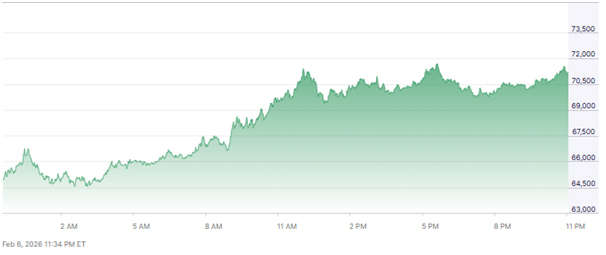

On Friday, Bitcoin recovered to its high of $70,000 following a bloody sell-off that shook traders all over the world. The prices declined to $61,000 following a 13% fall on Thursday.

It was the sharpest one-day decline since November 2022. The crash was similar to the FTX panic. Accelerated overnight sales were made in a market where there was a weakened appetite towards risk.

But customers intervened swiftly at the reduced levels. The spring back instilled confidence in short-term traders. The dip was considered by many as a point of entry. The recovery phase reported high volumes of trading.

Market observers used the action as a technical rebound, as opposed to a complete inversion. Nevertheless, the strength of prices shocked a number of sceptics. This update on the Bitcoin market shows that the sentiment can shift very quickly.

The price charts of Bitcoin are indicative of a sharp decline and an immediate surge back towards the levels of $70,000. [Nasdaq]

Market Volatility Returns Across Crypto And Metals

The digital asset turbulence was not the only one. Selling pressure in equity markets was also experienced in the same period. Gold futures increased by 2.03 percent and silver was up by 1.06 per cent.

Ether was trading at close to 2000, having fallen by almost 15 per cent in five sessions. Risk assets unified as traders de-exposed themselves. Bitcoin is still at a loss of about 19%. January was the fourth month of consecutive losses.

Its wider slumping is an indication that macro uncertainty continues to burden sentiment. According to analysts, the number of correlations between crypto and traditional assets is rising.

Such a connection may increase future oscillations. Macro cues are now being followed keenly by the investors prior to them investing in more capital.

What Triggered The 13% Bitcoin Worst Daily Drop Since 2022?

It plummeted by a big margin following a high selling pressure that had rocked the market. Prices dropped to over 50 per cent of the high of $126,000 of the last October.

Liquidity became thin with traders scampering to get out of positions. Liquidations were an addition to derivatives markets. Stop losses were triggered within a short time span.

Cryptocurrency native investors became scared. Sean Farrell of Fundstrat explained the feeling of exhaustion. He has observed that there is still imperfection in comparing across cycles.

Nevertheless, emotional stress was observed. Farrell has raised his net long exposure up to 80 per cent. But he still allowed himself to visit some more into the $50,000s. His position is cautious optimism as opposed to unblinking faith.

Traders watch screens in a heavily volatile situation when Bitcoin goes down and then up. [WRAL]

ETF Exposure Creates Structural Selling Pressure

Any increase has been cautioned against by the strategists because the holders of exchange-traded funds would pull any increase down. Quite a few ETF investors purchased on approaches to higher levels.

It has been estimated that it takes roughly 90,000 to acquire. That makes a man underwater today. Underwater holders tend to sell into strength. This behaviour puts a limit on upside momentum.

10X Research identified such an overhang as a primary risk. The company claimed that it might be a challenge to attract new Wall Street allocations.

Buyer’s remorse among current possessions is a deterrent to new purchases. The same dynamics are occurring in Ethereum ETFs. These structural pressures can extend the time of consolidation.

Could Bitcoin Have Formed A Durable Bottom Here?

Some traders believe that the worst is behind them. The rapid recovery indicates high demand in the area of 60,000.

Before the bounce, it can be noted that the technical indicators indicate oversold conditions. Extreme fear is also reflected in sentiment readings. In the past, recoveries have been ushered in with fear.

Nevertheless, macro risks are to be settled. Flow expectations are still affected by interest rates. ETF inflows may be back within a short time.

Analysts, hence, do not call a clear bottom. They like reassurances in the form of prolonged high highs. In this Bitcoin market update, there is hope and also apprehension.

A physical token of a bitcoin facing a downward market chart that is heading up. [Shutterstock]

Outlook Suggests Cautious Optimism For Digital Assets

In future, investors foresee rough trading. The wider risk appetite will be relied upon as a source of price stability. Directing flows is still needed in institutions.

Breaking above 70000 over a period might entice momentum buyers. On the other hand, renewed selling may retest below or below 61,000.

The failure of Ether is also an indicator of a weak crypto. Nevertheless, those who hold long-term beliefs perceive pullbacks as accumulation stages. The participation of the market is increasing at an international level.

Clarity of regulations may justify future inflows. Traders are currently concerned with rigorous risk management. The rebound in the price of Bitcoin is a relief rather than an assurance.

FAQs

Q1: What caused the recent Bitcoin crash?

A1: A 13% sell-off, liquidations, and weak sentiment triggered Bitcoin’s worst daily drop since 2022.

Q2: How high did Bitcoin recover?

A2: Bitcoin rebounded to $70,000 after touching $61,000.

Q3: Why are ETF holders important?

A3: Many hold near $90,000, creating selling pressure during rallies.

Q4: Is this rebound a confirmed bottom?

A4: Analysts remain cautious and seek sustained higher prices for confirmation.