Brightstar Resources has signed a non-binding Memorandum of Understanding (MoU) with Paddington Gold (a Norton Gold Fields subsidiary) to process gold ore from its Lady Shenton deposit at the Paddington mill, located 37 km south of the Menzies project in Western Australia.

The agreement paves the way for a low-capex gold mining start-up and accelerates production timelines for Brightstar’s Menzies gold project, one of WA’s emerging near-surface gold hubs.

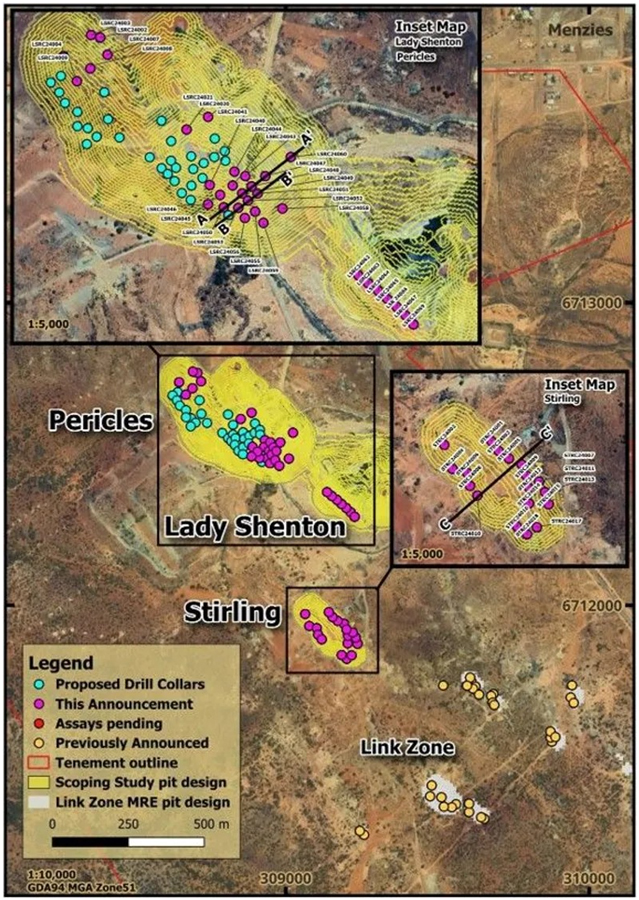

Lady Shenton pit and surrounding Menzies gold belt terrain. Source; Investing News Network

Ore Deal Highlights

The MoU outlines a proposed ore purchase agreement in which Brightstar will deliver run-of-mine (ROM) ore to Paddington’s 3.8 Mtpa mill facility for processing. Commercial terms, haulage logistics, and payment mechanisms are under negotiation, with binding terms expected by Q4 2025.

Key Benefits of the Deal:

- Removes the need for standalone processing plant development

- Lowers upfront capital requirements

- De-risks initial production phase at Lady Shenton

- Creates an early revenue opportunity by accelerating the timeline from ore extraction to gold sales.

- Aligns with Brightstar’s staged production strategy across Menzies and Laverton assets

About the Lady Shenton Deposit

Located in the heart of the Menzies Goldfield, the Lady Shenton deposit is part of a larger 500,000 oz mineral resource base Brightstar has delineated across Menzies. The current mineral resource estimate for Lady Shenton alone stands at:

- 370,000 tonnes @ 2.7 g/t Au for ~32,000 oz of gold

The deposit’s near-surface geometry and shallow oxide profile make it highly suitable for open-pit extraction and short-lead development.

Brightstar is currently completing mining approvals in WA, including permitting, heritage clearance, and waste dump licensing for Lady Shenton.

