Bitcoin price falls into its worst week since November 2022. Traders are unloading leveraged positions, ETFs experience a reversal in outflows, and a “doom-loop” scenario fueled by fear is emerging in the cryptocurrency market. This article will decode what has occurred, why it matters in current circumstances, and how to navigate it. (barrons)

Bitcoin tumbles amid leveraged sell-offs and ETF outflows (Image Source: Bloomberg.com)

The Essential Facts

However, Bitcoin starts to decline from above $120,000 in October to around $80,000 towards the end of November, losing about a third of its value in a short period. This is coupled with massive liquidations in futures contracts exceeding $1 billion, with alts plummeting as risk-off activity sweeps across global markets.

Why This Week Feels So Different

It is not uncommon for the crypto markets to see corrections. What has distinguished this phase, however, has been the potent force of leverage, ETF reversals, and uncertainty about certain macro events, mainly when precisely the Fed would begin reducing its rates. Fewer willing buyers at important levels ensure that any slide becomes swifter and sharper.

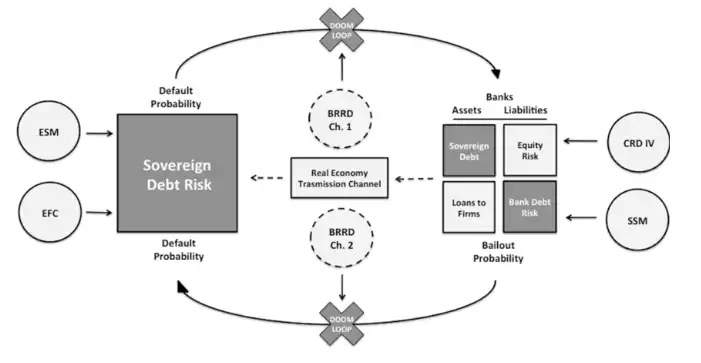

The Mechanics Of “Doom-Loop” Situations

A doom loop gets triggered when traders are forced to sell to pay margin calls. This causes prices to crash, resulting in more forced sales and ETF outflows. This causes prices to crash with bigger gaps and higher volatility, and this phenomenon is seen to continue with lower volumes during holidays. This happens even faster for cryptocurrency derivatives. (investing.com)

Who’s Most Exposed

Leverage retail traders are prominent levers on elevated stages. So are funds that financed long strategies against short-term borrowing for cryptos. Then again, miners, certain kinds of hedged counterparties, or ETF arrangements could also contribute to stress amplification once institutional vehicles change direction to reverse flow, what was once a persistent demand pattern converts into a swift sell channel.

Macro Cross-Currents

It appears now that there are two larger forces at work. First, uncertainty about Fed easing has reduced demand for beta assets, and secondly, underperformance in technology and risk sectors causes passive money to flow out of crypto. This creates a situation where there is limited cheap money to fuel momentum trades and increasingly so when volatility emerges.

Liquidity Indicators To Track

Key factors include: futures prices, funding rates, and ETF net flow. Large discounts and adverse funding impact arbitrage profits and market making. ETF net outflows point to a removal of a mechanical buyer that has aided prices to rise, which can often act as a warning sign for draining supplies.

Real-World Implications

The doom-loop has implications well beyond price graphs: miners can wait to spend, exchanges can raise margin sizes, and merchant adoption can slow as volatility rises. For others, it’s about being dragged into forced sales with nowhere to find peace.

A Timeline Of Triggers

- Mid-October to early November: Price peaks after institutional demand and ETF inflows.

- November Profit taking and headlines: Pockets of weakness emerge.

- Mid to late November: Leveraged funds start to unwind, liquidations explode, ETF inflows begin to turn, and prices pierce main supports, revealing the doom loop.

Crypto doom-loop hits as leveraged sell-offs and ETF reversals push prices down. (Image Source: ResearchGate)

Does This Constitute A Full-Blown Structural Crisis?

