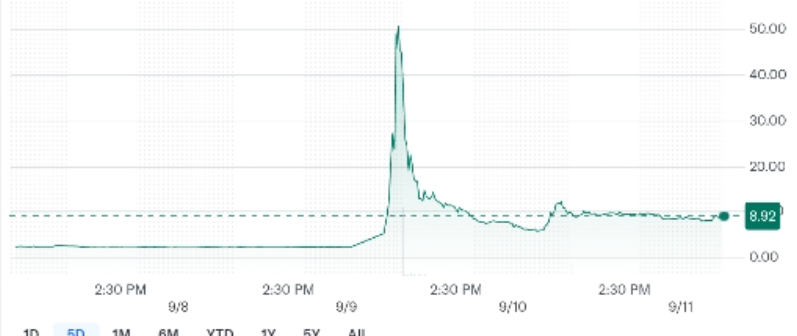

CaliberCos (NASDAQ: CWD) stock dramatically soared in early September 2025. Shares touched an intraday high of $48 before settling near $12. Trading volume reached 79 million shares, significantly above the average of 9.6 million. Caliber’s Nasdaq-listed shares surged more than 2,000% on Tuesday, but fell back to about $9 in Wednesday’s pre-market trading.

This rally came after the LINK treasury plan was announced by the company, which essentially focused on Chainlink tokens. This is a move that has captured the attention of both institutional and retail investor communities.

What Is the CaliberCos LINK Treasury Plan?

The treasury strategy of CaliberCos consists of gradually purchasing Chainlink (LINK) tokens. The company desires to build a large position with minimal market impact. It funds itself through its Enhanced Line of Credit (ELOC), cash reserves, and equity issuance.

The strategy is only for capital appreciation and staking yield. According to Chris Loeffler, CEO, the treasury plan is designed from a long-term view of digital asset integration. The plan establishes Caliber as the first listed company on Nasdaq with a Chainlink treasury asset.

Why Chainlink Is Central to the Strategy

Chainlink is a decentralised oracle network for smart contract connectivity. It bridges blockchain protocols with outside data, APIs, and payment systems. Its technology powers a plethora of DeFi and enterprise blockchain projects. Caliber’s decision reflects confidence in Chainlink’s infrastructure role. Investing in LINK, therefore, provides one with a platform to take a position on blockchain growth without being fully dependent on cryptocurrencies. The strategy thus sends signals about the disciplined manner in which digital assets will be integrated into corporate finance.

Chainlink connects blockchains to real-world data securely.

How Did the Market React?

Chainlink is a decentralised oracle network for smart contract connectivity. It bridges blockchain protocols with outside data, APIs, and payment systems. Its technology powers a plethora of DeFi and enterprise blockchain projects.

Caliber’s decision reflects confidence in Chainlink’s infrastructure role. Investing in LINK, therefore, provides one with a platform to take a position on blockchain growth without being fully dependent on cryptocurrencies. The strategy thus sends signals about the disciplined manner in which digital assets will be integrated into corporate finance.

Is Institutional Interest Driving the Rally?

The Caliber action is part of a more general institutional trend characterising digital assets. Corporate treasuries are increasingly considering cryptocurrencies for hedging or yield purposes.

LINK adoption by Nasdaq-listed companies represents a legitimate step forward for tokenised assets. Other companies have focused on Bitcoin or Ethereum, whereas Chainlink offered an infrastructure-specific exposure.

Institutional demand might stabilise markets if and when other players embrace similar strategies. On the other hand, some analysts maintain that the price boom could reverse due to market instability.

Caliber reflects a wider institutional shift toward using crypto in corporate treasuries.

Future Outlook for Caliber and LINK

The success of the Caliber treasury plan depends entirely on the crypto market conditions. LINK price fluctuations could weigh heavily on corporate balance sheets.

The company must handle risks of digital assets alongside operational growth. Investor sentiment is still fragile with volatility in the stock markets as well as crypto.

However, in its position, Caliber may open the doors for wider digital asset adoption across corporate finance. With that said, anybody interested in sustainability in the long term must commit to disciplined execution and provide clarity to shareholders on it.

Also Read: Ex-Crypto Fund Execs Bet Big on BNB with $100M Nasdaq-Listed Treasury Plan

FAQs

- What does the LINK treasury plan encompass for CaliberCos?

CaliberCos intends to use a slow and steady purchase strategy for Chainlink tokens for capital appreciation and for staking yields.

- How is the treasury plan funded?

The sources of funds are: Enhanced Line of Credit, cash reserves, and issuance of equity.

- Why did Caliber choose Chainlink?

Chainlink provides trusted blockchain connectivity supporting smart contracts and enterprise projects.

- How did the market respond to the LINK plan?

Shares surged more than 2,000% then stabilised, reflecting excitement and volatility risks.

- Does this point to a wider range of institutional acceptance of crypto?

Yes, the Nasdaq-listed adoption continues to signal growing interest towards integrating digital assets into corporate finance.