BNB, the utility token of Binance, crosses the four-figure threshold and is trading above US$1,000, a threshold that represents the confluence of three trends: protocol and product development, a better (or at least clearer) regulatory environment, and an institutional allocation wave. It is a price threshold that resonates because it converts utility-token fever into a mass-market meme and gets institutional investors, banks, and policy-makers to sit up and notice. (CoinDesk)

BNB shatters the $1,000 mark, driven by tech innovation, regulatory clarity, and growing institutional adoption (Image Source: InteractiveCrypto)

The market trend, the facts you cannot avoid

On 18–19 September 2025, BNB pierced above US$1,000 for the first time ever, spurred by rising trading volumes and strengthened institutional and large holder demand. The breakout puts BNB into crypto’s market capitalization big league and invites direct comparisons with previous major token breakouts. Traders identify tight order books and aggregated bids as immediate causes of the sudden spike. (CoinDesk)

Three drivers converging

1) Network and technology utility

The BNB price today captures more than just token burns and exchange rebates. The BNB Chain (and its forthcoming product layers) is showing further on-chain usage, new DeFi and gaming applications, and further staking and yield products that give the token continued utility in an expanding ecosystem. Product sets and devs are providing functionality that transforms BNB into something beyond a transaction token; it’s creating a rails-and-services story that institutional allocators can get behind. Market commentary links increased on-chain usage and utility to better price discovery for BNB. (AInvest)

2) Transparency around regulation and custody pathways

Greater regulatory oversight during the last few years pushed issuers and exchanges of tokens to mature rapidly. Cues reassuring investors about nervousness, such as releases stating that regulatory bank custody arrangements are in the pipeline and the progress of negotiating compliance-related phrases, improve sentiment. Binance has been working with banks (for instance, BBVA) to offer off-exchange custody arrangements, an innovation that reinforces institutional faith in holding assets related to Binance’s environment. (Reuters)

3) Institutional demand and new product launches

Institutional demand is now a done deal. A series of partnerships, product filing, and big-corp buys propel the narrative away from retail frenzy to financial-market use case. Asset managers and corporate treasuries are flagging big-money allocations to BNB, direct purchases, custody setups, and structured products. In contrast, product filings for BNB funds indicate simpler on-ramp channels for big money. These are merely the flows that move markets when liquidity is tight. (The Economic Times)

How specific news biased the market this week

Market experts point to a string of bullish news: a relief in perceived regulatory pressure (dispatches of DOJ meetings and surveillance agreements), institutional partnerships, and rumors of giant corporate hoards, some including corporate buys spotted by on-chain observers and reports over the last couple of weeks. They were coincident with a benign macro tailwind as risk assets rebounded from central-bank signals, setting a liquidity environment primed for a spillover. (CoinDesk)

A closer look at institutional cues

Franklin Templeton and other traditional asset managers have formally signaled more earnest work on digital-asset products tied to large tokens, reducing frictions on institutional flows. These tie-ups give CIOs an audit trail and governance structure to safeguard allocation. (The Economic Times)

Corporations and some corporates have started to buy BNB in size — they are not necessarily on-chain whale buys; they are frequently OTC blocks or through custodian conduits, which reduce market slippage but are genuine demand nonetheless. Corporate issuances and filings across the previous quarters attest to this fact. (Investopedia)

BREAKING:

Franklin Templeton’s official Digital Assets account confirms partnership with DBS Bank and Ripple to launch tokenized trading & lending solutions via the Benji Technology Platform. $XRP is at the core of the new financial era. pic.twitter.com/OPYR8UbROG

— John Squire (@TheCryptoSquire) September 18, 2025

The technical backdrop, why momentum accelerates

Crypto order books are shallower than equities or FX ones. That structural reality is that price action accelerates when a large and concentrated buying wave hits. BNB’s seemingly order-book liquidity at the $900–$1,000 level seemed paltry, approaching four figures; institution and OTC supply swiftly cleared resting sell orders and advanced the visible price, attracting momentum traders and retail entrants. That feedback loop is the basis on which the token can take a steep parabolic trajectory on brief time scales. (CryptoRank)

The human factor, banks, exec, and the new normal

This rally is social as well as financial. Public courting of bank alliances by CEOs, regulated BNB fund applications, and vocal calls by crypto leadership for bank onboarding create cultural momentum. Tweets and remarks from executives generate headlines and FOMO; when that social signal is augmented by product and regulatory progress, professional allocators sit up and take notice, investing accordingly. A few big-name endorsements or some major corporate buys can convert curiosity into balance-sheet commitments. (CryptoDnes.bg)

4,421 regional banks in US are sitting on a $500 billion problem they don’t even know how to solve. Integrating crypto rails:

Most people think crypto adoption is about retail users getting excited about buying more Bitcoin.

Actually? It’s about the 11,700 banks globally that… pic.twitter.com/Omq5wcB7EJ

— Tomer Sharoni (@TomerSharoni) September 15, 2025

Risk and a narrow margin to capital headlines

Sensitivity to regulation is the flip side of rapid adoption. Legal good news is petrol: adverse rulings or new enforcement action are the opposite. Binance’s recent history in regulatory matters, large fines and compliance orders in previous years, still taints investor confidence, so any sign of capital healing by the law or, conversely, new attention, can suddenly turn back gains. That regulatory tightrope act is one of BNB and closely exchange-ecosystem-alike tokens’ top structural risks.