“Doom-loop” is not an innocuous buzzword. This outpouring of selling could be harsh cycle selling rather than systemic failure. However, structural elements, leverage, large exposures, and illiquidity exacerbate systemic risks over and above those seen in a normal market correction. Oversight agencies are vigilant about contagion risks to derivatives traders, loans, and fiat ramps.

What Experts Are Saying About It

Some strategists find this to be a painful restart to revitalize healthy volatility and wash out too much leverage. It has also been opined that how quickly the crash happens can shake out market makers, forcing non-crypto institutions to record losses. This division reveals the uncertainty over whether or not this shock is absorbed or passed on to the entire ecosystem.

What we are experiencing very much feels like this kind of forced seller. Continuous, systematic sales during NY market hours especially. A “controlled liquidation.”

Liquidations like this are painful for the market because it paints a chart that shows a much more negative… https://t.co/OrKKwTGuFU

— Matt Sheffield (@sheffieldreport) November 21, 2025

Key Steps For Traders And Investors

Short-term traders should scale back on leverage and ensure wide controls and limit orders are preferred over market orders when market activity is thin.

- Medium-term investors: Consider using dollar-cost averaging instead of trying to time the bottom, and holding a fiat/stablecoin buffer to exploit mispricings.

- Institutional allocators: stress test counterparties, diversify sources of liquidity, and ensure custody/legal processes scale. Prettiness is useless in a doom loop. Thanks to Mudrex

Where This Could Stabilise

Forced selling must decrease, and money rates must consolidate, so big buyers or ETFs must draw back for stability to return to the market. The technical levels for long-term investors, weekly moving averages, and accumulation levels could remain valid once buyers emerge. However, uncertainty exists for both.

What History Teaches Us

Historical crashes (2018, March 2020, 2022) indicate that for crypto, a recovery happens once the forceful selling cycle is over. Every crash has its own circumstances, and sometimes, relaxing policies are needed, while other crashes can only recover from structural adjustments. Learn history to inform foresight, not predictions.

On-Chain Signals To Monitor

“Influx data on blockchain is timely information. The inflow to exchanges, derivatives contracts, Open Interest, and SOPR provides information about areas where selling is likely to happen. Current on-chain data indicate that exchange inflow and short-term holder sales are on the rise, indicating that sales are not limited to speculation but also involve coins sold within very short periods after purchasing. “

“People are always expecting something new for every new event or environment. “

Stablecoins And Crypto Plumbing

Stablecoins are foundational to crypto-liquidity. In stress, either they absorb or reveal friction: redemption delay or market-maker withdrawal to exacerbate selling pressure. ItSoundETNovember tested pegs. Any followed-through redundancy friction would cause on-ramps to seize and fuel the doom-loop.

Miner And Supply Dynamics

The miners need to sell this production to fund their operations. As prices decline, they either sell more or halt expansion to either increase supply in the short term or look for alternative ways to generate revenue, for example, selling compute services. Miner activity is important as they are structural supply sources.

Ripple Effects At The Regional Level

Volatility has implications for remittances, acceptance, and savings within emerging markets. Some countries enhance control to create protection for consumers, while others adopt pro-crypto strategies to entice investments. Decisions on policies will contribute to shaping growth rates for various regions.

Three possible alternatives for what happens next

- Shallow Stabilization: Forced sales decrease, and money flow becomes normal.

- Prolonged correction: Liquidity is shallow, and prices have been trending downward for several weeks or months.

- Contagion shock: This refers to a shock in either the counterparty market or the stablecoin market that spills over into other markets.

Exposure to the above-mentioned situations can now be mapped for stress-testing portfolios.

Solutions for various types of readers

- For day traders: emphasis on liquidity and trading type, decimated leverage, and uncrowded egress strategies. Medium-term investors can utilize portfolio rebalancing and dollar-cost averaging.

- Institutional investors: maintenance of custody agreements, stress tests for resiliency on other sides, and seeking sources for obtaining liquidity in various venues. Preparedness is resistance to surprise.

