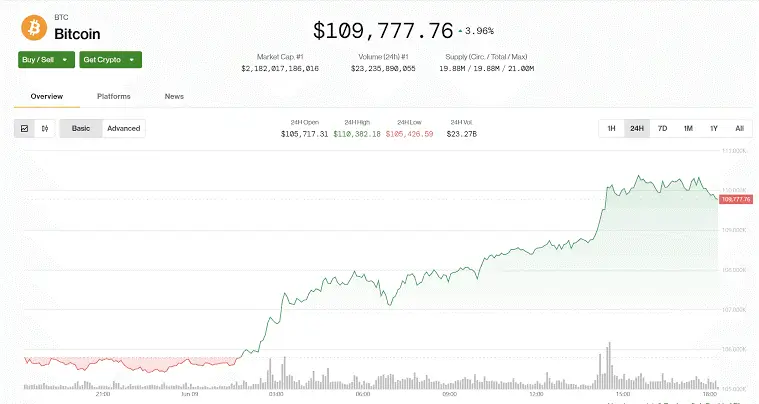

Bitcoin Slips Below $110K as Market Momentum Falters in Asia

Bitcoin is showing signs of fatigue.

In early Monday trading across Asian markets, BTC fell below the US$110,000 threshold — a dip that underscores a fading bullish drive and rising investor caution. After briefly rallying over the weekend, the crypto giant appears to have entered a consolidation phase, with price action stalling and sentiment shifting.

Although not dramatic, the latest price movement hints at a broader cooling in the crypto market.

Bitcoin Falls Below $110K Amid Asia Slowdown ( Image Source: CoinDesk )

BTC Hovers Below Key Resistance: The Calm Before a Move?

At the time of writing, Bitcoin trades just under the $110K mark. The decline follows a weekend high that initially sparked hopes of continued upward momentum. Instead, the move appears to have lost steam, with Asian traders showing restrained interest.

Key indicators reflect this cautious mood. Volatility remains low, futures activity is subdued, and inflows into crypto ETFs are slowing. Even strong US job data released on Friday failed to lift market enthusiasm — a signal that traders may be in wait-and-see mode.

Though the dip is slight, it’s enough to raise concerns about a potential correction ahead.

What’s Behind the Market Slowdown?

The cryptocurrency market operates in cycles — bullish momentum often gives way to brief pauses or retracements. This latest dip appears less a cause for panic and more a sign of exhaustion following recent rallies.

According to analysts at QCP Capital, there’s a visible pullback in risk appetite. Perpetual futures positions have thinned, and inflows into digital asset investment products have declined. The tone is consistent across the board — cautious, not fearful.

A few macroeconomic and geopolitical factors could be behind this hesitancy:

- Ongoing U.S.–China diplomatic negotiations in London

- The looming $22 billion U.S. Treasury auction

- Investors waiting for fresh economic data and market cues

Together, these elements create a fog of uncertainty that’s keeping traders on the sidelines.

Weekend Rally Fizzles Out: A False Signal?

Over the weekend, Bitcoin experienced a brief surge of around 3.3%, rising from about $105,400 to over $110,000. While this lifted hopes of a renewed bull run, the rally was short-lived.

By Monday morning in Asia, those gains had all but evaporated. Traders who joined late were quick to lock in profits, and without strong buying pressure, momentum reversed.

This pattern — short rallies followed by immediate cool-offs — suggests the market isn’t in panic mode but is certainly lacking conviction.

@CoinDesk @thesamreynolds Bitcoin dipping below $110K? Sounds like Asia needs a shot of espresso and a degen thread to wake up. ☕ ‘Market fatigue’ is just code for ‘not enough hopium in the system.

— Arfolomew (@Arfolomew) June 10, 2025

Market Psychology: Traders Stuck in Limbo

Picture a crypto trader in Hong Kong or Singapore waking up to the weekend’s BTC uptick. Alerts go off. Optimism builds. But within hours, the charts flatten again.

That’s the reality of a fatigued market: high anticipation, followed by hesitation.

Currently, many traders are paralysed by indecision. They’re not selling in fear — they’re holding out for stronger signals. This behavioural pattern is common during consolidation phases, where neither bulls nor bears are in control.

Also Read: Bitcoin Outflows Grow While Ethereum ETFs Attract Fresh Capital: Is Investor Sentiment Shifting?

What Should You Watch Next?

Traders and investors — from seasoned analysts to casual enthusiasts — should keep an eye on the following developments this week:

- BTC’s Hold Around $110K: A sustained recovery above this mark, especially with strong volume, could indicate renewed bullish sentiment. Failing to reclaim it might open the door to further downside pressure.

- US Treasury Auction: If the $22 billion auction surprises markets, it could ripple through both traditional and digital asset classes.

- On-chain and Institutional Data: Futures open interest and ETF inflows are vital indicators of market conviction. Continued weakness here suggests money is still parked on the sidelines.

- Volatility Levels: With Bitcoin’s implied one-year volatility currently low, a sudden spike could precede a significant price move — up or down.

A Moment for Both Veterans and Newcomers

Whether you’re a long-time HODLer or someone new to crypto, this phase is crucial.

For seasoned investors, it’s a time to refine strategy — to recognise the difference between a correction and a full reversal. This isn’t about fear; it’s about discipline.

For newcomers, this could be a good entry point, provided they stay informed. Bitcoin’s long-term trend is defined by waves, and current fatigue doesn’t erase its larger trajectory.

Above all, be alert. In markets like this, low volatility is often a precursor to sharp movement. The next major price swing could be imminent.

Final Thoughts: Breathing Room or Red Flag?

Bitcoin’s latest slip below $110K is less a collapse and more a moment of pause. The crypto market is clearly catching its breath after an intense stretch of upward movement.

Still, pauses like these don’t last forever. As investors weigh macroeconomic uncertainties, global diplomacy, and internal market data, one thing is certain — change is coming.

Whether this is the start of a deeper dip or just a consolidation before another rally remains to be seen. For now, traders walk the line between caution and conviction, eyes trained on the next move.