Cryptocurrency market is facing fresh turmoil as Bitcoin and Ethereum exchange-traded funds lose capital under heightened market pressure. BlackRock, the world’s biggest asset manager, has offloaded 1,885 BTC worth around $111 million and 59,606 ETH worth around $254 million to Coinbase Prime. The offload worth more than $365 million has triggered rumors of a massive sell-off.

This flip is happening as Bitcoin and Ethereum ETFs together report $311 million in outflows across several days, with Bitcoin dropping to $113,000, a decline of around 8.5% from a recent high, and Ethereum staying at around $4,300.

@BlackRock dumps $111M in BTC & $254M in ETH!

Arkham: 1,885 BTC & 59,606 ETH moved to Coinbase Prime today.

ETF outflows persist:

iShares $BTC ETF: -$220M

iShares $ETH ETF: -$257.8M#Crypto #Bitcoin #Ethereum #ETF #Coinbasehttps://t.co/4zX4jo0SXo— CoinGape (@CoinGapeMedia) August 21, 2025

Institutional Outflows Signal Bearish Sentiment

The trend can be seen: institutions are pulling money out of crypto ETFs. Facts show that in just four consecutive trading days, Bitcoin ETFs have lost $970.82 million, and Ethereum ETFs have lost $925.83 million.

These flows are more than typical profit-taking. They are a cautious step as foreign investors anticipate signals from US Federal Reserve Chairman Jerome Powell’s address at Jackson Hole. With economic stability and interest rate policy on the table, risk assets like crypto are under increased scrutiny.

BlackRock’s Transfer Stirs Debate

BlackRock’s big-block migration onto Coinbase Prime has caught the attention of eyebrows well beyond the crypto community. Such transfers usually come before selling or portfolio rebalancing, fueling speculation that the asset manager is gearing up to ride out volatility.

For retail investors, the perception is ugly. If the biggest player in global finance appears to be reducing exposure, faith can easily be lost. However, some see the action as likely being strategic rather than bearish, at least potentially related to liquidity management or re-shuffling custody.

In crypto, though, perception all too often becomes reality. A single action by a market leader can generate waves of sentiment, exaggerating fear as well as momentum.

Market Reaction: A Mix of Panic and Patience

Market responses have been mixed. Bitcoin’s drop below $115,000 rattled short-term investors, while Ethereum’s struggle to maintain $4,300 highlighted the precarious balance of demand and supply.

In trading forums and social media, debate swings between doom and opportunity. Panic is perceived by some investors in the sustained outflows, but others regard the pullback as a typical dip to buy into.

Derivatives markets offer further clues. Open interest in Ethereum and Bitcoin futures has tempered, which means reduced leverage. But neutral funding rates suggest a partial hesitation by traders to embrace bearishness, across the board. The room for surprise remains.

Why ETF Flows Are a Big Deal

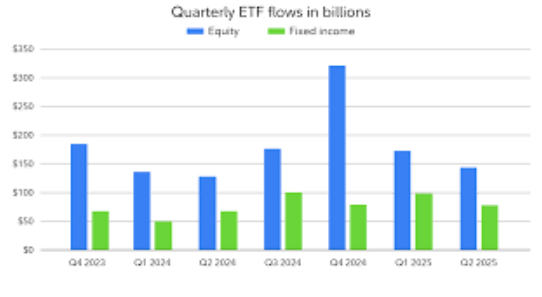

Exchange-traded funds (ETFs) are currently the most important vehicle of crypto to institutional capital. Their inflows and outflows mostly determine short-term sentiment, shifting markets much more than retail trading in isolation.

ETF flows move crypto markets more than retail trades ( Image Source: Fidelity Investments )

When ETFs bring in capital, it usually adds liquidity and signals institutional support. But when they lose capital, such as today, the pressure is mounting. Retailers, observing institutional cues, will follow the same action.

The ongoing sell-off of crypto assets serves to illustrate just how linked crypto prices are these days to global macroeconomics. Readings of inflation, central bank policies, and geopolitical tensions all weigh heavily on ETF demand.

Jackson Hole: The Event Everyone Awaits

Markets are holding their breath awaiting Jerome Powell’s address at the Jackson Hole symposium. Should Powell signal that rates will be higher for longer, this can support the US dollar and drive selling pressure further on risk assets like Bitcoin and Ethereum.

Powell’s Jackson Hole speech could shake crypto markets ( Image Source: Kiplinger )

Or even a whiff of policy easing could get the crypto ETFs moving once again. To investors, the Fed’s communication is as potent as any chart pattern or technical indicator.

A Stress Test for Crypto’s Maturity

These ETF withdrawals are indicative of something more than a temporary price wobble—they are an effort to shake out the strength in crypto amid institutional doubt. The same flows that brought Bitcoin and Ethereum into mainstream finance now risk exposing them to the very same cycles of caution and risk-off mentality that govern equities and bonds.

Volatility is the journey for long-term investors. But institutional investors who are just getting into crypto have their faith tested with sudden drops. The test will be whether these players will treat crypto as a long-term hedge or simply another volatile asset that’s trimmed during bad times.

Final Outlook

Crypto markets are at a juncture today. BlackRock’s multimillion-dollar movement to Coinbase Prime and the almost $2 billion withdrawn from Bitcoin and Ethereum ETFs tell a story of tempered institutions preparing for rough seas.

Bitcoin lingering around $113,000 and Ethereum at approximately $4,300 demonstrate how volatile sentiment can be when ETF flows flip negative. History, though, teaches that in times of decline there are opportunities—particularly for investors that have the tenacity to ride out volatility.

Whether this is the start of a long-term bear trend or just a correction preceding the next rise is very much dependent on external forces, specifically Powell’s Jackson Hole speech. Until then, retail traders and institutional titans alike are waiting for more certainty—and in crypto, certainty never lasteth long.