Tokenisation is running wild in the real world. The real-world asset (RWA) tokenisation market was worth approximately US$24 billion in 2025 and is developing rapidly as funds, custodians, and regulators test actual, revenue-generating use cases. (CoinDesk)

Global organisations and policy networks increasingly view tokenisation as a market structure shift and not merely a niche fintech development. The World Economic Forum’s recently released comprehensive report argues that tokenisation has the potential to disrupt issuance, trading, and custody if infrastructure and regulation keep up. (World Economic Forum Reports)

Predictions are everywhere: there are market consultants who predict tokenised assets in the trillions within a decade, and doomsday consultants who claim the ride will be bumpy and long. This variance matters: it dictates where the capital flows, to whom infrastructure is invested, and how regulators act. (Mordor Intelligence)

A sequence of commercial pilots, private property tokenised, funds tokenised, and T-bills tokenised now show proof of concept to the world’s eyes. That commercial push and bigger players in the background constructing tokenised ETFs and funds is the reason the discussion switched from “if” to “when.” (Reuters)

Tokenisation hits US$24B in 2025, with real estate, funds, and T-bill pilots proving it’s here to stay (Image Source: Crypto News

What we refer to as tokenisation (short, simple English)

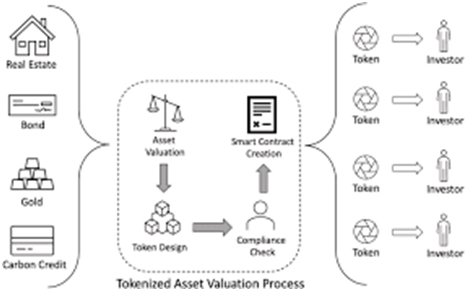

Tokenisation involves taking a claim on an asset, a flat in a building, a bond, a stake in a fund, and representing it as a digital token on a decentralised ledger. That token then has legal rights (if the model is properly engineered), settles immediately on-chain, and can be programmed into smart contracts, driving payment, reporting, and compliance.

In practice, tokenisation is a toolkit: there are law wrappers, custody rails, token standards, on-chain transactions, and off-chain governance. When all of them are put together, markets become faster, fractional, and more inclusive.

Tokenization converts real-world assets such as real estate, art, or financial instruments into blockchain-based tokens, making them divisible, tradable, and accessible on a global scale while creating new opportunities for investors and asset owners.

Microblog by @antgrasso pic.twitter.com/jnCdTl7wu7

— Antonio Grasso (@antgrasso) September 10, 2025

Why is now important?

Three things simultaneously:

- Infrastructure maturity. Controlled trading platforms and token-issuance facilities are moving from pilot code to production. Institutional token issuers and regulated custodians run live programmes. (World Economic Forum)

- Institutional demand. Trustees and asset managers need to see efficiency gains: lower cost of reconciliation, faster settlement, and broader distribution. Tokenised ETFs and tokenised fund structures are being considered by large firms. (InvestmentNews)

- Regulatory engagement. Multilateral bodies and national regulators are thrashing out agreements on digital securities and on-chain cross-border settlement. It’s piecemeal, but it’s occurring.

In short, the tech is powerful, capital requires it, and the rule-makers are finally waking up and taking notice.

How tokenisation replumbs the finance pipes, an example

A US$100 million building block of business and selling a small percentage today involves mountains of legal work, custody settlements, and high costs.

Tokenisation divides that share into millions of tokens, one of which is a legally binding share. An investor anywhere on the earth can purchase a fraction of the value of a dollar, trade it on a compliant exchange, and automatically start receiving rental payments from a smart contract.

Not science fiction: pilots and controlled funds already demonstrate this flow. Tokenisation reduces issuance friction, pays out sooner, and allows for more granular price discovery – all of which can release stranded capital and facilitate participation. (Deloitte)

real estate has always been the ultimate RICH MENS GAME

million-dollar estates, skyscrapers, commercial plazas… things most people admire from the outside but never touch

but what happens when ownership becomes digital, divisible, and liquid? suddenly, the door cracks open… pic.twitter.com/L2MMfHTYzm

— Waziri ♞ (@akuwazir) September 13, 2025

The size of the prize, highly heterogeneous estimates, and the same direction

Not everyone agrees on the speed at which tokenisation will advance. Commercial research reports have envisioned multi-trillion markets a decade or more hence; others see somewhat more gradual change.

- A market forecast (commercial) puts asset tokenisation on a rapid growth path to US$13–14 trillion by 2030 in one estimate. (Mordor Intelligence)

- McKinsey is more cautious, with a tokenised opportunity of less than US$2 trillion in 2030 in its base case, with further upside in scenarios. (Ledger Insights)

Why the difference? Different assumptions on regulation, cross-border standards, and whether tokenization simply digitizes existing assets or releases new sources of value.

The lesson for investors and product teams: anticipate heroic growth, but develop products that can succeed in a mosaic regulatory environment.

