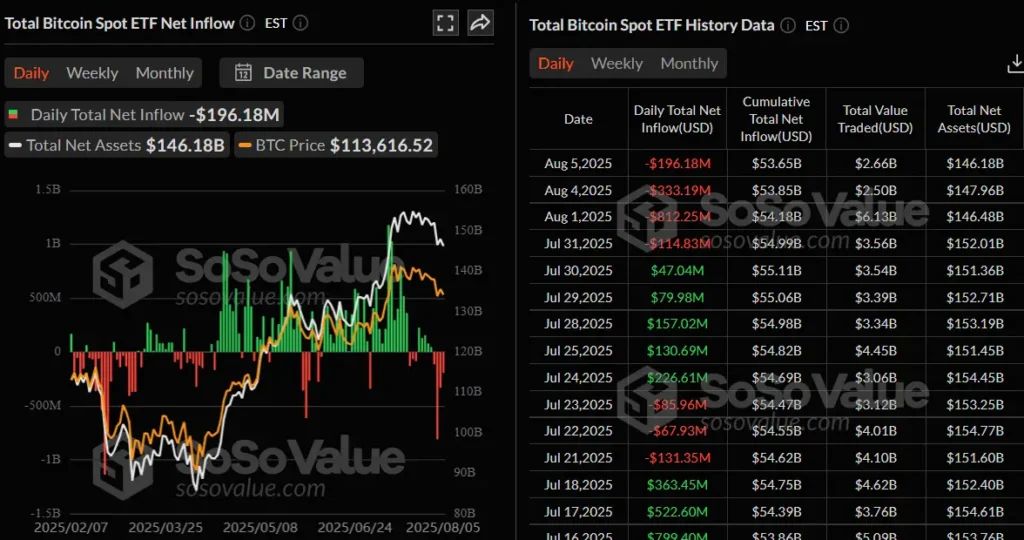

Bitcoin is trading at $116,000 on the heels of fresh spot ETF flows and fresh institutional demand, despite the fact that markets are expecting a US rate cut in the near term. ETF inflows are large enough to drive market direction; investors are watching ETF flows, Fed statements, and on-chain metrics for the next directional cue. (Yahoo Finance)

Bitcoin hovers at $116K, lifted by strong spot ETF inflows and institutional buying, even as traders eye a looming US rate cut and track ETF flows, Fed signals, and on-chain data for the next move (Image Source: MEXC Blog – MEXC Exchange)

What’s moving the market right now

ETF demand is the focus. Spot Bitcoin exchange-traded funds experience multi-day inflows that impose actual buying pressure on spot markets and futures. The numbers in flow—hundreds of millions in individual sessions, put institutional liquidity behind price levels that retail alone is unable to support. (The Block)

Macro expectations are also tightening the script. Traders are progressively pricing a quarter-point Fed cut into September’s meeting, and that situation allows the window of risk appetite to open for most institutions. But markets also see weak growth numbers and sticky inflation pockets, so the situation is “sensitive” and not one-way bullish. (Reuters)

Story and technicals cross at $116K. $116K is now a headliner level and a technical trendline: persuasively breaking it opens the door to short-term targets at $120K and higher; not holding it risks re-testing lower levels of support. Analysts and algos are employing this price as a pivot between mean reversion and momentum. (Brave New Coin)

Bitcoin holds at $116K, powered by ETF inflows and Fed cut bets, but weak growth and sticky inflation keep the outlook fragile (Image Source: FXStreet)

Why institutions are stepping in, and why that matters

Institutional participation changes the numbers. While consumers buy propel the market in fits and starts, institutional capital arrives in large, programmatic tranches: ETFs, OTC desk buying, and balance-sheet commitments from funds. That pushes out liquidity curves, enhances order books, and reduces the “brittleness” that characterized earlier rallies.

Spot ETFs don’t merely offer exposure; they channel latent demand into on-chain buying by qualified participants. Continuing large daily inflows concentrate buying pressure into a short time horizon, which compresses volatility to the upside and creates structural support that traders are afraid of. Recent inflow streaks show institutions prefer regulated vehicles for Bitcoin exposure now. (Cointelegraph)

Macroeconomic uncertainty is the counterweight

Even while institutional flows push prices higher, macro risk acts as a leveler. The market’s current euphoria about rate cuts is tempered: if upcoming economic prints surprise on the upside (stronger wages, more resilient consumption), the Fed may hold back. Holding back can be seen in sudden reversals in cross-asset flows and spikes in implied volatility.