Also Read: WA Government Allocates A$1.4 Billion to Mining Diversification in 2025–26 Budget

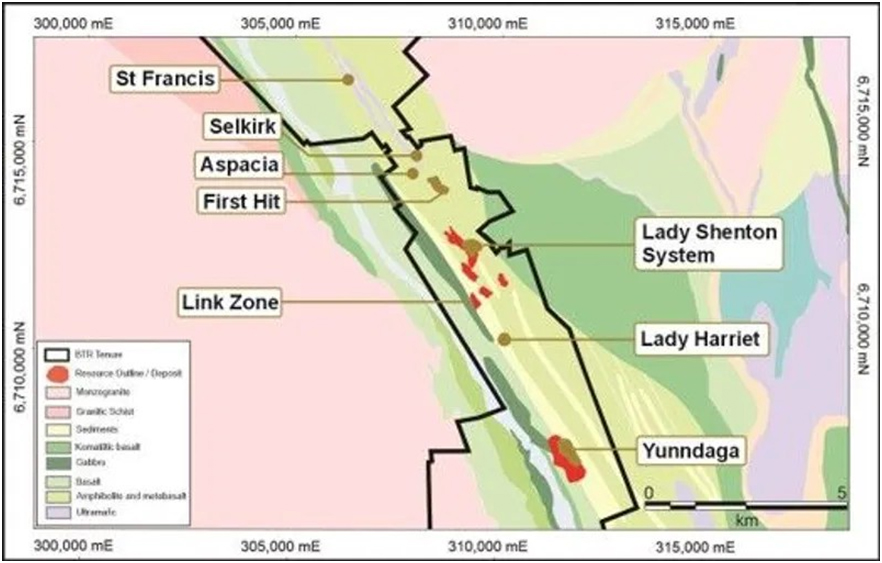

Overview of the Lady Shenton deposit site and nearby mineralized zones within the broader Menzies region of Western Australia. Source; Investing News Network

Leadership Commentary

Brightstar’s Managing Director, Alex Rovira, described the agreement as a strategic step that aligns with the company’s goal to advance gold production through a cost-effective and adaptable development model.

“The Paddington agreement allows us to transform Lady Shenton from a resource into revenue, without the long timelines and high costs associated with plant construction,” Rovira stated.

“This milestone reinforces our staged approach to unlocking value across Brightstar’s portfolio.”

Strategic Outlook for Brightstar

The agreement with Paddington complements Brightstar’s broader regional strategy, including:

- Fast-tracked open-pit mining at Lady Shenton

- Pre-feasibility studies for nearby deposits in Menzies and Laverton

- Scoping studies to assess satellite deposit integration

- Exploration programs across underexplored shear zones

In parallel, Brightstar is also advancing its Laverton gold project, targeting +100,000 oz annual production across both hubs.

Market Insights and Regional Implications

The Brightstar–Paddington ore deal reflects a wider shift in the Western Australian gold sector toward leaner production models and infrastructure sharing. As exploration success continues across the Menzies and Laverton belts, juniors like Brightstar are prioritizing speed-to-market strategies over costly plant builds.

Investors have responded positively to Brightstar’s recent moves. The company’s ability to secure a toll treatment route without issuing equity or debt signals strong operational discipline, an increasingly rare trait among junior miners.

Additionally, Brightstar’s agreement validates the value of stranded deposits that sit within trucking distance of established mills. This opens the door for:

- Further MoUs with underutilized plants across the WA Goldfields

- Acquisition interest from larger operators seeking low-cost growth ounces

- Government and community support, as fast-start projects create local jobs and royalties without long development cycles

With gold prices remaining robust above USD $2,300/oz, regional production deals like this could shape a new wave of collaboration between juniors and mill owners — especially as ESG and capex pressures tighten across the sector.

What’s Next?

According to the company’s roadmap:

- Q3 2025: Finalise haulage contracts and Paddington ore purchase agreement

- Q4 2025: Commence mining activities at Lady Shenton

- H1 2026: First gold production and cash flow generation

Brightstar is also assessing potential to stockpile ore during approvals, which could further compress time to revenue once mining begins.

Conclusion: Low-Cost Launch into WA Gold

The Brightstar Menzies ore deal represents a low-risk, high-impact catalyst for WA’s gold sector. By leveraging Paddington’s established infrastructure, Brightstar sidesteps heavy capital spend and accelerates its entry into gold production.

With Lady Shenton’s shallow ore body, supportive geology, and strategic proximity to third-party processing, this agreement may well serve as a blueprint for similar low-capex gold startups across Australia.