Map of real, commercially transacted use cases

- Tokenised money-market and fixed-income funds. Tokenised money-market and fixed-income funds are settlement time-reducible and programmatically redeemable. Already tokenised, some large managers have tokenized and have money-market products. (Yahoo Finance)

- Tokenised Treasuries and short-duration sovereign exposure. Private managers and jurisdictions launched tokenised T-bill funds to make short-duration government bonds tradable on chains.

- Private markets: private equity & debt. Fractional tokens provide access to retail and smaller institutions to erstwhile illiquid private deals, and provide secondary liquidity for limited partners.

- Real estate: Tokenised ownership and fund units lower minimum investment thresholds and speed up fundraising for developers. Projections see enormous upside in property tokenisation in the coming decade.

- Commodities and other assets (art, carbon credits). Tokenisation provides for exact provenance, divisibility, and tradability to hitherto middleman-mediated markets.

Various use cases have differing legal and operational requirements — a tokenised real-estate fund differs from a tokenized Treasury product.

Who’s building the ecosystem players?

- Asset managers and incumbents. Large asset managers experiment with tokenised funds and tokenised ETFs. Incremental rollouts expected over the overnight revolution. (InvestmentNews)

- Issuance platforms. Token issuances, KYC/AML, and registry service providers provide the rails for compliant tokens.

- Exchanges and custodians. Traditional custodians and regulated exchanges embrace DLT rails or pair with crypto natives to custody tokens and enable secondary trading. (World Economic Forum)

- Infrastructure providers. Stablecoin issuers, on-chain settlement layers, and cross-chain bridges enable composability and liquidity.

The disruptor-up-ending-incumbent overnight narrative underestimates the strength of trust, governance, and legal wrappers that remain in the hands of big institutions.

Tokenisation’s ecosystem spans managers, issuers, custodians, and infra builders, yet incumbents still hold the keys (Image Source: AInvest)

The investor script, which actually shifts for institutional and retail investors

For retail investors: tokenisation lowers minimums and improves access to products like private equity or prime property that were out of reach for players at scale before.

For institutions: tokenisation reduces settlement cycles, decreases reconciliation expenses, and enables further fractionalisation and product programmability.

For markets, improved price discovery and quicker settlement can reduce counterparty and settlement risk, provided that legal rights and custody are secure.

The legal and regulatory fault lines

Tokenisation is at a legal crossroads.

- Tokens must be tied to enforceable legal rights, or they are essentially information records of no utility. It is difficult to develop legal wrapping that can stand up to the proof of litigation across borders.

- Regulators have an interest in investor protection, AML practices, and market integrity. Some jurisdictions rush to deliver frameworks to them; others fall behind, delaying rollouts.

- Cross-border flow needs harmonised standards, or tokenised assets will get fragmented and less liquid across borders. That’s why global regulation is needed, and that’s why industry associations call for it.

In short, the tech can outpace the law. Successful tokenisation projects involve legal engineering and technical design from day one.

Risks that matter (and how teams are mitigating them)

- Ownership or custody failure and inconsistent on-chain ledgers. Mitigation: insured custody, regulated custodians, open legal registries.

- Excessive regulation or confused rules in markets. Mitigation: compliance by design, involve regulators, strong KYC/AML.

- Liquidity illusion. A token is tradable on a ledger with no real buyers. Mitigation: primary placement design and regulated secondary markets, market-making.

- Technology risk (bridge exploits, smart contract vulnerabilities). Mitigation: audits, insurance, cautious escalation procedures.

Good tokenisation is engineering + law + market design, short-changing any of these is a recipe for disaster.

Case study: tokenised T-bills and short-term money

A Middle Eastern firm tokenized an issued tranche of T-bills, selling tradable tokens whose US Treasury exposures were collateralized. The project illustrates strategic value: distribution enablement, overnight settlement, and another way for digital markets to access stable, short-duration assets. That actual, cash-paying one is proof of the commercial viability of tokenisation beyond pilot press releases.

Why big managers matter, BlackRock and the signalling effect

Asset management taking it seriously and having household names makes markets sit up and take notice. BlackRock has recently been in the news, considering tokenised ETFs and accelerating tokenised product pilots. Opening the doors to upper-end asset managers brings professionalisation of markets: more accurate regulation, deeper distribution channels, and better custody and compliance requirements. (InvestmentNews)

BlackRock’s tokenised ETF push signals mainstream adoption, driving market professionalism, stronger custody, and wider distribution (Image Source: LinkedIn)

Market dynamics, how tokens change settlement, custody, and trading

Traditional securities move in custody chains, settle in days, and need to be reconciled over a series of systems.

Tokens settle in seconds, can have fee streams or dividends built inside them through smart contracts, and enable compliance rules to be sticky on-chain (e.g., transfer locks can be programatically enforced). That is fewer ops frictions, but good custody and legal infrastructure are required.

Emerging market impact, an inclusion story?

