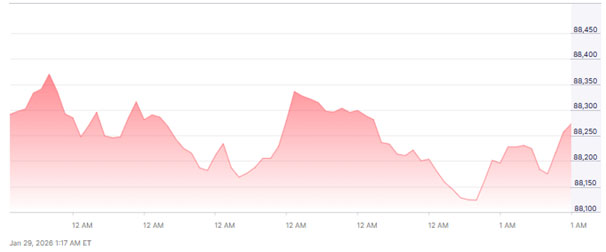

Bitcoin market prospects are promising a little better at the beginning of 2026 after a rough and dismal 2025 showing. Bitcoin declined by over 5% at the end of 2025 and indicates continued macroeconomic stress and high yields in Treasury.

The uncertainty in the world led to investor sentiment as the capital moved to less risky and yield-driven investments. Nevertheless, 2026 was the first year that Bitcoin did not register a down day session, meaning that it is now stable.

The digital asset has increased by approximately one % in the year to date, giving hope to the long-term holders. According to the analysts, lower volatility would help Bitcoin in its developing nature as a macro hedge as opposed to a speculative trade.

Stability of the price of cryptocurrency gains momentum as the year 2026 gets underway. [AURPAY]

What Macro Factors Are Supporting Bitcoin Market Outlook?

The prospects of the Bitcoin market are being served by the changing money situation across the world and the relaxation of policy issues. The Federal Reserve has already done 6 interest rate cuts in the year 2024 and 2025, which have lowered the headwinds of risk assets.

Last year, treasury yields were high, but restricted the upside of Bitcoin despite the reduced rates. Analysts believe the yields will stabilise, indicating favour to alternative stores of value.

The further depreciation of the US dollar can stimulate institutional investors to get more crypto exposure. These factors put Bitcoin in the same position as gold and silver under defensive allocation.

Bitcoin’s Supply Scarcity Strengthens Long-Term Market Outlook

The fixed supply system of Bitcoin remains to support the long-term investment story of the cryptocurrency. Almost 20 million out of the 21 million total number of Bitcoin tokens of Bitcoin have already been mined.

Planned half-year cuts also limit further introduction into circulation. The proof-of-work model of Bitcoin mining requires lots of energy and infrastructure.

These dynamics increase the scarcity of Bitcoin, which supports the comparison to hard assets. Supply constraints are becoming more of a stabilising, not growth, driver for the market participants.

The shortage of Bitcoins supports the narrative of Bitcoin as digital gold. [Fortune]

Can Institutional Demand Shape Bitcoin Price Forecast 2026?

The future of Bitcoin in 2026 will be more and more reliant on institutional involvement via institutionalised investment vehicles. In 2024, accessibility to large capital pools was expanded by Spot Bitcoin exchange-traded funds.

These cars enable organisations to store Bitcoin without the complexity of custody. Volatility can be taken up more effectively by larger investors than retailers.

Higher institutional ownership can frustrate price fluctuations in the long run. Analysts are of the opinion that this change favours gradual rises instead of explosive increases.

Is Bitcoin Becoming A Safe Haven Asset In 2026?

Bitcoin market prospects imply a slow shift to the safe-haven position in diversified portfolios. Other commentators make parallels between the place of Bitcoin and that of gold when there is debasement of currency.

The decentralised nature protects it against the risks of fiat devaluation. With increased confidence, governments can consider the Bitcoin reserves or legal tender frameworks.

The adoption on the sovereign level may also stabilise demand patterns. Regulatory clarity, however, is necessary to ensure continued global acceptance.

Bitcoin is gaining ground against conventional safe-haven assets. [Nasdaq]

What Should Investors Expect From Bitcoin Investment in 2026?

Bitcoin investment 2026 projections must be controlled despite the macroeconomic conditions. Bitcoin has risen by an average of 23,360 % in the last ten years.

Rates of growth have also decreased as the market became mature in adoption, and its participation expanded. Analysts warn that no momentous price spikes can be expected in the short term. Step-by-step appreciation in line with the macro recovery seems more feasible.

The development of Bitcoin has shifted to focus on resilience and capital preservation, and no longer speculative returns.

Also Read: US Shutdown Odds 2026 Hit 75% As Bitcoin Markets Brace For Volatility And Liquidity Shifts

FAQs

Q1: Is Bitcoin a good investment in 2026?

A1: Bitcoin investment 2026 may suit investors seeking long-term diversification rather than rapid gains.

Q2: What is the Bitcoin price forecast for 2026?

A2: Bitcoin price forecast 2026 suggests gradual appreciation supported by institutional stability.

Q3: Why is Bitcoin considered digital gold?

A3: Bitcoin’s limited supply and mining difficulty mirror characteristics of traditional hard assets.

Q4: Will Bitcoin volatility decrease in 2026?

A4: Rising institutional ownership could reduce volatility over time.