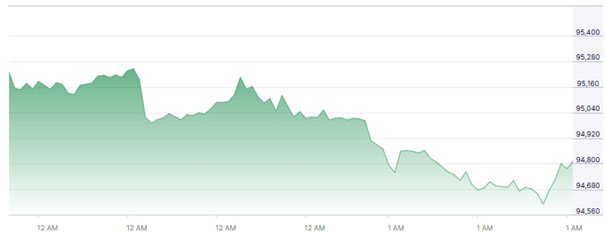

Today, the price of Bitcoin skyrocketed and reached more than $96,000, which is the highest price since November 2025, and in consequence, more than $500 million in futures were liquidated.

The cryptocurrency managed to pass the resistance at $94,500 after three earlier failed attempts to do so on Jan. 5, Dec. 10, and Dec. 3, which made traders cover their bearish bets. The experts interpret the breakout as a sign of revived market confidence and modern-day flow from the previous oversold condition.

Bitcoin’s breakout above $94,500 sparks market optimism and heavy liquidations in futures. [Nasdaq]

What Role Did Altcoins Play In The Rally?

The gains were completely led by the altcoins as the traders positioned themselves across various tokens. DASH touched its peak since 2021, while OP soared by 18.5% and TIA and PENGU went up by 14% within 24 hours.

Bitcoin’s market share reduced from 59.3% on Dec. 24 to 58.6%, which indicated the overall power of the altcoins. The CoinDesk 80 Index (CD80) gained 8% on the day, thus outpacing the CD20 index, which was up 6.35% and also showing a revival of interest in the smaller tokens.

Is $94,500 A Key Level For BTC?

Analysts regard $94,500 as an important support level for Bitcoin. A retest of this level may influence whether BTC will go towards $99,000, the next major resistance. Not being able to keep $94,500 might start a fall between $85,000 and $94,500.

The traders are keeping an eye on the derivatives markets as the $30.6 billion in open futures positions indicates aggressive spot buying and heavy short-covering activity.

Bitcoin Futures Liquidations Signal Aggressive Buying

Over $500 million worth of futures contracts were liquidated within a mere four-hour period as Bitcoin’s price soared above $94,500. The decline in open interest from $31.5 billion to $30.6 billion is a clear indicator of the strong buying that took place in spot markets.

According to the experts, the $19 billion liquidation cascade of October had left many assets undervalued. Although retail investors vacated the crypto space and shifted their money into precious metals such as gold and silver, as well as into AI stocks, the recent gains are interpreted as a sign of returning confidence.

Futures liquidations indicate traders are covering shorts and entering new positions at higher levels. [XBO]

How Could Market Sentiment Affect Future Prices?

The crypto fear and greed index recently displayed “extreme fear”, which is synonymous with the condition of being oversold and being a potential opportunity to buy. The analysts foresee Bitcoin to take a breather around $94,500 before making a move towards $99,000.

Altcoins may continue their superior performance over BTC due to factors like fresh retail interest and technical rebounds after being corrected. The market watchers are of the opinion that sentiment-driven moves will be the determining factor in the short-term price action.

BTC Two-Month High Analysis January 2026

Bitcoin’s technical breakout indicates strong bullish momentum for traders, who are then aiming at the higher levels. Price gains have been supported by both spot buying and short-covering, while altcoins’ performance indicates the return of confidence in the larger market.

Historically, it has been observed that during an oversold period, corrective rebounds are often triggered, which in turn supports the current rally. It is advisable for investors to monitor closely the levels of $94,500 for support and $99,000 for resistance, while also keeping track of the derivatives market for insights on trader behaviour.

Bitcoin’s two-month high may set the stage for continued bullish momentum if $94,500 holds. [Bloomberg]

Market Insights And Broader Crypto Trends

Bitcoin’s comeback is a result of the quiet opening of the year 2026, and at the same time, it shows that the whole market is resilient. The analysts see there is a possibility of altcoins surpassing BTC and therefore the temporary reduction in its dominance. However, they believe it is a signal that the market cycling is healthier.

The strong performance of DASH, OP, TIA, and PENGU among the tokens indicates that the traders do not only trust Bitcoin, but they are also confident in further diversification. The open interest drop is also a support to the fact that the spot buying is more than the speculative futures trades, thus providing the market with more stability.

The liquidation event in October 2025 led to the generation of the mispriced assets, which are now being targeted by the traders as a sign of the renewed participation by both institutional and retail investors.

The analysts predict that a possible consolidation phase will be experienced before any further upward movement. During this time, traders will be using risk-adjusted strategies. The $94,500 level is of great importance; its break or support will decide if BTC heads to $99,000 or undergoes a short-term retreat.

Also Read: Rising Global Conflict Risks: Could World War 3 Reshape Bitcoin’s Role?

FAQs

Q1: What is the current Bitcoin price today?

A1: Bitcoin is trading at $96,240, its highest level since November 2025.

Q2: Why did altcoins surge alongside Bitcoin?

A2: Altcoins like DASH, OP, TIA, and PENGU rallied due to trader optimism and short-covering.

Q3: What is the significance of the $94,500 support level?

A3: $94,500 acts as a key floor; breaking below may trigger a drop to $85,000.

Q4: How does this impact BTC two-month high analysis January 2026?

A4: The breakout indicates potential further gains if $94,500 holds, showing market resilience.