Early warnings for investors and allocators (what to look out for now)

- Custody disclosures, bank custody partnerships, or institutional custody reduce friction on large flows. Reuters’ BBBA announcement is the kind of news that does matter. (Reuters)

- Fund filings, N-1A or similar filings for BNB products, are indicative of institutional on-ramps. Recent reports and filings confirm the build-out of the same vehicles. (Coinspeaker)

- OTC/whale accumulation, large OTC buy, and corporate amassing (e.g., the rumored Nano Labs and CEA buys) are a direct demand sign. (Investopedia)

- Regulatory headlines, DOJ negotiations, tracking outcomes, or guidance from large jurisdictions will quickly shift sentiment. (CoinDesk)

Investors should watch for custody partnerships, fund filings, whale accumulation, and regulatory headlines, all key signals shaping BNB’s next moves (image Source: Jersey Finance)

Short FAQ (traders’ quick-fire questions now)

Q: Did BNB really hit US$1,000?

A: Yes — different market sources report BNB hitting the four-figure mark in mid-September 2025.

Q: Institutional adoption or retail pump?

A: The rally has some mixed reasons behind it: social frenzy and retail momentum have a role to play, but fund filings, recent custody transactions, and corporate purchases talk of strong institutional demand.

Q: Will regulation kill the rally?

A: Flows are facilitated or restrained by regulation. Institutional access is facilitated by clear product and custody regulations; enforcement or the application of new regulations can shift sentiment in a hurry. Watch announcements from regulators closely.

Tokenomics deep dive, supply, burns, and staking that matter now

BNB’s price action is based on a plain supply-and-demand narrative, and its supply side now appears more constrained than it did several years ago.

Binance also has quarterly burns on top of protocol-level fee burns (BEP-95 and adjacent mechanisms). These burn BNB out of circulation both on a fixed rate and activity-driven transactions. Recent reports and token-economics digests estimate high total burns up to 2025, with continually improving developers aimed at optimizing fee-burning mechanisms correlating network activity with token scarcity. That creates a conceivable scarcity narrative: as it gets more demanding, the shrinking supply enhances price movements. (Figment)

Staking utility and on-chain utility are also included. BNB now has uses in exchange fee rebates, staking rewards, on-chain voting, and as gas on BNB Chain. These types of utility hooks translate speculative demand into protocol usage, which still generates activity when retail interest dips. In short, the token-paired engineered deflationary forces with growing real-world rails, and that’s one of the reasons institutions look at BNB as greater than just an exchange token.

The beauty of BurnBux is that the burn is fully algorithmic and tied to trade volume. Every transaction takes 3% out of circulation forever, meaning the more activity, the faster supply shrinks.

Here’s a simulation:

With just 0.5% daily turnover, supply steadily declines over… pic.twitter.com/5ra0VYN0bl— BurnBux (@BurnBux) September 15, 2025

On-chain signs and smart-money actions, what to watch out for (without making up counts)

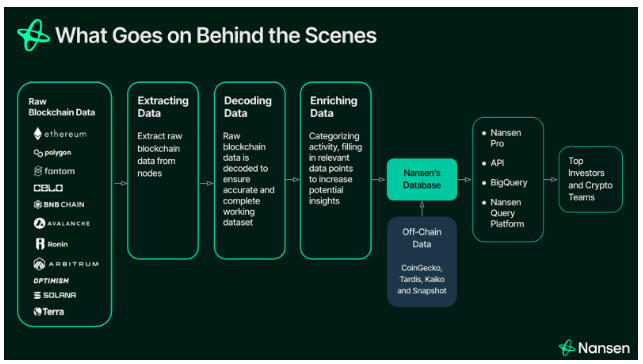

Analysts employ on-chain analysis tools (Nansen, Glassnode, Chainalysis) to find accumulation, custody flows, and whale activity. Watch out for the following repeatable signs:

- Centralized exchange net inflows vs. net outflows, large outflows typically reflect accumulation in wallets or cold custody.

- High-wallet cohort growth, rising balances in the top 100/1,000 addresses may be a sign of smart-money accumulation; Nansen reports usually emphasize increasing cohorts of whales.

- Stablecoin mint spikes, sudden spikes in USDC/USDT minting are common only ahead of major buys because buyers convert fiat to stablecoins before they make major trades.

- OTC desk volumes and dark-pool fills, these indirectly get reflected in increased off-book flows; wallet labels and custodian addresses at times reflect such activity.

Recent analysis attributed institutional custody transactions and whale clustering to the BNB move; metrics like Nansen and on-chain dashboards provide the underlying telemetry to confirm trends without requiring exact single-day volumes in a public article. On-chain data, if utilized, provides data stamps and source hyperlinks so readers can verify the snapshot.