In simple words: the same macro narrative that favors Bitcoin (rate cuts = liquidity) can also work against it (growth surprises = tighter policy = risk-off reflows). The dynamic keeps investor positioning cautious, even as some flows appear aggressively bullish. (Reuters)

Institutional inflows lift Bitcoin, but macro risk keeps traders cautious. Rate cuts may fuel gains, yet strong data could flip sentiment and trigger sharp reversals (Image Source: MDPI)

On-chain signals and whale behavior, color from the blockchain

Outside of ETFs, on-chain metrics reveal whales building into positions and some old wallets waking up from years of inactivity. Huge cold storage transfers and renewed accumulation from long-term holders underpin the bullish argument: supply that won’t circulate takes coins out of the available pool and makes scarcity effects at the margin more potent. A standout reactivation of a holding as old as a decade comes in line with the $116K move and injects a psychological element into the price action. (TradingView)

Brief, sharp scenarios that traders are discussing

- Bull case: ETFs continue to monitor multi-day inflows, the Fed outlines a clear path for easing, and technical ceilings are broken. It all adds up to trigger a quick test of $120K+, with momentum traders and funds flooding in after institutional buying. (The Block)

- Range case: ETF demand tapers, macro prints keep Fed on data watch. Bitcoin trades $108K–$118K as traders hedge into event windows (CPI, Fed minutes). On-chain accumulation trudges on. (Alpha Node Capital)

- Bear case: Hawkish surprise or ETF flow stoppage triggers liquidations. Unwind is rapid and sparks further, prompting some funds to rebalance, pushing the price to near support levels. Institutional bids that seemed firm pull back when macro risk spikes. (Reuters)

What this does for different market players

- Long-term investors (HODLers): Institutional adoption narrative accords with the store-of-value hypothesis. They watch on-chain supply metrics and ETF positions rather than near-term candles.

- Institutional allocators: They view regulated ETFs as a scalable on-ramp. They make decisions based on liquidity, custody risk, and macro correlation to equities and rates.

- Retail traders: They feel the volatility and trade off technical breakouts and headlines. Retail flows exaggerate moves, but institutions set the base.

- Macro traders: Macro traders trade Bitcoin as a cross-asset play; rate expectations, real yields, and dollar movement determine if crypto is a tactical risk position or a speculative vehicle.

The human element, why this feels different

This rally is distinct, not due to Bitcoin having found a fresh narrative suddenly, but because multiple narratives are now converging. Fund managers who ridiculed crypto a few years ago now speak of ETF allocations; portfolio groups discuss proper sizing; traders optimize execution tactics in an effort to reduce slippage against institutional order flow.

To screen-based investors, this is both thrilling and unsettling. There’s a thrill because price action yields real profits. There’s unease because policy risk and macro surprise remain very present and can reverse bullish positioning in a short time. The market is now in a state of tension, momentum, and macro uncertainty coexisting.

This rally stands out as institutions embrace ETFs, bringing both excitement from gains and unease from looming policy risks (Image Source: Cointelegraph)

Frequently Asked Questions (brief, actionable)

Q: Is the rise in Bitcoin to $116K largely ETF-driven?

A: ETFs are the top contributor now. Multi-day inflows drive together buying power and set up structural demand that supports prices above past ranges. (The Block)

Q: Would a rate cut by the Fed necessarily lift Bitcoin?

A: Not necessarily. Rate cuts might drive risk assets, yet markets react to policy direction and tone. Even if cuts follow behind soft growth, risk appetite would still be in danger. (Reuters)

Q: Are the whales in buy mode now?

A: Big transfers and on-chain action are indicating new accumulation by large investors, with some of the older accounts switching back on. That supports the bull supply-side case. (TradingView)

Q: What technical level is of note next?

A: $116K is now the pivot; clear breaking may unlock $120K and higher targets. Not holding risk, a re-test of lower supports near recent ranges.

Story continuation, the stage is set, what’s next?