Reaction from media and regulators

Obviously, price headlines will follow. More valuable information will relate to mechanics sellers, reasons for selling, and corresponding liquidity. Regulators could start paying special attention to transparency in derivatives and ways of withdrawing stablecoins. Rules could add friction in the short term but enhance long-term adoption.

Deep Dive: Case Study: The October Wipe-Out And Its Reverberations

The historic outpouring of liquidation in October, removing about US$19 billion in a single day, did not end with prices bouncing back. It rather took out a massive body of speculative capital and reconfigured market structure. As Bitcoin rallied into October and November, new long positions are now dependent on short-term liquidity and leverage prices. It became harder for borrowers, market-making institutions, and prime brokers to lend out money after the October splurge. Therefore, when new selling pressure emerged towards November, markets did not possess sufficient volume to handle it. Hence, catalysts can now create massive price movements from trivial order flow.

This is seen to involve two steps by analysts for large media organizations and on-chain companies.

Step 1: The liquidations remove the most vulnerable exposures to other parties.

Step 2: The ETFs result in making ‘was-a-buyer-of-ETFs’ into ‘is-now-a-seller-of-ETFs.’ This union sustains contagion within crypto to become something for ‘pockets-of-finance.’

On-Chain Data Confirming “Fear”

Here are the on-chain indicators pointing to distress at present and why they are important:

- Exchange inflows skyrocket. More coins flow to exchanges, typically ahead of selling pressure. Currently, data indicate that exchange inflows are large in the periods where coins are sold in large volumes. This can only happen when investors want to sell their coins.

Bitcoin Doom-Loop Analysis: Funding Rates, Liquidations, and Market Stress

Negative Funding Rates and Market Sentiment

Funding rates have plunged deeply into negative territory. Negative derivative funding rates indicate that shorts are being funded while longs are bleeding. This discourages new long leverage and reflects overall bearish sentiment. Platforms such as Binance report that funding rates have reached multi-month lows.

Open Interest Volatility

Open interest is fluctuating sharply. Liquidation waves temporarily push open interest lower, only for it to surge again as new short sales or hedges emerge. These dynamics amplify market volatility.

SOPR and Short-Term Holder Capitulation

Indicators for SOPR and short-term holders are showing signs of capitulation. Recent data suggest that buyers, rather than long-term holders, have been experiencing losses over the past few weeks. While these indicators do not predict market bottoms, they reflect market psychology and structure: prices are increasingly influenced by sellers rather than confident buyers, forming what is fundamentally a doom-loop.

Bitcoin’s doom-loop worsens with falling funding rates and short-term seller losses. (Image Source: NewsBTC)

Who Got Hit: Three Concrete Examples

Leveraged Retail on Derivative Platforms

During the peak of the crash, platforms reported US$12 billion in liquidations within 24-hour periods. These forced sales pushed prices lower, resulting in further liquidations and increased volatility.

Spot ETF Allocations

Record single-day withdrawals from spot ETFs, including BlackRock’s IBIT, reached hundreds of millions. Large ETF redemptions require fund managers to sell spot ETFs or transfer assets to cover withdrawals, reducing structural demand.

Whale Behaviors

On-chain data shows at least one large whale dramatically transferring BTC to exchanges during the crash. Whale sales at critical moments contribute to flash crashes.

Stock Price-Based Modeling and Balance Sheet Channels

Banks and macro desks highlight three ways crypto stress spills over into traditional markets:

- Counterparty Losses: Defaults or bail-ins at prime brokers and OTC traders force banks to manage risks related to losses on margins or reputational damage. Market desks may reduce operations during stress periods.

- ETF Redemption Mechanics: Spot ETFs mechanically link investor outflows to spot selling. Large outflows force sellers to liquidate BTC or rely on illiquid swap and borrowing markets.

- Liquidity Spirals in Stablecoin Corridors: Stablecoins provide intraday liquidity. As market makers withdraw or redemption frictions appear, price discovery slows, and spreads widen, amplifying market velocity.