On-chain signals like whale wallets, stablecoin spikes, and exchange outflows reveal smart-money moves driving BNB’s momentum (Image Source: Nansen)

Institutional rails and custody, why banks matter for BNB’s next upswing

Institutional adoption is typically a hostage to custody: unaffiliated, regulated custody reduces counterparty risk and soothes compliance groups. Tales later tell of Binance partnering with banks such as BBVA (and other mentioned custodians within FT and Reuters stories) to offer off-exchange custody solutions. Those arrangements are significant: they enable pension funds, asset managers, and family offices to take delivery of BNB without exposing assets to exchange operational risk. That institutional comfort is a key ingredient if large-scale allocations continue.

Deutsche Börse’s AnchorNote solves a critical institutional pain point: settlement risk in off-exchange trading

Custody-native settlement means assets never leave regulated custody during trades

This is the infrastructure evolution institutions need pic.twitter.com/QpD8hUBJ3Z

— BitSafe (@BitSafe_Finance) September 18, 2025

Trader’s playbook, execution, sizing, and risk controls

If you’re an active trader or allocator looking to position around BNB’s structural story, here’s a practical playbook:

Sizing & allocation

- Treat BNB as a higher-volatility allocation within a diversified digital-asset sleeve.

- Use position sizing that limits drawdown exposure — e.g., risk only a small percentage of portfolio NAV per trade.

Entry strategy

- Prior staged buys: ladder into positions within a range (VWAP-type) to reduce slippage in thin order-book regions.

- Use OTC desks for large blocks to avoid front-running visible order-book liquidity.

Execution strategies

- Use algorithmic VWAP/TWAP buys for large buys on exchanges.

- Use prime brokers and OTC liquidity providers for institution-sized flows; have KYC/custody in place upfront.

- Monitor funding rates and open interest; unbalanced funding is a potential indicator of crowded trades and quick reversals.

Risk controls

- Hard stop-loss (relative size) and dynamic trailing stops to lock profit in a volatile parabolic.

- Stress-test positions for margin-call cascades: simulate a 30–50% intraday drawdown to safeguard capital and margin buffers.

- Have a liquidity reserve; crypto rallies can reverse rapidly when leverage is unwound.

Exit plan

- Stage exits into deep liquidity bands and takes profit in tranches; avoid completely exiting at the momentum top when depth vanishes.

- Use hedges (inverse perpetuals, put options) if available and reasonably priced to protect against large exposures in sucking rallies.

This playbook likes to be conservative with engagement: parabolic rallies are quick money, but also tempt quick reversals that punish over-leverage.

Scenario stress tests, three likely regulator/market scenarios, and responses

Scenario A, “Clearance and scale”

Regulators keep issuing custody and product rules; custodial rails rise and institutional flows persist. Result: extended high valuations, gradually but steadily deeper books. Trader response: scale into longer-dated contracts, utilize covered call strategies for yield.

Scenario B, “Headline shock”

A high-profile enforcement action or adverse regulatory ruling against Binance or associated services. Effect: abrupt outflows, liquidity shortage, and lower price discrepancy. Trader response: decrease leverage, carry more cash, employ puts or inverse positions for hedging.

Sequenced macro risk-on rally and dovish central bank policy push general risk assets higher; BNB rises by contagion. Outcome: rapid rally driven by liquidity, but also crowded position. Trader reaction: monitor funding rates and unwind orders to not get caught out by deleveraging abruptly.

In preparation for each of the three: size defensively, note entry/exit triggers, and stress capital allocations vs. adverse rapid-market moves.

Also Read: Crypto Market Reacts After FOMC Rate Cut — Bitcoin, Ethereum and Altcoin Outlook

Regulatory news and market implications, what could turn sentiment around

Regulatory development governs the length of any rally. The key dynamics:

- Custody clearings & bank relationships drive inflows by validating holdings. Positive rulings remove counterparty risk and engage big allocators. (Financial Times)

- Enforcement actions or penalties against Binance or big service providers trigger rapid repricing and can lead to forced liquidations. Earlier enforcement events prove how mood shifts rapidly.

- Market structure reforms (e.g., asset segregation requirements, more transparent ETF structures) can lengthen investor horizons and enhance liquidity; their absence remains a source of headline risk.

Follow regulatory calendars, major court filings, and bank partnership announcements as near-term catalysts.

Practical monitoring checklist (daily/weekly indicators)

- MMF redemptions & macro rate signals (weekly).

- Stablecoin issuance (real-time via issuers’ dashboards).

- Exchange order-book depth and visible net flows (real-time).

- Nansen/Glassnode whale-cohort metrics (daily).

- Custody partnership and fund-filing announcements (news alerts).

These indicators enable you to connect macro liquidity, on-chain plumbing, and institutional readiness.

Final thought — temper ambition with humility

BNB’s four-digit watermark represents a rare intersection of tech utility, token engineering, and institutional on-ramps. Convergence is a source of promise but also concentrates risk in a single token with profound reliance on a single ecosystem and exchange. Traders and institutional investors black-boxing BNB as a “pump” are not nuanced: custody solutions, burn mechanisms, on-chain dynamics, and regulatory developments all affect to which and for how long this rally runs.