Bitcoin is at a technical and psychological crossroads. Institutional pressures, mainly spot ETFs, push supply out of circulation and onto wrapped-up regulated wrappers. Meanwhile, markets watch the US Federal Reserve like a weather vane: a predicted rate cut has risk-seeking investors salivating, but any deviation from the script can quickly reverse sentiment on its head. It leaves a market that appears both structurally more robust and psychologically more sensitive than at prior cycles. (Crypto News Australia)

This dichotomy works to produce a strange trading environment. On bright days, the tape is radiant and order books seem solid; in chilly mornings, even tiny macro prints firm up legs and provide outsized action. The traders now handle two worlds at once: rising institutional support supported by ETF flows, and the ever-present macro risk that works to flip momentum into a short squeeze or a capitulation. (The Block)

ETF flows: mechanics and math

Latent investor demand is translated into targeted, traceable buying by spot ETFs. Authorized participants (APs) build shares by transferring Bitcoin to custodians; they sweep up spot supply in the process and effectively channel cash directly into the market. When inflows are hundreds of millions or billions in scale over days, they produce measurable net buying that must be serviced by dealers and market-makers. That focused buying can drive the marginal buyer price higher and flatten volatility along the way up, establishing a psychological floor beneath recent highs.

Data show daily repeated inflows across different ETF issuers last week, something that is a trend that traders appreciate. Whereas retail buying is episodic and often temporary, ETFs are large, long-lasting concentrations of funds that institutional desks rotate in and out of with more purpose. That changes microstructure in the market, spreads contracts, depth increases, and liquidity that once vanished at the points of focus seems stickier. (The Block)

Macroeconomic tailwinds and the weakness beneath them

Markets practically universally anticipate a September rate cut and additional easing later this year. That anticipation explains some of Bitcoin’s rally: looser policy will reduce real yields and increase the carry for risk assets. But the same stream of data that brings on easing can also catch the upside, good payrolls, sticky inflation readings, which leads central banks to rein back or cut less. And when it does, markets reprice risk in a rush. The implication: Bitcoin benefits from the easing storyline but is hostage to each new economic datapoint.

Key to remember: monetary policy is not in a vacuum. Cross-currents of geopolitical shocks, trade tensions, and commodity swings can reinforce or mute the Fed’s potency. Institutions offset these cross-currents before increasing allocations. That’s why you see a spurt of ETF buying followed by a subdued pause, not an uninterrupted steady stream of buying. (The Wall Street Journal)

➥ This FOMC week feels like a turning point

ngl fam this FOMC cut on Sept 17 is the real boss fight

there’re scenarios i’d share with you, this is all my POV, i could be so wrong

• 0.25% cut → healthy, market can breathe & continue pumping

• 0.5% cut → sth broken under… pic.twitter.com/qso6aUd0mP— Nick Research (@Nick_Researcher) September 15, 2025

On-chain behavior: whales and the changing supply story

On-chain metrics show renewed patterns of accumulation by large wallets. Long-quiescent addresses come to life; others slowly build up their balances. When whales move coins into cold storage or into ETFs, the circulating supply is reduced. Scarcity matters in a market that’s coming ever more to rely on finite supply narratives. Even small changes to circulating supply can amplify price action when institutional demand comes into the market at scale. (CoinDesk)

But concentration has risks too. Institutional investors can move prices through timing of execution, i.e., sell in a rally or distribute into new ETF demand. Historically, recent events show both patterns: accumulation and selective distribution. That push-and-pull keeps market participants nervous and creates headline risk every time large transfers occur. (CoinDesk)

Technical map, what traders watch next

$116K serves as the short-term pivot. Ongoing trading above that level with solid volume indicates the market is willing to challenge $120K–$125K. A breakdown will most assuredly produce a re-test of support levels in the $108K–$112K vicinity. Market players view these points as more than just figures — they are lines of battle where pools of liquidity, stop orders, and program flows converge. (Trading News)

Volume on breaks. A break without verified ETF-driven flows or visible on-chain support risks being a headline-driven fakeout. Traders prefer confluence: ETF inflows, rising open interest, and new on-chain accumulation together. When all three point in the same direction, the path of least resistance is up. When they diverge, ranges and gappy price action lie ahead. (The Block)

Practical playbook, what different players can use

Long-term investors: Keep things in perspective. If your thesis is structural adoption and supply constraints, periodic volatility is the price of admission. Dollar-cost average into positions, rather than trying to time tops.

