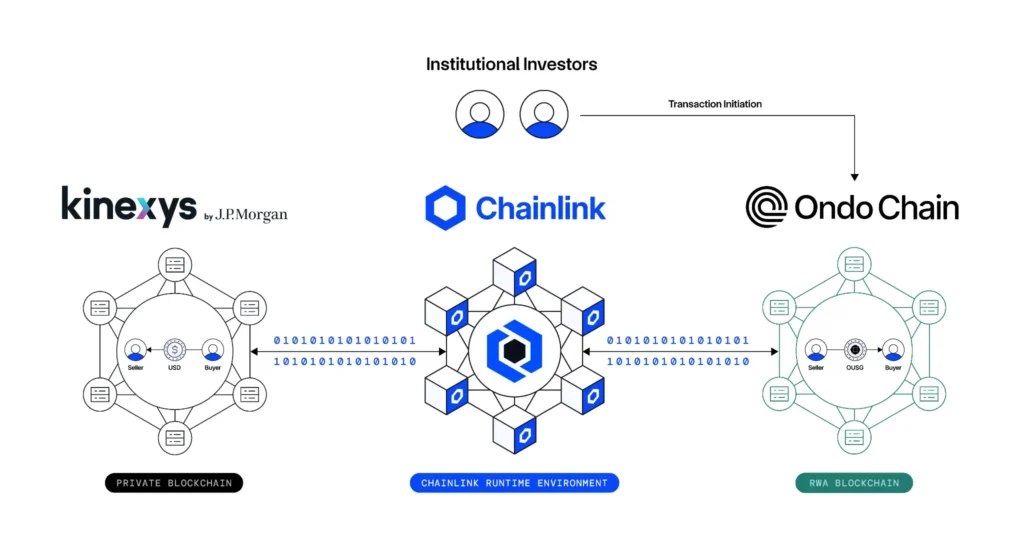

The movement to digitise financial markets has taken another step forward, as Chainlink, Kinexys by J.P. Morgan, and Ondo Finance successfully demonstrated a cross-chain Delivery versus Payment (DvP) transaction involving tokenised real-world assets (RWAs). The trial highlights how institutional-grade assets and digital payments can interact securely across separate blockchain networks.

The test was conducted using Chainlink’s Runtime Environment (CRE), a recently introduced off-chain infrastructure layer that allows for secure coordination of activity between public blockchains, private systems, and traditional finance. This development comes as more institutions explore the use of blockchain to facilitate the buying and selling of tokenised assets.

Image 1: (Source: X)

Digital Bonds and Blockchain Payments in Sync

The demonstration brought together three major components. Ondo Finance contributed the asset in the form of its tokenised U.S. Treasury fund, OUSG. The transaction was executed on the Ondo Chain testnet, which is designed to support tokenised financial instruments. Kinexys by J.P. Morgan provided the payment platform, a permissioned blockchain solution built to support institutional-scale digital settlement. Chainlink’s CRE served as the coordination layer, enabling both the payment and asset movements to happen simultaneously and securely.

The transaction was structured to reflect the standard DvP process, where the delivery of a security is contingent on the simultaneous receipt of payment. This model ensures that neither party in the transaction is exposed to risk from the other failing to uphold their part of the deal.

In this case, the digital asset (OUSG) was locked on the Ondo testnet. CRE then confirmed the buyer’s payment status through the Kinexys platform. Upon verification that the payment was successfully processed, CRE triggered the release of the tokenised treasury asset to the buyer. This workflow was completed without either the asset or the payment leaving their respective blockchain environments.

Chainlink’s off-chain infrastructure ensured that both legs of the transaction—the asset and the payment—were tightly coordinated. At no point did the system rely on trust between parties; the entire transaction was governed by code and completed with institutional-grade security measures.

CRE: Coordinating Cross-Chain Workflows

The Chainlink Runtime Environment is designed to allow developers and institutions to manage complex multi-network operations. In this scenario, it enabled a secure exchange between a public RWA blockchain (Ondo Chain) and a permissioned payment network (Kinexys). By operating off-chain, CRE avoided exposing the transaction to unnecessary risks while maintaining compliance standards.

The system functioned by monitoring smart contracts on the Ondo Chain for locked asset events. Once the asset was confirmed in escrow, CRE initiated communication with Kinexys to verify payment readiness. The payment was then authorised through secure API channels, and confirmation was sent back to trigger the asset’s release.

J.P. Morgan Chainlink Ondo

Today, @jpmorgan announced the successful completion of a cross-chain Delivery versus Payment (DvP) transaction between Kinexys and @OndoFinance, powered by @Chainlink

In this transaction, a tokenized U.S. Treasuries Fund (OUSG) on the public… https://t.co/4IKdJIt70j pic.twitter.com/KrrqemDy6n

— Zach Rynes | CLG (@ChainLinkGod) May 14, 2025

Johann Eid, Chief Business Officer at Chainlink Labs, noted that CRE was developed to meet rising demand for secure, cross-chain interactions in capital markets. He emphasised the value of a system that not only connects different blockchains but also integrates with traditional finance platforms to streamline tokenised asset settlement.

Kinexys’ role in this process was key. Its synchronised settlement design allowed CRE to validate the buyer’s balance and initiate the payment in advance of asset release. This architecture ensures that both asset and payment are cleared in a controlled and pre-validated sequence, reducing the risk of failed transactions.

Image 2: (Source: LinkedIn)

Expanding Tokenisation Through Infrastructure

The collaboration between these three firms demonstrates how tokenisation infrastructure is evolving to support more complex use cases. With over AUD 34 billion in tokenised RWAs now existing on public blockchain platforms, reliable settlement methods are becoming increasingly necessary.

Ondo Finance’s OUSG, which is backed by short-term U.S. Treasury bonds, is one of the most actively used tokenised assets in the sector. By enabling its transfer through a controlled cross-chain settlement, the partners have created a pathway for institutions to participate in onchain financial markets without compromising operational standards.

The trial also served as a launch for Ondo’s testnet, a blockchain purpose-built for RWAs. This network will eventually support a wide range of institutional-grade tokenised instruments, allowing for real-time settlement, enhanced transparency, and programmable financial operations.

Read Also: Chainlink Powers ASTR on Superchain as LINK Price Eyes $17 Target

Chainlink’s CRE, according to the company, can support a wide range of settlement types. These include DvP transactions on the same chain, across chains, or even involving off-chain payment systems such as SWIFT. The flexibility allows for broader adoption across varying technical and compliance landscapes.

The model used in this test did not involve transferring the actual assets between blockchains. Instead, CRE transmitted settlement instructions between systems, ensuring that both the asset and payment remained native to their original networks. This preserves the security and structure of each chain while allowing coordinated execution.