Tokenisation can unlock opportunity: emerging economy investors can buy fractional interests in offshore property, funds, or sovereign exposure without the threat of current overhead discouraging entry.

But only when local rails (payment, KYC, consumer protection) and compliance worldwide are present does the opportunity become real. For emerging markets, tokenisation is a promise, but one that requires transposed legal frameworks and on-ramps in the real world.

Composability: the two-edged sword

On-chain issued tokens can find their way into DeFi lending, collateralisation, and automated market-making services. That generates and creates liquidity but also binds regulated assets to riskier, less-regulated markets.

Designers have to choose to enable composability (and expose it to risk) or wait for regulatory clarity before on-chain interaction.

Composability boosts liquidity by linking tokenised assets to DeFi, but it also ties them to higher risks, forcing builders to balance innovation with caution (Image Source: ScienceDirect.com)

Practical checklist for an organisation designing tokenised products

- Map legal rights; tokens have to map to enforceable claims.

- Choose a regulated issuance partner and custodian.

- Introduce KYC/AML procedures and sanctions screening for on-chain transactions.

- Include a market-making mechanism to facilitate early liquidity.

- Test settlement and reconciliation with legacy systems.

- Involve regulators early and openly.

Where tokenisation will most likely be leading the way, and where it will lag behind

Early successes: money-market instruments, tokenised short-term sovereigns, and shares in private funds with investors already set up to accommodate limited secondary markets. (BCG)

Gradual transition: extensive trading in tokenised equities and closely regulated securities in a jurisdiction with gradual rulemaking. There, the transition will be evolutionary.

Tokenisation represents a transformative innovation to improve the old & enable the new. Tokenised central bank reserves, commercial bank money & government bonds could revolutionise financial markets, payments & the monetary system https://t.co/stlDITLJQd #BISAnnualEconReport pic.twitter.com/BwhXgKJmAk

— Bank for International Settlements (@BIS_org) June 24, 2025

Storytelling interlude, an investor’s day in the life of a tokenised one

Introducing Priya, a mid-professional Australian. She would be delighted to have exposure to a quality US commercial property, but doesn’t have US$500,000 to spend. Considering her options in a regulated tokenised fund, she buys a small token parcel for some hundred dollars. Her dividends are redeemed automatically in stablecoins or fiat to her bank, and she can sell on a compliant secondary market whenever she wants to access cash.

That genuine advantage, fewer entry points, faster payments, and improved reporting, is the human dividend that tokenisation provides.

Economic and system implications

As tokenisation accelerates, markets can expect:

- Faster allocation of capital as fundraising and secondary sales become more efficient.

- Greater fractional ownership will diversify risk but also change the way that investors think about assets.

- New sources of liquidity that reduce some of the tension between primary and secondary markets.

But the systemic risk exposure is also altered: highly networked “on-chain” exposures can transmit shocks more easily if risk management and governance lag.

FAQs, most read questions

Q: Is “tokenisation” the same as “cryptocurrency”?

A: No. Tokenisation is just one way of expressing rights of ownership through distributed ledger technology. Tokens can express traditional securities, units in a fund, or bonds, and those tokens can be issued, traded, and purchased in regulated environments, independent of speculative cryptocurrencies.

Q: How large is the market now?

A: Tokenized real-world assets amounted to about US$24 billion in 2025 in RWA trackers; long-term growth projections are orders of magnitude, depending on adoption and regulation assumptions. (CoinDesk)

Q: Will giant asset managers tokenise existing funds?

A: Giant managers are testing tokenized money-market products and tokenized funds. Mass conversion will depend on waiting for regulation and demand. (Yahoo Finance)

Q: Are tokenized assets safe?

A: Yes, they can, but security hinges on legal enforceability, custody integrity, and market liquidity. Legal matters ought to be in order, there needs to be a regulated custodian, and the market infrastructure needs to be strong.

Q: How do I invest?

A: Look for regulated issuance platforms, tokenized funds with listed managers, and markets that use KYC/AML and provide clear legal documentation.

Also Read: AI Tokens Drive Crypto Market Rally with 14% Rise as Institutional Adoption Gathers Pace

Bottom line, what to look out for next (quick checklist)

- Regulatory clarity in key markets (US, EU, Hong Kong).

- Launch of institutional products of key asset managers (additional tokenised ETFs and funds).

- Liquidity validation: Are tokenised assets being taken up by committed buyers or merely speculative flows?

- Standardisation efforts across cross-border token transfers and custodial settlement.

Last to consider, realistic timeline

Tokenisation can potentially make finance more programmable, divisible, and inclusive. The path to trillions of dollars does not appear inevitable or imminent but rather dependent on sane regulation, trusted infrastructure, and legal engineering.

And still, there is momentum: customers are business-like, challenging incumbents, and policy groups see tokenisation as essential. For product groups and investors, the sensible path is to build with legal certainty, test with actual customers, and prepare for incremental but revolutionary change.