Active traders: Employ range edges as trade anchors. Short failure to hold the pivot; fade spent breakouts with tight, data-based stops. Focus on liquidity; ETFs shift execution cost, so route orders through OTC desks wherever possible.

Institutional allocators: Make decisions on allocations at the portfolio level. Implement diversification across ETFs, OTC, and futures to keep slippage in check. Size positions proportionate to liquidity and ensure custody and regulatory infrastructures are integrated with internal compliance.

Macro desks: Monitor correlation dynamics. When real yields are rising with improving data, expect correlation with growth assets to increase and risk assets to correct. Hedging with options can protect convexity in turbulent windows.

Risk checklist: What could ruin the rally

- Hawkish macro surprises. Positive inflation or payroll surprises can cause the Fed to delay cuts and tighten financial conditions. That alone can suck out risk appetite across asset classes. (Al Jazeera)

- Reversals in ETF flows. ETF delays or withdrawals remove the concentrated bid and expose the market to sudden rebalancing events. Monitor daily ETF flow balances. (Cointelegraph)

- Big whale distributions. Large transfers from custody to exchanges, or coordinated selling by major holders, can overwhelm available market liquidity and lead to extreme drops. (CoinDesk)

- Regulatory shocks. Emerging regulations, tax announcements, or custody events in major jurisdictions can create headline risk and drive temporary de-risking. Keep regulatory calendars on your radar. (Crypto News Australia)

What to watch this week (and why it matters)

- ETF flow reports: Daily released inflow numbers tell us whether the structural bid remains intact. A string of up days supports a breakout narrative.

- Fed announcements and speeches: Even subtle hints on timing and pace of cuts will dictate short-term positioning.

- On-chain large transfers: Sudden flows between wallets and exchanges indicate whether supply tightens or opens up.

- Macro datapoints (CPI, jobs): Change the baseline rate picture and hence the risk assets’ setting.

Frequently Asked Questions, expanded (practical, crisp)

Q: How reliable are ETF inflows as a directional signal?

A: Very useful but not trustworthy. Ongoing flows across multiple issuers provide the most compelling indication since they take out spot supply and are committed, regulated capital. But flows may cease. Always pair flow data with volume, open interest, and on-chain metrics. (Cointelegraph)

Q: Does retail trading follow through on the breakout to $120K?

A: Pursuing late-stage momentum maximizes execution risk. Superior alternatives are defined entries (limit orders), trailing stops, or scaling to minimize the emotional cost of volatility. Wait for confirmation from ETF flows and on-chain accumulation before adding aggressively. (Trading News)

Q: Do Fed cuts ensure higher Bitcoin prices?

A: No guarantee. Cuts lower real yields and can support risk assets, but markets read context. Cuts to signal weak growth can have a tendency to be combined with a weak risk appetite. Watch the tone, not just the action.

Q: What horizon should I use to assess this cycle?

A: Structural forces, ETF adoption, and institutional allocation have a medium-term horizon. Expect short-term episodic volatility but a multi-month window in order to confirm a durable regime change. Position sizing must be commensurate with that window. (Crypto News Australia)

Closing, why this moment matters

Bitcoin’s fight at $116K matters because it’s not only a price test; it’s a stress test on the market’s new geography. Institutional flows now act in conjunction with retail euphoria and macro crosswinds. How the market resolves this tension will show us if Bitcoin surges up into the next leg higher or lags sideways as risk cycles elsewhere.

For investors, the time now demands respect for momentum and macro discipline. For allocators, it raises the question of whether controlled exposure by ETFs is compatible with long-term strategy and compliance needs. For everyone watching, the market sends a clear message: adoption changes mechanics but does not remove market risk.

If ETFs keep delivering steady inflows, and macro leads remain dovish, the path of higher seems feasible. If those suppositions unravel, ranges, headline surprises, and more pronounced retracements are in store. Traders and investors need to be ready for both and position exposures accordingly. (Crypto News Australia)