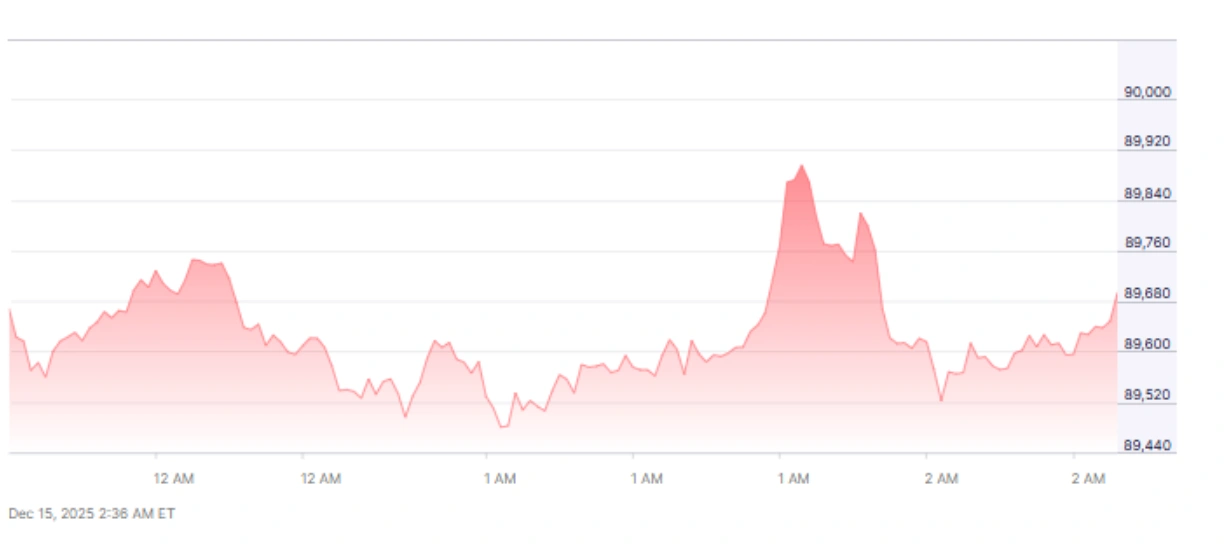

The Bitcoin price dropped to below $90,000 as a consequence of a general weak sentiment of investors in the global markets. The drop happened at the time of the weekend when there were not many people trading, and the price changes were easily exaggerated due to low liquidity. The price of Bitcoin is reflecting the decline of all digital currencies, and today it was the lowest at USD $89,600.

As uncertainty grew around the macroeconomic events that were going to happen, the market players took a cautious stance. The traders cut their risk by selling off their stocks in the crypto markets, among others, and waiting for the economy to send clear signals.

The fall of BTC below $90K reveals how sensitive the crypto markets still are to the sentiment surrounding global risks.

Bitcoin slid below $90,000 amid weak weekend trading

Why Are Macro Events Influencing Bitcoin Price Today?

Investors are targeting a macro calendar that is so full of important economic data and central bank decisions that it will be hard to miss anything. The inflation readings and the labour market data will always be the main indicators of the monetary policy direction. Any surprises could alter the interest rate expectations and thus influence the price of risk assets such as Bitcoin.

The central banks of the developed economies are currently under heavy surveillance, and they could be forced to make policy changes that would impact liquidity conditions.

Generally, tighter financial settings lead to a decline in the prices of speculative assets, while easing expectations frequently have the opposite effect. Hence, the BTC macro events’ impact is critical to short-term crypto price movements.

The uncertainty about these developments has led traders to take a defensive stance. A lot of investors would rather sit on the fence and wait for a confirmation signal before putting their money into the high-risk assets.

How Does BTC Falling Below $90K Reflect Market Sentiment?

The price of Bitcoin, which has fallen below USD $90,000, is a sign that the bearing of the risk has spread to the whole financial market. The price of Bitcoin today is in line with the general nervousness in stocks and commodities. The trading activity has gone down that which indicates the lack of conviction rather than panic selling.

Traders using technical analysis are keeping a close watch to see where the prices will not go below, and USD $86,000 is often quoted as the main area. If the price goes down that much, it will be harder for buyers to stay in the market. Still, if the price remains, it will be a signal for consolidation instead of deepening losses.

Bitcoin’s market share or dominance, which is the percentage of the total market accounted for by Bitcoin, has not changed very much, and that tells us that the fall is not one specific coin’s problem but a case of the entire market. The leading altcoins (and their trading) have also gone down in price, along with the cautious attitude that has taken over the traders’ minds.

Bitcoin below $90K reflects broader market risk aversion

What Could Shift BTC Macro Events to Impact Positively?

A positive take might come from the macroeconomic data, which would imply that financial conditions are going to ease. With inflation going down or the economy growing at a slow pace, the market, which expects easy policy, will come alive again. Such a situation is usually the one where the risk assets, including crypto, gain the most.

The lift in traditional markets may as well trickle down to the digital assets. In case the stock market gets back up and the volatility comes down, Bitcoin might well have been given the chance to move up again. Investors’ interest is very much correlated with the level of uncertainty in the market.

The data from the derivatives market and funding rates will still be monitored closely. The increase in long positions might be seen as the emergence of new confidence; on the contrary, the continued caution may lead to the limitation of short-term gains.

Can Bitcoin Reclaim The $90K Level Soon?

The reclamation of USD $90,000 will most likely hinge upon the stabilisation of sentiments and the revival of demand. The buying interest that is kept up might send Bitcoin back passing the psychological barrier. But at the same time, traders may continue in a selective mode until macro conditions get clearer.

One of the realistic scenarios is still the short-term consolidation. The majority of experts predict that Bitcoin will be priced in a limited range while the economic signs are digested by the markets. The narrative of BTC dropping below $90K may still hold until the considerably weaker signs of change appear.

Long-term positioning of institutional players is positive despite the short-term pressure. The investors executing the strategy are still viewing the price dips as the best moments to add to their already held positions.

Is The Broader Crypto Market Also Under Pressure?

The larger crypto market has been responding in the same manner to Bitcoin’s lack of strength. Major altcoins have suffered and are still suffering lesser to the inactivity of the trades done. This points out a general risk-off attitude rather than relating it to specific assets.

The market is prepared for and keeps its eyes on the sudden volatility that could come as a result of macro announcements. Until those events are over, there is likely to be a cautious attitude ruling the behaviour of the crypto trades.

Also Read: BTC Price Post-Fed Announcement: Bitcoin Rebounds Strongly

Frequently Asked Questions

Q1: What does BTC falling below $90K indicate?

Investors’ risk-taking willingness goes down, and thus their caution increases as major macroeconomic events approach.

Q2: Why is the Bitcoin price today sensitive to macro data?

The state of macro influences directly and heavily the rates of liquidity rates for Bitcoin since these are the determinants of its demand.

Q3: Can Bitcoin recover above $90K quickly?

The return is contingent upon the positive mood of the market, the facilitative economic reports, and the restoration of market trust.

Q4: Does this move suggest a long-term downturn?

Not at all, since the price action indicates short-term insecurity rather than a confirmed long-term trend.