The probability of tail-risk events for sell-side models is higher in the near term. This does not imply systemic collapse but signals that institutions may expect broader haircuts during recovery periods.

Also Read: Ripple Cryptocurrency ETF News: XRP ETF Market Reaction Heats Up

Risk Management Checklist: Simple ‘To-Do’ Tasks

For traders, funds, and allocators:

- Reduce Leverage: Lower leverage ratios and unwind cross-collateral trades to avoid expensive forced deleverages.

- Keep Fiat/Stablecoin Buffer: Maintain cash for dislocation trades or margin calls; avoid panic selling.

- Use Limit Orders: Limit orders reduce slippage in thin markets and help control execution prices.

- Counterparty Stress Exposures: Contact prime brokers to review rehypothecation agreements and emergency liquidity lines.

- Diversify Execution Venues: Spread trades across reputable exchanges and OTC traders to manage risk.

- Monitor ETF Fund Flows Daily: ETF fund flow can reverse bid and sell demand structures.

Spend your day here ⬇️

1. Liquidity Sweep (TS)

• Concept: Price hunts liquidity sitting above recent highs or below recent lows.

• Behavior: Triggers breakout entries or stop-loss runs, then often reverses.

• Use Case: Spotting false breakouts and liquidity grabs before… pic.twitter.com/LRiSzJigG9— SIRRILLAH (@sirrillahfx) October 14, 2025

What May Change Policy and Regulation

Crypto stress tests are under regulatory scrutiny. Immediate expected outcomes include:

- More Derivatives Transparency: Regulators may require clearer reporting on open interest and counterparty risk, limiting leverage.

- Stablecoin Regulation: Agencies may require redemption or audit receipts for reserves, improving investor confidence but possibly delaying on-ramp flow.

- Rules on ETF Redemption Procedures: Regulators may request stress plans for large spot ETF redemptions to prevent selling spirals. These rules increase operational costs but mitigate tail risks.

Conclusion

This has been Bitcoin’s most challenging week since 2022, but it does not mark the end of the market. The crash highlights the interconnected nature of leverage, ETFs, liquidity, and investor sentiment. When one component falters, all respond immediately.

While historical crashes have wiped out excessive leverage and enabled stronger rebounds, Bitcoin now faces a “doom-loop,” acting as a critical pivot. Traders navigate fear, investors gain clarity, and resilient projects and patient capital will endure.

This correction may later be seen as an opportunity rather than a disaster, strengthening risk controls and improving liquidity. The next uptrend, when it comes, will be well-prepared. For now, the message is to remain alert, rational, and ready.

FAQ

- Q: Could this doom-loop phenomenon spill over into traditional markets?

A: Yes, but size matters. Current connectivity via prime-broker exposures, ETF mechanics, and bank trading desks provides conduits. More damage depends on larger exposures or sudden institutional failures. Regulators monitor closely. - Q: Is the bull market lost for good?

A: No. The cycle depends on fundamental adoption, regulation, balance sheets, and broader market health. This correction is not the end; leverage and ETFs can retrench, making recovery protracted. - Q: Will miner sales exacerbate supply pressures?

A: Some miners may sell due to local pressures, but many hedge their positions. Miner sales add a temporary supply but do not drive prices. - Q: Are stablecoins safe in this environment?

A: Large stablecoins are maintaining pegs, though stress tests reveal friction risks, such as delayed redeems and reduced market making. - Q: What action can retail investors take?

A: Avoid leverage, place stop losses, and consider staged or stealth buying based on fundamentals. - Q: When will the market stabilize?

A: Stabilisation occurs once forced selling ends, rate signals clarify, and liquidity returns. This can take days to months. Key indicators include funding rates, ETF outflows, and on-chain liquidations. - Q: What is a doom-loop?

A: A feedback loop where margin calls, redemptions, and liquidity withdrawals fuel selling pressures. - Q: Does the fall of Bitcoin mark the end of the bull market?

A: No. This decline reflects deleveraging and fear, not the end of adoption or fundamentals. Fund flow data will reveal underlying trends.