the yuan and assessing the role of stablecoins in international payments.

At the same time, regulators such as the People’s Bank of China would take charge of implementation once the plan is finalized. Details of the strategy could be released in the coming weeks, according to sources.

Yuan’s Position in Global Payments

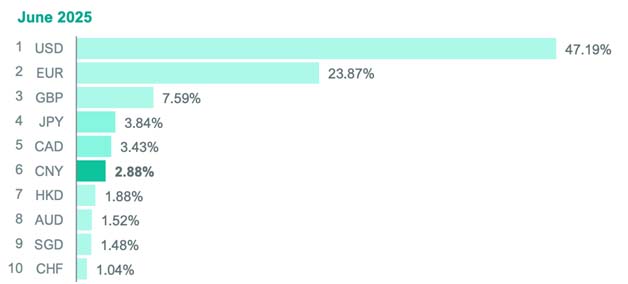

The yuan remains underutilized in global transactions despite China’s economic size. Data from SWIFT in June showed the yuan accounting for 2.88% of global payments, its lowest in two years. By contrast, the US dollar held a 47.19% share.

Persistent trade surpluses and capital controls have limited the currency’s international growth. Officials believe that a yuan-backed stablecoin could improve accessibility in cross-border settlements and counterbalance dollar reliance.

Hong Kong and Shanghai as Key Hubs

Hong Kong and Shanghai are positioned to lead the stablecoin rollout. Hong Kong introduced a new regulatory framework for fiat-backed stablecoins on August 1, making it one of the first jurisdictions in Asia with such laws.

Shanghai is simultaneously building an international operations center to expand the use of the digital yuan. Both cities are expected to serve as pilot bases for the proposed yuan stablecoin, according to the sources.

Role in Cross-Border Trade

China’s stablecoins are expected to feature in discussions with international partners at the Shanghai Cooperation Organization summit in Tianjin on August 31 to September 1. The meeting will include talks on expanding the use of the yuan in trade and cross-border payments.

One anticipated application is the facilitation of faster and cheaper transactions with partner countries. Stablecoins, typically pegged to fiat currencies, allow instant transfers at a lower cost compared to traditional methods.

Competitive Landscape in the Stablecoin Market

The global stablecoin market currently stands at $247 billion and could grow to $2 trillion by 2028, according to projections by Standard Chartered. Nearly 98% of existing stablecoins are tied to the US dollar.

Dollar-backed tokens dominate the space, but Beijing views yuan stablecoins as a tool to promote its currency internationally. With Washington moving ahead on regulation, China is keen to secure its position in the rapidly expanding market.

Also Read: SEI Price Declines as Market Tests Key Support at $0.3000

Next Steps for Beijing

The State Council’s roadmap will be crucial for setting the boundaries of China’s stablecoins. It is expected to include defined targets, regulatory oversight, and methods for preventing financial instability.

Should the proposal be approved, yuan-backed tokens may soon begin pilot phases in Hong Kong and Shanghai before wider rollout. Official announcements are anticipated in the coming weeks as leadership reviews the policy.